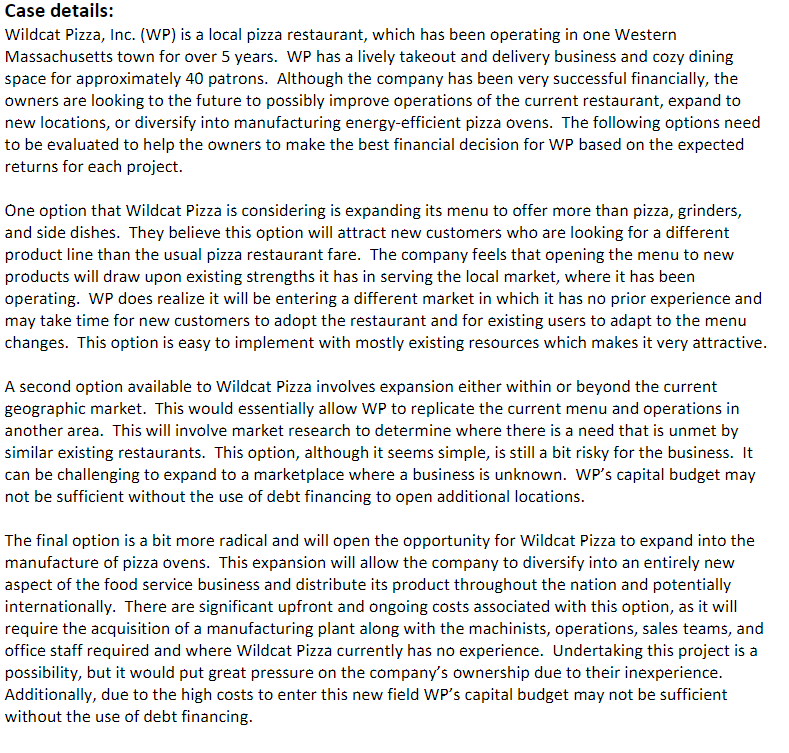

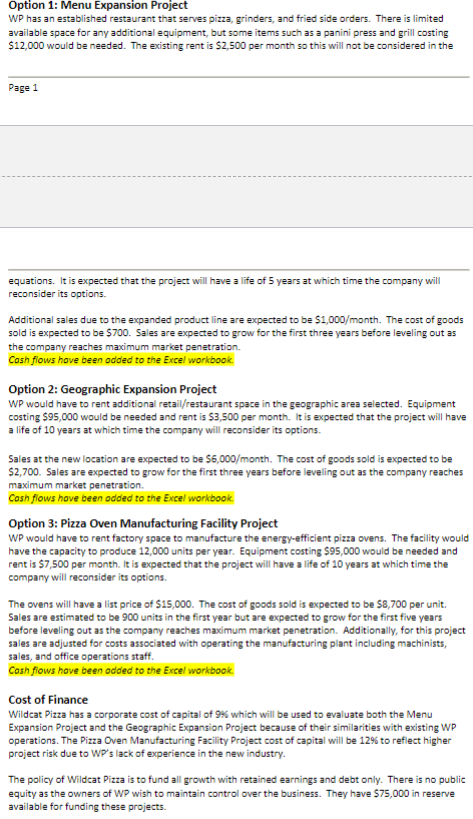

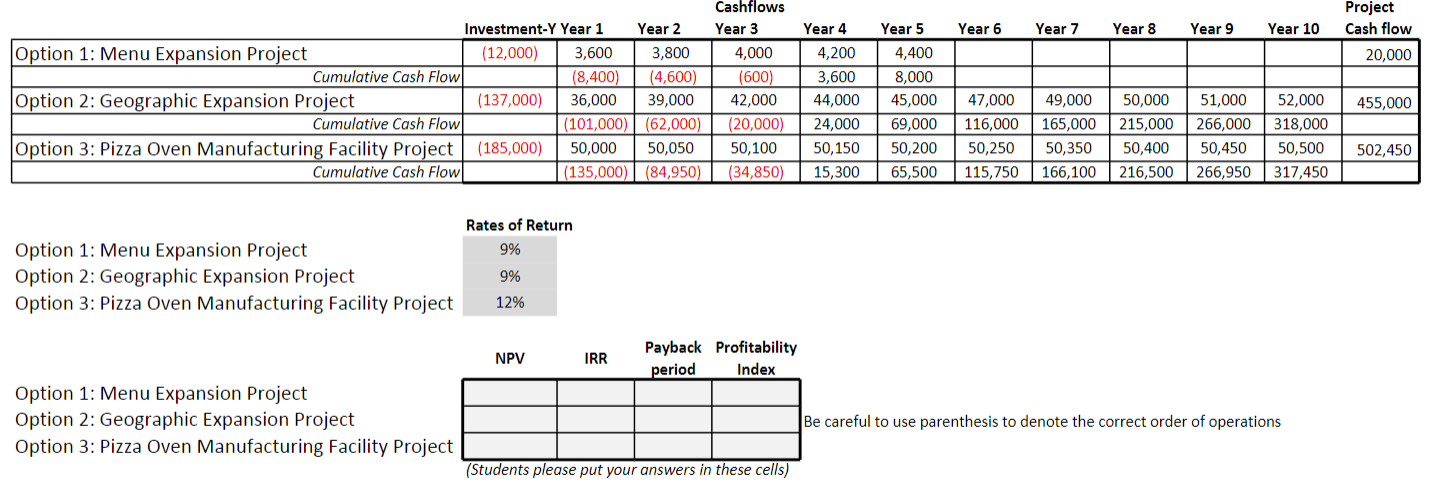

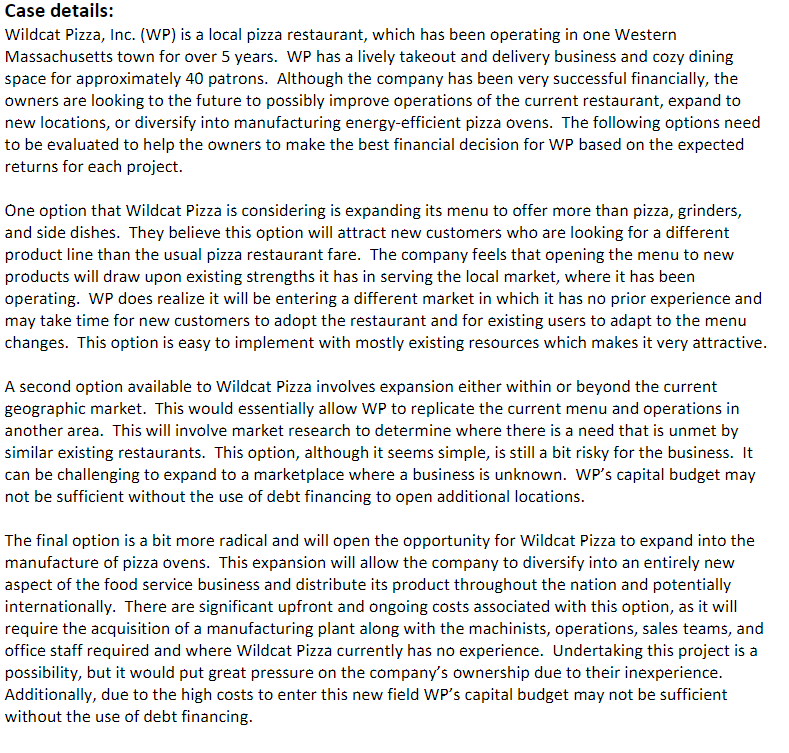

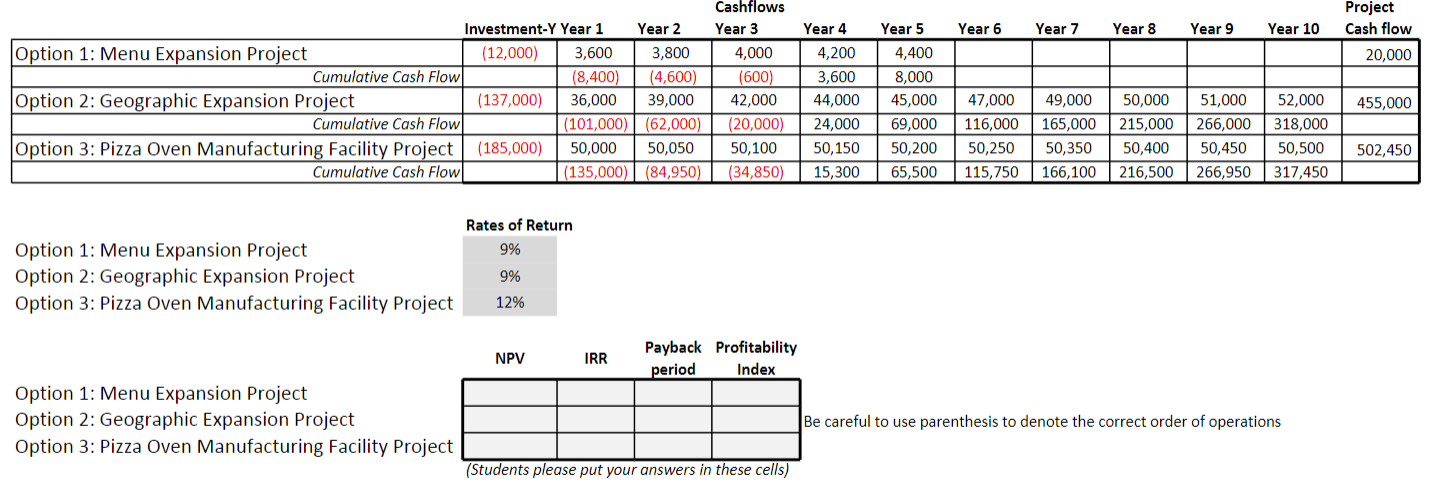

Case details: Wildcat Pizza, Inc. (WP) is a local pizza restaurant, which has been operating in one Western Massachusetts town for over 5 years. WP has a lively takeout and delivery business and cozy dining space for approximately 40 patrons. Although the company has been very successful financially, the owners are looking to the future to possibly improve operations of the current restaurant, expand to new locations, or diversify into manufacturing energy-efficient pizza ovens. The following options need to be evaluated to help the owners to make the best financial decision for WP based on the expected returns for each project. One option that Wildcat Pizza is considering is expanding its menu to offer more than pizza, grinders, and side dishes. They believe this option will attract new customers who are looking for a different product line than the usual pizza restaurant fare. The company feels that opening the menu to new products will draw upon existing strengths it has in serving the local market, where it has been operating. WP does realize it will be entering a different market in which it has no prior experience and may take time for new customers to adopt the restaurant and for existing users to adapt to the menu changes. This option is easy to implement with mostly existing resources which makes it very attractive. A second option available to Wildcat Pizza involves expansion either within or beyond the current geographic market. This would essentially allow WP to replicate the current menu and operations in another area. This will involve market research to determine where there is a need that is unmet by similar existing restaurants. This option, although it seems simple, is still a bit risky for the business. It can be challenging to expand to a marketplace where a business is unknown. WP's capital budget may not be sufficient without the use of debt financing to open additional locations. The final option is a bit more radical and will open the opportunity for Wildcat Pizza to expand into the manufacture of pizza ovens. This expansion will allow the company to diversify into an entirely new aspect of the food service business and distribute its product throughout the nation and potentially internationally. There are significant upfront and ongoing costs associated with this option, as it will require the acquisition of a manufacturing plant along with the machinists, operations, sales teams, and office staff required and where Wildcat Pizza currently has no experience. Undertaking this project is a possibility, but it would put great pressure on the company's ownership due to their inexperience. Additionally, due to the high costs to enter this new field WP's capital budget may not be sufficient without the use of debt