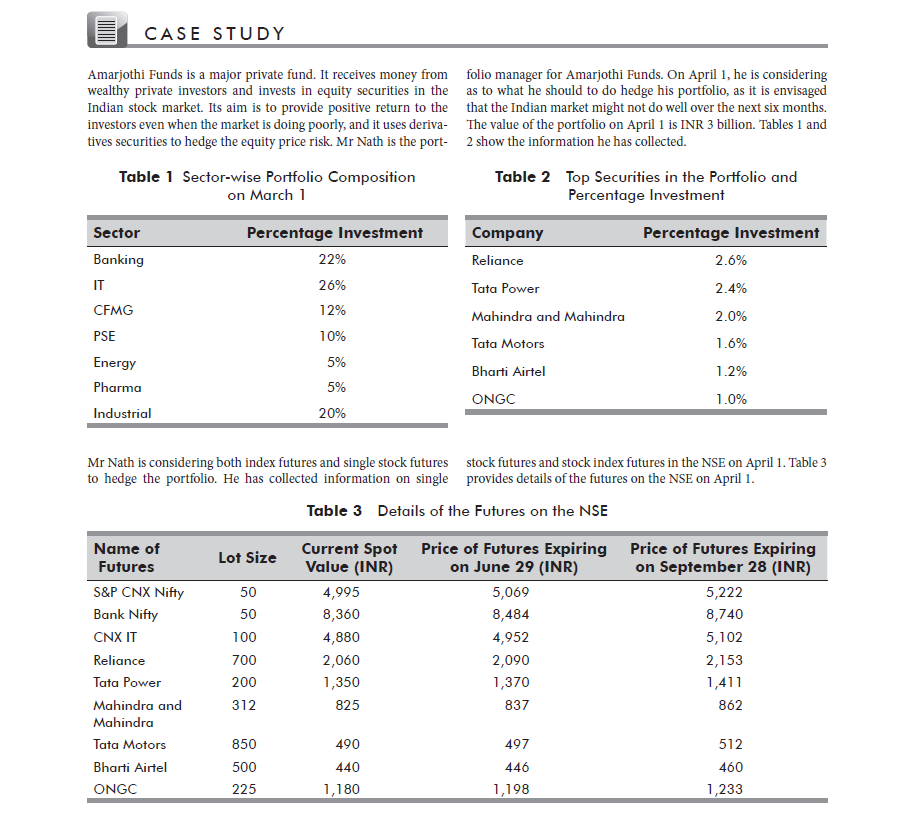

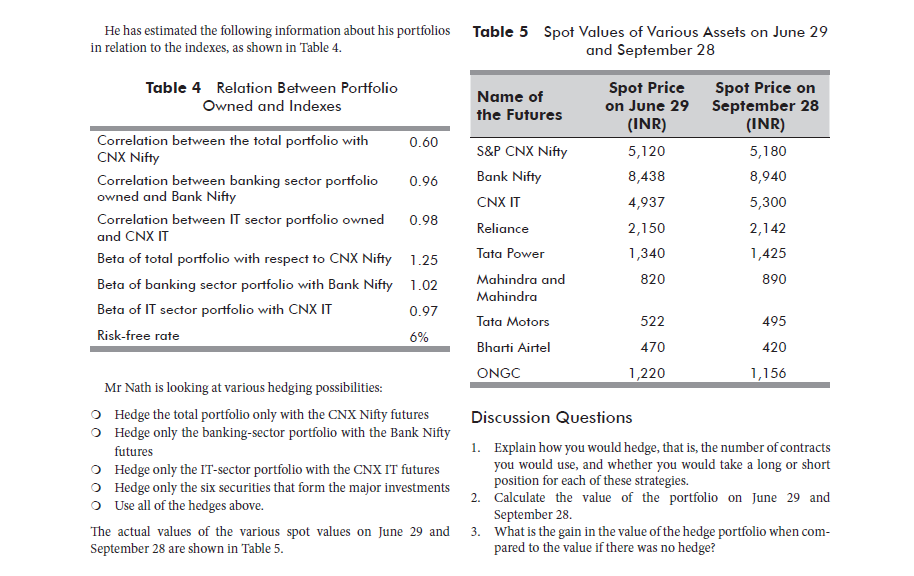

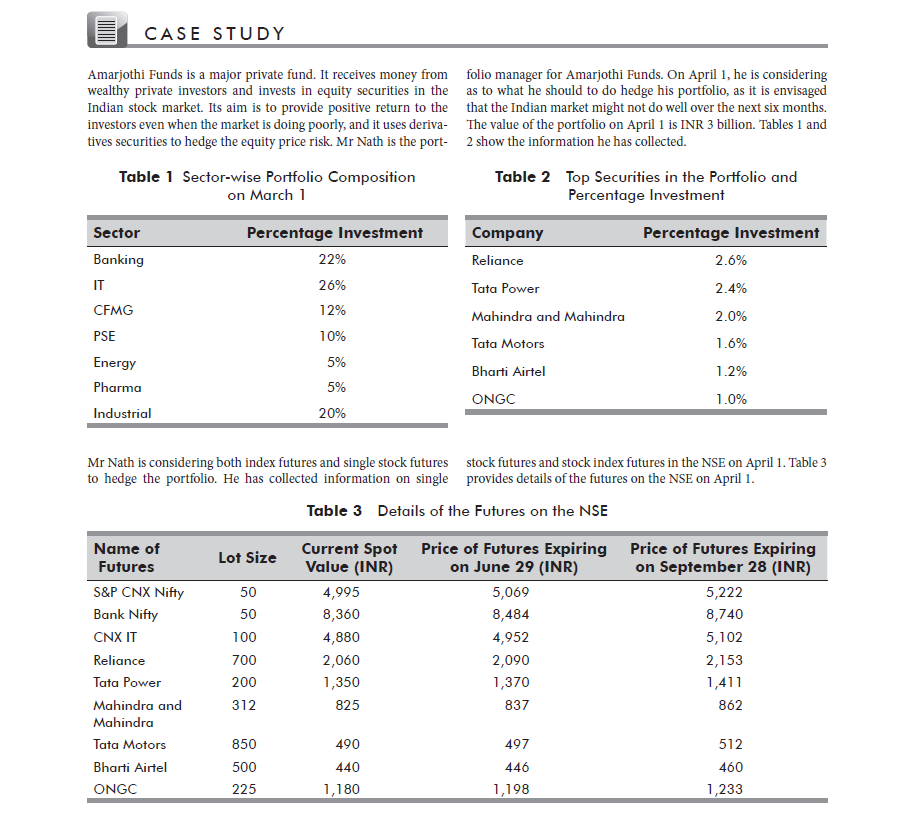

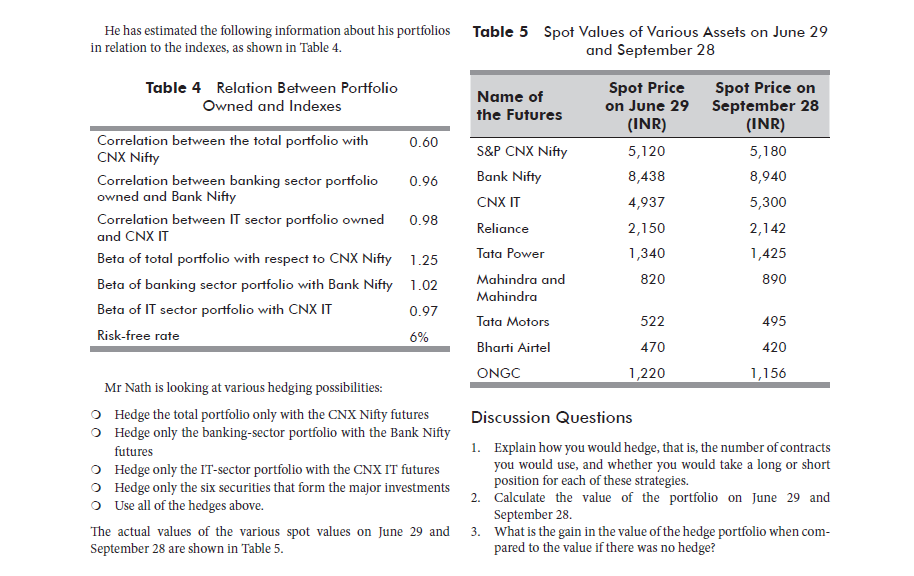

CASE STUDY Amarjothi Funds is a major private fund. It receives money from folio manager for Amarjothi Funds. On April 1, he is considering wealthy private investors and invests in equity securities in the as to what he should to do hedge his portfolio, as it is envisaged Indian stock market. Its aim is to provide positive return to the that the Indian market might not do well over the next six months. investors even when the market is doing poorly, and it uses deriva- The value of the portfolio on April 1 is INR 3 billion. Tables 1 and tives securities to hedge the equity price risk. Mr Nath is the port- 2 show the information he has collected. Table 1 Sector-wise Portfolio Composition on March 1 Table 2 Top Securities in the Portfolio and Percentage Investment Percentage Investment 2.6% Percentage Investment 22% 26% 12% 2.4% Sector Banking IT CFMG PSE Energy Pharma Industrial Company Reliance Tata Power Mahindra and Mahindra Tata Motors Bharti Airtel ONGC 2.0% 10% 1.6% 5% 5% 1.2% 1.0% 20% Mr Nath is considering both index futures and single stock futures stock futures and stock index futures in the NSE on April 1. Table 3 to hedge the portfolio. He has collected information on single provides details of the futures on the NSE on April 1. Table 3 Details of the Futures on the NSE Name of Current Spot Price of Futures Expiring Price of Futures Expiring Futures Lot Size Value (INR) on June 29 (INR) on September 28 (INR) S&P CNX Nifty 50 4,995 5,069 5,222 Bank Nifty 50 8,360 8,484 8,740 CNX IT 100 4,880 4,952 5,102 Reliance 700 2,060 2,090 2,153 