Answered step by step

Verified Expert Solution

Question

1 Approved Answer

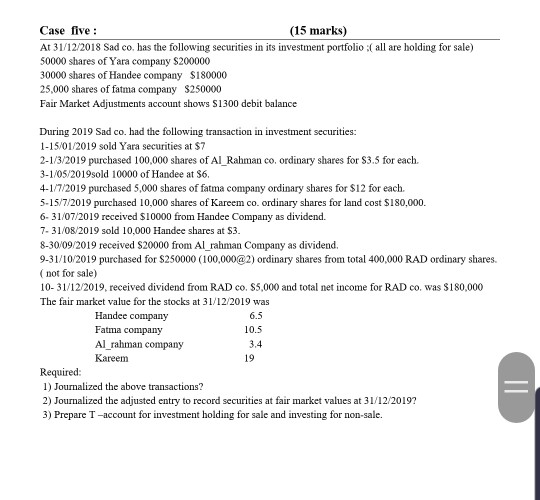

Case five : (15 marks) At 31/12/2018 Sad co. has the following securities in its investment portfolio :( all are holding for sale) 50000 shares

Case five : (15 marks) At 31/12/2018 Sad co. has the following securities in its investment portfolio :( all are holding for sale) 50000 shares of Yara company S200000 30000 shares of Handee company $180000 25,000 shares of fatma company $250000 Fair Market Adjustments account shows $1300 debit balance During 2019 Sad co. had the following transaction in investment securities: 1-15/01/2019 sold Yara securities at $7 2-1/3/2019 purchased 100,000 shares of Al_Rahman co ordinary shares for $3.5 for each. 3-1/05/2019sold 10000 of Handee at $6. 4-1/7/2019 purchased 5,000 shares of fatma company ordinary shares for $12 for each. 5-15/7/2019 purchased 10,000 shares of Kareem coordinary shares for land cost $180,000 6- 31/07/2019 received $10000 from Handee Company as dividend. 7-31/08/2019 sold 10,000 Handee shares at $3. 8-30/09/2019 received $20000 from Al_rahman Company as dividend, 9-31/10/2019 purchased for $250000 (100,000@2) ordinary shares from total 400,000 RAD ordinary shares. (not for sale) 10-31/12/2019, received dividend from RAD Co. $5,000 and total net income for RAD Co. was $180,000 The fair market value for the stocks at 31/12/2019 was Handee company Fatma company Al_rahman company Kareem 19 Required: 1) Journalized the above transactions? 2) Journalized the adjusted entry to record securities at fair market values at 31/12/2019? 3) Prepare T-account for investment holding for sale and investing for non-sale. 6.5 10.5 3.4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started