Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case Study Background Ship'emIn&Out Pty Ltd (ABN 12 345 678 901) operates as a company and you are the accountant for them. Ship'emIn&Out Pty Ltd

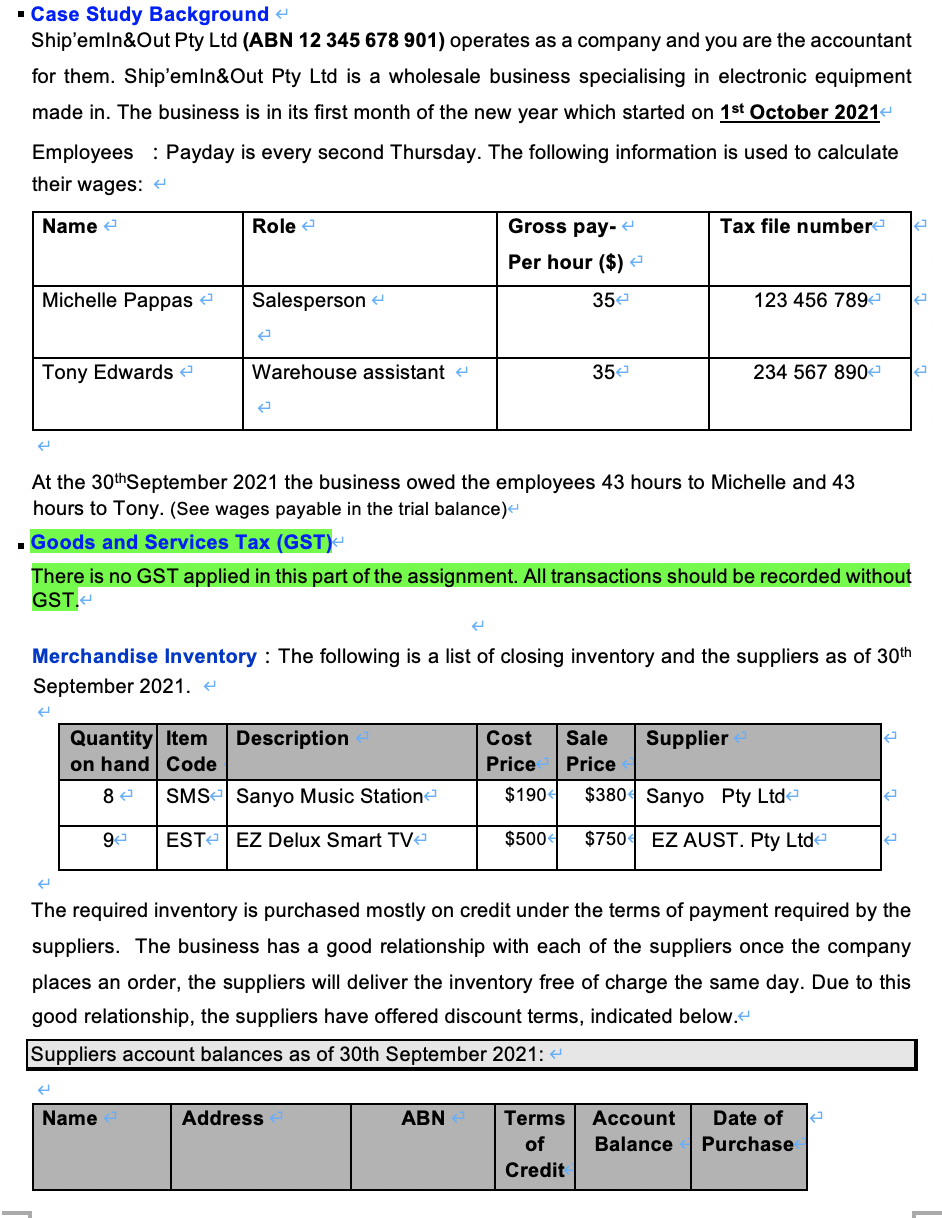

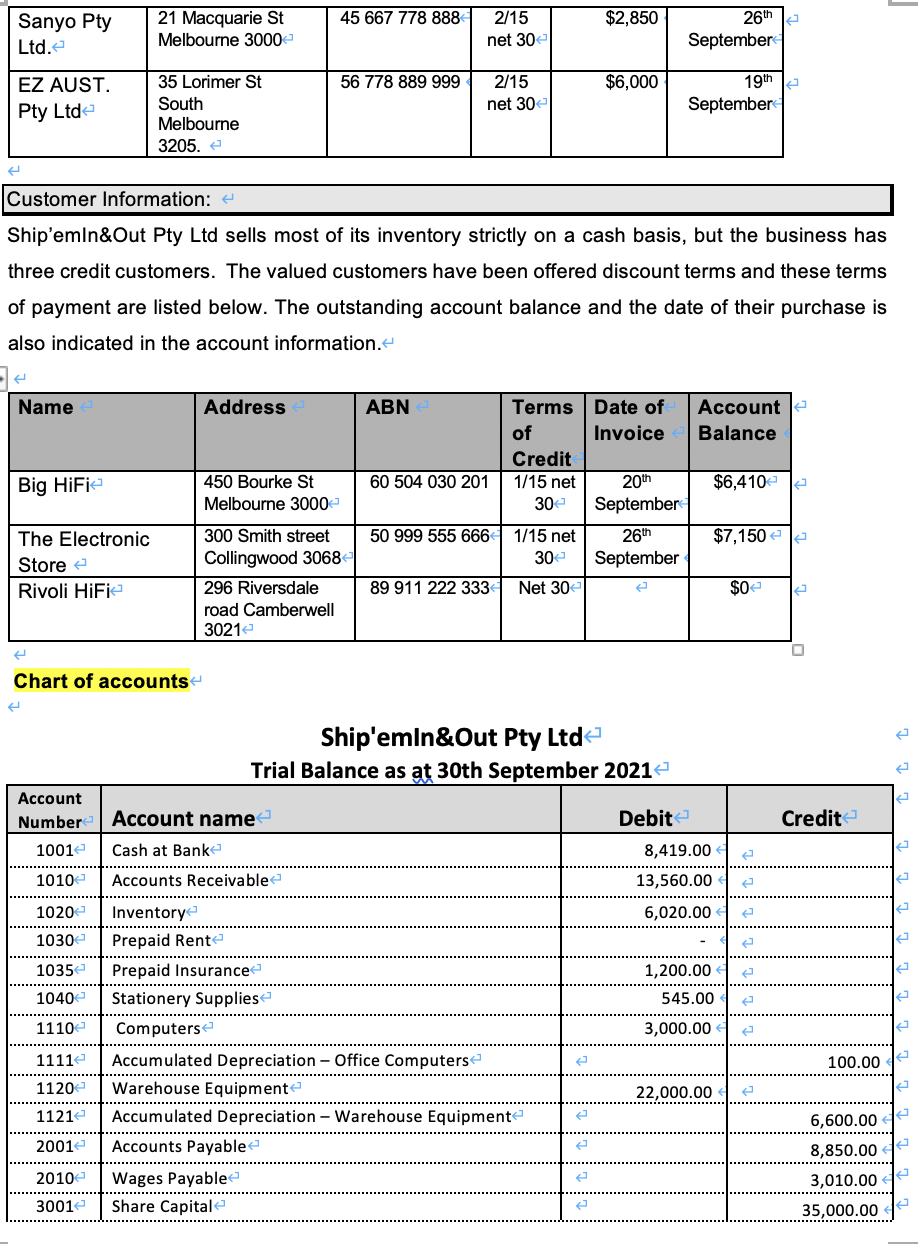

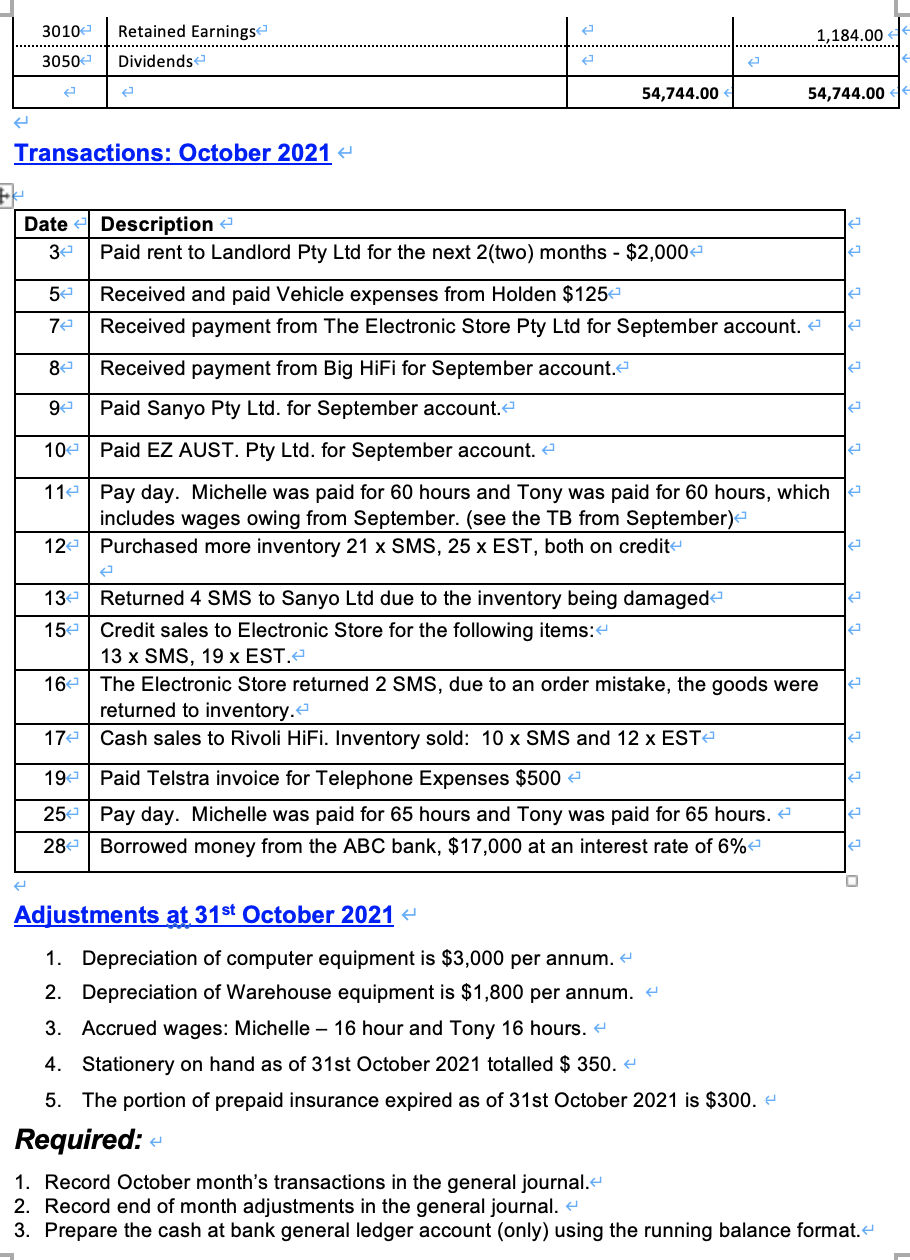

Case Study Background Ship'emIn&Out Pty Ltd (ABN 12 345 678 901) operates as a company and you are the accountant for them. Ship'emIn&Out Pty Ltd is a wholesale business specialising in electronic equipment made in. The business is in its first month of the new year which started on 1st October 2021 Employees : Payday is every second Thursday. The following information is used to calculate their wages: Name Role e Gross pay- Tax file number Per hour ($) Michelle Pappas Salesperson 352 123 456 789 Tony Edwards Warehouse assistant 352 234 567 890 At the 30th September 2021 the business owed the employees 43 hours to Michelle and 43 hours to Tony. (See wages payable in the trial balance) . Goods and Services Tax (GST) There is no GST applied in this part of the assignment. All transactions should be recorded without GST. Merchandise Inventory : The following is a list of closing inventory and the suppliers as of 30th September 2021.4 Cost Price Quantity Item Description on hand Code SMS Sanyo Music Station Sale Price Supplier 8 $190 $380 Sanyo Pty Ltd 9 ESTEZ Delux Smart TV $500 $750 EZ AUST. Pty Ltd The required inventory is purchased mostly on credit under the terms of payment required by the suppliers. The business has a good relationship with each of the suppliers once the company places an order, the suppliers will deliver the inventory free of charge the same day. Due to this good relationship, the suppliers have offered discount terms, indicated below.- Suppliers account balances as of 30th September 2021:4 Name Address ABN Terms of Credit Account Balance Date of Purchase 45 667 778 888 $2,850 Sanyo Pty Ltd. 21 Macquarie St Melbourne 3000 2/15 net 30 26th September EZ AUST. 56 778 889 999 $6,000 19thle 35 Lorimer St South Melbourne 3205. 