Case Information

For 2018, one (1) withholding allowance is equivalent to $4,150. Employers compute how much federal income tax to withhold from your paychecks by using the following formula:

- W-2 Box 1 wages ($4,150 * # of allowances you claimed on Form W-4) = Net taxable wages

- Federal income tax withholding is then computed by applying the appropriate tax rate bracket to the net taxable wage amount

Assume you have always claimed two (2) allowances simply out of habit, and you are in the 24% marginal tax rate bracket. You typically end up with a reasonable refund when you file your tax return each year, which means your employer is likely withholding too much federal income tax from your paychecks (i.e. you should be claiming more than 2 allowances).

Directions

Respond to all these questions in a word document. Show your calculations.

-

What is the purpose of Form W-4 (hint the purpose of the form is explained at the top of Pg. 1 of the related pdf document)?

-

When can you ask your employer to update your withholding allowances on Form W-4?

- Option A: At any point during the year

- Option B: Only during your companys open enrollment period for benefits

- Option C: You cant make any changes after youve returned the completed form with your new-hire paperwork

-

If you had asked your employer for a new Form W-4 at the beginning of the year and decided to claim five (5) allowances instead of two (2), how much additional take-home pay would you have had? See the bullets below for assistance with your calculations:

- Your change in allowances would be 3 (i.e. from 2 to 5)

- Multiply that amount by $4,150

- Multiply that amount by your marginal tax rate of 24%

-

If instead you decided to claim zero (0) allowances, simply because you wanted the biggest possible tax return refund, how much would your tax return refund have increased if you went from two (2) allowances to zero (0) allowances at the beginning of the year? See the bullets below for assistance with your calculations:

- Your change in allowances would be 2 (i.e. from 2 to 0)

