Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case Study: Audit Procedures for Audit Documentation and Working Papers In a large auditing firm, a team of auditors is tasked with conducting an audit

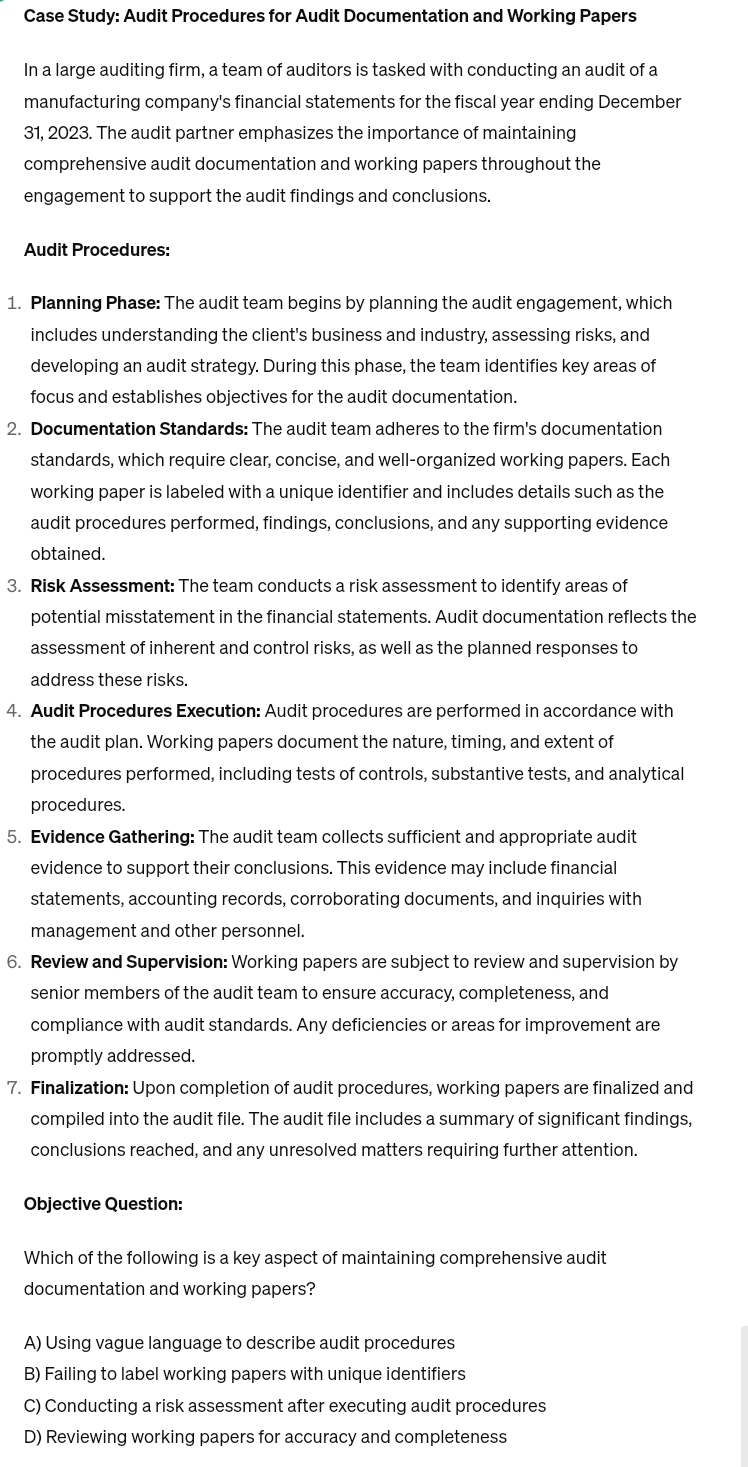

Case Study: Audit Procedures for Audit Documentation and Working Papers

In a large auditing firm, a team of auditors is tasked with conducting an audit of a manufacturing company's financial statements for the fiscal year ending December The audit partner emphasizes the importance of maintaining comprehensive audit documentation and working papers throughout the engagement to support the audit findings and conclusions.

Audit Procedures:

Planning Phase: The audit team begins by planning the audit engagement, which includes understanding the client's business and industry, assessing risks, and developing an audit strategy. During this phase, the team identifies key areas of focus and establishes objectives for the audit documentation.

Documentation Standards: The audit team adheres to the firm's documentation standards, which require clear, concise, and wellorganized working papers. Each working paper is labeled with a unique identifier and includes details such as the audit procedures performed, findings, conclusions, and any supporting evidence obtained.

Risk Assessment: The team conducts a risk assessment to identify areas of potential misstatement in the financial statements. Audit documentation reflects the assessment of inherent and control risks, as well as the planned responses to address these risks.

Audit Procedures Execution: Audit procedures are performed in accordance with the audit plan. Working papers document the nature, timing, and extent of procedures performed, including tests of controls, substantive tests, and analytical procedures.

Evidence Gathering: The audit team collects sufficient and appropriate audit evidence to support their conclusions. This evidence may include financial statements, accounting records, corroborating documents, and inquiries with management and other personnel.

Review and Supervision: Working papers are subject to review and supervision by senior members of the audit team to ensure accuracy, completeness, and compliance with audit standards. Any deficiencies or areas for improvement are promptly addressed.

Finalization: Upon completion of audit procedures, working papers are finalized and compiled into the audit file. The audit file includes a summary of significant findings, conclusions reached, and any unresolved matters requiring further attention.

Objective Question:

Which of the following is a key aspect of maintaining comprehensive audit documentation and working papers?

A Using vague language to describe audit procedures

B Failing to label working papers with unique identifiers

C Conducting a risk assessment after executing audit procedures

D Reviewing working papers for accuracy and completeness

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started