2/15 net 30 Pty Ltd September Customer Information: 4 Ship'emIn&Out Pty Ltd sells most of its inventory strictly on a cash basis, but the business has three credit customers. The valued customers have been offered discount terms and these terms of payment are listed below. The outstanding account balance and the date of their purchase is also indicated in the account information. Name Address ABN Account Balance Big HiFi 60 504 030 201 $6,410 450 Bourke St Melbourne 3000 Terms Date of of Invoice Credit 1/15 net 20th 30 September 1/15 net 26th 30 September Net 30 50 999 555 666 $7,150 e The Electronic Store e Rivoli HiFi 300 Smith street Collingwood 3068 296 Riversdale road Camberwell 30212 89 911 222 333 $o Chart of accounts Credit ttt Ship'emIn&Out Pty Ltd Trial Balance as at 30th September 2021 Account Number Account name Debit 10012 Cash at Banke 8,419.00 10102 Accounts Receivable 13,560.00 1020 Inventory 6,020.00 1030 Prepaid Rent 10352 Prepaid Insurance 1,200.00 1040 Stationery Supplies 545.00 1110 Computers 3,000.00 1111e Accumulated Depreciation - Office Computers 1120 Warehouse Equipment 22,000.00 1121 Accumulated Depreciation - Warehouse Equipment 2001e Accounts Payable 2010 Wages Payable 3001 Share Capitale 100.00 6,600.00 8,850.00 3,010.00 35,000.00 30102 1,184.00 Retained Earnings Dividendse 3050 54,744.00 54,744.00 Transactions: October 20214 Date 32 Description Paid rent to Landlord Pty Ltd for the next 2(two) months - $2,000 5 7 Received and paid Vehicle expenses from Holden $125 Received payment from The Electronic Store Pty Ltd for September account. Received payment from Big HiFi for September account. 8 9 Paid Sanyo Pty Ltd. for September account. 