Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Amber Redson made a number of gifts in the current year, which are listed in the table. Amber has already used up her lifetime

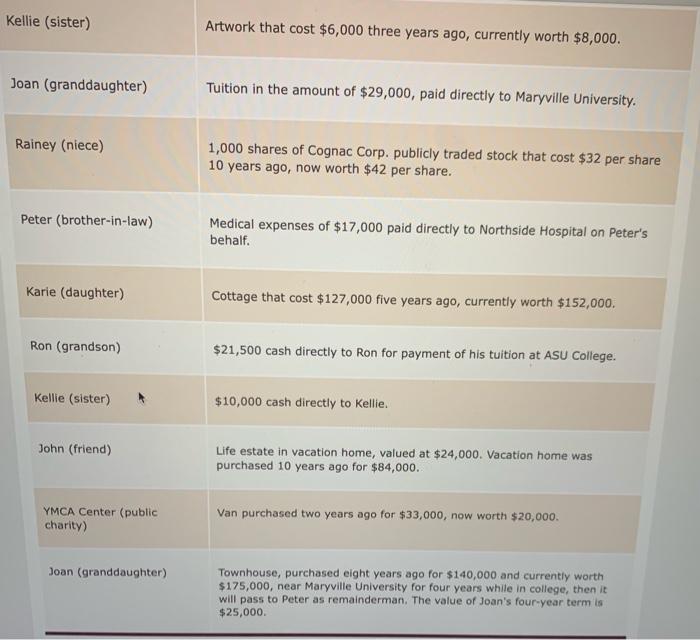

Amber Redson made a number of gifts in the current year, which are listed in the table. Amber has already used up her lifetime transfer tax credit. For each item, determine the value of each donee's gifts and the taxable amount. If the appropriate amount is zero, enter a zero (0). Kellie (sister) Artwork that cost $6,000 three years ago, currently worth $8,000. Joan (granddaughter) Tuition in the amount of $29,000, paid directly to Maryville University. 1,000 shares of Cognac Corp. publicly traded stock that cost $32 per share 10 years ago, now worth $42 per share. Rainey (niece) Peter (brother-in-law) Medical expenses of $17,000 paid directly to Northside Hospital on Peter's behalf. Karie (daughter) Cottage that cost $127,000 five years ago, currently worth $152,000. Ron (grandson) $21,500 cash directly to Ron for payment of his tuition at ASU College. Kellie (sister) $10,000 cash directly to Kellie. Life estate in vacation home, valued at $24,000. Vacation home was purchased 10 years ago for $84,000. John (friend) Van purchased two years ago for $33,000, now worth $20,000. YMCA Center (public charity) Townhouse, purchased eight years ago for $140,000 and currently worth $175,000, near Maryville University for four years while in college, then it will pass to Peter as remainderman. The value of Joan's four-year term is $25,000. Joan (granddaughter)

Step by Step Solution

★★★★★

3.54 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Solution Foom the given given data in foomation the and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started