Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CASE: PRUhappy retirement Consider whether the product PRUhappy retirement from PRUDENTIAL Insurance Co.Ltd. is suitable for your retirement plan. Work with your group and follow

CASE: PRUhappy retirement

Consider whether the product PRUhappy retirement from PRUDENTIAL Insurance Co.Ltd. is suitable for your retirement plan. Work with your group and follow the steps below. You may make your own assumptions on any ambiguous matter, but please state them explicitly if you do.

Part 1: Planning for your retirement.

1. How much money will you need each year after your retirement?

Part 2: Considering the product.

1. Based on Part 1, how much of the sum assured will you need so that the living benefits from this product is sufficient for your post-retirement spending?

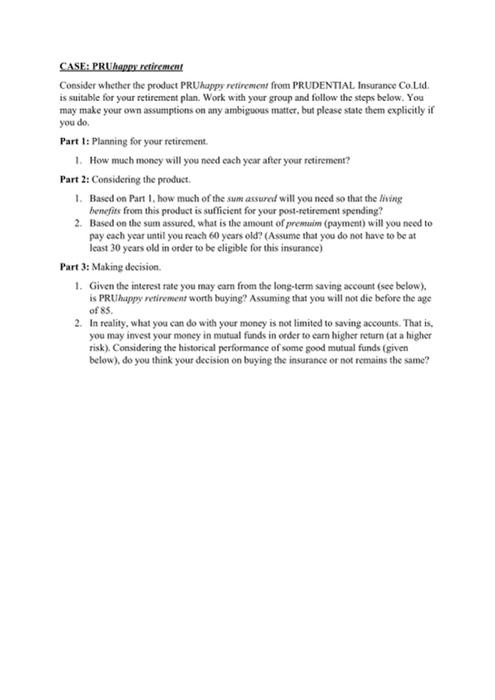

2. Based on the sum assured, what is the amount of premuim (payment) will you need to pay each year until you reach 60 years old? (Assume that you do not have to be at least 30 years old in order to be eligible for this insurance)

Part 3: Making decision.

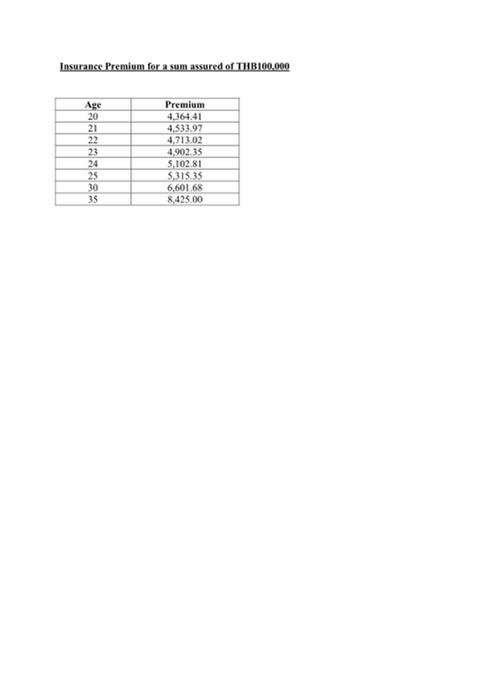

1. Given the interest rate you may earn from the long-term saving account (see below), is PRUhappy retirement worth buying? Assuming that you will not die before the age of 85.

2. In reality, what you can do with your money is not limited to saving accounts. That is, you may invest your money in mutual funds in order to earn higher return (at a higher risk). Considering the historical performance of some good mutual funds (given below), do you think your decision on buying the insurance or not remains the same?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started