Question

Case Dunder Mifflin You have recently joined the team at a small paper company in Scranton PA, as a summer intern. The company has been

Case Dunder Mifflin

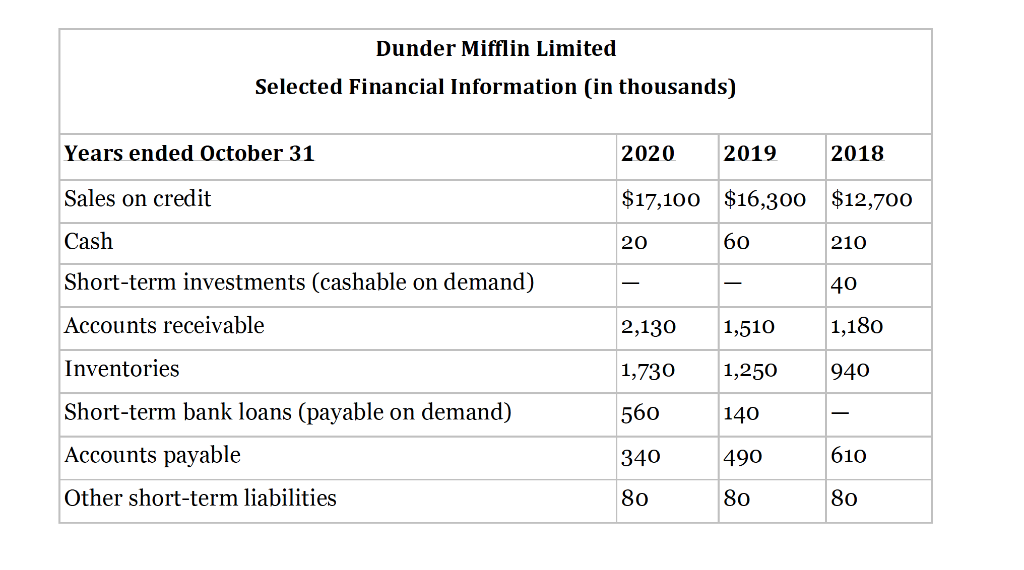

You have recently joined the team at a small paper company in Scranton PA, as a summer intern. The company has been operating for many years but is beginning to worry about its ability to pay its debts. The accounting team is currently short staffed, with one of its members out on an extended honeymoon, and another having recently left to start a local pub. You have been tasked by the remaining accountant, Oscar Martinez, to analyse the attached financial information and explain why the company is experiencing problems with its cash balance. Oscar has asked you to calculate any ratios necessary to support you work, as well as make recommendation as to what the company could do to reduce these problems.

Dunder Mifflin Limited Selected Financial Information (in thousands) Years ended October 31 2020 2019 2018 Sales on credit $17,100 $16,300 $12,700 Cash 20 60 210 Short-term investments (cashable on demand) 40 Accounts receivable 2,130 1,510 1,180 Inventories 1,730 1,250 940 560 140 - Short-term bank loans (payable on demand) Accounts payable Other short-term liabilities 340 490 610 80 80 80Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started