financing. Option 1: Menu Expansion Project WP has an established restaurant that serves pizza, grinders, and fried side orders. There is limited available space for any additional equipment, but some items such as a panini press and grill costing $12,000 would be needed. The existing rent is $2,500 per month so this will not be considered in the Page 1 equations. It is expected that the project will have a life of 5 years at which time the company will reconsider its options Additional sales due to the expanded product line are expected to be $1,000/month. The cost of goods sold is expected to be $700. Sales are expected to grow for the first three years before leveling out as the company reaches maximum market penetration Cosh flows have been added to the Excel workbook Option 2: Geographic Expansion Project WP would have to rent additional retail/restaurant space in the geographic area selected. Equipment costing $95,000 would be needed and rent is $3,500 per month. It is expected that the project will have a life of 10 years at which time the company will reconsider its options. Sales at the new location are expected to be $5,000/month. The cost of goods sold is expected to be $2,700. Sales are expected to grow for the first three years before leveling out as the company reaches maximum market penetration Cosh flows hove been added to the Excel workbook Option 3: Pizza Oven Manufacturing Facility Project WP would have to rent factory space to manufacture the energy-efficient pizza ovens. The facility would have the capacity to produce 12,000 units per year. Equipment costing $95,000 would be needed and rent is $7,500 per month. It is expected that the project will have a life of 10 years at which time the company will reconsider its options. The ovens will have a list price of $15,000. The cost of goods sold is expected to be $8,700 per unit. Sales are estimated to be 900 units in the first year but are expected to grow for the first five years before leveling out as the company reaches maximum market penetration. Additionally, for this project sales are adjusted for costs associated with operating the manufacturing plant including machinists, sales, and office operations staff. Cash flows have been added to the Excel workbook Cost of Finance Wildcat Pizza has a corporate cost of capital of 9% which will be used to evaluate both the Menu Expansion Project and the Geographic Expansion Project because of their similarities with existing WP operations. The Pizza Oven Manufacturing Facility Project cost of capital will be 12% to reflect higher project risk due to WP's lack of experience in the new industry. The policy of Wildcat Pizza is to fund all growth with retained earnings and debt only. There is no public equity as the owners of WP wish to maintain control over the business. They have $75,000 in reser available for funding these projects. Project Cash flow Year 6 Year 7 Year 8 Year 9 Year 10 20,000 Investment-Y Year 1 Year 2 Option 