- Multiply that amount by $4,150

- Multiply that amount by your marginal tax rate of 24%

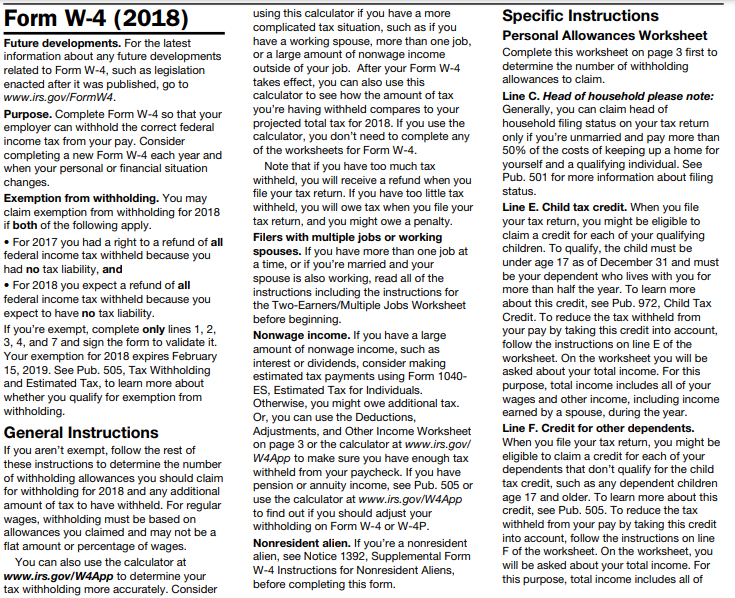

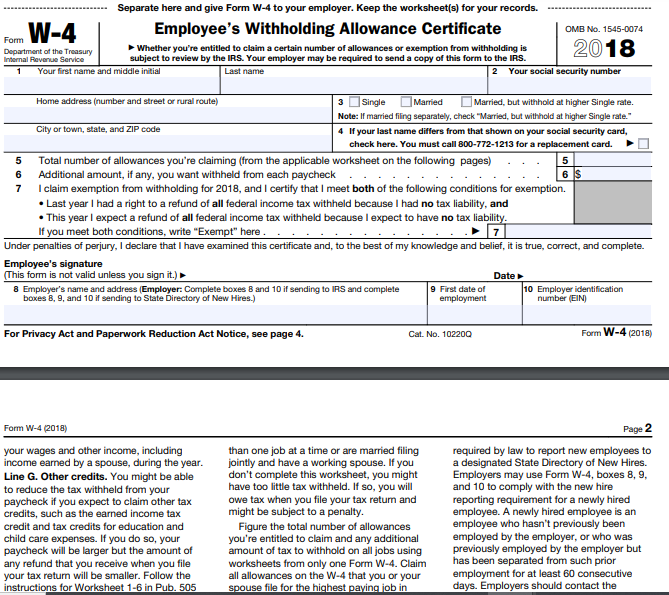

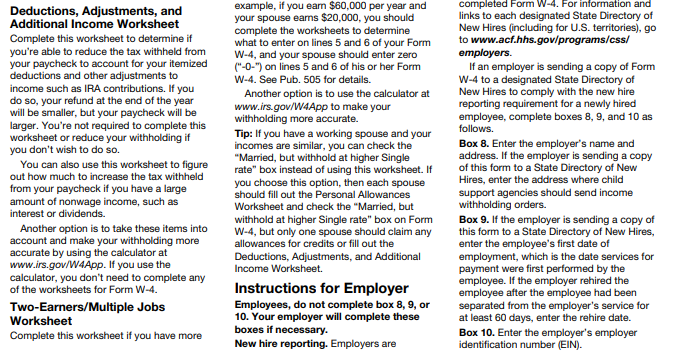

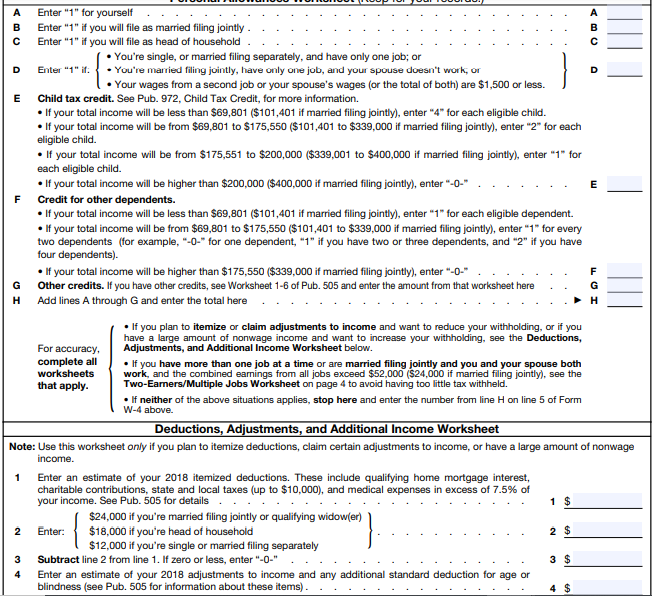

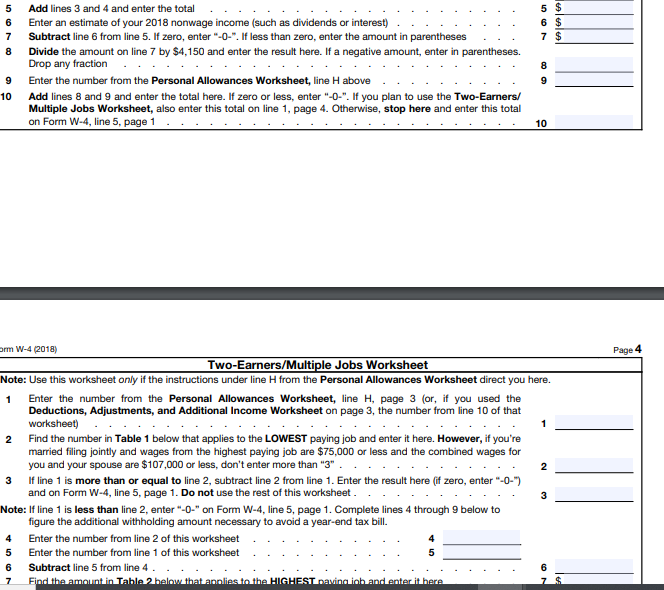

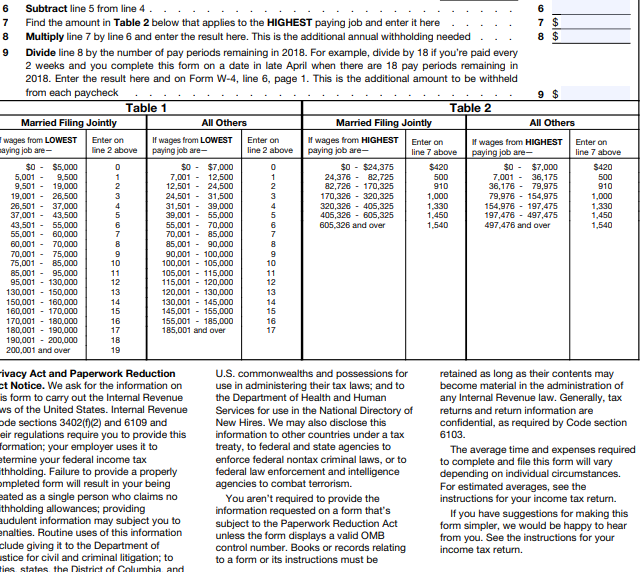

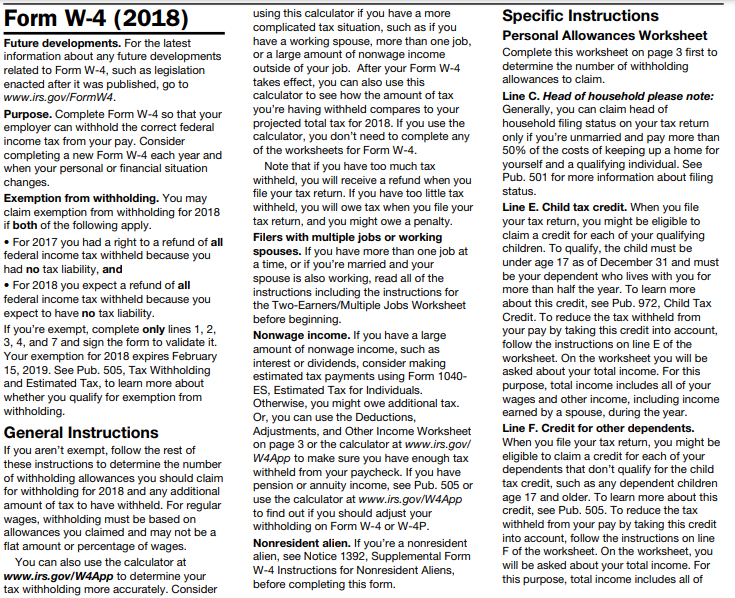

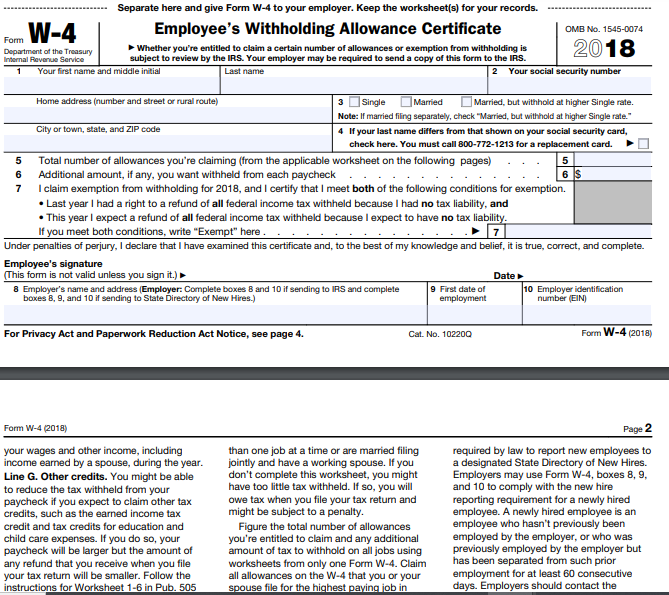

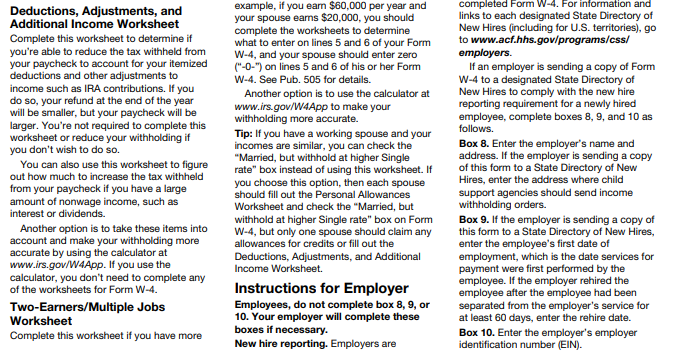

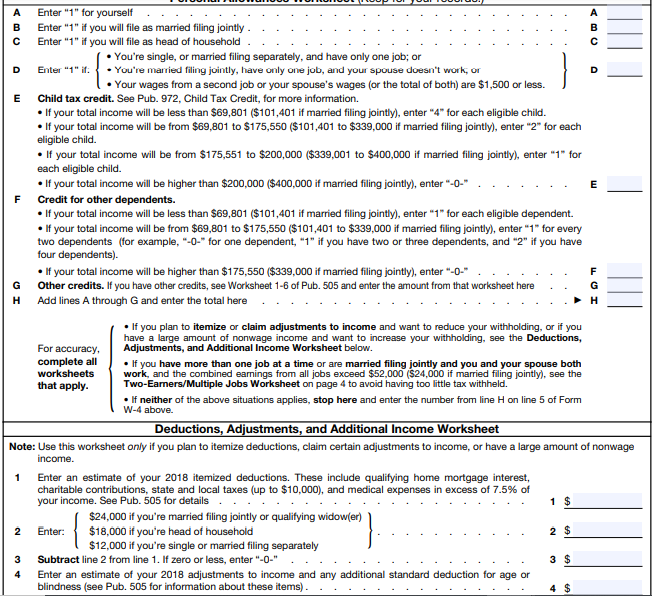

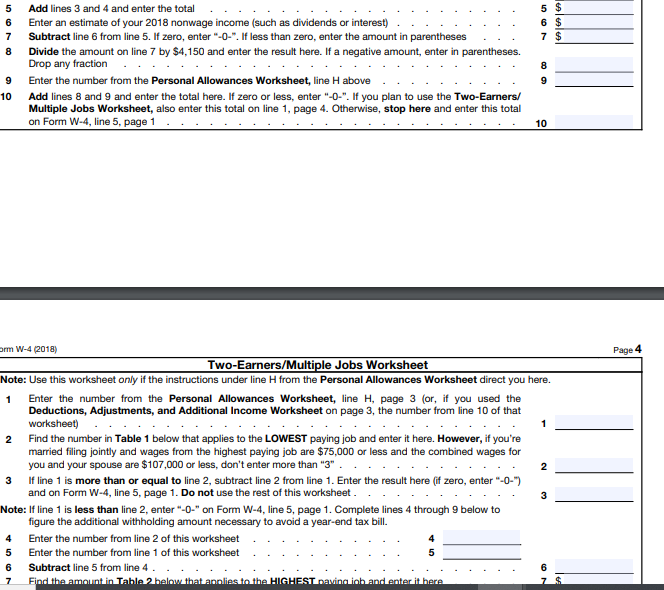

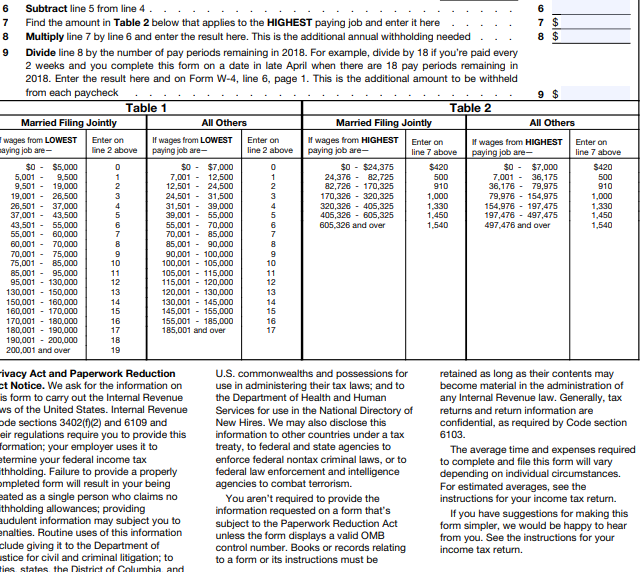

Form W-4 (2018) Future developments. For the latest information about any future developments related to Form W-4, such as legislation enacted after it was published, go to www.irs.gov/FormW4. Purpose. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Consider completing a new Form W-4 each year and when your personal or financial situation changes. Exemption from withholding. You may claim exemption from withholding for 2018 if both of the following apply. For 2017 you had a right to a refund of all federal income tax withheld because you had no tax liability, and For 2018 you expect a refund of all federal income tax withheld because you expect to have no tax liability. If you're exempt, complete only lines 1, 2, 3, 4, and 7 and sign the form to validate it. Your exemption for 2018 expires February 15, 2019. See Pub. 505, Tax Withholding and Estimated Tax, to learn more about whether you qualify for exemption from withholding. General Instructions If you aren't exempt, follow the rest of these instructions to determine the number of withholding allowances you should claim for withholding for 2018 and any additional amount of tax to have withheld. For regular wages, withholding must be based on allowances you claimed and may not be a flat amount or percentage of wages. You can also use the calculator at www.irs.gov/W4App to determine your tax withholding more accurately. Consider using this calculator if you have a more complicated tax situation, such as if you have a working spouse, more than one job, or a large amount of nonwage income outside of your job. After your Form W-4 takes effect, you can also use this calculator to see how the amount of tax you're having withheld compares to your projected total tax for 2018. If you use the calculator, you don't need to complete any of the worksheets for Form W-4. Note that if you have too much tax withheld, you will receive a refund when you file your tax return. If you have too little tax withheld, you will owe tax when you file your tax return, and you might owe a penalty. Filers with multiple jobs or working spouses. If you have more than one job at a time, or if you're married and your spouse is also working, read all of the instructions including the instructions for the Two-Earners/Multiple Jobs Worksheet before beginning. Nonwage income. If you have a large amount of nonwage income, such as interest or dividends, consider making estimated tax payments using Form 1040- ES, Estimated Tax for Individuals. Otherwise, you might owe additional tax. Or, you can use the Deductions, Adjustments, and Other Income Worksheet on page 3 or the calculator at www.irs.gov/ W4App to make sure you have enough tax withheld from your paycheck. If you have pension or annuity income, see Pub. 505 or use the calculator at www.irs.gov/W4App to find out if you should adjust your withholding on Form W-4 or W-4P. Nonresident alien. If you're a nonresident alien, see Notice 1392, Supplemental Form W-4 Instructions for Nonresident Aliens, before completing this form. Specific Instructions Personal Allowances Worksheet Complete this worksheet on page 3 first to determine the number of withholding allowances to claim. Line C. Head of household please note: Generally, you can claim head of household filing status on your tax retum only if you're unmarried and pay more than 50% of the costs of keeping up a home for yourself and a qualifying individual. See Pub. 501 for more information about filing status. Line E. Child tax credit. When you file your tax return, you might be eligible to claim a credit for each of your qualifying children. To qualify, the child must be under age 17 as of December 31 and must be your dependent who lives with you for more than half the year. To learn more about this credit, see Pub. 972, Child Tax Credit. To reduce the tax withheld from your pay by taking this credit into account, follow the instructions on line E of the worksheet. On the worksheet you will be asked about your total income. For this purpose, total income includes all of your wages and other income, including income earned by a spouse, during the year. Line F. Credit for other dependents. When you file your tax return, you might be eligible to claim a credit for each of your dependents that don't qualify for the child tax credit, such as any dependent children age 17 and older. To learn more about this credit, see Pub. 505. To reduce the tax withheld from your pay by taking this credit into account, follow the instructions on line F of the worksheet. On the worksheet, you will be asked about your total income. For this purpose, total income includes all of Separate here and give Form W-4 to your employer. Keep the worksheet(s) for your records. Employee's Withholding Allowance Certificate OMB No. 1545-0074 Form Department of the Treasury Whether you're entitled to claim a certain number of allowances or exemption from withholding is 2018 Internal Revenue Service subject to review by the IRS. Your employer may be required to send a copy of this form to the