Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case Problem Analysis: Corporate Formation Solo Services, Inc., was a trucking company established in 2005 and owned by Toby Solo as the sole shareholder.

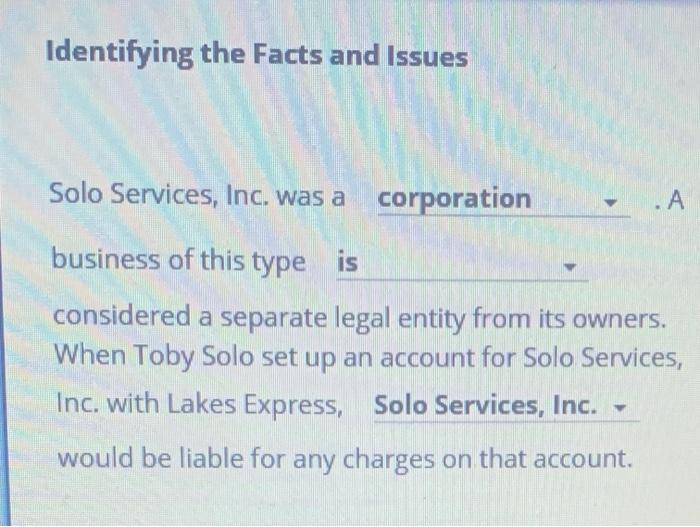

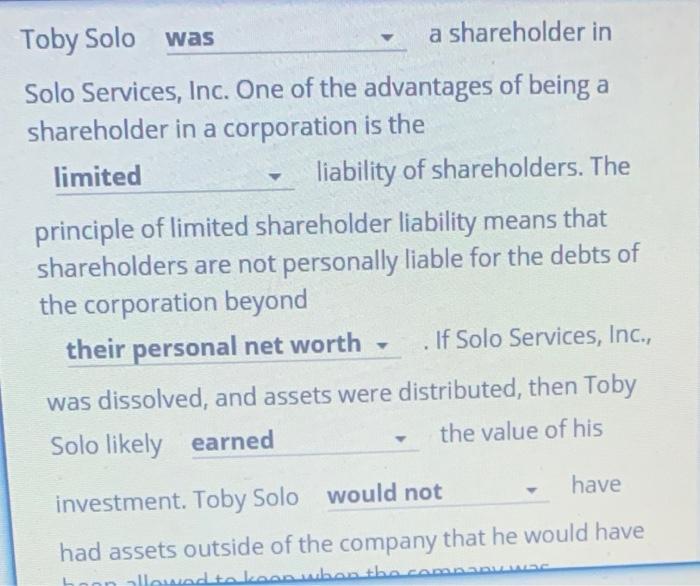

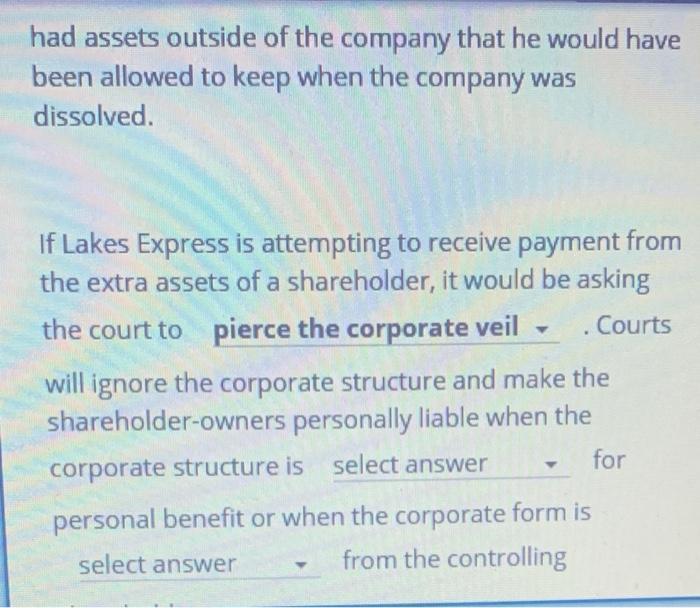

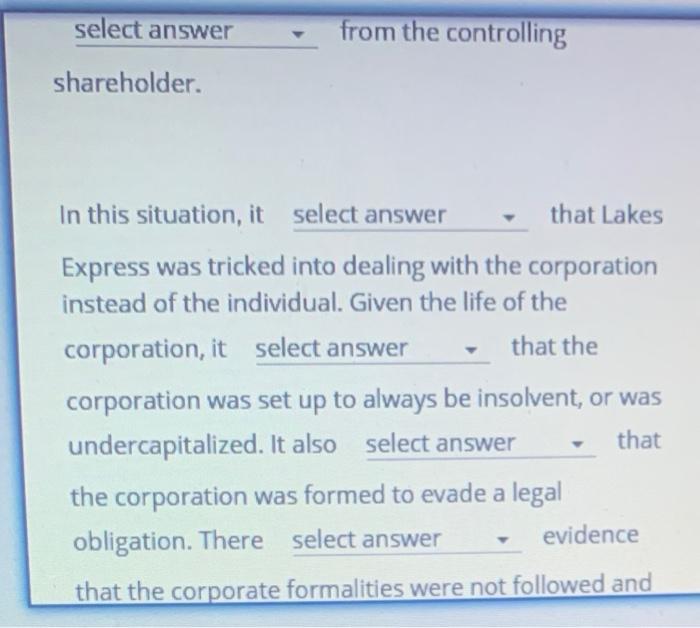

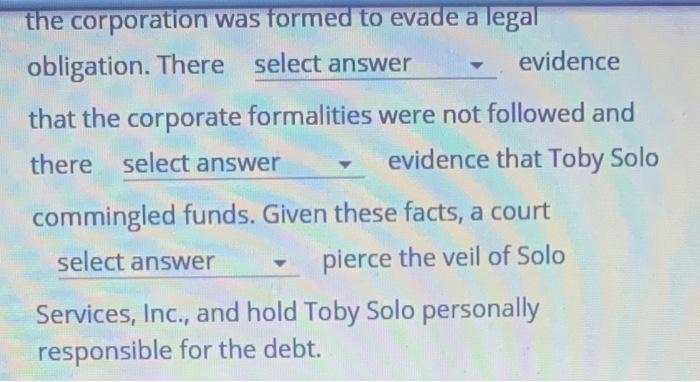

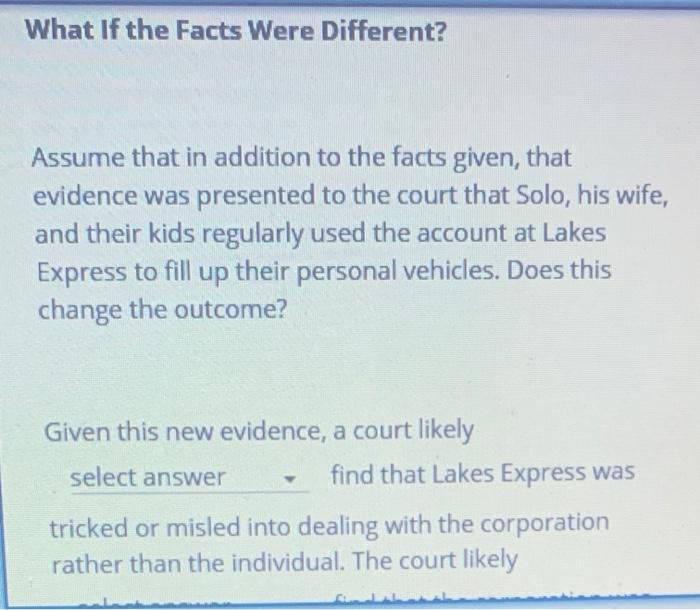

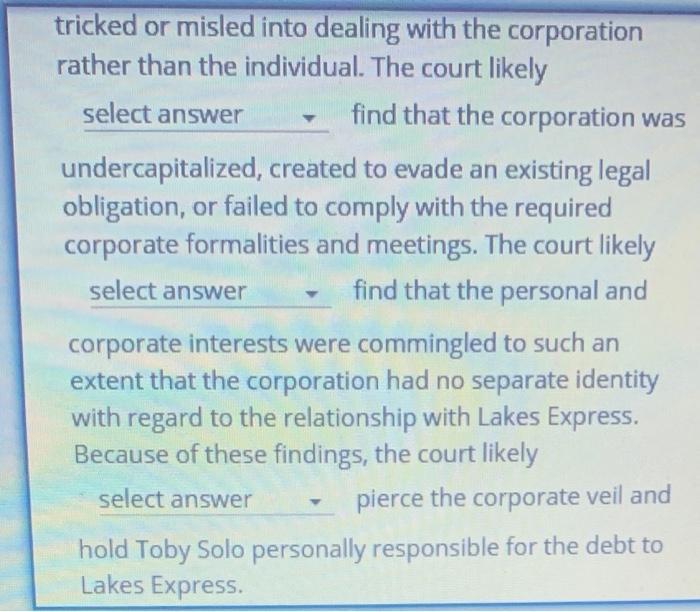

Case Problem Analysis: Corporate Formation Solo Services, Inc., was a trucking company established in 2005 and owned by Toby Solo as the sole shareholder. Toby Solo also was the president of the company. Toby Solo set up an account with Lakes Express, a fuel provider, on behalf of Solo Services, Inc., and his drivers often would charge fuel purchases for the company trucks to that account. Lakes Express then would bill Solo Services regularly for the charges on the account. After several months of low business, Solo Services ceased doing business and was dissolved in 2018, with its assets being distributed to creditors. Lakes Express only recovered a small part of the amount owed by Solo Services, Inc. Toby Solo then opened up a new trucking service business as a sole proprietor. Lakes After several months of low business, Solo Services ceased doing business and was dissolved in 2018, with its assets being distributed to creditors. Lakes Express only recovered a small part of the amount owed by Solo Services, Inc. Toby Solo then opened up a new trucking service business as a sole proprietor. Lakes Express sought to recover Solo Services' unpaid fuel charges, which amounted to about $35,000, from Solo. Solo argued that he was not personally liable for a corporate debt. Should a court hold Toby Solo personally liable? 