1 Case problem: The Redwood plant makes two types of rotators for automobile engines: R361 and R572. The old cost system at the plant

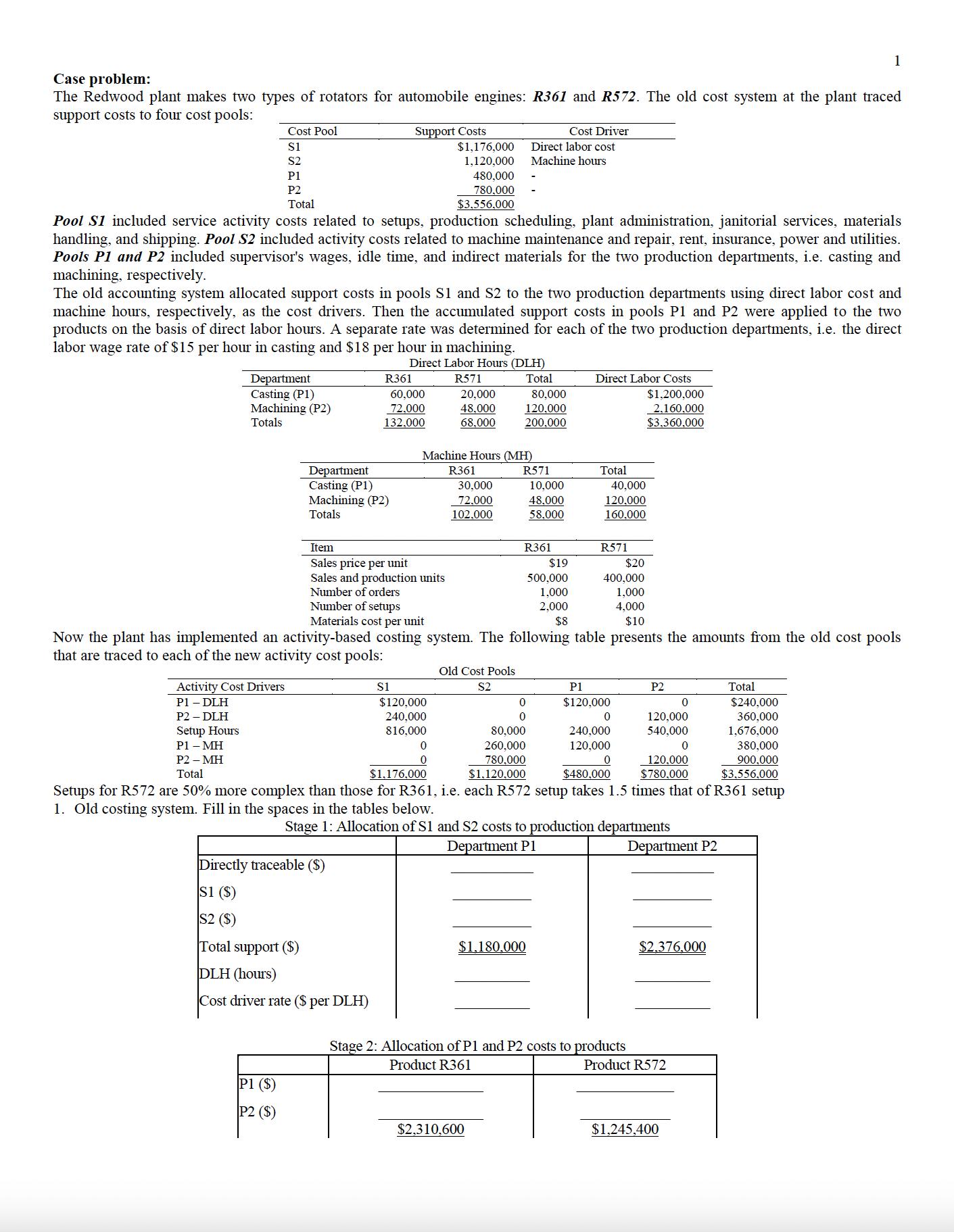

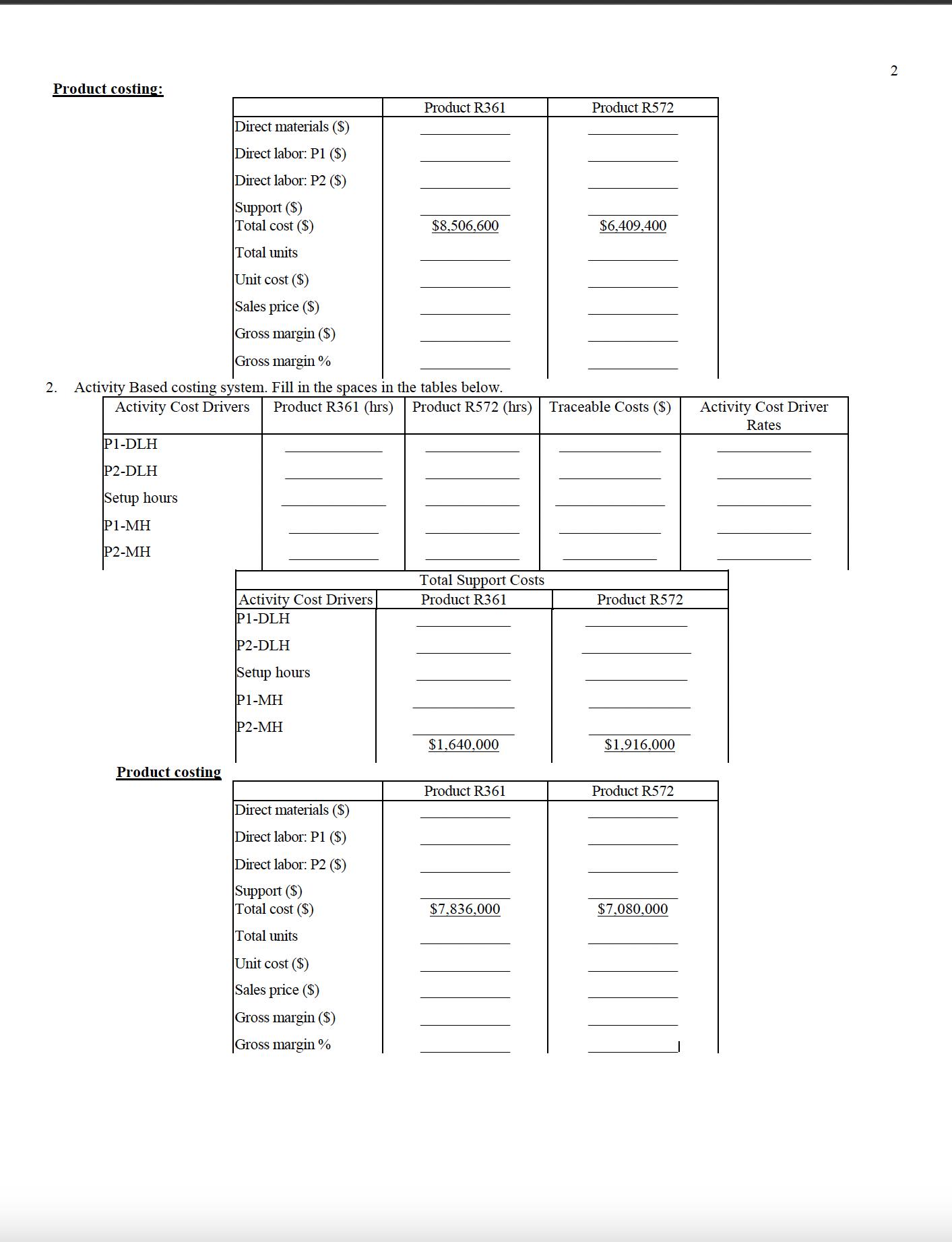

1 Case problem: The Redwood plant makes two types of rotators for automobile engines: R361 and R572. The old cost system at the plant traced support costs to four cost pools: Cost Pool S1 S2 P1 P2 Total Support Costs $1,176,000 1,120,000 480.000 780,000 $3,556,000 Cost Driver Direct labor cost Machine hours Pool S1 included service activity costs related to setups, production scheduling, plant administration, janitorial services, materials handling, and shipping. Pool S2 included activity costs related to machine maintenance and repair, rent, insurance, power and utilities. Pools P1 and P2 included supervisor's wages, idle time, and indirect materials for the two production departments, i.e. casting and machining, respectively. The old accounting system allocated support costs in pools S1 and S2 to the two production departments using direct labor cost and machine hours, respectively, as the cost drivers. Then the accumulated support costs in pools P1 and P2 were applied to the two products on the basis of direct labor hours. A separate rate was determined for each of the two production departments, i.e. the direct labor wage rate