IRS. Your first name and middle initial Last name 2 Your social security number 1 6 Home address (number and street or rural route) 3 Single Married Married, but withhold at higher Single rate. Note: If married filing separately, check "Married, but withhold at higher Single rate." City or town, state, and ZIP code 4 If your last name differs from that shown on your social security card, check here. You must call 800-772-1213 for a replacement card. 5 Total number of allowances you're claiming (from the applicable worksheet on the following pages) 5 Additional amount, if any, you want withheld from each paycheck 6S 7 I claim exemption from withholding for 2018, and I certify that I meet both of the following conditions for exemption. Last year I had a right to a refund of all federal income tax withheld because I had no tax liability, and This year I expect a refund of all federal income tax withheld because I expect to have no tax liability. If you meet both conditions, write "Exempt" here. Under penalties of perjury, I declare that I have examined this certificate and, to the best of my knowledge and belief, it is true, correct, and complete. Employee's signature (This form is not valid unless you sign it.) Date 8 Employer's name and address (Employer: Complete boxes 8 and 10 if sending to IRS and complete 9 First date of 10 Employer identification boxes 8, 9, and 10 if sending to State Directory of New Hires.) employment number (EIN) For Privacy Act and Paperwork Reduction Act Notice, see page 4. Cat. No. 102200 Form W-4 (2018) Form W-4 (2018) Page 2 your wages and other income, including income earned by a spouse, during the year. Line G. Other credits. You might be able to reduce the tax withheld from your paycheck if you expect to claim other tax credits, such as the earned income tax credit and tax credits for education and child care expenses. If you do so, your paycheck will be larger but the amount of any refund that you receive when you file your tax return will be smaller. Follow the instructions for Worksheet 1-6 in Pub. 505 than one job at a time or are married filing jointly and have a working spouse. If you don't complete this worksheet, you might have too little tax withheld. If so, you will owe tax when you file your tax return and might be subject to a penalty. Figure the total number of allowances you're entitled to claim and any additional amount of tax to withhold on all jobs using worksheets from only one Form W-4. Claim all allowances on the W-4 that you or your spouse file for the highest paying job in required by law to report new employees to a designated State Directory of New Hires. Employers may use Form W-4, boxes 8, 9, and 10 to comply with the new hire reporting requirement for a newly hired employee. A newly hired employee is an employee who hasn't previously been employed by the employer, or who was previously employed by the employer but has been separated from such prior employment for at least 60 consecutive days. Employers should contact the Deductions, Adjustments, and Additional Income Worksheet Complete this worksheet to determine if you're able to reduce the tax withheld from your paycheck to account for your itemized deductions and other adjustments to income such as IRA contributions. If you do so, your refund at the end of the year will be smaller, but your paycheck will be larger. You're not required to complete this worksheet or reduce your withholding if you don't wish to do so. You can also use this worksheet to figure out how much to increase the tax withheld from your paycheck if you have a large amount of nonwage income, such as interest or dividends. Another option is to take these items into account and make your withholding more accurate by using the calculator at www.irs.gov/W4App. If you use the calculator, you don't need to complete any of the worksheets for Form W-4. Two-Earners/Multiple Jobs Worksheet Complete this worksheet if you have more example, if you earn $60,000 per year and your spouse earns $20,000, you should complete the worksheets to determine what to enter on lines 5 and 6 of your Form W-4, and your spouse should enter zero ("-O-") on lines 5 and 6 of his or her Form W-4. See Pub. 505 for details. Another option is to use the calculator at www.irs.gov/W4App to make your withholding more accurate. Tip: If you have a working spouse and your incomes are similar, you can check the "Married, but withhold at higher Single rate" box instead of using this worksheet. If you choose this option, then each spouse should fill out the Personal Allowances Worksheet and check the "Married, but withhold at higher Single rate" box on Form W-4, but only one spouse should claim any allowances for credits or fill out the Deductions, Adjustments, and Additional Income Worksheet. Instructions for Employer Employees, do not complete box 8, 9, or 10. Your employer will complete these boxes if necessary. New hire reporting. Employers are completed Form W-4. For information and links to each designated State Directory of New Hires (including for U.S. territories), go to www.acf.hhs.gov/programs/css/ employers. If an employer is sending a copy of Form W-4 to a designated State Directory of New Hires to comply with the new hire reporting requirement for a newly hired employee, complete boxes 8, 9, and 10 as follows. Box 8. Enter the employer's name and address. If the employer is sending a copy of this form to a State Directory of New Hires, enter the address where child support agencies should send income withholding orders. Box 9. If the employer is sending a copy of this form to a State Directory of New Hires, enter