Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case in Point Summary Exercise FORD MOTOR COMPANY ww.ford.com Facts: - 1925: Price of first Ford truck was $281 - 1950s: Cars styled for more

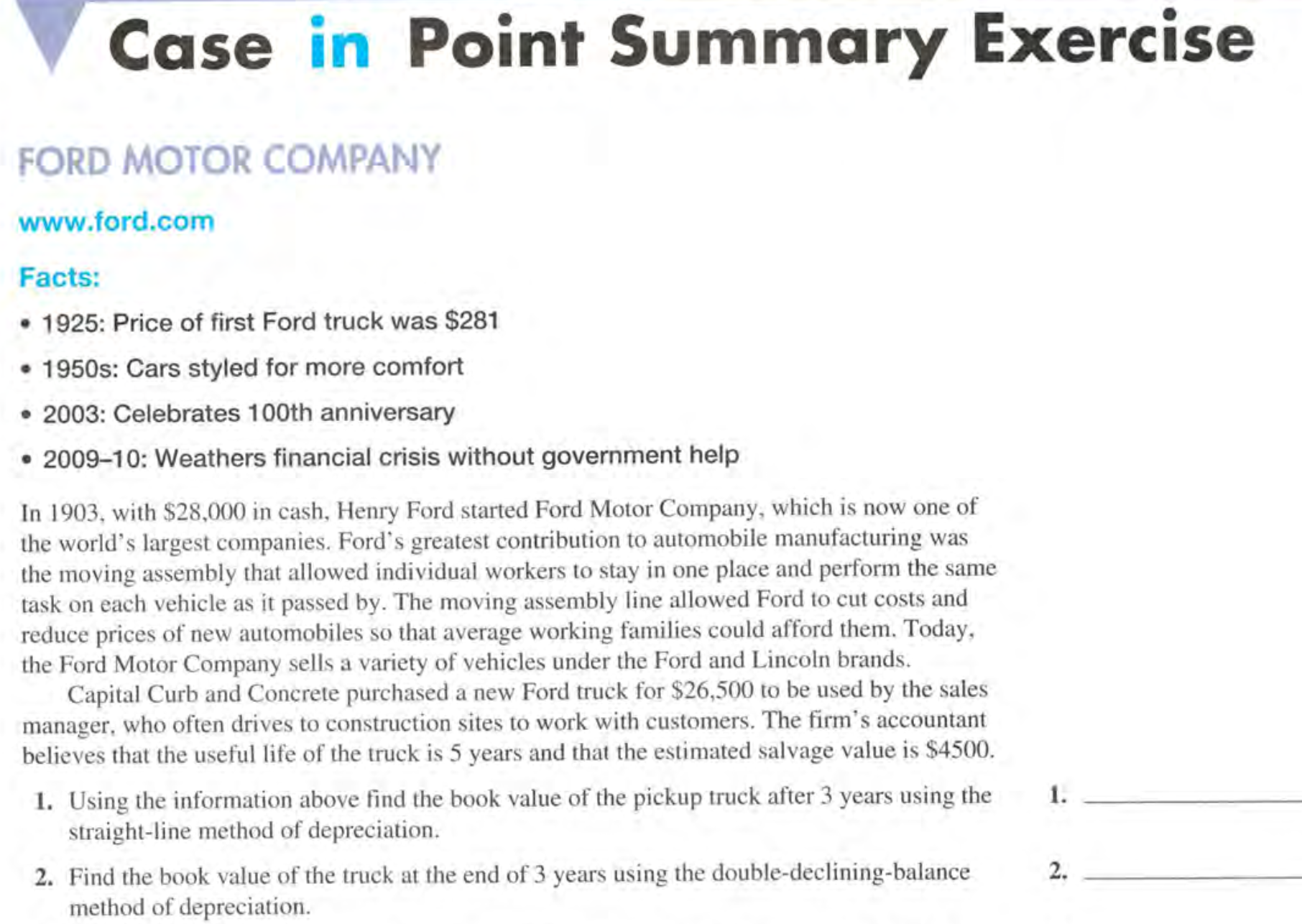

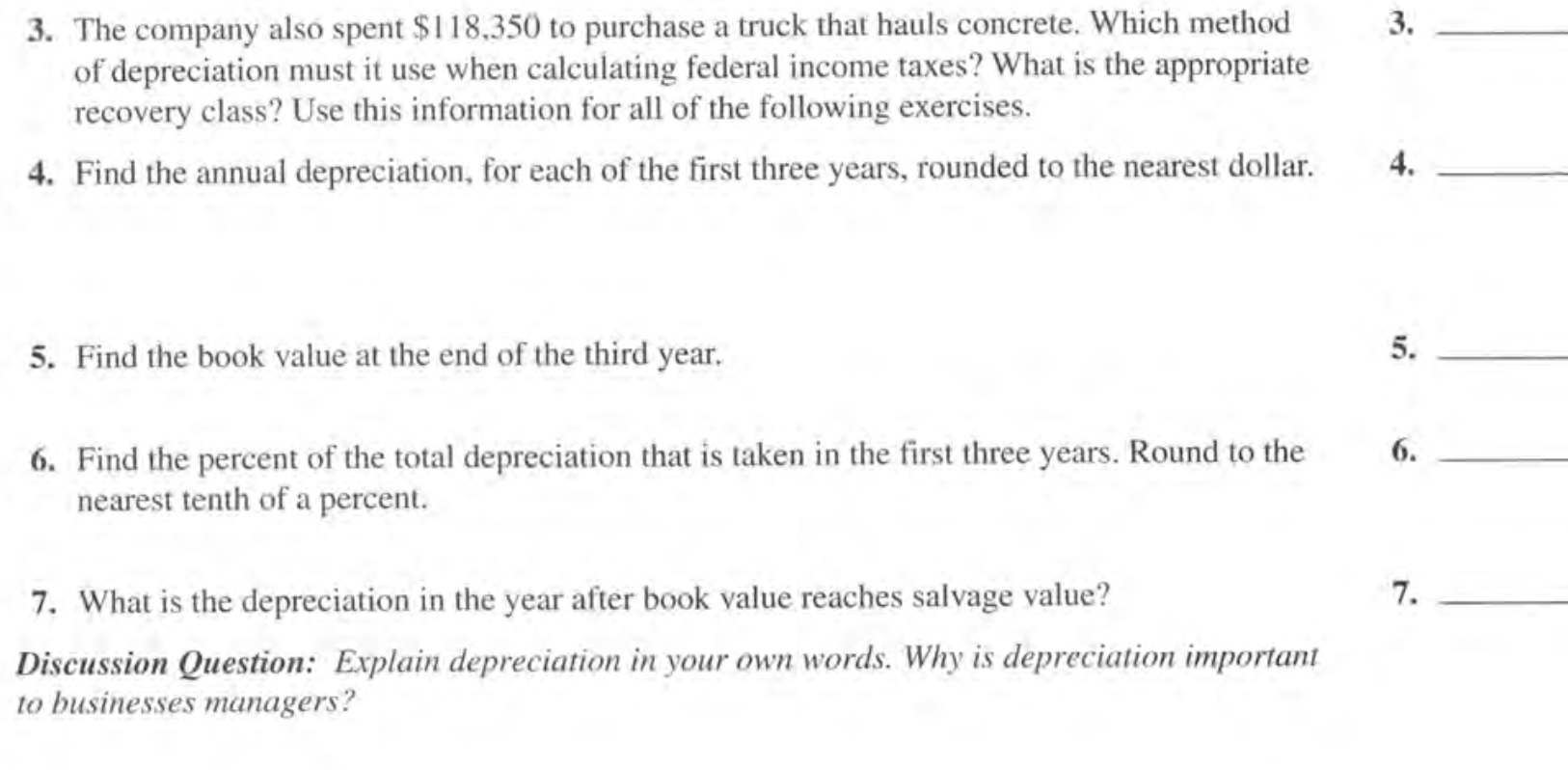

Case in Point Summary Exercise FORD MOTOR COMPANY ww.ford.com Facts: - 1925: Price of first Ford truck was $281 - 1950s: Cars styled for more comfort - 2003: Celebrates 100th anniversary - 2009-10: Weathers financial crisis without government help In 1903 , with $28,000 in cash, Henry Ford started Ford Motor Company, which is now one of the world's largest companies. Ford's greatest contribution to automobile manufacturing was the moving assembly that allowed individual workers to stay in one place and perform the same task on each vehicle as it passed by. The moving assembly line allowed Ford to cut costs and reduce prices of new automobiles so that average working families could afford them. Today, the Ford Motor Company sells a variety of vehicles under the Ford and Lincoln brands. Capital Curb and Concrete purchased a new Ford truck for $26,500 to be used by the sales manager, who often drives to construction sites to work with customers. The firm's accountant believes that the useful life of the truck is 5 years and that the estimated salvage value is $4500. 1. Using the information above find the book value of the pickup truck after 3 years using the 1. straight-line method of depreciation. 2. Find the book value of the truck at the end of 3 years using the double-declining-balance 2. method of depreciation. 3. The company also spent $118,350 to purchase a truck that hauls concrete. Which method of depreciation must it use when calculating federal income taxes? What is the appropriate recovery class? Use this information for all of the following exercises. 4. Find the annual depreciation, for each of the first three years, rounded to the nearest dollar. 5. Find the book value at the end of the third year. 6. Find the percent of the total depreciation that is taken in the first three years. Round to the nearest tenth of a percent. 7. What is the depreciation in the year after book value reaches salvage value? Discussion Question: Explain depreciation in your own words. Why is depreciation important to businesses managers