of $15 per hour in casting and $18 per hour in machining. Direct Labor Hours (DLH) Department Casting (P1) Machining (P2) Totals R361 R571 60,000 20,000 72,000 48,000 Total 80,000 120,000 Direct Labor Costs $1,200,000 2,160,000 132,000 68,000 200.000 $3.360.000 Machine Hours (MH) Department R361 R571 Total Casting (P1) 30,000 10,000 40,000 Machining (P2) 72.000 48,000 120,000 Totals 102.000 58,000 160,000 Item Sales price per unit Sales and production units Number of orders Number of setups R361 R571 $19 $20 500,000 400,000 1,000 1,000 2,000 $8 4,000 $10 Materials cost per unit Now the plant has implemented an activity-based costing system. The following table presents the amounts from the old cost pools that are traced to each of the new activity cost pools: Activity Cost Drivers P1 - DLH P2 - DLH Setup Hours P1 - MH P2 - MH Total Old Cost Pools S1 S2 P1 P2 Total $120,000 0 $120,000 0 $240,000 240,000 816,000 0 0 80,000 0 0 260,000 $1,176,000 780.000 $1,120,000 240,000 120,000 0 120,000 540,000 360,000 1,676,000 0 380,000 $480,000 120,000 $780,000 900,000 $3,556,000 Setups for R572 are 50% more complex than those for R361, i.e. each R572 setup takes 1.5 times that of R361 setup 1. Old costing system. Fill in the spaces in the tables below. Stage 1: Allocation of S1 and S2 costs to production departments Directly traceable ($) S1 ($) S2 ($) Total