the employee's first date of employment, which is the date services for payment were first performed by the employee. If the employer rehired the employee after the employee had been separated from the employer's service for at least 60 days, enter the rehire date. Box 10. Enter the employer's employer identification number (EIN). B D D F G Enter "1" for yourself B Enter "1" if you will file as married filing jointly. Enter "1" if you will file as head of household You're single, or married filing separately, and have only one job; or D Enter "1" if. You're married filing jointly, have only one job, and your spouse doesn't work, or Your wages from a second job or your spouse's wages for the total of both) are $1,500 or less. E Child tax credit. See Pub. 972, Child Tax Credit, for more information. If your total income will be less than $69,801 ($101,401 if married filing jointly), enter "4" for each eligible child. If your total income will be from $69,801 to $175,550 ($101,401 to $339,000 if married filing jointly), enter "2" for each eligible child. If your total income will be from $175,551 to $200,000 ($339,001 to $400,000 if married filing jointly), enter "1" for each eligible child. If your total income will be higher than $200,000 ($400,000 if married filing jointly), enter"--" E F Credit for other dependents. If your total income will be less than $69,801 ($101,401 if married filing jointly), enter "1" for each eligible dependent. If your total income will be from $69,801 to $175,550 ($101,401 to $339,000 if married filing jointly), enter "1" for every two dependents (for example, "--" for one dependent, "1" if you have two or three dependents, and "2" if you have four dependents). If your total income will be higher than $175,550 ($339,000 if married filing jointly), enter"-0-- G Other credits. If you have other credits, see Worksheet 1-6 of Pub. 505 and enter the amount from that worksheet here H Add lines A through G and enter the total here If you plan to itemize or claim adjustments to income and want to reduce your withholding, or if you have a large amount of nonwage income and want to increase your withholding, see the Deductions, For accuracy, Adjustments, and Additional Income Worksheet below. complete all If you have more than one job at a time or are married filing jointly and you and your spouse both worksheets work, and the combined earnings from all jobs exceed $52,000 ($24,000 if married filing jointly), see the that apply. Two-Earners/Multiple Jobs Worksheet on page 4 to avoid having too little tax withheld. . If neither of the above situations applies, stop here and enter the number from line H on line 5 of Form W-4 above. Deductions, Adjustments, and Additional Income Worksheet Note: Use this worksheet only if you plan to itemize deductions, claim certain adjustments to income, or have a large amount of nonwage income. Enter an estimate of your 2018 itemized deductions. These include qualifying home mortgage interest, charitable contributions, state and local taxes (up to $10,000), and medical expenses in excess of 7.5% of your income. See Pub. 505 for details 1 $ $24,000 if you're married filing jointly or qualifying widow(er) Enter: $18,000 if you're head of household 2 $ $12,000 if you're single or married filing separately Subtract line 2 from line 1. If zero or less, enter"--" 3 $ Enter an estimate of your 2018 adjustments to income and any additional standard deduction for age or blindness (see Pub. 505 for information about these items). 1 2 3 4 5 $ 5 6 7 8 6 $ 7 $ Add lines 3 and 4 and enter the total Enter an estimate of your 2018 nonwage income (such as dividends or interest) Subtract line 6 from line 5. If zero, enter"-O-". If less than zero, enter the amount in parentheses Divide the amount on line 7 by $4,150 and enter the result here. If a negative amount, enter in parentheses. Drop any fraction Enter the number from the Personal Allowances Worksheet, line H above Add lines 8 and 9 and enter the total here. If zero or less, enter "-O-". If you plan to use the Two-Earners/ Multiple Jobs Worksheet, also enter this total on line 1, page 4. Otherwise, stop here and enter this total on Form W-4, line 5, page 1 8 9 9 10 10 Page 4 1 2 Orm W-4 (2018) Two-Earners/Multiple Jobs Worksheet Note: Use this worksheet only if the instructions under line from the Personal Allowances Worksheet direct you here. Enter the number from the Personal Allowances Worksheet, line H, page 3 (or, if you used the Deductions, Adjustments, and Additional Income Worksheet on page 3, the number from line 10 of that worksheet) Find the number in Table 1 below that applies to the LOWEST paying job and enter it here. However, if you're married filing jointly and wages from the highest paying job are $75,000 or less and the combined wages for you and your spouse are $107,000 or less, don't enter more than "3" 2 3 If line 1 is more than or equal to line 2, subtract line 2 from line 1. Enter the result here (if zero, enter"-6") and on Form W-4, line 5, page 1. Do not use the rest of this worksheet Note: If line 1 is less than line 2, enter"--" on Form W-4 line 5, page 1. Complete lines 4 through 9 below to figure the additional withholding amount necessary to avoid a year-end tax bill. 4 Enter the number from line 2 of this worksheet 5 Enter the number from line 1 of this worksheet 5 6 Subtract line 5 from line 4. 7 Find the amount in Table 2 helow that anglies to the HIGHEST navina ich and enter it here 3 4 6 Subtract line 5 from line 4 . 