Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CASE STUdy 4.1, Retail Method of Inventory The buyer for the sneaker department for a major shoe retailer, has been analyzing their classification performance for

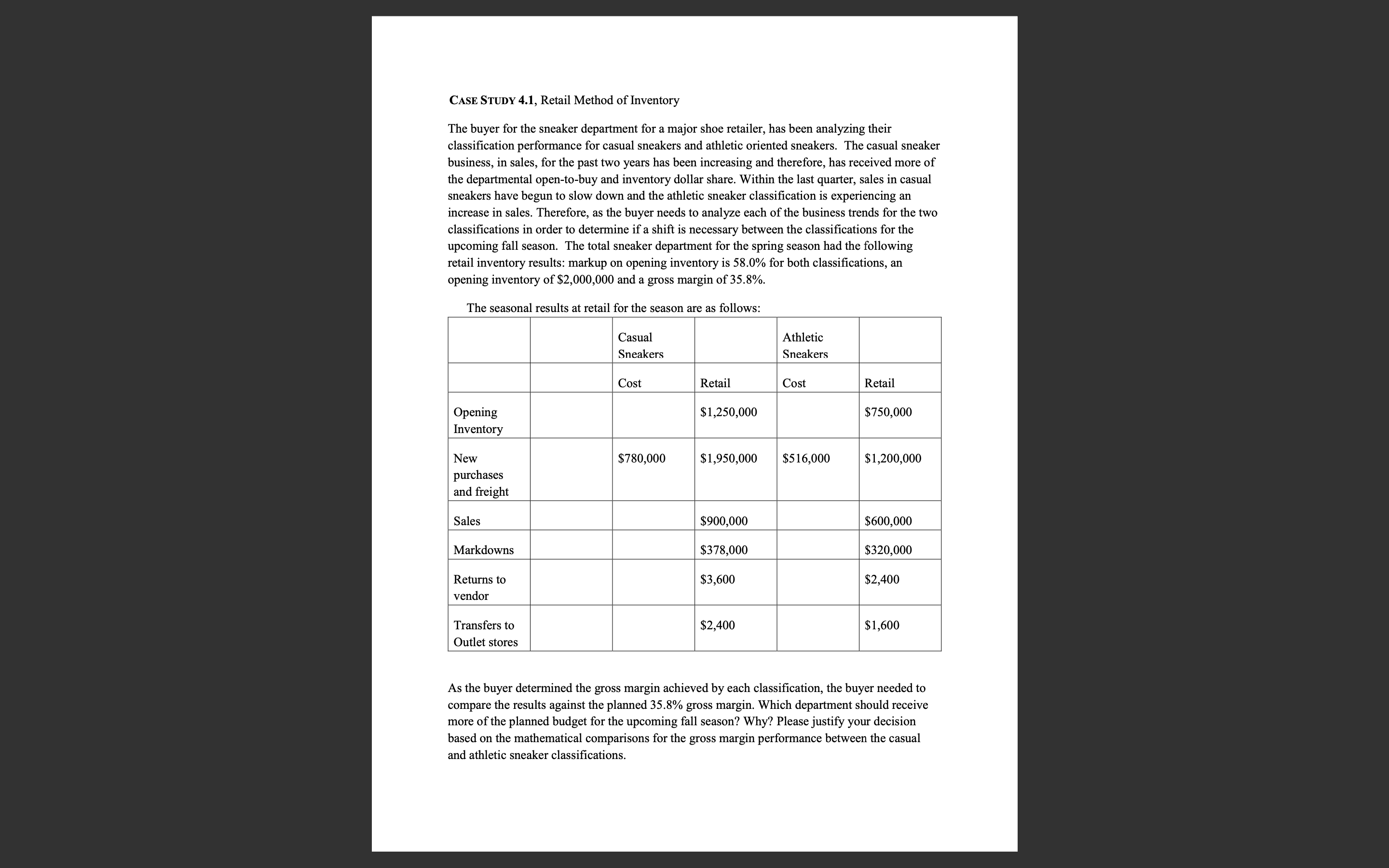

CASE STUdy 4.1, Retail Method of Inventory The buyer for the sneaker department for a major shoe retailer, has been analyzing their classification performance for casual sneakers and athletic oriented sneakers. The casual sneaker business, in sales, for the past two years has been increasing and therefore, has received more of the departmental open-to-buy and inventory dollar share. Within the last quarter, sales in casual sneakers have begun to slow down and the athletic sneaker classification is experiencing an increase in sales. Therefore, as the buyer needs to analyze each of the business trends for the two classifications in order to determine if a shift is necessary between the classifications for the upcoming fall season. The total sneaker department for the spring season had the following retail inventory results: markup on opening inventory is 58.0% for both classifications, an opening inventory of $2,000,000 and a gross margin of 35.8%. The seasonal results at retail for the season are as follows: As the buyer determined the gross margin achieved by each classification, the buyer needed to compare the results against the planned 35.8% gross margin. Which department should receive more of the planned budget for the upcoming fall season? Why? Please justify your decision based on the mathematical comparisons for the gross margin performance between the casual and athletic sneaker classifications

CASE STUdy 4.1, Retail Method of Inventory The buyer for the sneaker department for a major shoe retailer, has been analyzing their classification performance for casual sneakers and athletic oriented sneakers. The casual sneaker business, in sales, for the past two years has been increasing and therefore, has received more of the departmental open-to-buy and inventory dollar share. Within the last quarter, sales in casual sneakers have begun to slow down and the athletic sneaker classification is experiencing an increase in sales. Therefore, as the buyer needs to analyze each of the business trends for the two classifications in order to determine if a shift is necessary between the classifications for the upcoming fall season. The total sneaker department for the spring season had the following retail inventory results: markup on opening inventory is 58.0% for both classifications, an opening inventory of $2,000,000 and a gross margin of 35.8%. The seasonal results at retail for the season are as follows: As the buyer determined the gross margin achieved by each classification, the buyer needed to compare the results against the planned 35.8% gross margin. Which department should receive more of the planned budget for the upcoming fall season? Why? Please justify your decision based on the mathematical comparisons for the gross margin performance between the casual and athletic sneaker classifications Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started