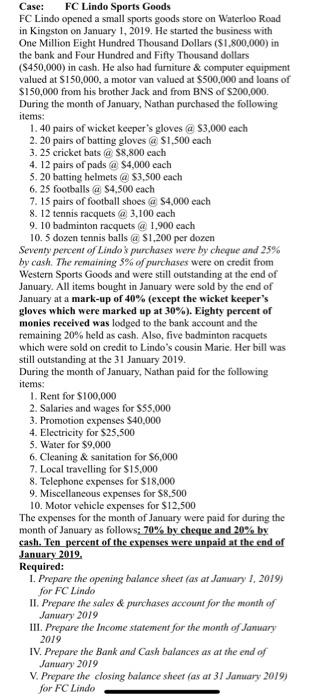

Case: FC Lindo Sports Goods FC Lindo opened a small sports goods store on Waterloo Road in Kingston on January 1, 2019. He started the business with One Million Eight Hundred Thousand Dollars ($1.800,000) in the bank and Four Hundred and Fifty Thousand dollars (S450,000) in cash. He also had furniture & computer equipment valued at $150.000, a motor van valued at $500,000 and loans of $150,000 from his brother Jack and from BNS of $200,000 During the month of January, Nathan purchased the following items: 1.40 pairs of wicket keeper's gloves @ $3,000 each 2.20 pairs of batting gloves @ $1.500 cach 3. 25 cricket bats @ $8,800 each 4. 12 pairs of pads @ $4,000 each 5.20 batting helmets @ $3,500 each 6. 25 footballs @ $4,500 each 7. 15 pairs of football shoes @ $4.000 each 8.12 tennis racquets @3.100 each 9. 10 badminton racquets @ 1,900 each 10.5 dozen tennis balls @ $1,200 per dozen Seventy percent of Lindos purchases were by cheque and 25% by cash. The remaining 3% of purchases were on credit from Western Sports Goods and were still outstanding at the end of January. All items bought in January were sold by the end of January at a mark-up of 40% (except the wicket keeper's gloves which were marked up at 30%). Eighty percent of monies received was lodged to the bank account and the remaining 20% held as cash. Also, five badminton racquets which were sold on credit to Lindo's cousin Marie. Her bill was still outstanding at the 31 January 2019. During the month of January, Nathan paid for the following items: 1. Rent for $100,000 2. Salaries and wages for $55,000 3. Promotion expenses $40,000 4. Electricity for $25,500 5. Water for $9.000 6. Cleaning & sanitation for $6,000 7. Local travelling for $15,000 8. Telephone expenses for $18,000 9. Miscellaneous expenses for $8.500 10. Motor vehicle expenses for $12,500 The expenses for the month of January were paid for during the month of January as follows: 70% by cheque and 20% by cash. Ten percent of the expenses were unpaid at the end of January 2019 Required: 1. Prepare the opening balance sheet (as ar January 1, 2019) for FC Lindo II. Prepare the sales & purchases account for the month of January 2019 III. Prepare the income statement for the month of January 2019 IV. Prepare the Bank and Cash balances as at the end of January 2019 V. Prepare the closing balance sheet (as ar 31 January 2019) for FC Lindo