Question

The beta of ABC Company is 1.2, and the company is 100% equity financed. Assume a risk-free rate of 4% and a market risk

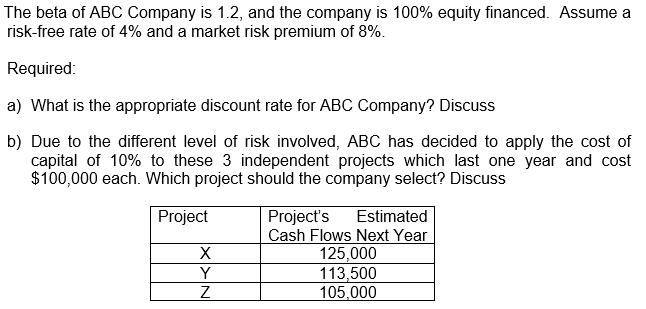

The beta of ABC Company is 1.2, and the company is 100% equity financed. Assume a risk-free rate of 4% and a market risk premium of 8%. Required: a) What is the appropriate discount rate for ABC Company? Discuss b) Due to the different level of risk involved, ABC has decided to apply the cost of capital of 10% to these 3 independent projects which last one year and cost $100,000 each. Which project should the company select? Discuss Project X Y Z Project's Estimated Cash Flows Next Year 125,000 113,500 105,000

Step by Step Solution

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Operations Management Sustainability and Supply Chain Management

Authors: Jay Heizer, Barry Render, Chuck Munson

10th edition

978-0134183954, 134183959, 134181980, 978-0134181981

Students also viewed these General Management questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App