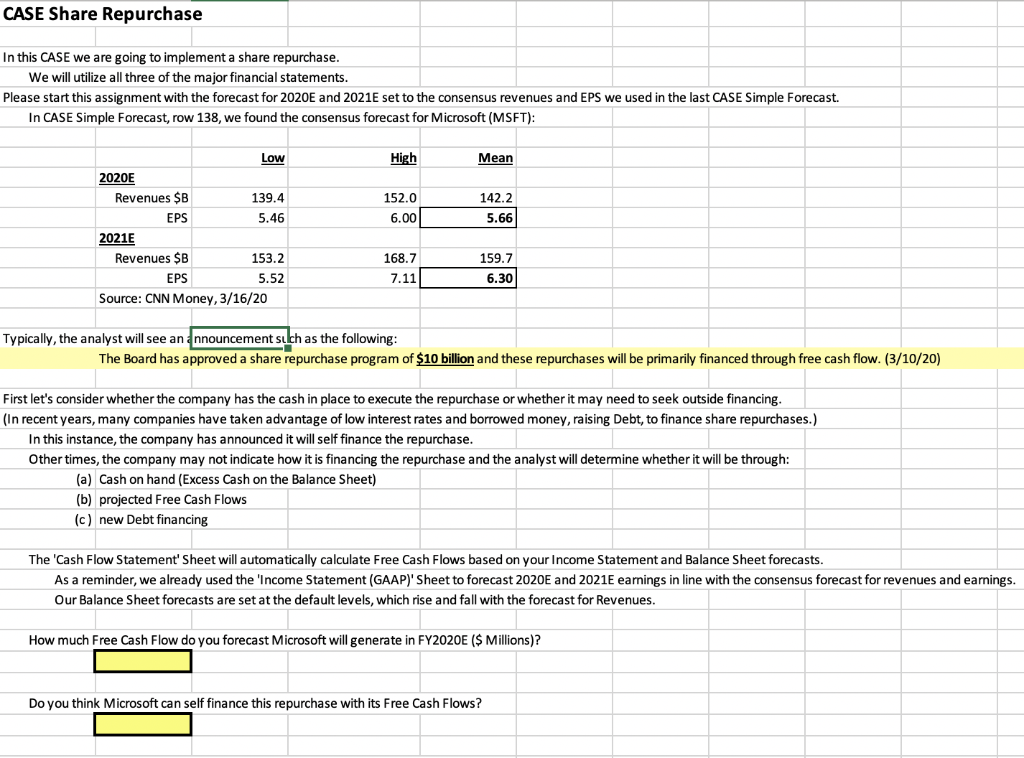

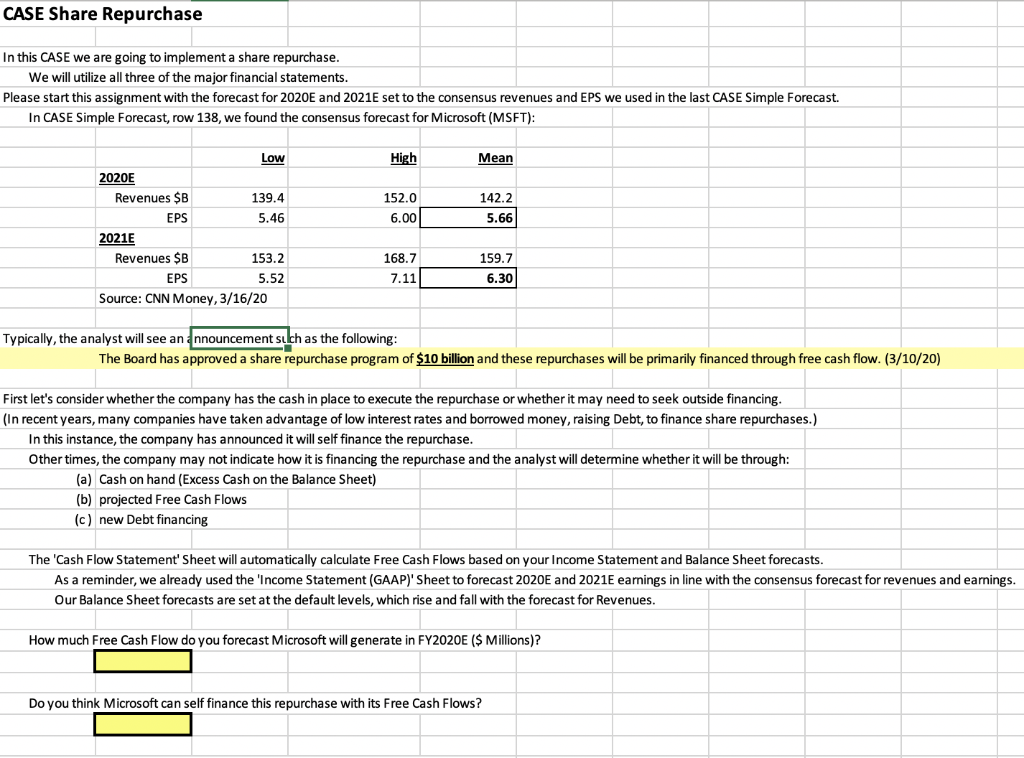

CASE Share Repurchase In this CASE we are going to implement a share repurchase. We will utilize all three of the major financial statements. Please start this assignment with the forecast for 2020E and 2021E set to the consensus revenues and EPS we used in the last CASE Simple Forecast. In CASE Simple Forecast, row 138, we found the consensus forecast for Microsoft (MSFT): High Mean 152.0 6.00 142.2 5.66 Low 2020E Revenues $B 139.4 EPS 5.46 2021E Revenues $B 153.2 EPS 5.52 Source: CNN Money, 3/16/20 168.7 7.11 159.7 6.30 Typically, the analyst will see an announcement such as the following: The Board has approved a share repurchase program of $10 billion and these repurchases will be primarily financed through free cash flow. (3/10/20) First let's consider whether the company has the cash in place to execute the repurchase or whether it may need to seek outside financing. (In recent years, many companies have taken advantage of low interest rates and borrowed money, raising Debt, to finance share repurchases.) In this instance, the company has announced it will self finance the repurchase. Other times, the company may not indicate how it is financing the repurchase and the analyst will determine whether it will be through: (a) Cash on hand (Excess Cash on the Balance Sheet) (b) projected Free Cash Flows (c) new Debt financing The 'Cash Flow Statement' Sheet will automatically calculate Free Cash Flows based on your Income Statement and Balance Sheet forecasts. As a reminder, we already used the 'Income Statement (GAAP)' Sheet to forecast 2020E and 2021E earnings in line with the consensus forecast for revenues and earnings. Our Balance Sheet forecasts are set at the default levels, which rise and fall with the forecast for Revenues. How much Free Cash Flow do you forecast Microsoft will generate in FY2020E ($ Millions)? Do you think Microsoft can self finance