6 7 Find the amount in Table 2 below that applies to the HIGHEST paying job and enter it here 7 $ 8 Multiply line 7 by line 6 and enter the result here. This is the additional annual withholding needed 8 $ 9 Divide line 8 by the number of pay periods remaining in 2018. For example, divide by 18 if you're paid every 2 weeks and you complete this form on a date in late April when there are 18 pay periods remaining in 2018. Enter the result here and on Form W-4, line 6, page 1. This is the additional amount to be withheld from each paycheck 9 $ Table 1 Table 2 Married Filing Jointly All Others Married Filing Jointly All Others wages from LOWEST Enter on If wages from LOWEST Enter on If wages from HIGHEST Enter on If wages from HIGHEST Enter on maying job are- line 2 above paying job are line 2 above paying job are line 7 above paying job are- line 7 above $0 - $5,000 0 $0 - $7,000 0 $0 - $24,375 $420 $0 - $7,000 $420 5,001 - 9.500 1 7,001 - 12,500 1 24,376 - 82,725 500 7,001 - 36,175 500 9,501 - 19,000 2 12,501 - 24,500 2. 82,726 - 170,325 910 36,176 - 79,975 910 19.001 - 26.500 3 24,501 - 31,500 3 170,326 - 320,325 1.000 79,976 - 154,975 1,000 26,501 - 37.000 4 31.501 - 39,000 4 320,326 - 405,325 1.330 154,976 - 197,475 1,330 37.001 43,500 5 39,001 - 55,000 5 406,326 - 606,325 1.450 197,476 - 497,475 1,450 43,501 55.000 6 55,001 - 70,000 6 605.326 and over 1,540 497,476 and over 1,540 55,001 60,000 7 70,001 - 85,000 7 60.001 70.000 B 85,001 - 90,000 8 70,001 75.000 9 90,001 - 100,000 9 75,001 85.000 10 100,001 - 105,000 10 85,001 - 95.000 11 105,001 - 115,000 11 95,001 130,000 12 115,001 - 120,000 12 130.001 150.000 13 120,001 - 130,000 13 150,001 160,000 14 130,001 - 145,000 14 160.001 170,000 15 145,001 - 155,000 15 170,001 180,000 16 155,001 - 185,000 16 180,001 190.000 17 185,001 and over 17 190.001 - 200.000 18 200,001 and over 19 ivacy Act and Paperwork Reduction ct Notice. We ask for the information on is form to carry out the Internal Revenue ws of the United States. Internal Revenue de sections 3402(1)(2) and 6109 and eir regulations require you to provide this formation; your employer uses it to termine your federal income tax thholding. Failure to provide a properly ompleted form will result in your being sated as a single person who claims no thholding allowances; providing audulent information may subject you to analties. Routine uses of this information clude giving it to the Department of stice for civil and criminal litigation; to ties states the District of Columbia and U.S. commonwealths and possessions for use in administering their tax laws; and to the Department of Health and Human Services for use in the National Directory of New Hires. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism. You aren't required to provide the information requested on a form that's subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by Code section 6103. The average time and expenses required to complete and file this form will vary depending on individual circumstances. For estimated averages, see the instructions for your income tax return. If you have suggestions for making this form simpler, we would be happy to hear from you. See the instructions for your income tax return. Form W-4 (2018) Future developments. For the latest information about any future developments related to Form W-4, such as legislation enacted after it was published, go to www.irs.gov/FormW4. Purpose. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Consider completing a new Form W-4 each year and when your personal or financial situation changes. Exemption from withholding. You may claim exemption from withholding for 2018 if both of the following apply. For 2017 you had a right to a refund of all federal income tax withheld because you had no tax liability, and For 2018 you expect a refund of all federal income tax withheld because you expect to have no tax liability. If you're exempt, complete only lines 1, 2, 3, 4, and 7 and sign the form to validate it. Your exemption for 2018 expires February 15, 2019. See Pub. 505, Tax Withholding and Estimated Tax, to learn more about whether you qualify for exemption from withholding. General Instructions If you aren't exempt, follow the rest of these instructions to determine the number of withholding allowances you should claim for withholding for 2018 and any additional amount of tax to have withheld. For regular wages, withholding must be based on allowances you claimed and may not be a flat amount or percentage of wages. You can also use the calculator at www.irs.gov/W4App to determine your tax withholding more accurately. Consider using this calculator if you have a more complicated tax situation, such as if you have a working spouse, more than one job, or a large amount of nonwage income outside of your job. After your Form W-4 takes effect, you can also use this calculator to see how the amount of tax you're having withheld compares to your projected total tax for 2018. If you use the calculator, you don't need to complete any of the worksheets for Form W-4. Note that if you have too much tax withheld, you will receive a refund when you file your tax return. If you have too little tax withheld, you will owe tax when you file your tax return, and you might owe a penalty. Filers with multiple jobs or working spouses. If you have more than one job at a time, or if you're married and your spouse is also working, read all of the instructions including the instructions for the Two-Earners/Multiple Jobs Worksheet before beginning. Nonwage income. If you have a large amount of nonwage income, such as interest or dividends, consider making estimated tax payments using Form 1040- ES, Estimated Tax for Individuals. Otherwise, you might owe additional