support ($) DLH (hours) Cost driver rate ($ per DLH) P1 ($) P2 ($) Department P1 Department P2 $1,180,000 $2,376,000 Stage 2: Allocation of P1 and P2 costs to products Product R361 $2,310,600 Product R572 $1,245,400 Product costing: Product R361 Product R572 Direct materials ($) Direct labor: P1 ($) Direct labor: P2 ($) Support ($) Total cost ($) Total units $8,506,600 $6,409,400 Unit cost ($) Sales price ($) Gross margin ($) Gross margin % 2. Activity Based costing system. Fill in the spaces in the tables below. Activity Cost Drivers Product R361 (hrs) P1-DLH P2-DLH Setup hours P1-MH P2-MH Product R572 (hrs) Traceable Costs ($) Activity Cost Driver Rates Activity Cost Drivers P1-DLH Total Support Costs Product R361 Product R572 P2-DLH Setup hours P1-MH P2-MH $1,640,000 $1,916,000 Product costing Product R361 Product R572 Direct materials ($) Direct labor: P1 ($) Direct labor: P2 ($) Support ($) Total cost ($) Total units $7,836,000 $7,080,000 Unit cost ($) Sales price ($) Gross margin ($) Gross margin % 2

Step by Step Solution

3.50 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

To fill in the tables well go through the allocation process for the old costing system step by step Stage 1 Allocation of S1 and S2 costs to production departments Calculate the cost driver rates for ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started