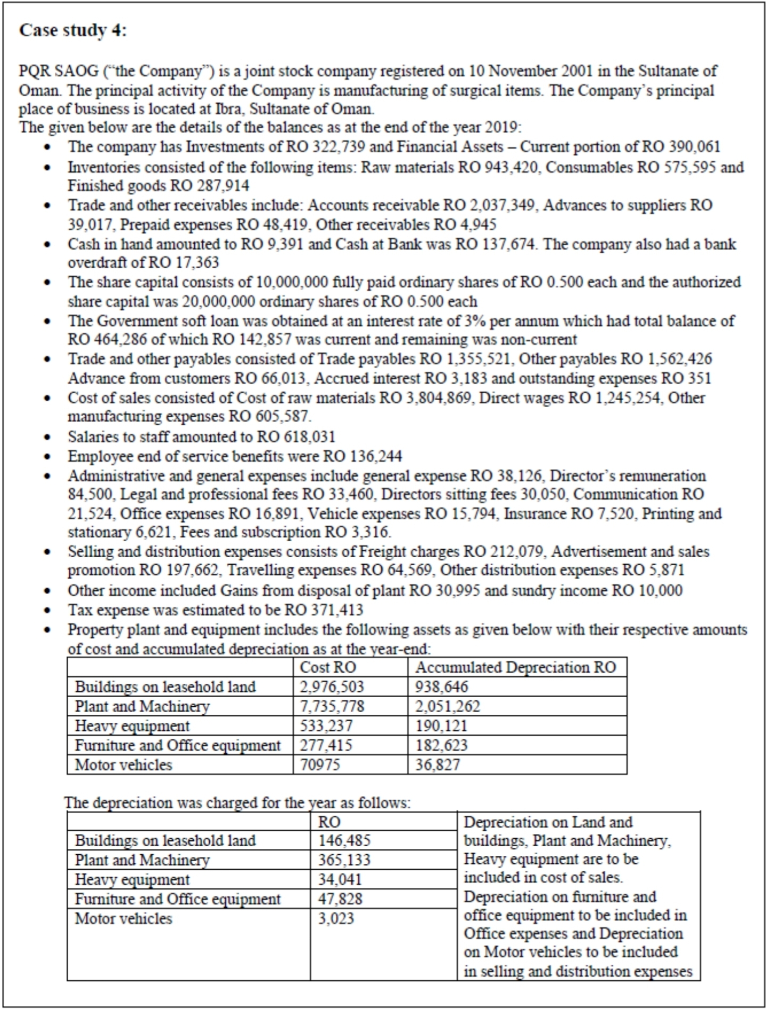

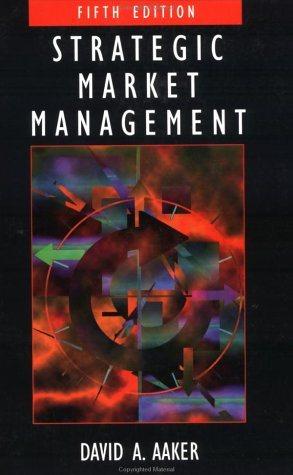

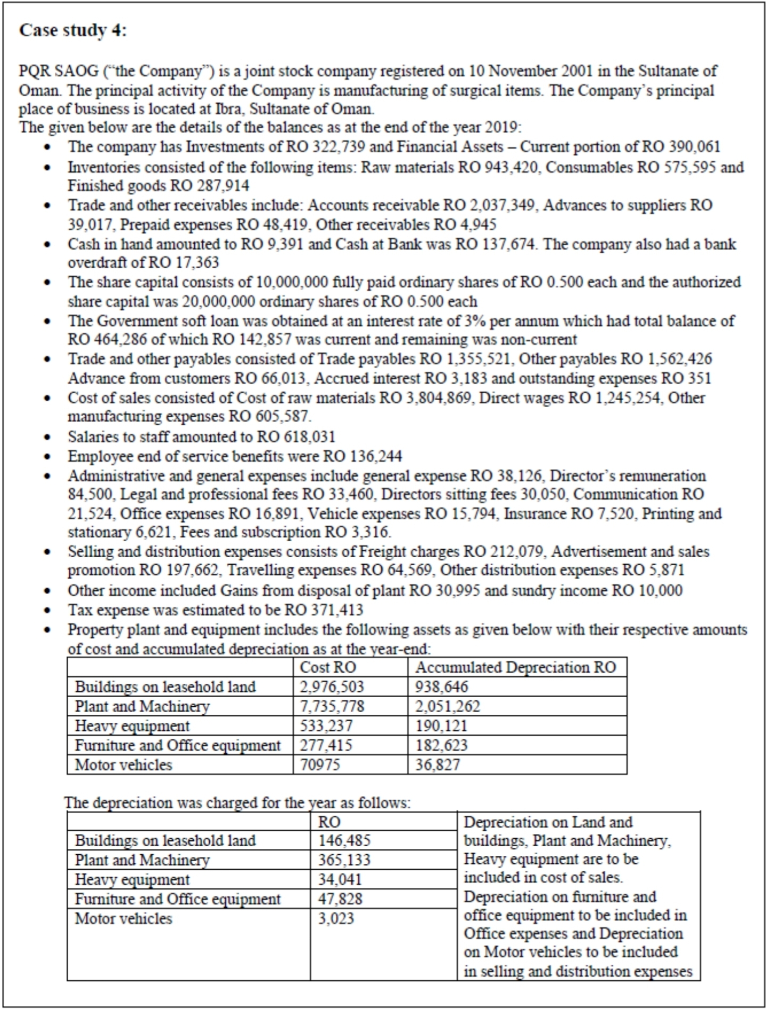

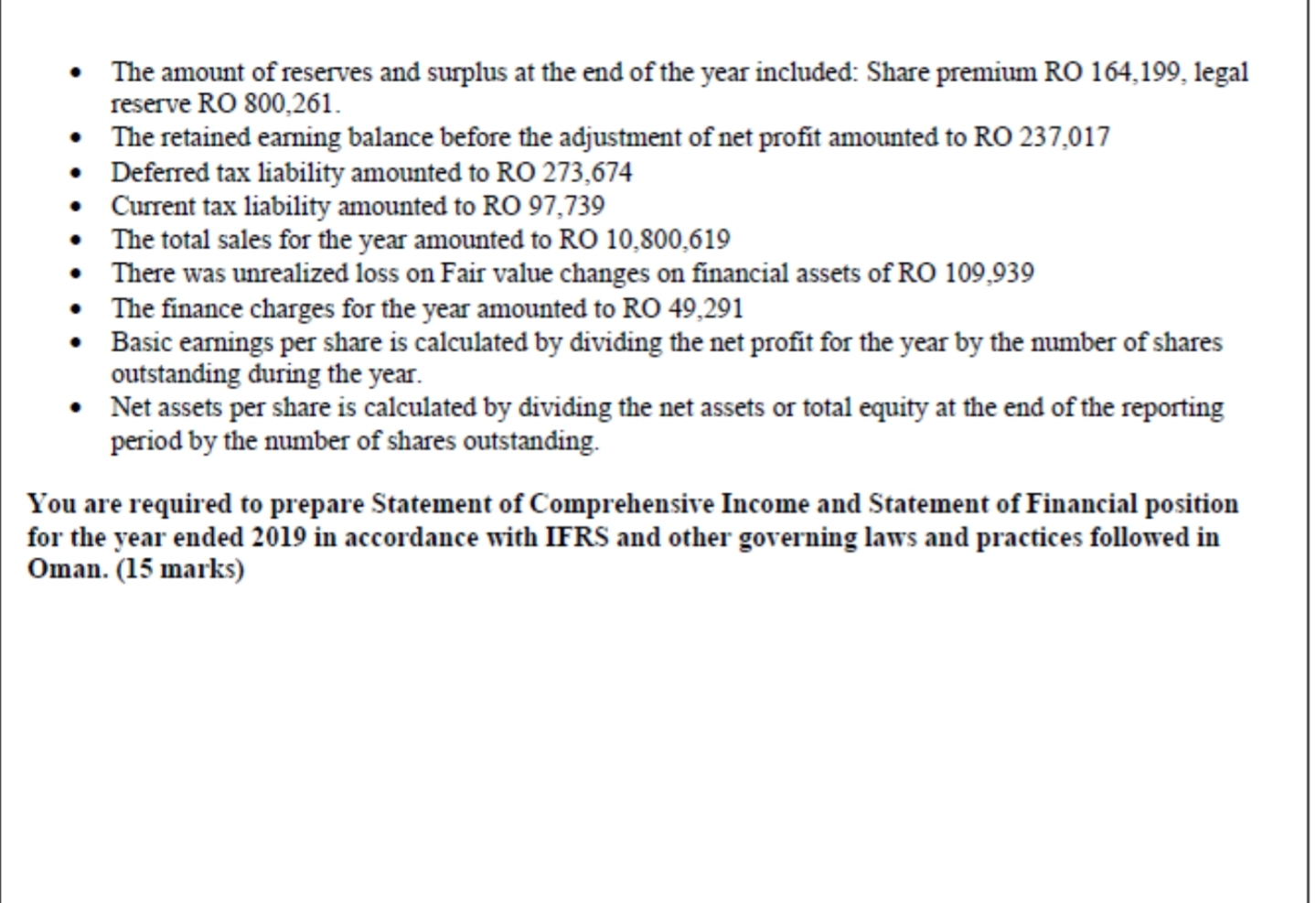

Case study 4: . . PQR SAOG("the Company") is a joint stock company registered on 10 November 2001 in the Sultanate of Oman. The principal activity of the Company is manufacturing of surgical items. The Company's principal place of business is located at Ibra, Sultanate of Oman. The given below are the details of the balances as at the end of the year 2019: The company has Investments of RO 322,739 and Financial Assets - Current portion of RO 390,061 Inventories consisted of the following items: Raw materials RO 943,420, Consumables RO 575,595 and Finished goods RO 287,914 Trade and other receivables include: Accounts receivable RO 2,037,349, Advances to suppliers RO 39,017, Prepaid expenses RO 48,419, Other receivables RO 4,945 Cash in hand amounted to RO 9,391 and Cash at Bank was RO 137,674. The company also had a bank overdraft of RO 17,363 The share capital consists of 10,000,000 fully paid ordinary shares of RO 0.500 each and the authorized share capital was 20,000,000 ordinary shares of RO 0.500 each The Government soft loan was obtained at an interest rate of 3% per annum which had total balance of RO 464,286 of which RO 142,857 was current and remaining was non-current Trade and other payables consisted of Trade payables RO 1,355,521, Other payables RO 1,562,426 Advance from customers RO 66,013, Accrued interest RO 3,183 and outstanding expenses RO 351 Cost of sales consisted of Cost of raw materials RO 3,804,869, Direct wages RO 1,245,254, Other manufacturing expenses RO 605,587. Salaries to staff amounted to RO 618,031 Employee end of service benefits were RO 136,244 Administrative and general expenses include general expense RO 38,126, Director's remuneration 84,500, Legal and professional fees RO 33,460, Directors sitting fees 30,050, Communication RO 21,524, Office expenses RO 16,891, Vehicle expenses RO 15,794, Insurance RO 7,520, Printing and stationary 6,621, Fees and subscription RO 