1: Menu Expansion Project (12,000) ) 3,600 3,800 Cumulative Cash Flow (8,400) (4,600) Option 2: Geographic Expansion Project (137,000) 36,000 39,000 Cumulative Cash Flow (101,000)| (62,000) Option 3: Pizza Oven Manufacturing Facility Project (185,000) 50,000 50,050 Cumulative Cash Flow (135,000)| (84,950) Cashflows Year 3 4,000 (600) 42,000 (20,000) 50,100 (34,850) Year 4 4,200 3,600 44,000 24,000 50,150 15,300 Year 5 4,400 8,000 45,000 69,000 50,200 65,500 455,000 47,000 116,000 50,250 115,750 49,000 165,000 50,350 166,100 50,000 215,000 50,400 216,500 51,000 266,000 50,450 266,950 52,000 318,000 50,500 317,450 502,450 9% Option 1: Menu Expansion Project Option 2: Geographic Expansion Project Option 3: Pizza Oven Manufacturing Facility Project Rates of Return 9% 9% 12% NPV IRR Payback Profitability period Index Option 1: Menu Expansion Project Option 2: Geographic Expansion Project Option 3: Pizza Oven Manufacturing Facility Project Be careful to use parenthesis to denote the correct order of operations (Students please put your answers in these cells) Prepare a 1 to 2 page memorandum to the company CEO. Your memorandum will include your assessment of the financial measures for each project. Be sure to explain what the numbers mean to a layperson. Be sure to share the importance of the metrics for decision-making. Provide your best financial recommendation on whether Wildcat Pizza has sufficient financial and management resources for the given project. Your recommendations need to be both quantitative (financial measures) and qualitative (what action should be taken and why). Case details: Wildcat Pizza, Inc. (WP) is a local pizza restaurant, which has been operating in one Western Massachusetts town for over 5 years. WP has a lively takeout and delivery business and cozy dining space for approximately 40 patrons. Although the company has been very successful financially, the owners are looking to the future to possibly improve operations of the current restaurant, expand to new locations, or diversify into manufacturing energy-efficient pizza ovens. The following options need to be evaluated to help the owners to make the best financial decision for WP based on the expected returns for each project. One option that Wildcat Pizza is considering is expanding its menu to offer more than pizza, grinders, and side dishes. They believe this option will attract new customers who are looking for a different product line than the usual pizza restaurant fare. The company feels that opening the menu to new products will draw upon existing strengths it has in serving the local market, where it has been operating. WP does realize it will be entering a different market in which it has no prior experience and may take time for new customers to adopt the restaurant and for existing users to adapt to the menu changes. This option is easy to implement with mostly existing resources which makes it very attractive. A second option available to Wildcat Pizza