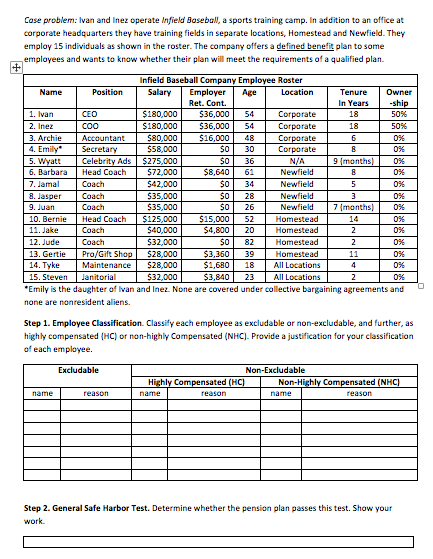

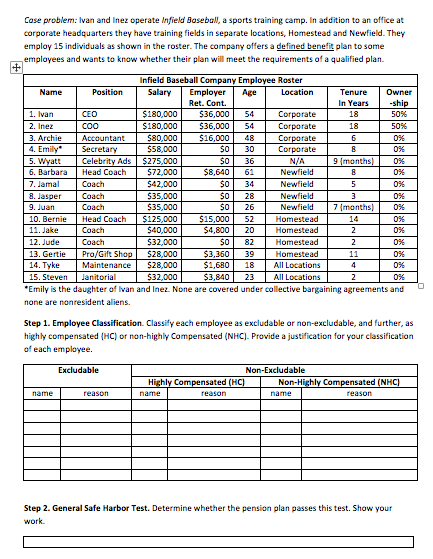

Case problem: Ivan and Inez operate infield Baseball a sports training camp. In addition to an office at corporate headquarters they have training fields in separate locations, Homestead and Newfield. They employ 15 individuals as shown in the roster. The company offers a defined benefit plan to some employees and wants to know whether their plan will meet the requirements of a qualified plan. Infield Baseball Company Employee Roster Name Position Salary Employer Age Location Tenure Owner Ret. Cont In Years T-ship 1. Ivan CEO $180,000 $36.000 54 Corporate 18 50% 2. Ines COO S80.000 $36.000 54 Corporate 18 50% 3. Archie Accountant $80.000 $16.000 48 Corporate 6 4. Emily Secretary $58,000 SO 30 Corporate 5. Wyatt Celebrity Ads $275.000 $0 36 N/A 9 months 0% 6. Barbara Head Coach $72,000 $8,640 61 Newfield 7. Jamal Coach $42.000 $0 34 Newfield T 5 8. Jasper Coach $35.000 SO 28 Newfield 3 0 % 9. Juan Coach $35.000 So 26 Newfield 7 months) OX 10. Bernie Head Coach $125,000 $15,000 52 Homestead 14 OX 11. Jake Coach $40,000 $4,800 20 Homestead 2 OX 12. Jude Coach $32,000 $0 82 Homestead 2 ox 13. Gertie Pro/Gift Shop $28,000 $3.360 391 Homestead 11 T OX 14. Tyke Maintenance $28,000 $1,68018 All Locations 4 0 % 15. Steven Janitorial $32.000 $3,840 23 All Locations 2 0 % *Emily is the daughter of Ivan and Inez. None are covered under collective bargaining agreements and none are nonresident aliens. Step 1. Employee Classification. Classify each employee as excludable or non-excludable, and further, as highly compensated (HC) or non-highly Compensated (NHC). Provide a justification for your classification of each employee. Excludable Non-Excludable Highly Compensated (HC) Non-Highly Compensated (NHC) name reason name reason name reason Step 2. General Safe Harbor Test. Determine whether the pension plan passes this test. Show your Case problem: Ivan and Inez operate infield Baseball a sports training camp. In addition to an office at corporate headquarters they have training fields in separate locations, Homestead and Newfield. They employ 15 individuals as shown in the roster. The company offers a defined benefit plan to some employees and wants to know whether their plan will meet the requirements of a qualified plan. Infield Baseball Company Employee Roster Name Position Salary Employer Age Location Tenure Owner Ret. Cont In Years T-ship 1. Ivan CEO $180,000 $36.000 54 Corporate 18 50% 2. Ines COO S80.000 $36.000 54 Corporate 18 50% 3. Archie Accountant $80.000 $16.000 48 Corporate 6 4. Emily Secretary $58,000 SO 30 Corporate 5. Wyatt Celebrity Ads $275.000 $0 36 N/A 9 months 0% 6. Barbara Head Coach $72,000 $8,640 61 Newfield 7. Jamal Coach $42.000 $0 34 Newfield T 5 8. Jasper Coach $35.000 SO 28 Newfield 3 0 % 9. Juan Coach $35.000 So 26 Newfield 7 months) OX 10. Bernie Head Coach $125,000 $15,000 52 Homestead 14 OX 11. Jake Coach $40,000 $4,800 20 Homestead 2 OX 12. Jude Coach $32,000 $0 82 Homestead 2 ox 13. Gertie Pro/Gift Shop $28,000 $3.360 391 Homestead 11 T OX 14. Tyke Maintenance $28,000 $1,68018 All Locations 4 0 % 15. Steven Janitorial $32.000 $3,840 23 All Locations 2 0 % *Emily is the daughter of Ivan and Inez. None are covered under collective bargaining agreements and none are nonresident aliens. Step 1. Employee Classification. Classify each employee as excludable or non-excludable, and further, as highly compensated (HC) or non-highly Compensated (NHC). Provide a justification for your classification of each employee. Excludable Non-Excludable Highly Compensated (HC) Non-Highly Compensated (NHC) name reason name reason name reason Step 2. General Safe Harbor Test. Determine whether the pension plan passes this test. Show your