Question

CASE STUDY: A RENEWABLE POWER PROJECT IN MEXICO Western Wind Power (WWP) is a renewable energy company that builds and operates wind power farms. Currently,

CASE STUDY: A RENEWABLE POWER PROJECT IN MEXICO

Western Wind Power (WWP) is a renewable energy company that builds and operates wind power farms.

Currently, its operations are located in Colorado, Utah, and Wyoming. However, the reforms in the Mexican power sector in 2012 generated a lot of opportunities for investment in electricity generation and distribution and the firm is currently considering whether to undertake a project south of the border. WWPs Current Operations In its US operations, WW P focuses on operating wind farms owned by third parties. It has several long term contracts with US power companies and municipalities.Several years ago, WWP also earned significant revenues from constructing wind farms for third parties However, this business has been stagnating recently; WWP has not received a new construction contract in five years. After the 2016 presidential election, US energy priorities shifted, and WWP does not expect any new US business - either construction or operationsin the foreseeable future.

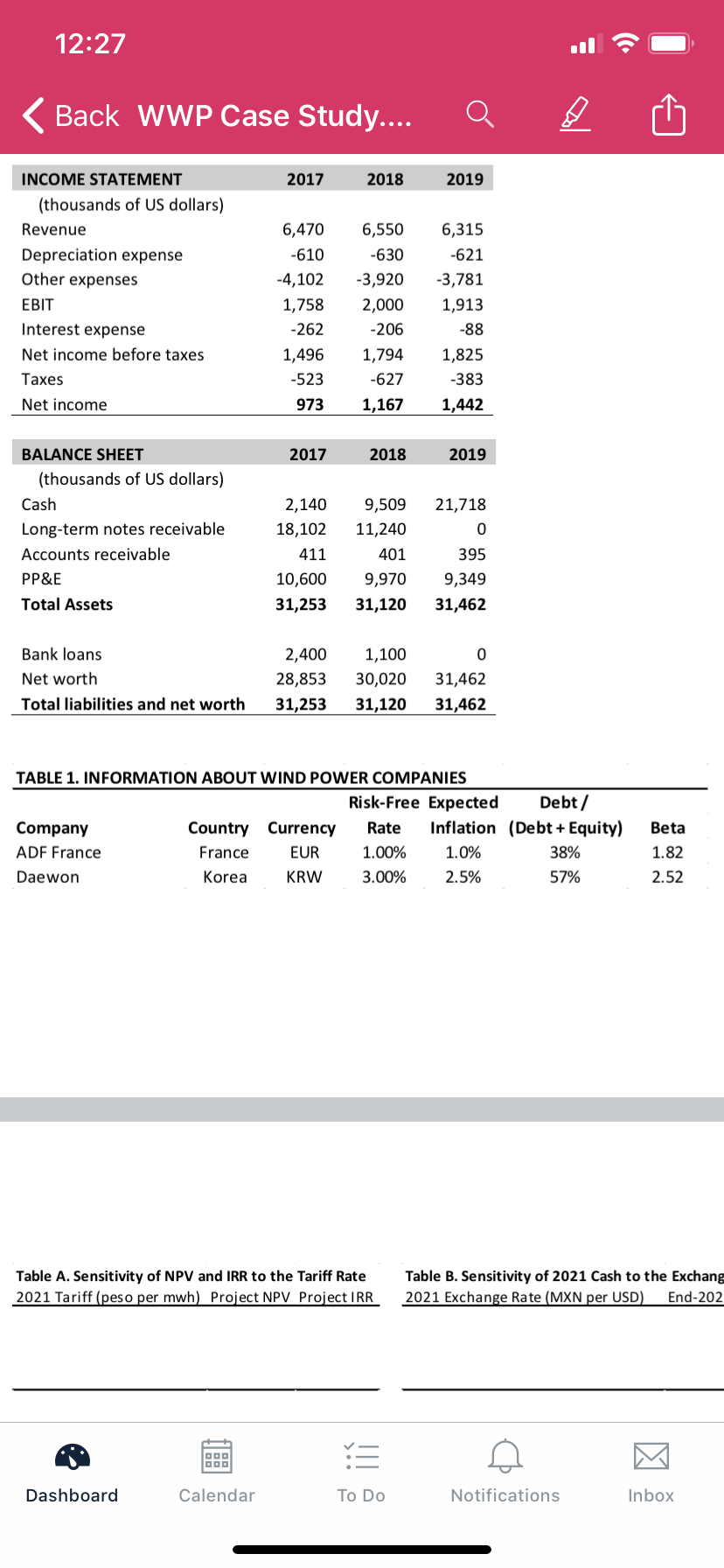

WWP has paid down its debt over the years. It leases most of its equipment, which limits its need for capital. In previous years, deferred payments from previous construction projects (long-term notes receivable on the balance sheets) have matured, and WWP holds a considerable amount of cash on the balance sheet far more than it needs to run its existing operations. WWP faces pressure to return cash to its shareholders, especially if it fails to win new projects.The firms recent financial statements are attached below. WWPs Shareholders WWP is a privately held company. It was founded by Dr Sharma, who owns 6% of the shares and is the CEO . The remaining shares are held by private equity companies and wealthy individuals. The project in Mexico would represent a large investment for WWP, and the shareholders would need to approve it. As