Answered step by step

Verified Expert Solution

Question

1 Approved Answer

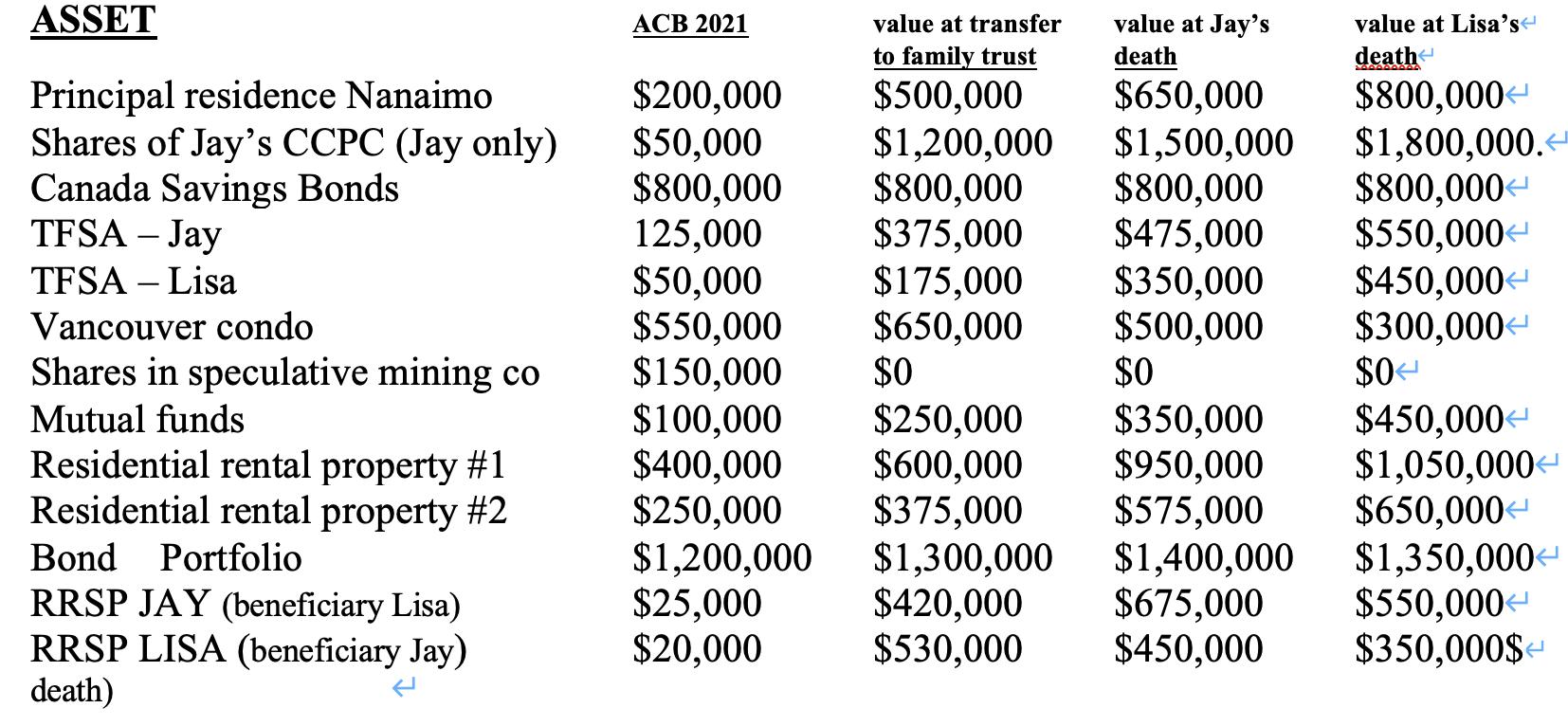

If Jay and Lisa want to set up a family trust for Sarah, by moving all the assets except for the principal residence, TFSAs and

- If Jay and Lisa want to set up a family trust for Sarah, by moving all the assets except for the principal residence, TFSA’s and RRSP’s into this trust, what are the tax implications of doing this assuming a tax rate of 45%? (i.e., indicate whether the asset should be transferred at cost or at market value and the resulting tax consequence). The trust will be established as an inter viros trust and created while all family members are still alive. (8 marks) What type of trust restrictions should they specify since Sarah is not very responsible with money and she is age 30 at the time of transfer? Assume the trustee is a corporation like RBC Trust (2 marks).

- If Jay dies and the assets are valued as above in the third column and all the assets except RRSP, TFSA and CCPC shares are registered in joint names with rights of survivorship, what are the tax implications on transferring the assets from Jay’s estate over to Lisa? (10 marks) Are there any assets that should be transferred at fair market value instead of being transferred at cost to take advantage of losses and/or exemptions? Be specific (4 marks).

- When Lisa dies what are the tax consequences to her estate? That is how much taxes will be owed assuming a 45% tax rate? (10 marks) What will be the probate fees on the estate? (10 marks)

- If the Clark’s want to maximize the value of their estate what amount of life insurance would you recommend to cover the taxes and probate fees on Lisa’s death assuming that Jay has pre-deceased Lisa? (2 marks) What type of insurance would you recommend and why, including any special features? (2 marks) Given that they have significant assets and excellent incomes from their investment assets, and assuming they have always maximized their RRSP’s, are there any other opportunities to invest tax sheltered funds? (2 marks)

ASSET Principal residence Nanaimo Shares of Jay's CCPC (Jay only) Canada Savings Bonds TFSA - Jay TFSA - Lisa Vancouver condo Shares in speculative mining co Mutual funds Residential rental property #1 Residential rental property #2 Bond Portfolio RRSP JAY (beneficiary Lisa) RRSP LISA (beneficiary Jay) death) ACB 2021 $200,000 $50,000 $800,000 125,000 $50,000 $550,000 $150,000 $100,000 $400,000 $250,000 $1,200,000 $25,000 $20,000 value at Jay's death value at transfer to family trust $500,000 $650,000 $1,200,000 $1,500,000 $800,000 $800,000 $375,000 $475,000 $175,000 $350,000 $650,000 $500,000 $0 $0 $250,000 $350,000 $600,000 $950,000 $375,000 $575,000 $1,300,000 $1,400,000 $420,000 $675,000 $530,000 $450,000 value at Lisa's death $800,000 $1,800,000. $800,000 $550,000 $450,000 $300,000 $0 $450,000 $1,050,000 $650,000 $1,350,000 $550,000 $350,000$ E

Step by Step Solution

★★★★★

3.58 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

To assess the tax implications and considerations regarding the establishment of a family trust transfer of assets and tax consequences upon the death of Jay and Lisa a comprehensive analysis is requi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started