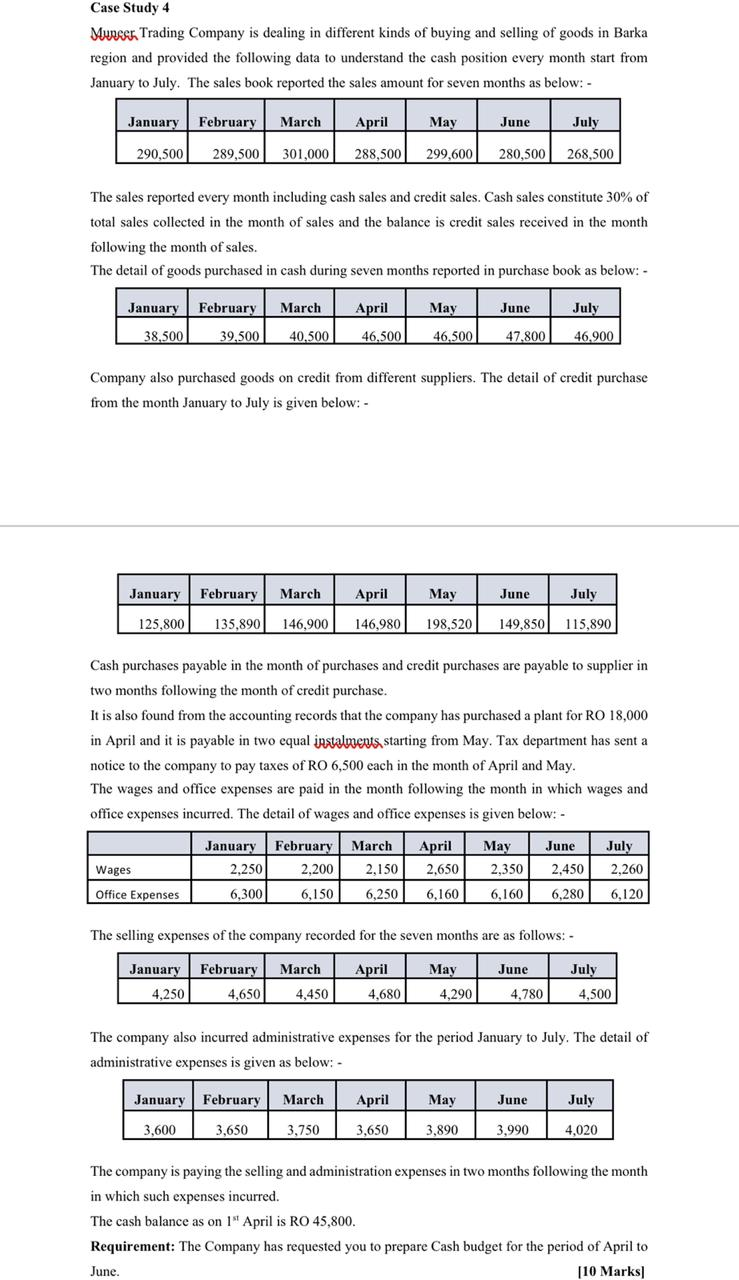

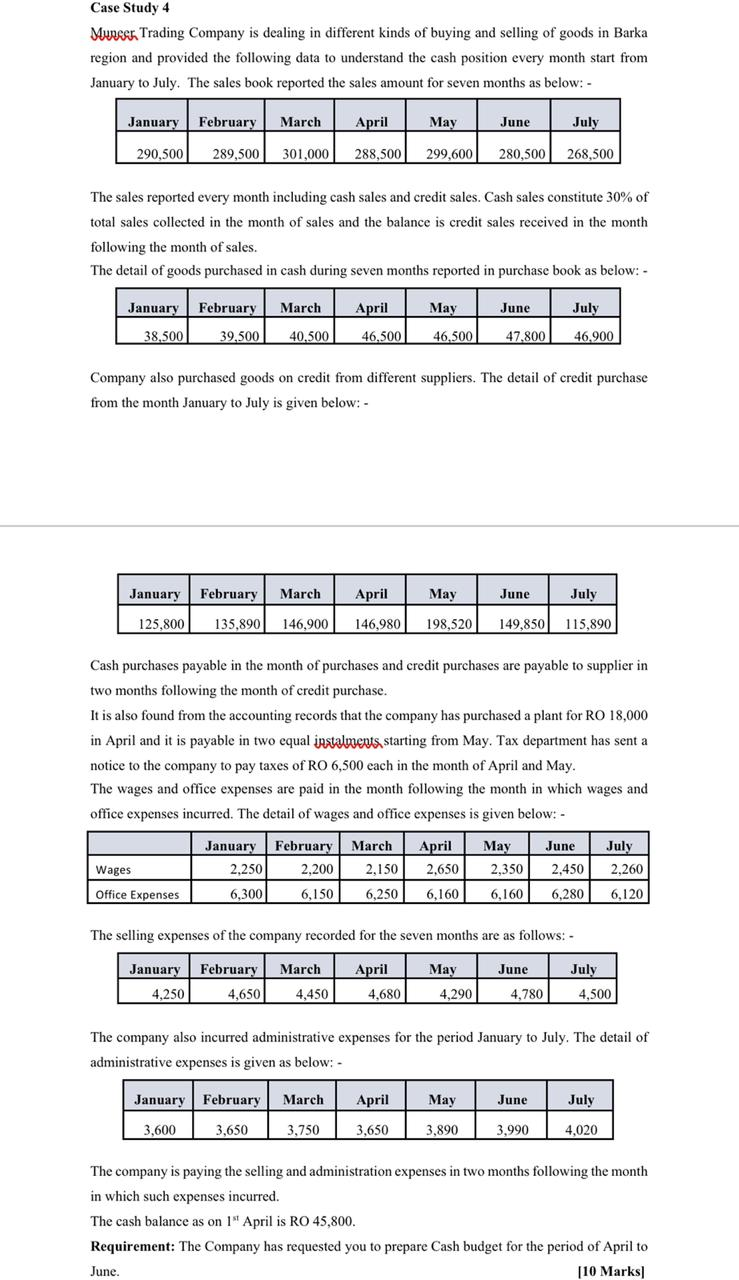

Case Study 4 Muresa Trading Company is dealing in different kinds of buying and selling of goods in Barka region and provided the following data to understand the cash position every month start from January to July. The sales book reported the sales amount for seven months as below:- January February March April May June July 290,500 289,500 301,000 288,500 299,600 280.500 268,500 The sales reported every month including cash sales and credit sales. Cash sales constitute 30% of total sales collected in the month of sales and the balance is credit sales received in the month following the month of sales. The detail of goods purchased in cash during seven months reported in purchase book as below:- January February March April May June July 38,500 39.500 40.500 46,500 46,500 47.800 46.900 Company also purchased goods on credit from different suppliers. The detail of credit purchase from the month January to July is given below:- January February March April May June July 125.800 135,890 146,900 146,980 198,520 149,850 115,890 Cash purchases payable in the month of purchases and credit purchases are payable to supplier in two months following the month of credit purchase. It is also found from the accounting records that the company has purchased a plant for RO 18,000 in April and it is payable in two equal instalments, starting from May. Tax department has sent a notice to the company to pay taxes of RO 6,500 each in the month of April and May. The wages and office expenses are paid in the month following the month in which wages and office expenses incurred. The detail of wages and office expenses is given below: - June January 2,250 February 2.200 March 2,150 April 2,650 6,160 May 2,350 Wages 2,450 July 2,260 6,120 Office Expenses 6,300 6,150 6.250 6.160 6,280 The selling expenses of the company recorded for the seven months are as follows: - January March June July February 4,650 April 4.680 May 4,290 4,250 4,450 4,780 4,500 The company also incurred administrative expenses for the period January to July. The detail of administrative expenses is given as below: - January February March April May June July 3,600 3,650 3,750 3,650 3,890 3,990 4,020 The company is paying the selling and administration expenses in two months following the month in which such expenses incurred. The cash balance as on 1" April is RO 45,800. Requirement: The Company has requested you to prepare Cash budget for the period of April to June. [10 Marks