involves expansion either within or beyond the current geographic market. This would essentially allow WP to replicate the current menu and operations in another area. This will involve market research to determine where there is a need that is unmet by similar existing restaurants. This option, although it seems simple, is still a bit risky for the business. It can be challenging to expand to a marketplace where a business is unknown. WP's capital budget may not be sufficient without the use of debt financing to open additional locations. The final option is a bit more radical and will open the opportunity for Wildcat Pizza to expand into the manufacture of pizza ovens. This expansion will allow the company to diversify into an entirely new aspect of the food service business and distribute its product throughout the nation and potentially internationally. There are significant upfront and ongoing costs associated with this option, as it will require the acquisition of a manufacturing plant along with the machinists, operations, sales teams, and office staff required and where Wildcat Pizza currently has no experience. Undertaking this project is a possibility, but it would put great pressure on the company's ownership due to their inexperience. Additionally, due to the high costs to enter this new field WP's capital budget may not be sufficient without the use of debt financing. Option 1: Menu Expansion Project WP has an established restaurant that serves pizza, grinders, and fried side orders. There is limited available space for any additional equipment, but some items such as a panini press and grill costing $12,000 would be needed. The existing rent is $2,500 per month so this will not be considered in the Page 1 equations. It is expected that the project will have a life of 5 years at which time the company will reconsider its options Additional sales due to the expanded product line are expected to be $1,000/month. The cost of goods sold is expected to be $700. Sales are expected to grow for the first three years before leveling out as the company reaches maximum market penetration Cosh flows have been added to the Excel workbook Option 2: Geographic Expansion Project WP would have to rent additional retail/restaurant space in the geographic area selected. Equipment costing $95,000 would be needed and rent is $3,500 per month. It is expected that the project will have a life of 10 years at which time the company will reconsider its options. Sales at the new location are expected to be $5,000/month. The cost of goods sold is expected to be $2,700. Sales are expected to grow for the first three years before leveling out as the company reaches maximum market penetration Cosh flows hove been added to the Excel workbook Option 3: Pizza Oven Manufacturing Facility Project WP would have to rent factory space to manufacture the energy-efficient pizza ovens. The facility would have the capacity to produce 12,000 units per year. Equipment