3,316. Selling and distribution expenses consists of Freight charges RO 212,079, Advertisement and sales promotion RO 197,662, Travelling expenses RO 64,569. Other distribution expenses RO 5,871 Other income included Gains from disposal of plant RO 30,995 and sundry income RO 10,000 Tax expense was estimated to be RO 371,413 Property plant and equipment includes the following assets as given below with their respective amounts of cost and accumulated depreciation as at the year-end: Cost RO Accumulated Depreciation RO Buildings on leasehold land 2.976,503 938.646 Plant and Machinery 7,735,778 2.051.262 Heavy equipment 533.237 190.121 Furniture and Office equipment 277,415 182.623 Motor vehicles 70975 36,827 The depreciation was charged for the year as follows: RO Buildings on leasehold land 146,485 Plant and Machinery 365.133 Heavy equipment 34.041 Furniture and Office equipment 47.828 Motor vehicles 3,023 Depreciation on Land and buildings, Plant and Machinery, Heavy equipment are to be included in cost of sales. Depreciation on furniture and office equipment to be included in Office expenses and Depreciation on Motor vehicles to be included in selling and distribution expenses The amount of reserves and surplus at the end of the year included: Share premium RO 164,199, legal reserve RO 800,261. The retained earning balance before the adjustment of net profit amounted to RO 237,017 Deferred tax liability amounted to RO 273,674 Current tax liability amounted to RO 97,739 The total sales for the year amounted to RO 10,800.619 There was unrealized loss on Fair value changes on financial assets of RO 109,939 The finance charges for the year amounted to RO 49,291 Basic earnings per share is calculated by dividing the net profit for the year by the number of shares outstanding during the year. Net assets per share is calculated by dividing the net assets or total equity at the end of the reporting period by the number of shares outstanding. You are required to prepare Statement of Comprehensive Income and Statement of Financial position for the year ended 2019 in