102 Paid EZ AUST. Pty Ltd. for September account. e 11 Pay day. Michelle was paid for 60 hours and Tony was paid for 60 hours, which includes wages owing from September. (see the TB from September) 12 Purchased more inventory 21 x SMS, 25 x EST, both on credit 132 152 16 Returned 4 SMS to Sanyo Ltd due to the inventory being damaged Credit sales to Electronic Store for the following items: 13 x SMS, 19 x EST. The Electronic Store returned 2 SMS, due to an order mistake, the goods were returned to inventory. Cash sales to Rivoli HiFi. Inventory sold: 10 x SMS and 12 x EST Paid Telstra invoice for Telephone Expenses $500 Pay day. Michelle was paid for 65 hours and Tony was paid for 65 hours. Borrowed money from the ABC bank, $17,000 at an interest rate of 6% 17e 19 252 282 Adjustments at 31st October 20214 1. Depreciation of computer equipment is $3,000 per annum. 2. Depreciation of Warehouse equipment is $1,800 per annum. 4 3. Accrued wages: Michelle - 16 hour and Tony 16 hours. 4. Stationery on hand as of 31st October 2021 totalled $ 350.4 5. The portion of prepaid insurance expired as of 31st October 2021 is $300. Required: - 1. Record October month's transactions in the general journal. 2. Record end of month adjustments in the general journal. 3. Prepare the cash at bank general ledger account (only) using the running balance format. Case Study Background Ship'emIn&Out Pty Ltd (ABN 12 345 678 901) operates as a company and you are the accountant for them. Ship'emIn&Out Pty Ltd is a wholesale business specialising in electronic equipment made in. The business is in its first month of the new year which started on 1st October 2021 Employees : Payday is every second Thursday. The following information is used to calculate their wages: Name Role e Gross pay- Tax file number Per hour ($) Michelle Pappas Salesperson 352 123 456 789 Tony Edwards Warehouse assistant 352 234 567 890 At the 30th September 2021 the business owed the employees 43 hours to Michelle and 43 hours to Tony. (See wages payable in the trial balance) . Goods and Services Tax (GST) There is no GST applied in this part of the assignment. All transactions should be recorded without GST. Merchandise Inventory : The following is