tax. Or, you can use the Deductions, Adjustments, and Other Income Worksheet on page 3 or the calculator at www.irs.gov/ W4App to make sure you have enough tax withheld from your paycheck. If you have pension or annuity income, see Pub. 505 or use the calculator at www.irs.gov/W4App to find out if you should adjust your withholding on Form W-4 or W-4P. Nonresident alien. If you're a nonresident alien, see Notice 1392, Supplemental Form W-4 Instructions for Nonresident Aliens, before completing this form. Specific Instructions Personal Allowances Worksheet Complete this worksheet on page 3 first to determine the number of withholding allowances to claim. Line C. Head of household please note: Generally, you can claim head of household filing status on your tax retum only if you're unmarried and pay more than 50% of the costs of keeping up a home for yourself and a qualifying individual. See Pub. 501 for more information about filing status. Line E. Child tax credit. When you file your tax return, you might be eligible to claim a credit for each of your qualifying children. To qualify, the child must be under age 17 as of December 31 and must be your dependent who lives with you for more than half the year. To learn more about this credit, see Pub. 972, Child Tax Credit. To reduce the tax withheld from your pay by taking this credit into account, follow the instructions on line E of the worksheet. On the worksheet you will be asked about your total income. For this purpose, total income includes all of your wages and other income, including income earned by a spouse, during the year. Line F. Credit for other dependents. When you file your tax return, you might be eligible to claim a credit for each of your dependents that don't qualify for the child tax credit, such as any dependent children age 17 and older. To learn more about this credit, see Pub. 505. To reduce the tax withheld from your pay by taking this credit into account, follow the instructions on line F of the worksheet. On the worksheet, you will be asked about your total income. For this purpose, total income includes all of Separate here and give Form W-4 to your employer. Keep the worksheet(s) for your records. Employee's Withholding Allowance Certificate OMB No. 1545-0074 Form Department of the Treasury Whether you're entitled to claim a certain number of allowances or exemption from withholding is 2018 Internal Revenue Service subject to review by the IRS. Your employer may be required to send a copy of this form to the IRS. Your first name and middle initial Last name 2 Your social security number 1 6 Home address (number and street or rural route) 3 Single Married Married, but withhold at higher Single rate. Note: If married filing separately, check "Married, but withhold at higher Single rate." City or town, state, and ZIP code 4 If your last name differs from that shown on your social security card, check here. You must call 800-772-1213 for a replacement card. 5 Total number of allowances you're claiming (from the applicable worksheet on the following pages) 5 Additional amount, if any, you want withheld from each paycheck 6S 7 I claim exemption from withholding for 2018, and I certify that I meet both of the following conditions for exemption. Last year I had a right to a refund of all federal income tax withheld because I had no tax liability, and This year I expect a refund of all federal income tax withheld because I expect to have no tax liability. If you meet both conditions, write "Exempt" here. Under penalties of perjury, I declare that I have examined this certificate and, to the best of my knowledge and belief, it is true, correct, and complete. Employee's signature (This form is not valid unless you sign it.) Date 8 Employer's name and address (Employer: Complete boxes 8 and 10 if sending to IRS and complete 9 First date of 10 Employer identification boxes 8, 9, and 10 if sending to State Directory of New Hires.) employment number (EIN) For Privacy Act and Paperwork Reduction Act Notice, see page 4. Cat. No. 102200 Form W-4 (2018) Form W-4 (2018) Page 2 your wages and other income, including income earned by a spouse, during the year. Line G. Other credits. You might be able to reduce the tax withheld from your paycheck if you expect to claim other tax credits, such as the earned income tax credit and tax credits for education and child care expenses. If you do so, your paycheck will be larger but the amount of any refund that you receive when you file your tax return will be smaller. Follow the instructions for Worksheet 1-6 in Pub. 505 than one job at a time or are married filing jointly and have a working spouse. If you don't complete this worksheet, you might have too little tax withheld. If so, you will owe tax when you file your tax return and might be subject to a penalty. Figure the total number of allowances you're entitled to claim and any additional amount of tax to withhold on all jobs using worksheets from only one Form W-4. Claim all allowances on the W-4 that you or your spouse file for the highest paying job in required by law to report new employees to a designated State Directory of New Hires. Employers may use Form W-4, boxes 8, 9, and 10 to comply with the new hire reporting requirement for a newly hired employee. A newly hired employee is an employee who hasn't previously been employed by the employer, or who was previously employed by the employer but has been separated from such prior employment for at least 60 consecutive days. Employers should contact the Deductions, Adjustments, and Additional Income Worksheet Complete this worksheet to determine