Tata Power 200 1,350 1,370 1,411 Mahindra and 312 825 837 862 Mahindra Tata Motors 850 490 497 512 Bharti Airtel 500 440 446 460 ONGC 225 1,180 1,198 1,233 890 He has estimated the following information about his portfolios Table 5 Spot Values of Various Assets on June 29 in relation to the indexes, as shown in Table 4. and September 28 Table 4 Relation Between Portfolio Name of Spot Price Spot Price on Owned and Indexes on June 29 September 28 the Futures (INR) (INR) Correlation between the total portfolio with 0.60 CNX Nifty S&P CNX Nifty 5,120 5,180 Correlation between banking sector portfolio 0.96 Bank Nifty 8,438 8,940 owned and Bank Nifty CNX IT 4,937 5,300 Correlation between IT sector portfolio owned 0.98 and CNX IT Reliance 2,150 2,142 Beta of total portfolio with respect to CNX Nifty 1.25 Tata Power 1,340 1,425 Beta of banking sector portfolio with Bank Nifty 1.02 Mahindra and 820 Mahindra Beta of IT sector portfolio with CNX IT 0.97 Tata Motors 522 495 Risk-free rate 6% Bharti Airtel 470 420 ONGC 1,220 1,156 Mr Nath is looking at various hedging possibilities: Hedge the total portfolio only with the CNX Nifty futures Discussion Questions O Hedge only the banking-sector portfolio with the Bank Nifty futures 1. Explain how you would hedge, that is, the number of contracts Hedge only the IT-sector portfolio with the CNX IT futures you would use, and whether you would take a long or short O Hedge only the six securities that form the major investments position for each of these strategies. o Use all of the hedges above. 