Case in Point Summary Exercise FORD MOTOR COMPANY ww.ford.com Facts: - 1925: Price of first Ford truck was $281 - 1950s: Cars styled for more comfort - 2003: Celebrates 100th anniversary - 2009-10: Weathers financial crisis without government help In 1903 , with $28,000 in cash, Henry Ford started Ford Motor Company, which is now one of the world's largest companies. Ford's greatest contribution to automobile manufacturing was the moving assembly that allowed individual workers to stay in one place and perform the same task on each vehicle as it passed by. The moving assembly line allowed Ford to cut costs and reduce prices of new automobiles so that average working families could afford them. Today, the Ford Motor Company sells a variety of vehicles under the Ford and Lincoln brands. Capital Curb and Concrete purchased a new Ford truck for $26,500 to be used by the sales manager, who often drives to construction sites to work with customers. The firm's accountant believes that the useful life of the truck is 5 years and that the estimated salvage value is $4500. 1. Using the information above find the book value of the pickup truck after 3 years using the 1. straight-line method of depreciation. 2. Find the book value of the truck at the end of 3 years using the double-declining-balance 2. method of depreciation. 3. The company also spent $118,350 to purchase a truck that hauls concrete. Which method of depreciation must it use when calculating federal income taxes? What is the appropriate recovery class? Use this information for all of the following exercises. 4. Find the annual depreciation, for each of the first three years, rounded to the nearest dollar. 5. Find the book value at the end of the third year. 6. Find the percent of the total depreciation that is taken in the first three years. Round to the nearest tenth of a percent. 7. What is the depreciation in the year after book value reaches salvage value? Discussion Question: Explain depreciation in your own words. Why is depreciation important to businesses managers Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started