Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case Study B: Applying Accounting Practices for Assets Mustang Company reported the following financial information for its first year of operations. Below are the

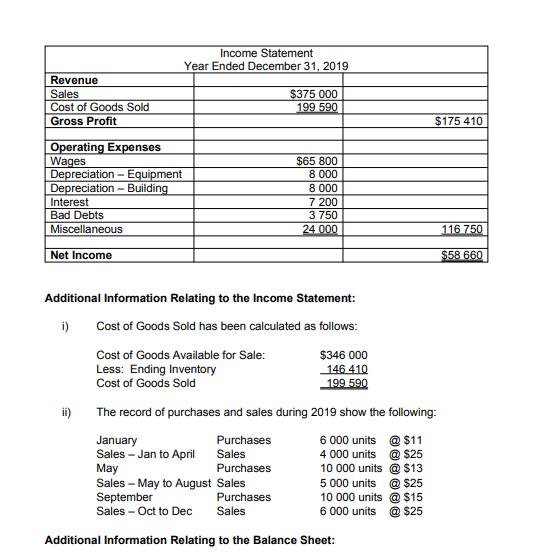

Case Study B: Applying Accounting Practices for Assets Mustang Company reported the following financial information for its first year of operations. Below are the financial statements for the year ended December 31, 2019: Mustang Company Balance Sheet As At December 31, 2019 Assets Current Assets Cash Accounts Receivable Less: Doubtful Accounts Inventory Prepaid Expenses $5 660 $52 000 3 750 48 250 146 410 3 200 Total Current Assets $203 520 Property, Plant & Equipment Land Building Less: Accumulated Amortization 200 000 $80 000 8 000 72 000 Equipment Less: Accumulated Amortization Total Property Plant and Equipment Total Assets 40 000 8 000 32 000 304 000 $507 520 Liabilities & Owner's Equity Current Liabilities Accounts Payable Wages Payable Mortgage Payable - Current Portion Total Current Liabilities $77 000 2 350 20. 000 $99 350 Long Term Liabilities Mortgage Payable Total Liabilities 220 000 319 350 Owner's Equity J. Mustang, Capital Total Liabilities & Owner's Equity 188 170 $507 520 Income Statement Year Ended December 31, 2019 Revenue Sales $375 000 199 590 Cost of Goods Sold Gross Profit $175 410 Operating Expenses Wages Depreciation-Equipment Depreciation - Building Interest Bad Debts Miscellaneous $65 800 8 000 8 000 7 200 3 750 24 000 116 750 Net Income $58 660 Additional Information Relating to the Income Statement: i) Cost of Goods Sold has been calculated as follows: Cost of Goods Available for Sale: Less: Ending Inventory Cost of Goods Sold $346 000 146 410 199 590 ii) The record of purchases and sales during 2019 show the following: 6 000 units January Sales - Jan to April May Sales - May to August Sales September Sales - Oct to Dec Purchases Sales @ $11 @ $25 10 000 units @ $13 5 000 units @ $25 10 000 units @ $15 6 000 units 4 000 units Purchases Purchases Sales @ $25 Additional Information Relating to the Balance Sheet: The estimated useful life of the equipment is 10 years or 20,000 hours of usage with a residual value of $5,000. The company used the equipment for 4,571 hours during the first year. The estimated useful life of the building is 10 years with a salvage value of i) ii) $12,000. ii) The accounts receivable aging schedule is as follows: Number of Days Outstanding 0-30 days 31-60 days 61-90 days Over 90 days Estimated % Amount Uncollectible 1% 5% $30,000 12,000 8,000 2,000 10% 30% J. Mustang has consulted you because of his dissatisfaction with the financial results for the year. Mr. Mustang is hoping you can recast the financial statements to show the business in a better in a better financial position. Required: 1. Determine the accounting policies used in the preparation of the financial statements with regard to Cost of Goods Sold and Depreciation Expense. Show all calculations. 2. Provide an alternative value for Cost of Goods Sold and Depreciation Expense. Explain how you arrived at these values. Show all calculations. 3. The bad debt expense reported on the Income Statement was calculated by using the percentage of sales approach. Using the aging schedule provided above, determine an alternate amount for bad debt expense. Nordstar Inc. operates hardware stores in several provinces. Selected comparative financial statement data are shown below. Nordstar Inc. Balance Sheet (partial) December 31 (in millions) 2019 2018 2017 Current Assets Cash $30 91 60 Short-term investments 55 60 40 Accounts receivable 676 586 496 Inventory Prepaid expenses Total current assets 628 525 575 41 52 $1,430 $890 $1,314 $825 29 $1,200 $750 Total current liabilities Additional information (in millions): 2019 Net Credit Sales Cost of Goods Sold Net Income 2018 $3,940 2,650 $4,190 2,900 290 310 Required: a) Calculate all possible liquidity ratios for 2019 and 2018. Determine whether the liquidity of Nordstar Inc. improved or deteriorated from 2018 to 2019. b) Given the information above, determine the net cash flows from operating activities for 2018 and 2019. c) As a potential creditor to Nordstar Inc., outline any concerms you may have with respect to selling on credit to Nordstar. Level 1 0-5 marks Level 2 Level 3 Level 4 11-15 marks 16-20 marks CATEGORY Application - 6-10 marks TAL Applies concepts to case facts in order to solve the issues Applies concepts with limited Applies concepts with some Applies concepts with a considerable amount of Applies concepts with a high degree of effectiveness /20 effectiveness effectiveness effectiveness

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Tax 2019 15 million 2018 issue 36 million equity shares and 10 million 8 c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

6257e35742e7d_96222.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started