2. Calculate the value of the portfolio on June 29 and September 28. The actual values of the various spot values on June 29 and 3. What is the gain in the value of the hedge portfolio when com- September 28 are shown in Table 5. pared to the value if there was no hedge? CASE STUDY Amarjothi Funds is a major private fund. It receives money from folio manager for Amarjothi Funds. On April 1, he is considering wealthy private investors and invests in equity securities in the as to what he should to do hedge his portfolio, as it is envisaged Indian stock market. Its aim is to provide positive return to the that the Indian market might not do well over the next six months. investors even when the market is doing poorly, and it uses deriva- The value of the portfolio on April 1 is INR 3 billion. Tables 1 and tives securities to hedge the equity price risk. Mr Nath is the port- 2 show the information he has collected. Table 1 Sector-wise Portfolio Composition on March 1 Table 2 Top Securities in the Portfolio and Percentage Investment Percentage Investment 2.6% Percentage Investment 22% 26% 12% 2.4% Sector Banking IT CFMG PSE Energy Pharma Industrial Company Reliance Tata Power Mahindra and Mahindra Tata Motors Bharti Airtel ONGC 2.0% 10% 1.6% 5% 5% 1.2% 1.0% 20% Mr Nath is considering both index futures and single stock futures stock futures and stock index futures in the NSE on April 1. Table 3 to hedge the portfolio. He has collected information on single provides details of the futures on the NSE on April 1. Table 3 Details of the Futures on the NSE Name of Current Spot Price of Futures Expiring Price of Futures Expiring Futures Lot Size Value (INR) on June 29 (INR) on September 28 (INR) S&P CNX Nifty 50 4,995 5,069 5,222 Bank Nifty 50 8,360 8,484 8,740 CNX IT 100 4,880 4,952 5,102 Reliance 700 2,060 2,090 2,153 Tata Power 200 1,350 1,370 1,411 Mahindra and 312 825 837 862 Mahindra Tata Motors 