a list of closing inventory and the suppliers as of 30th September 2021.4 Cost Price Quantity Item Description on hand Code SMS Sanyo Music Station Sale Price Supplier 8 $190 $380 Sanyo Pty Ltd 9 ESTEZ Delux Smart TV $500 $750 EZ AUST. Pty Ltd The required inventory is purchased mostly on credit under the terms of payment required by the suppliers. The business has a good relationship with each of the suppliers once the company places an order, the suppliers will deliver the inventory free of charge the same day. Due to this good relationship, the suppliers have offered discount terms, indicated below.- Suppliers account balances as of 30th September 2021:4 Name Address ABN Terms of Credit Account Balance Date of Purchase 45 667 778 888 $2,850 Sanyo Pty Ltd. 21 Macquarie St Melbourne 3000 2/15 net 30 26th September EZ AUST. 56 778 889 999 $6,000 19thle 35 Lorimer St South Melbourne 3205. 2/15 net 30 Pty Ltd September Customer Information: 4 Ship'emIn&Out Pty Ltd sells most of its inventory strictly on a cash basis, but the business has three credit customers. The valued customers have been offered discount terms and these terms of payment are listed below. The outstanding account balance and the date of their purchase is also indicated in the account information. Name Address ABN Account Balance Big HiFi 60 504 030 201 $6,410 450 Bourke St Melbourne 3000 Terms Date of of Invoice Credit 1/15 net 20th 30 September 1/15 net 26th 30 September Net 30 50 999 555 666 $7,150 e The Electronic Store e Rivoli HiFi 300 Smith street Collingwood 3068 296 Riversdale road Camberwell 30212 89 911 222 333 $o Chart of accounts Credit ttt Ship'emIn&Out Pty Ltd Trial Balance as at 30th September 2021 Account Number Account name Debit 10012 Cash at Banke 8,419.00 10102 Accounts Receivable 13,560.00 1020 Inventory 6,020.00 1030 Prepaid Rent 10352 Prepaid Insurance 1,200.00 1040 Stationery Supplies 545.00 1110 Computers 3,000.00 1111e Accumulated Depreciation - Office Computers 1120 Warehouse