accordance with IFRS and other governing laws and practices followed in Oman. (15 marks) Case study 4: . . PQR SAOG("the Company") is a joint stock company registered on 10 November 2001 in the Sultanate of Oman. The principal activity of the Company is manufacturing of surgical items. The Company's principal place of business is located at Ibra, Sultanate of Oman. The given below are the details of the balances as at the end of the year 2019: The company has Investments of RO 322,739 and Financial Assets - Current portion of RO 390,061 Inventories consisted of the following items: Raw materials RO 943,420, Consumables RO 575,595 and Finished goods RO 287,914 Trade and other receivables include: Accounts receivable RO 2,037,349, Advances to suppliers RO 39,017, Prepaid expenses RO 48,419, Other receivables RO 4,945 Cash in hand amounted to RO 9,391 and Cash at Bank was RO 137,674. The company also had a bank overdraft of RO 17,363 The share capital consists of 10,000,000 fully paid ordinary shares of RO 0.500 each and the authorized share capital was 20,000,000 ordinary shares of RO 0.500 each The Government soft loan was obtained at an interest rate of 3% per annum which had total balance of RO 464,286 of which RO 142,857 was current and remaining was non-current Trade and other payables consisted of Trade payables RO 1,355,521, Other payables RO 1,562,426 Advance from customers RO 66,013, Accrued interest RO 3,183 and outstanding expenses RO 351 Cost of sales consisted of Cost of raw materials RO 3,804,869, Direct wages RO 1,245,254, Other manufacturing expenses RO 605,587. Salaries to staff amounted to RO 618,031 Employee end of service benefits were RO 136,244 Administrative and general expenses include general expense RO 38,126, Director's remuneration 84,500, Legal and professional fees RO 33,460, Directors sitting fees 30,050, Communication RO 21,524, Office expenses RO 16,891, Vehicle expenses RO 15,794, Insurance RO 7,520, Printing and stationary 6,621, Fees and subscription RO 3,316. Selling and distribution expenses consists of Freight charges RO 