Question

Case scenario: You have been recently assigned to the audit of Marino for the year ending December 2021. Marino is a furniture manufacturer that specialises

Case scenario:

You have been recently assigned to the audit of Marino for the year ending December 2021. Marino is a furniture manufacturer that specialises in the elements of interior design.

Marino offers its entire product line to major home renovation retailers, with 70 percent of its sales going to one big store James Lewis. The manufacturer secured a 2 year contract with this store in exchange of offering preferential prices and a fourth month credit policy instead of the one month standard credit policy.

Marino has decided to rely more on the imports from China instead of manufacturing its own products. More than half of the company's products are imported (55%) while 45% are locally manufactured.

The furniture orders from China need to be placed at least 5 months in advance and items might take up to two months to arrive. Marino records the inventory when it gets it.

The inventory is kept in the third party warehouse

The marketing director, Lucas Green was dismissed in October 202 0 after a disagreement with the company. The firm has requested the sales director to temporarily fill the vacancy until they find a new marketing director. Marino has been notified by Mr Green of his intentions to sue the company for illegal dismissal. No provisions or disclosure have been made with regard to this.

The company is planning to be listed in the stock exchange next year.

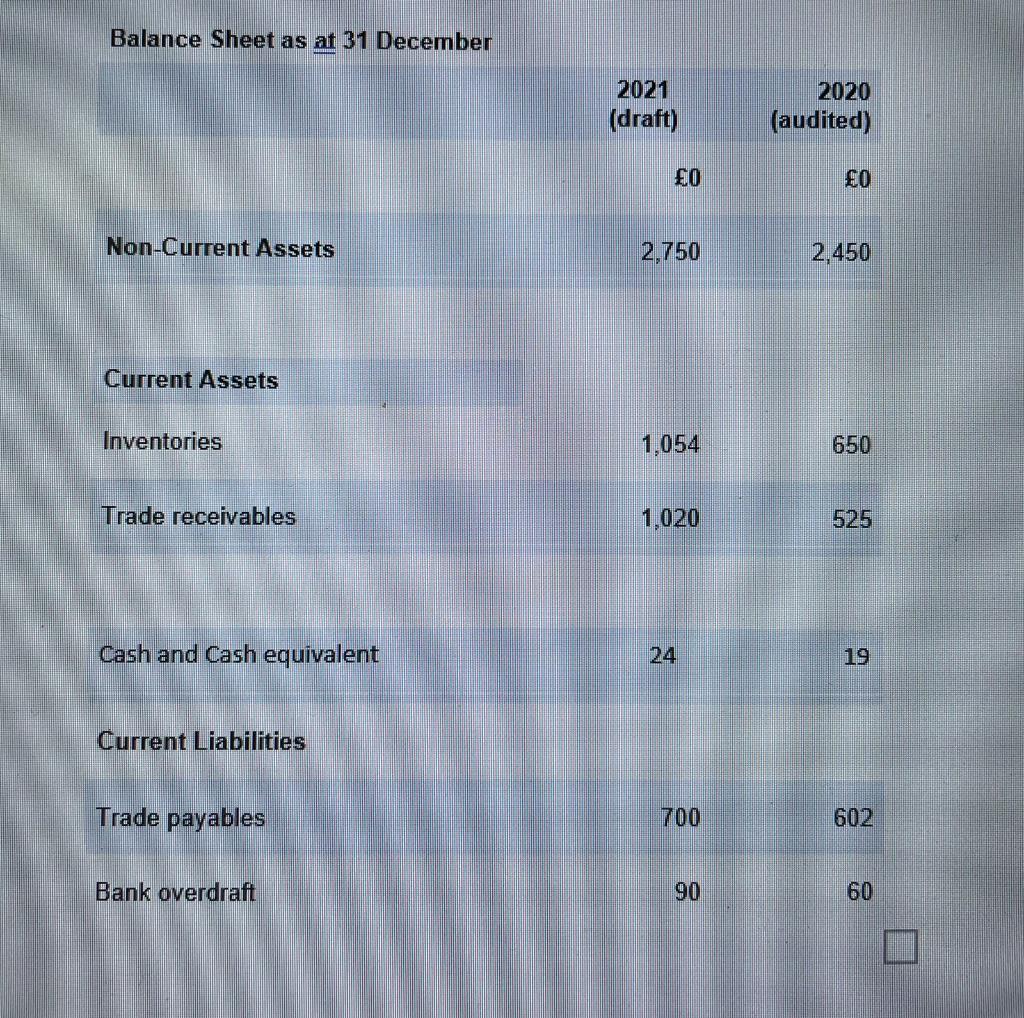

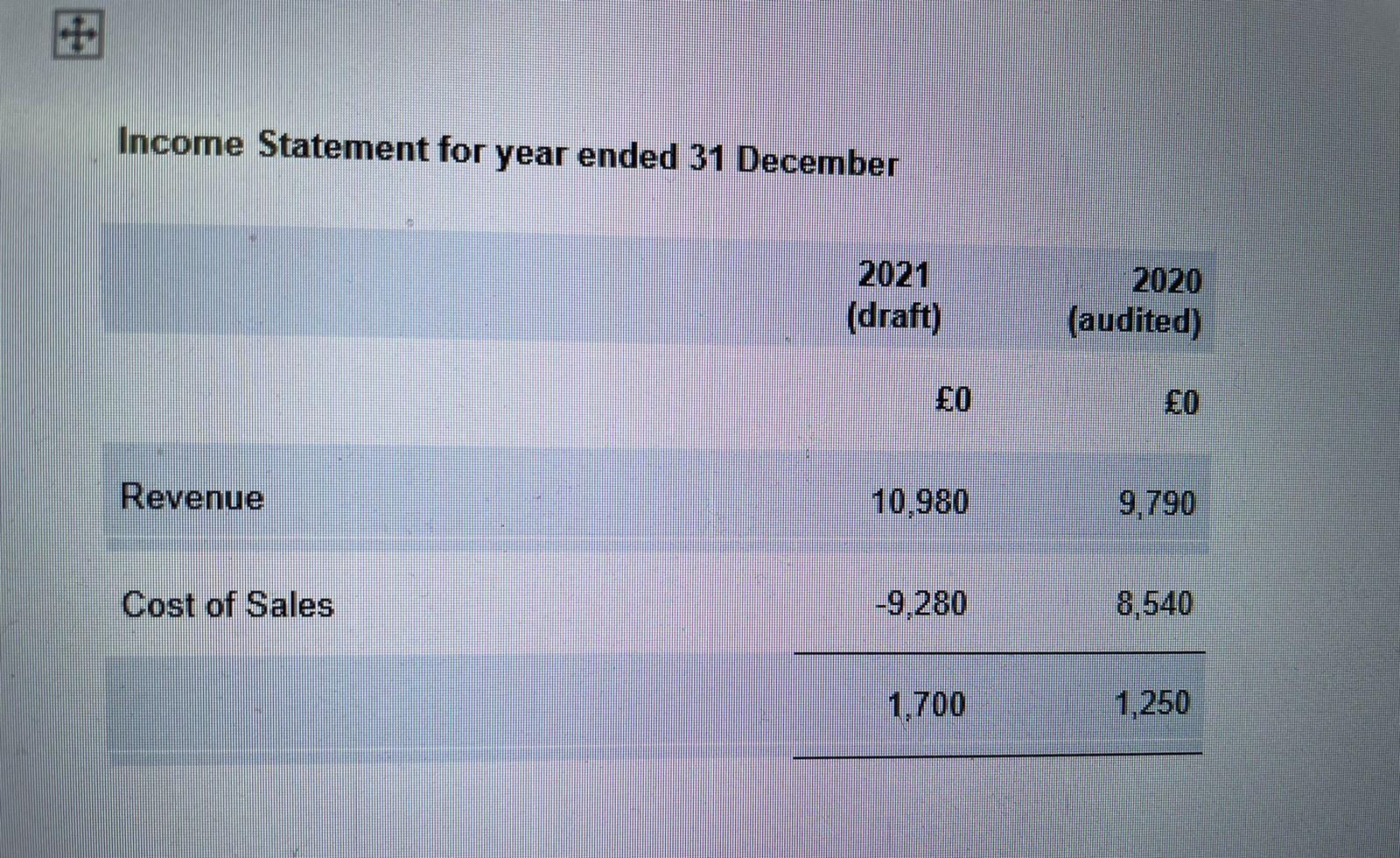

Extracts from the draft financial statements

Required:

- Identify and explain SEVEN audit risks at the planning stage of the audit of Marino Co.

(70 marks)

- Using the financial statement extracts, perform THREE analytical procedures on the draft financial statements of Marino Co and explain the associated audit risks.

(30 marks)

Please give references if used

Please give references if used

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started