Question

You are a Financial Investor representing one client and you have $500,000, which must be invested in a 1031 Exchange Type Property immediately. You

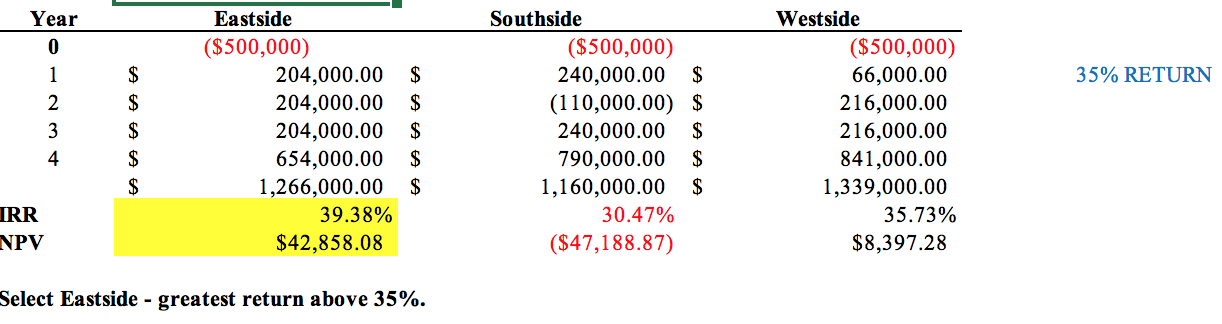

You are a Financial Investor representing one client and you have $500,000, which must be invested in a 1031 Exchange Type Property immediately. You have found three apartment complexes in Bend, which qualify. Your investors require a very high rate of return, 35%. They want their original investment back plus 35% at the end of 4 years. The decision to invest is a mutually exclusive decision; that is only one property can be selected. O All properties are revenue generating, each property have a positive cash flow All properties are renting at 100% occupancy All properties require additional maintenance and improvements, affecting cash flow. O The property must be sold at the end of the fourth year at the market value. We anticipate the real estate market will increase in value over the next four years; thus, the Eastside and Southside will appreciate by 10% over the next four years; and Westside will appreciate over the next four years by 25%. Eastside Apartments: 17 rental total units O 5 rent for $1,000 per month O 10 rent for $900 per month 2 rent for $1,500 per month $100,000 will be spent on improving the parking lot in year 4. Plus this Property is expected to appreciate by 10% over the entire four years. Southside Apartments: O 20 rental total units rent for $1,000 per month $350,000 will be spent on roofing, paving and landscaping in year 2. Plus this Property is expected to appreciate by 10% over the entire four years. Westside Apartments: 10 rental total units rent for $1,800 per month o $150,000 will be spent on landscaping and plumbing in the first year. Plus the Property is expected to appreciate by 25% over the entire four years. Using the NPV and IRR calculation, please rank the three possible investments, and determine which one we should invest $500,000. Year 0 Eastside Southside Westside ($500,000) ($500,000) ($500,000) 1 $ 204,000.00 $ 240,000.00 $ 2 $ 204,000.00 $ (110,000.00) $ 66,000.00 216,000.00 35% RETURN 3 $ 204,000.00 $ 240,000.00 $ 216,000.00 4 $ 654,000.00 $ 790,000.00 $ 841,000.00 $ 1,266,000.00 $ 1,160,000.00 $ 1,339,000.00 IRR 39.38% 30.47% 35.73% NPV $42,858.08 ($47,188.87) $8,397.28 Select Eastside - greatest return above 35%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started