Answered step by step

Verified Expert Solution

Question

1 Approved Answer

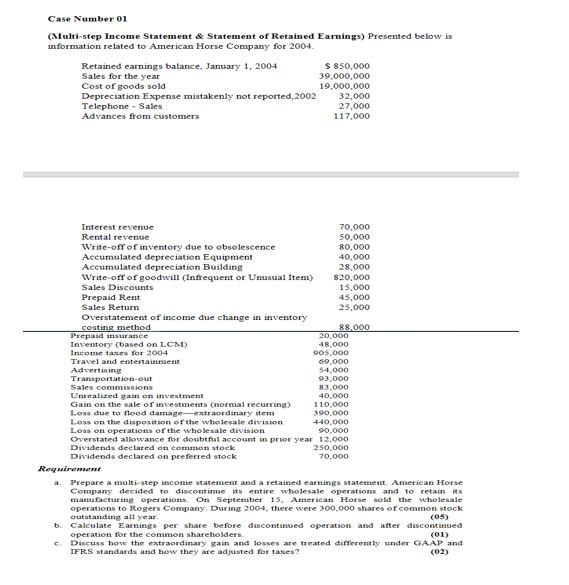

Case Number 01 (Multi-step Income Statement & Statement of Retained Earnings) Presented below is information related to American Horse Company for 2004. b. Retained

Case Number 01 (Multi-step Income Statement & Statement of Retained Earnings) Presented below is information related to American Horse Company for 2004. b. Retained earnings balance, January 1, 2004 Sales for the year Cost of goods sold Depreciation Expense mistakenly not reported, 2002 C Telephone Sales Advances from customers Interest revenue Rental revenue Write-off of inventory due to obsolescence Accumulated depreciation Equipment Accumulated depreciation Building Write-off of goodwill (Infrequent or Unusual Item) Sales Discounts Prepaid Rent Sales Return Overstatement of income due change in inventory costing method Prepaid insurance Inventory (based on LCM) Income taxes for 2004 Travel and entertainment Advertising Transportation-out Sales commissions Unrealized gain on investment Gain on the sale of investments (normal recurring) Loss due to flood damage-extraordinary item Loss on the disposition of the wholesale division Loss on operations of the wholesale division $ 850,000 39,000,000 19,000,000 32,000 27,000 117,000 70,000 50,000 80,000 40,000 28,000 820,000 15,000 45,000 25,000 88,000 20,000 48,000 905,000 69,000 54,000 93,000 83,000 40,000 110,000 390,000 Requirement Prepare a multi-step income statement and a retained earnings statement. American Horse Company decided to discontinue its entire wholesale operations and to retain its manufacturing operations. On September 15, American Horse sold the wholesale operations to Rogers Company. During 2004, there were 300,000 shares of common stock outstanding all year. 440,000 90,000 Overstated allowance for doubtful account in prior year 12,000 Dividends declared on common stock 250,000 Dividends declared on preferred stock 70,000 (05) Calculate Earnings per share before discontinued operation and after discontinued operation for the common shareholders. (01) Discuss how the extraordinary gain and losses are treated differently under GAAP and IFRS standards and how they are adjusted for taxes? (02)

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Solution For A Sales TelephoneSales Rental Revenue Total Reve...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started