a result, WWP will hold a shareholder meeting before submitting a bid.The firms shareholders are well diversified. From your previous discussions with them,you know that they would be willing to take on a large, potentially risky project even if it increases the firms risk profile, and even if it requires changing the firms capital structure. Of course, they would need to expect a reasonable return. You also believe that the shareholders are unlikely to commit new capital at this timethey believe the firm should take advantage of the current low interest rate environment.

Thus, any new investments would need to be funded by debt. Since WWP isnt listed, its share price isnt available to estimate the cost of equity. However,you can use the CAPM to estimate the cost of equity for listed companies that undertake comparable projects. The shareholders feel comfortable with this approach, and believe that it generates an acceptable required return to equity. Youve gathered some information on comparable listed companies in Table 1(below) Unfortunately, your comps are all foreign companies: there are no comparable listings in the US. 2 The Mexican Power Project The project in Mexico is a form of private-public partnership, known as a PPP project. The terms of the project have been approved by the National Energy Control Center, the regulator for Mexicos electricity sector. A company is eligible to submit a bid for the project if it can demonstrate expertise and experience in the field of wind power, and if it has sufficient financial capacity to construct the proposed project. After several meetings in Mexico City to discuss WWPs capabilities and balance sheet, WWP has been approved to submit a bid. The differentiating feature of each private companys bid is discussed in item (3) below.The private company that is awarded the contract will

:(1) Construct the wind farm, using its own funds or funding from private markets. The farm will need to construct and maintain capacity of 42 megawatts. The local government will provide land for the wind farm free of charge.

