Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case Study 1 The Zenor Corporation has long been recognized as one of the world's best managed companies and it has rewarded its shareholder's with

Case Study

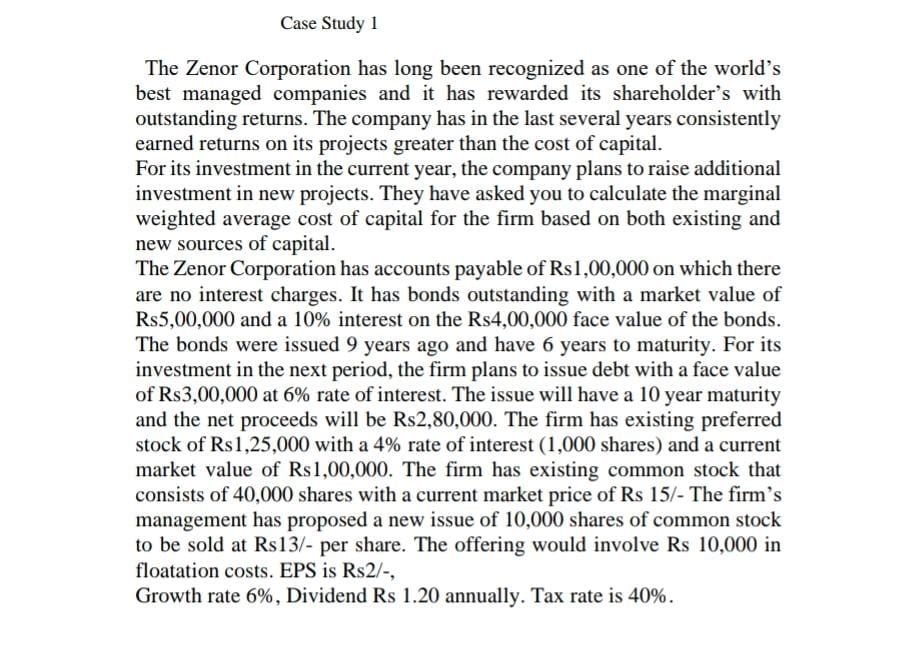

The Zenor Corporation has long been recognized as one of the world's best managed companies and it has rewarded its shareholder's with outstanding returns. The company has in the last several years consistently earned returns on its projects greater than the cost of capital.

For its investment in the current year, the company plans to raise additional investment in new projects. They have asked you to calculate the marginal weighted average cost of capital for the firm based on both existing and new sources of capital.

The Zenor Corporation has accounts payable of Rs on which there are no interest charges. It has bonds outstanding with a market value of Rs and a interest on the Rs face value of the bonds. The bonds were issued years ago and have years to maturity. For its investment in the next period, the firm plans to issue debt with a face value of Rs at rate of interest. The issue will have a year maturity and the net proceeds will be Rs The firm has existing preferred stock of Rs with a rate of interest shares and a current market value of Rs The firm has existing common stock that consists of shares with a current market price of Rs The firm's management has proposed a new issue of shares of common stock to be sold at Rs per share. The offering would involve Rs in floatation costs. EPS is Rs Growth rate Dividend Rs annually. Tax rate is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started