if you're able to reduce the tax withheld from your paycheck to account for your itemized deductions and other adjustments to income such as IRA contributions. If you do so, your refund at the end of the year will be smaller, but your paycheck will be larger. You're not required to complete this worksheet or reduce your withholding if you don't wish to do so. You can also use this worksheet to figure out how much to increase the tax withheld from your paycheck if you have a large amount of nonwage income, such as interest or dividends. Another option is to take these items into account and make your withholding more accurate by using the calculator at www.irs.gov/W4App. If you use the calculator, you don't need to complete any of the worksheets for Form W-4. Two-Earners/Multiple Jobs Worksheet Complete this worksheet if you have more example, if you earn $60,000 per year and your spouse earns $20,000, you should complete the worksheets to determine what to enter on lines 5 and 6 of your Form W-4, and your spouse should enter zero ("-O-") on lines 5 and 6 of his or her Form W-4. See Pub. 505 for details. Another option is to use the calculator at www.irs.gov/W4App to make your withholding more accurate. Tip: If you have a working spouse and your incomes are similar, you can check the "Married, but withhold at higher Single rate" box instead of using this worksheet. If you choose this option, then each spouse should fill out the Personal Allowances Worksheet and check the "Married, but withhold at higher Single rate" box on Form W-4, but only one spouse should claim any allowances for credits or fill out the Deductions, Adjustments, and Additional Income Worksheet. Instructions for Employer Employees, do not complete box 8, 9, or 10. Your employer will complete these boxes if necessary. New hire reporting. Employers are completed Form W-4. For information and links to each designated State Directory of New Hires (including for U.S. territories), go to www.acf.hhs.gov/programs/css/ employers. If an employer is sending a copy of Form W-4 to a designated State Directory of New Hires to comply with the new hire reporting requirement for a newly hired employee, complete boxes 8, 9, and 10 as follows. Box 8. Enter the employer's name and address. If the employer is sending a copy of this form to a State Directory of New Hires, enter the address where child support agencies should send income withholding orders. Box 9. If the employer is sending a copy of this form to a State Directory of New Hires, enter the employee's first date of employment, which is the date services for payment were first performed by the employee. If the employer rehired the employee after the employee had been separated from the employer's service for at least 60 days, enter the rehire date. Box 10. Enter the employer's employer identification number (EIN). B D D F G Enter "1" for yourself B Enter "1" if you will file as married filing jointly. Enter "1" if you will file as head of household You're single, or married filing separately, and have only one job; or D Enter "1" if. You're married filing jointly, have only one job, and your spouse doesn't work, or Your wages from a second job or your spouse's wages for the total of both) are $1,500 or less. E Child tax credit. See Pub. 972, Child Tax Credit, for more information. If your total income will be less than $69,801 ($101,401 if married filing jointly), enter "4" for each eligible child. If your total income will be from $69,801 to $175,550 ($101,401 to $339,000 if married filing jointly), enter "2" for each eligible child. If your total income will be from $175,551 to $200,000 ($339,001 to $400,000 if married filing jointly), enter "1" for each eligible child. If your total income will be higher than $200,000 ($400,000 if married filing jointly), enter"--" E F Credit for other dependents. If your total income will be less than $69,801 ($101,401 if married filing jointly), enter "1" for each eligible dependent. If your total income will be from $69,801 to $175,550 ($101,401 to $339,000 if married filing jointly), enter "1" for every two dependents (for example, "--" for one dependent, "1" if you have two or three dependents, and "2" if you have four dependents). If your total income will be higher than $175,550 ($339,000 if married filing jointly), enter"-0-- G Other credits. If you have other credits, see Worksheet 1-6 of Pub. 505 and enter the amount from that worksheet here H Add lines A through G and enter the total here If you plan to itemize or claim adjustments to income and want to reduce your withholding, or if you have a large amount of nonwage income and want to increase your withholding, see the Deductions, For accuracy, Adjustments, and Additional Income Worksheet below. complete all If you have more than one job at a time or are married filing jointly and you and your spouse both worksheets work, and the combined earnings from all jobs exceed $52,000 ($24,000 if married filing jointly), see the that apply. Two-Earners/Multiple Jobs Worksheet on page 4 to avoid having too little tax withheld. . If neither of the above situations applies, stop here and enter the number from line H on line 5 of Form W-4 above. Deductions, Adjustments, and Additional Income Worksheet Note: Use this worksheet only if you plan to itemize deductions, claim certain adjustments to income, or have a large amount of nonwage income. Enter an estimate of your 2018 itemized deductions. These include qualifying home mortgage interest, charitable contributions, state and local taxes (up to $10,000), and medical expenses in excess of 7.5% of your income. See Pub. 505 for details 1 $ $24,000 if you're married filing jointly or qualifying widow(er) Enter: $18,000 if you're head of household 2 $ $12,000 if you're single or married filing separately Subtract line 2 from line 1. If zero or less, enter"--" 3 $ Enter an estimate of your 2018 adjustments to income and any additional standard deduction for age or blindness (see Pub. 505 for information about these items). 