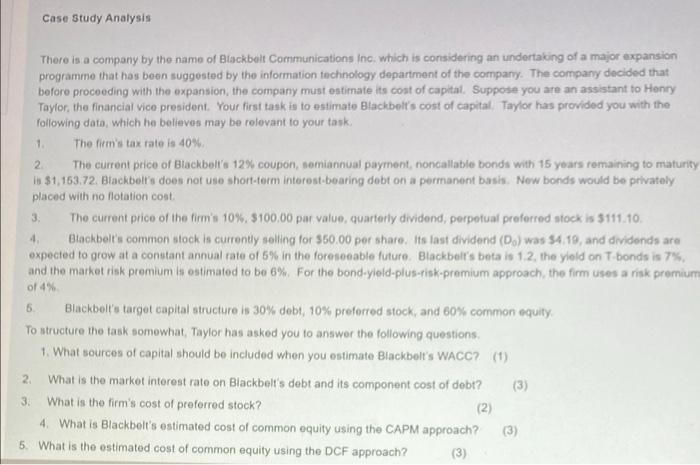

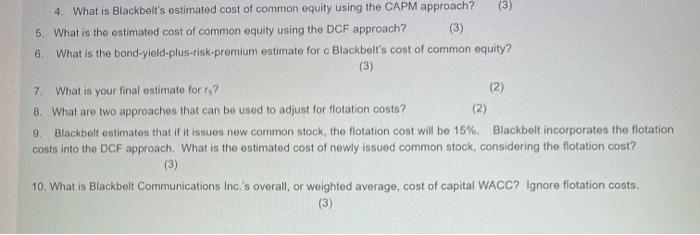

Case Study Analysis There is a company by the name of Blackbelt Communications Inc. which is considering an undertaking of a major expansion programme that has been suggested by the information technology department of the company. The company decided that before proceeding with the expansion, the company must estimate its cost of capital. Suppose you are an assistant to Henry Taylor, the financial vice president. Your first task is to estimate Blackbelt's cost of capital. Taylor has provided you with the following data, which he believes may be relevant to your task. 1. The firm's tax rate is 40%. 2. The current price of Blackbell's 12% coupon, semiannual payment, noncallable bonds with 15 years remaining to maturity is $1,153.72. Blackbelt's does not use short-term interest-bearing debt on a permanent basis. New bonds would be privately placed with no flotation cost. 3. The current price of the firm's 10%, $100.00 par value, quarterly dividend, perpetual preferred stock is $111.10. 4. Blackbelt's common stock is currently selling for $50.00 per share. Its last dividend (Do) was $4.19, and dividends are expected to grow at a constant annual rate of 5% in the foreseeable future. Blackbelt's beta is 1.2, the yield on T-bonds is 7%, and the market risk premium is estimated to be 6%. For the bond-yield-plus-risk-premium approach, the firm uses a risk premiuma of 4%. 6. Blackbelt's target capital structure is 30% debt, 10% preferred stock, and 60% common equity. To structure the task somewhat, Taylor has asked you to answer the following questions. 1. What sources of capital should be included when you estimate Blackbelt's WACC? (1) 2. What is the market interest rate on Blackbelt's debt and its component cost of debt? (3) 3. What is the firm's cost of preferred stock? (2) 4. What is Blackbelt's estimated cost of common equity using the CAPM approach? (3) 5. What is the estimated cost of common equity using the DCF approach? (3) 4. What is Blackbelt's estimated cost of common equity using the CAPM approach? (3) 5. What is the estimated cost of common equity using the DCF approach? (3) 6. What is the bond-yield-plus-risk-premium estimate for c Blackbelt's cost of common equity? (3) 7. What is your final estimate for rs? (2) (2) 8. What are two approaches that can be used to adjust for flotation costs? 9. Blackbelt estimates that if it issues new common stock, the flotation cost will be 15%. Blackbelt incorporates the flotation costs into the DCF approach. What is the estimated cost of newly issued common stock, considering the flotation cost? (3) 10. What is Blackbelt Communications Inc.'s overall, or weighted average, cost of capital WACC? Ignore flotation costs. (3)