4 Identifying the Facts and Issues Solo Services, Inc. was a corporation business of this type is considered a separate legal entity from its owners. When Toby Solo set up an account for Solo Services, Inc. with Lakes Express, Solo Services, Inc. - would be liable for any charges on that account. A Toby Solo a shareholder in Solo Services, Inc. One of the advantages of being a shareholder in a corporation is the limited liability of shareholders. The was principle of limited shareholder liability means that shareholders are not personally liable for the debts of the corporation beyond their personal net worth If Solo Services, Inc., was dissolved, and assets were distributed, then Toby Solo likely earned the value of his T T investment. Toby Solo would not have had assets outside of the company that he would have non allowed to keep when the com Dow wac had assets outside of the company that he would have been allowed to keep when the company was dissolved. If Lakes Express is attempting to receive payment from the extra assets of a shareholder, it would be asking the court to pierce the corporate veil . Courts will ignore the corporate structure and make the shareholder-owners personally liable when the corporate structure is select answer for Y personal benefit or when the corporate form is select answer from the controlling Y select answer shareholder. from the controlling In this situation, it select answer that Lakes Express was tricked into dealing with the corporation instead of the individual. Given the life of the corporation, it select answer that the T corporation was set up to always be insolvent, or was undercapitalized. It also select answer that the corporation was formed to evade a legal obligation. There select answer that the corporate formalities were not followed and T evidence the corporation was formed to evade a legal obligation. There select answer evidence that the corporate formalities were not followed and evidence that Toby Solo there select answer commingled funds. Given these facts, a court select answer pierce the veil of Solo Services, Inc., and hold Toby Solo personally responsible for the debt. What If the Facts Were Different? Assume that in addition to the facts given, that evidence was presented to the court that Solo, his wife, and their kids regularly used the account at Lakes Express to fill up their personal vehicles. Does this change the outcome? Given this new evidence, a court likely select answer find that Lakes Express was tricked or misled into dealing with the corporation rather than the individual. The court likely tricked or misled into dealing with the corporation rather than the individual. The court likely select answer find that the corporation was Y undercapitalized, created to evade an existing legal obligation, or failed to comply with the required corporate formalities and meetings. The court likely select answer find that the personal and corporate interests were commingled to such an extent that the corporation had no separate identity with regard to the relationship with Lakes Express. Because of these findings, the court likely select answer pierce the corporate veil and hold Toby Solo personally responsible for the debt to Lakes Express.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Solo Services Inc was a Answer corporation 2 A business of this type considered a separate legal entity from its owners Answer is 3 When Toby Solo s...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started