Question

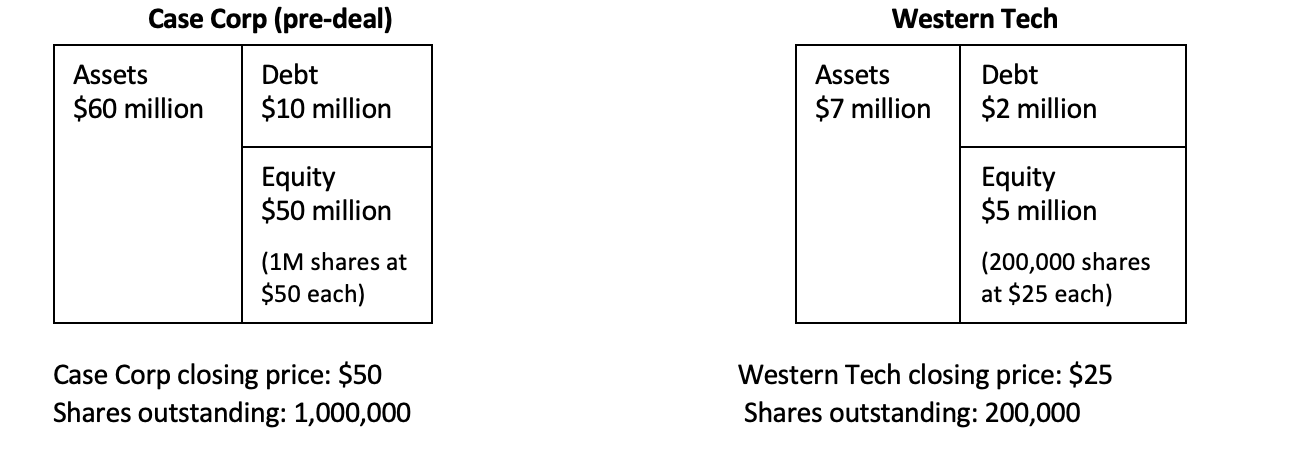

Case Corp in considering acquiring Western Tech. Their current stock price, number of shares outstanding and balance sheets are below: Suppose that Case Corp will

Case Corp in considering acquiring Western Tech. Their current stock price, number of shares outstanding and balance sheets are below:

Suppose that Case Corp will announce the acquisition tomorrow, but is still unsure on how to finance the deal. Analyze the following scenarios:

A 25% cash and 75% stock deal for a target price of $30.50. New debt will be issued to finance the 25% cash portion. Calculate the following:

1) How much will it cost Case Corp to finance this deal (buying all outstanding shares)?

2) What is the exchange ratio?

3) If you were a Western Tech shareholder and owned 25 shares, how many shares of Case Corp will you receive and how much will you receive in cash?

4) How many shares will Case Corp have to issue in order to finance this deal?

5) Calculate Case Corp's leverage ratio after acquiring Western Tech. Keep in mind that Case Corp issued both new equity and new debt to finance this deal.

6) Western Tech shareholders will now own shares of Case Corp. What percentage of ownership will Western Tech's shareholders have over Case Corp?

Case Corp (pre-deal) Debt Assets $60 million $10 million Equity $50 million (1M shares at $50 each) Case Corp closing price: $50 Shares outstanding: 1,000,000 Assets Western Tech $7 million Debt $2 million Equity $5 million (200,000 shares at $25 each) Western Tech closing price: $25 Shares outstanding: 200,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Analyzing the Acquisition of Western Tech by Case Corp Scenario 25 cash and 75 stock deal for a target price of 3050 Lets break down the questions one ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started