Equipment 22,000.00 1121 Accumulated Depreciation - Warehouse Equipment 2001e Accounts Payable 2010 Wages Payable 3001 Share Capitale 100.00 6,600.00 8,850.00 3,010.00 35,000.00 30102 1,184.00 Retained Earnings Dividendse 3050 54,744.00 54,744.00 Transactions: October 20214 Date 32 Description Paid rent to Landlord Pty Ltd for the next 2(two) months - $2,000 5 7 Received and paid Vehicle expenses from Holden $125 Received payment from The Electronic Store Pty Ltd for September account. Received payment from Big HiFi for September account. 8 9 Paid Sanyo Pty Ltd. for September account. 102 Paid EZ AUST. Pty Ltd. for September account. e 11 Pay day. Michelle was paid for 60 hours and Tony was paid for 60 hours, which includes wages owing from September. (see the TB from September) 12 Purchased more inventory 21 x SMS, 25 x EST, both on credit 132 152 16 Returned 4 SMS to Sanyo Ltd due to the inventory being damaged Credit sales to Electronic Store for the following items: 13 x SMS, 19 x EST. The Electronic Store returned 2 SMS, due to an order mistake, the goods were returned to inventory. Cash sales to Rivoli HiFi. Inventory sold: 10 x SMS and 12 x EST Paid Telstra invoice for Telephone Expenses $500 Pay day. Michelle was paid for 65 hours and Tony was paid for 65 hours. Borrowed money from the ABC bank, $17,000 at an interest rate of 6% 17e 19 252 282 Adjustments at 31st October 20214 1. Depreciation of computer equipment is $3,000 per annum. 2. Depreciation of Warehouse equipment is $1,800 per annum. 4 3. Accrued wages: Michelle - 16 hour and Tony 16 hours. 4. Stationery on hand as of 31st October 2021 totalled $ 350.4 5. The portion of prepaid insurance expired as of 31st October 2021 is $300. Required: - 1. Record October month's transactions in the general journal. 2. Record end of month adjustments in the general journal. 3. Prepare the cash at bank general ledger account (only) using the running balance format

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started