1 2 3 4 5 $ 5 6 7 8 6 $ 7 $ Add lines 3 and 4 and enter the total Enter an estimate of your 2018 nonwage income (such as dividends or interest) Subtract line 6 from line 5. If zero, enter"-O-". If less than zero, enter the amount in parentheses Divide the amount on line 7 by $4,150 and enter the result here. If a negative amount, enter in parentheses. Drop any fraction Enter the number from the Personal Allowances Worksheet, line H above Add lines 8 and 9 and enter the total here. If zero or less, enter "-O-". If you plan to use the Two-Earners/ Multiple Jobs Worksheet, also enter this total on line 1, page 4. Otherwise, stop here and enter this total on Form W-4, line 5, page 1 8 9 9 10 10 Page 4 1 2 Orm W-4 (2018) Two-Earners/Multiple Jobs Worksheet Note: Use this worksheet only if the instructions under line from the Personal Allowances Worksheet direct you here. Enter the number from the Personal Allowances Worksheet, line H, page 3 (or, if you used the Deductions, Adjustments, and Additional Income Worksheet on page 3, the number from line 10 of that worksheet) Find the number in Table 1 below that applies to the LOWEST paying job and enter it here. However, if you're married filing jointly and wages from the highest paying job are $75,000 or less and the combined wages for you and your spouse are $107,000 or less, don't enter more than "3" 2 3 If line 1 is more than or equal to line 2, subtract line 2 from line 1. Enter the result here (if zero, enter"-6") and on Form W-4, line 5, page 1. Do not use the rest of this worksheet Note: If line 1 is less than line 2, enter"--" on Form W-4 line 5, page 1. Complete lines 4 through 9 below to figure the additional withholding amount necessary to avoid a year-end tax bill. 4 Enter the number from line 2 of this worksheet 5 Enter the number from line 1 of this worksheet 5 6 Subtract line 5 from line 4. 7 Find the amount in Table 2 helow that anglies to the HIGHEST navina ich and enter it here 3 4 6 Subtract line 5 from line 4 . 6 7 Find the amount in Table 2 below that applies to the HIGHEST paying job and enter it here 7 $ 8 Multiply line 7 by line 6 and enter the result here. This is the additional annual withholding needed 8 $ 9 Divide line 8 by the number of pay periods remaining in 2018. For example, divide by 18 if you're paid every 2 weeks and you complete this form on a date in late April when there are 18 pay periods remaining in 2018. Enter the result here and on Form W-4, line 6, page 1. This is the additional amount to be withheld from each paycheck 9 $ Table 1 Table 2 Married Filing Jointly All Others Married Filing Jointly All Others wages from LOWEST Enter on If wages from LOWEST Enter on If wages from HIGHEST Enter on If wages from HIGHEST Enter on maying job are- line 2 above paying job are line 2 above paying job are line 7 above paying job are- line 7 above $0 - $5,000 0 $0 - $7,000 0 $0 - $24,375 $420 $0 - $7,000 $420 5,001 - 9.500 1 7,001 - 12,500 1 24,376 - 82,725 500 7,001 - 36,175 500 9,501 - 19,000 2 12,501 - 24,500 2. 82,726 - 170,325 910 36,176 - 79,975 910 19.001 - 26.500 3 24,501 - 31,500 3 170,326 - 320,325 1.000 79,976 - 154,975 1,000 26,501 - 37.000 4 31.501 - 39,000 4 320,326 - 405,325 1.330 154,976 - 197,475 1,330 37.001 43,500 5 39,001 - 55,000 5 406,326 - 606,325 1.450 197,476 - 497,475 1,450 43,501 55.000 6 55,001 - 70,000 6 605.326 and over 1,540 497,476 and over 1,540 55,001 60,000 7 70,001 - 85,000 7 60.001 70.000 B 85,001 - 90,000 8 70,001 75.000 9 90,001 - 100,000 9 75,001 85.000 10 100,001 - 105,000 10 85,001 - 95.000 11 105,001 - 115,000 11 95,001 130,000 12 115,001 - 120,000 12 130.001 150.000 13 120,001 - 130,000 13 150,001 160,000 14 130,001 - 145,000 14 160.001 170,000 15 145,001 - 155,000 15 170,001 180,000 16 155,001 - 185,000 16 180,001 190.000 17 185,001 and over 17 190.001 - 200.000 18 200,001 and over 19 ivacy Act and Paperwork Reduction ct Notice. We ask for the information on is form to carry out the Internal Revenue ws of the United States. Internal Revenue de sections 3402(1)(2) and 6109 and eir regulations require you to provide this formation; your employer uses it to termine your federal income tax thholding. Failure to provide a properly ompleted form will result in your being sated as a single person who claims no thholding allowances; providing audulent information may subject you to analties. Routine uses of this information clude giving it to the Department of stice for civil and criminal litigation; to ties states the District of Columbia and U.S. commonwealths and possessions for use in administering their tax laws; and to the Department of Health and Human Services for use in the National Directory of New Hires. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism. You aren't required to provide the information requested on a form that's subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by Code section 6103. The average time and expenses required to complete and file this form will vary depending on individual circumstances. For estimated averages, see the instructions for your income tax return. If you have suggestions for making this form simpler, we would be happy to hear from you. See the instructions for your income tax return