this repurchase with its Free Cash Flows? CASE Share Repurchase In this CASE we are going to implement a share repurchase. We will utilize all three of the major financial statements. Please start this assignment with the forecast for 2020E and 2021E set to the consensus revenues and EPS we used in the last CASE Simple Forecast. In CASE Simple Forecast, row 138, we found the consensus forecast for Microsoft (MSFT): High Mean 152.0 6.00 142.2 5.66 Low 2020E Revenues $B 139.4 EPS 5.46 2021E Revenues $B 153.2 EPS 5.52 Source: CNN Money, 3/16/20 168.7 7.11 159.7 6.30 Typically, the analyst will see an announcement such as the following: The Board has approved a share repurchase program of $10 billion and these repurchases will be primarily financed through free cash flow. (3/10/20) First let's consider whether the company has the cash in place to execute the repurchase or whether it may need to seek outside financing. (In recent years, many companies have taken advantage of low interest rates and borrowed money, raising Debt, to finance share repurchases.) In this instance, the company has announced it will self finance the repurchase. Other times, the company may not indicate how it is financing the repurchase and the analyst will determine whether it will be through: (a) Cash on hand (Excess Cash on the Balance Sheet) (b) projected Free Cash Flows (c) new Debt financing The 'Cash Flow Statement' Sheet will automatically calculate Free Cash Flows based on your Income Statement and Balance Sheet forecasts. As a reminder, we already used the 'Income Statement (GAAP)' Sheet to forecast 2020E and 2021E earnings in line with the consensus forecast for revenues and earnings. Our Balance Sheet forecasts are set at the default levels, which rise and fall with the forecast for Revenues. How much Free Cash Flow do you forecast Microsoft will generate in FY2020E ($ Millions)? Do you think Microsoft can self finance this repurchase with its Free Cash Flows