costing $95,000 would be needed and rent is $7,500 per month. It is expected that the project will have a life of 10 years at which time the company will reconsider its options. The ovens will have a list price of $15,000. The cost of goods sold is expected to be $8,700 per unit. Sales are estimated to be 900 units in the first year but are expected to grow for the first five years before leveling out as the company reaches maximum market penetration. Additionally, for this project sales are adjusted for costs associated with operating the manufacturing plant including machinists, sales, and office operations staff. Cash flows have been added to the Excel workbook Cost of Finance Wildcat Pizza has a corporate cost of capital of 9% which will be used to evaluate both the Menu Expansion Project and the Geographic Expansion Project because of their similarities with existing WP operations. The Pizza Oven Manufacturing Facility Project cost of capital will be 12% to reflect higher project risk due to WP's lack of experience in the new industry. The policy of Wildcat Pizza is to fund all growth with retained earnings and debt only. There is no public equity as the owners of WP wish to maintain control over the business. They have $75,000 in reser available for funding these projects. Project Cash flow Year 6 Year 7 Year 8 Year 9 Year 10 20,000 Investment-Y Year 1 Year 2 Option 1: Menu Expansion Project (12,000) ) 3,600 3,800 Cumulative Cash Flow (8,400) (4,600) Option 2: Geographic Expansion Project (137,000) 36,000 39,000 Cumulative Cash Flow (101,000)| (62,000) Option 3: Pizza Oven Manufacturing Facility Project (185,000) 50,000 50,050 Cumulative Cash Flow (135,000)| (84,950) Cashflows Year 3 4,000 (600) 42,000 (20,000) 50,100 (34,850) Year 4 4,200 3,600 44,000 24,000 50,150 15,300 Year 5 4,400 8,000 45,000 69,000 50,200 65,500 455,000 47,000 116,000 50,250 115,750 49,000 165,000 50,350 166,100 50,000 215,000 50,400 216,500 51,000 266,000 50,450 266,950 52,000 318,000 50,500 317,450 502,450 9% Option 1: Menu Expansion Project Option 2: Geographic Expansion Project Option 3: Pizza Oven Manufacturing Facility Project Rates of Return 9% 9% 12% NPV IRR Payback Profitability period Index Option 1: Menu Expansion Project Option 2: Geographic Expansion Project Option 3: Pizza Oven Manufacturing Facility Project Be careful to use parenthesis to denote the correct order of operations (Students please put your answers in these cells) Prepare a 1 to 2 page memorandum to the company CEO. Your memorandum will include your assessment of the financial measures for each project. Be sure to explain what the numbers mean to a layperson. Be sure to share the importance of the metrics for decision-making. Provide your best financial recommendation on whether Wildcat Pizza has sufficient financial and management resources for the given project. Your recommendations need to be both quantitative (financial measures) and qualitative (what action should be taken and why)