212,079, Advertisement and sales promotion RO 197,662, Travelling expenses RO 64,569. Other distribution expenses RO 5,871 Other income included Gains from disposal of plant RO 30,995 and sundry income RO 10,000 Tax expense was estimated to be RO 371,413 Property plant and equipment includes the following assets as given below with their respective amounts of cost and accumulated depreciation as at the year-end: Cost RO Accumulated Depreciation RO Buildings on leasehold land 2.976,503 938.646 Plant and Machinery 7,735,778 2.051.262 Heavy equipment 533.237 190.121 Furniture and Office equipment 277,415 182.623 Motor vehicles 70975 36,827 The depreciation was charged for the year as follows: RO Buildings on leasehold land 146,485 Plant and Machinery 365.133 Heavy equipment 34.041 Furniture and Office equipment 47.828 Motor vehicles 3,023 Depreciation on Land and buildings, Plant and Machinery, Heavy equipment are to be included in cost of sales. Depreciation on furniture and office equipment to be included in Office expenses and Depreciation on Motor vehicles to be included in selling and distribution expenses The amount of reserves and surplus at the end of the year included: Share premium RO 164,199, legal reserve RO 800,261. The retained earning balance before the adjustment of net profit amounted to RO 237,017 Deferred tax liability amounted to RO 273,674 Current tax liability amounted to RO 97,739 The total sales for the year amounted to RO 10,800.619 There was unrealized loss on Fair value changes on financial assets of RO 109,939 The finance charges for the year amounted to RO 49,291 Basic earnings per share is calculated by dividing the net profit for the year by the number of shares outstanding during the year. Net assets per share is calculated by dividing the net assets or total equity at the end of the reporting period by the number of shares outstanding. You are required to prepare Statement of Comprehensive Income and Statement of Financial position for the year ended 2019 in accordance with IFRS and other governing laws and practices followed in Oman. (15 marks)