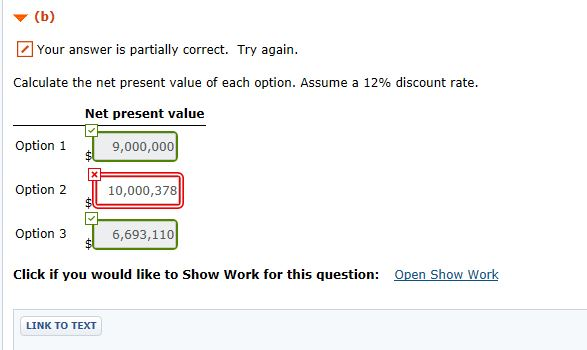

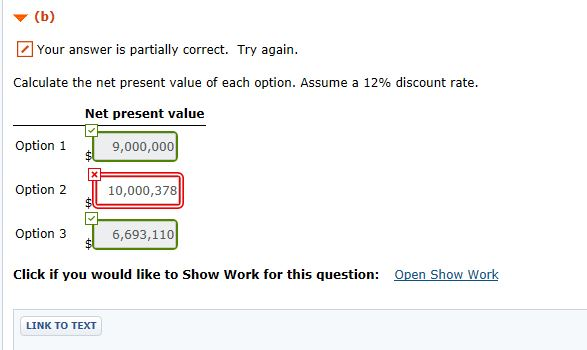

| Case Question 9-31 Maybe I should have stuck with teaching high school art. No matter what I try, I cant seem to turn that Roanoke plant around. Thats how the meeting between Warren Wingo, CEO of clothing manufacturer Wingo Designs, and Angie Tillery, vice president of corporate lending at First National Bank, ended. Wingo and Tillery had just concluded that the Roanoke plant was draining corporate cash flow and income, and should be closed on December 31, 2018. When he returned to his office, Wingo summoned corporate controller Ron Wright to tell him the bad news. Ron, I wish there were some way to turn this situation around. Weve had so many bad things happen latelythe fire in Lexington, the strike in Pulaski, and now this. Why didnt I stay at Cave Spring High? Warren, it may not be as bad as it seems, Ron replied. Lets put our heads together and do some investigating. Weve got some great folks working here, and I bet if we asked them to think about it, they could come up with some options. With that encouragement, Warren sent Ron out to find some way of disposing of the Roanoke facility. Early Monday morning, Ron ran into Warrens office waving a legal pad. Weve done it, Warren. Weve got three good options for the Roanoke plant. One of them even has us keeping the plant. Warren listened intently as Ron laid out the three options his staff had developed: Option 1 Sell the plant immediately to Tinsley Togs for $9,000,000. Option 2 Lease the plant for four years to Star City Mills (one of Wingos suppliers). Under the lease terms, Star City would pay Wingo $2,400,000 in rent each year and would grant Wingo a 10% discount on fabric purchased by another of its plants. The fabric normally sells for $2 per yard, and Wingo expects to purchase 2,370,000 yards of it each year. Star City would cover all the plants ownership costs, including property taxes. At the end of the lease, Wingo would sell the plant for $2,000,000. Option 3 Use the plant for four years to make souvenir 2022 Winter Olympic jackets. Fixed overhead, before equipment upgrades, is estimated at $200,000 a year. The jackets are expected to have a variable cost of $33 per unit and to sell for $42 each. Estimated unit sales are as follows; annual production would equal sales. | Year | | Jacket Sales in Units | | 2019 | | 200,000 | | 2020 | | 300,000 | | 2021 | | 400,000 | | 2022 | | 100,000 | To manufacture the jackets, some of the plants equipment would have to be replaced at an immediate cost of $1,500,000. The equipment would have a useful life of four years. Because of the upgraded equipment, Wingo could sell the plant for $3,000,000 at the end of four years. |  | | | |