(2)Retain ownership of the wind farm and operate it for 20 years (3) Sell electricity generated by the wind farm to the local power distributor, Jalisco Light and Power(JLP). JLP is a new entity, and does not have a credit rating. However, your finance department believes its credit rating would be a notch or two below that of the Mexican government. Each firms bid will propose an electricity tariff, which must be quoted as Mexican pesos per megawatt hour (mwh). JLP will purchase electricity from the wind farm at this tariff for the first year of operation, expected to be 2021. Afterwards, the tariff will increase each year at the rate of Mexican inflation. The firm with the lowest proposed tariff will win the contract.(4)JLP guarantees a minimum purchase of 75,000 mwh per year. It may purchase more than that,depending on electricity needs in the province and the price of wind -generated electricity relative to other sources. Due to its own revenue collection schedule, JLP will pay for the electricity generated by the project with a lag of about six months.(5)At the end of 20 years, ownership of the wind farm and all of the wind turbines installed upon it will pass to JLP. JLP will pay no compensation for this, and will operate the wind farm thereafter.(6)According to an agreement with the Mexican government, income from the project will be taxed at 21%, the same rate as US corporate income tax Thoughts from WWPs Engineers For the Mexico project, WWP plans to install large wind turbines produced by Shanghai Greentech, a Chinese company. Each turbine has capacity of 3 megawatts; the purchase price is USD 2.63million (including shipping and tariffs at the Mexican border). Installation costs are estimated at USD 245,000 per turbine. The wind farm could begin operation about one year after the contract is signed.If WWP 3 wins the bid, you expect to sign the contract in the fall of 2019 and begin construction in early 2020. The wind farm would begin generating electricity in 2021. Your engineering department explains that a single wind turbine, operating at full capacity for one hour,will generate electricity equivalent to 3 megawatt hours (mwh). However, a wind turbine will not always operate at full capacity. Large batteries are expensive, and it is not economically feasible to store wind-generated electricity. Sometimes, depending on the season of the year or time of day, there isnt enough demand for electricity, and the generator is simply turned off. And sometimes there isnt enough wind. After a careful study of the location, your engineers believe that a single 3 megawatt wind turbine could produce, at most, 11,750 mwh per year a capacity factor of 45%.

Your engineers believe that a sensible way to estimate operation and maintenance (O&M) costs is as a percentage of the purchase price (excluding installation costs), taking into account that O&M costs will increase will increase over time with inflation. For the five years, O&M costs should total 3% of the purchase price per year; roughly half of this is imported parts, priced in US dollars, and half is local labor and parts, priced in Mexican peso. After that, O&M costs should rise to 5% of the purchase price per year.

In addition, to O&M costs, your engineers estimate that variable costs are about USD 2.40 per mwh, and will rise over time with inflation. Thoughts from WWPs Energy Consultants WWP hired an energy consulting firm (Global Energy Associates, or GEA) to provide expert views on the sector and the project. GEA notes that electricity generated by natural gas is available in the region at a price of 882 Mexican peso per mwh in 2019, expected to rise at the rate of Mexican inflation. Coal-fired electricity is even cheaper, but coal-fired plants are operating at full capacity, and due to environmental concerns, GEA expects that no new coal -fired plants will be constructed. If the wind farms electricity is more expensive than the alternativeelectricity generated by natural gas GEA explains that regulations require JLP to purchase one-third of its electricity from renewable sources, such as wind power. Since there are few renewable options, GEA believes that, in this case,the wind farm will sell 98,000 mwh of electricity in the first year; this quantity is expected to increase at the growth rate of the Mexican economy. If the wind farms electricity is cheaper than the alternative, GEA believes that the wind farm can sell as much electricity as it can produce. Thoughts from WWPs Finance Department. You are the Chief Financial Officer of WWP. To help match assets and liabilities,you would like to borrow in Mexican peso (MXN). Unfortunately, after several discussions with Mexican banks, youre unable to secure a commitment for a large loan. You can borrow on an unsecured basis from Banco. Pueblo, who has agreed to provide a 20-year bulletloan of 42,000,000 MXN at an interest rate of 9%. The spot exchange rate is 20 MXN per USD. You expect inflation in Mexico to average 5% per year. US banks are willing to lend larger amounts, but are not excited about this type of project, and offer unfavorable teams. Bank of Southern Utah also offers you a 20-year bullet loan, but requires that the loan will be backed by the projects cash flows as well as by WWPs general revenues. The interest rate depends on the amount of the loan relative to the value of the projects assets. For a loan less than or equal to 40% of the value of the installed turbines, the lending rate would be 4.5% fixed. For a loan above 40%, but less than 60% of the projects upfront cost, the lending rate would be 7.5% fixed. No bank will lend beyond 60% of the projects cost.

Picture of statements.

Question is the following-

How sensitive are WWP s cash flows to the exchange rate in 2021?

Dr. Sharma is reluctant to hedge WWP is a small firm, and does not have the expertise. She will only consider this if an adverse movement in the Mexican peso would put the cash flows of the firm at risk.

12:27 ..FOStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started