850 490 497 512 Bharti Airtel 500 440 446 460 ONGC 225 1,180 1,198 1,233 890 He has estimated the following information about his portfolios Table 5 Spot Values of Various Assets on June 29 in relation to the indexes, as shown in Table 4. and September 28 Table 4 Relation Between Portfolio Name of Spot Price Spot Price on Owned and Indexes on June 29 September 28 the Futures (INR) (INR) Correlation between the total portfolio with 0.60 CNX Nifty S&P CNX Nifty 5,120 5,180 Correlation between banking sector portfolio 0.96 Bank Nifty 8,438 8,940 owned and Bank Nifty CNX IT 4,937 5,300 Correlation between IT sector portfolio owned 0.98 and CNX IT Reliance 2,150 2,142 Beta of total portfolio with respect to CNX Nifty 1.25 Tata Power 1,340 1,425 Beta of banking sector portfolio with Bank Nifty 1.02 Mahindra and 820 Mahindra Beta of IT sector portfolio with CNX IT 0.97 Tata Motors 522 495 Risk-free rate 6% Bharti Airtel 470 420 ONGC 1,220 1,156 Mr Nath is looking at various hedging possibilities: Hedge the total portfolio only with the CNX Nifty futures Discussion Questions O Hedge only the banking-sector portfolio with the Bank Nifty futures 1. Explain how you would hedge, that is, the number of contracts Hedge only the IT-sector portfolio with the CNX IT futures you would use, and whether you would take a long or short O Hedge only the six securities that form the major investments position for each of these strategies. o Use all of the hedges above. 2. Calculate the value of the portfolio on June 29 and September 28. The actual values of the various spot values on June 29 and 3. What is the gain in the value of the hedge portfolio when com- September 28 are shown in Table 5. pared to the value if there was no hedge