Question

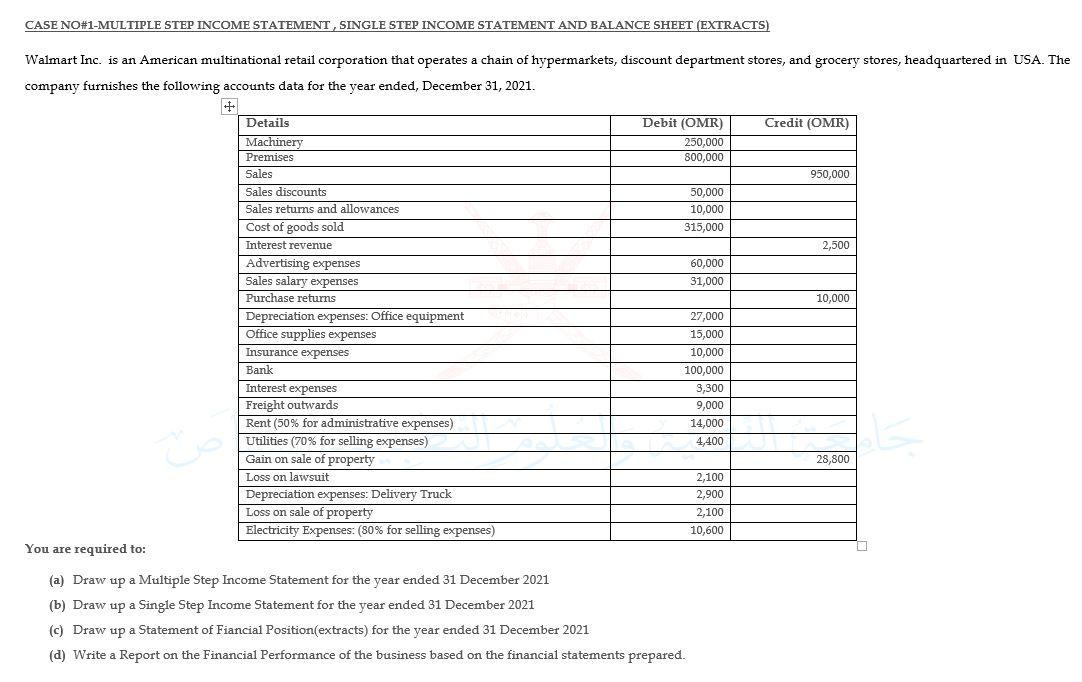

CASE NO#1-MULTIPLE STEP INCOME STATEMENT , SINGLE STEP INCOME STATEMENT AND BALANCE SHEET (EXTRACTS) Walmart Inc. is an American multinational retail corporation that operates a

CASE NO#1-MULTIPLE STEP INCOME STATEMENT , SINGLE STEP INCOME STATEMENT AND BALANCE SHEET (EXTRACTS)

Walmart Inc. is an American multinational retail corporation that operates a chain of hypermarkets, discount department stores, and grocery stores, headquartered in USA. The company furnishes the following accounts data for the year ended, December 31, 2021.

| Details | Debit (OMR) | Credit (OMR) |

| Machinery | 250,000 | |

| Premises | 800,000 | |

| Sales | 950,000 | |

| Sales discounts | 50,000 | |

| Sales returns and allowances | 10,000 | |

| Cost of goods sold | 315,000 | |

| Interest revenue | 2,500 | |

| Advertising expenses | 60,000 | |

| Sales salary expenses | 31,000 | |

| Purchase returns | 10,000 | |

| Depreciation expenses: Office equipment | 27,000 | |

| Office supplies expenses | 15,000 | |

| Insurance expenses | 10,000 | |

| Bank | 100,000 | |

| Interest expenses | 3,300 | |

| Freight outwards | 9,000 | |

| Rent (50% for administrative expenses) | 14,000 | |

| Utilities (70% for selling expenses) | 4,400 | |

| Gain on sale of property | 28,800 | |

| Loss on lawsuit | 2,100 | |

| Depreciation expenses: Delivery Truck | 2,900 | |

| Loss on sale of property | 2,100 | |

| Electricity Expenses: (80% for selling expenses) | 10,600 |

You are required to:

- Draw up a Multiple Step Income Statement for the year ended 31 December 2021

- Draw up a Single Step Income Statement for the year ended 31 December 2021

- Draw up a Statement of Fiancial Position(extracts) for the year ended 31 December 2021

- Write a Report on the Financial Performance of the business based on the financial statements prepared.

-------------------

this is the original question and no other things. you asked for a trial balance but it is not provided by my teatcher:(. please try to solve it as soon as possible.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started