Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are a senior staff member in the finance department of BCom Investments Ltd (BCom). In your role, you are charged with reviewing, performing

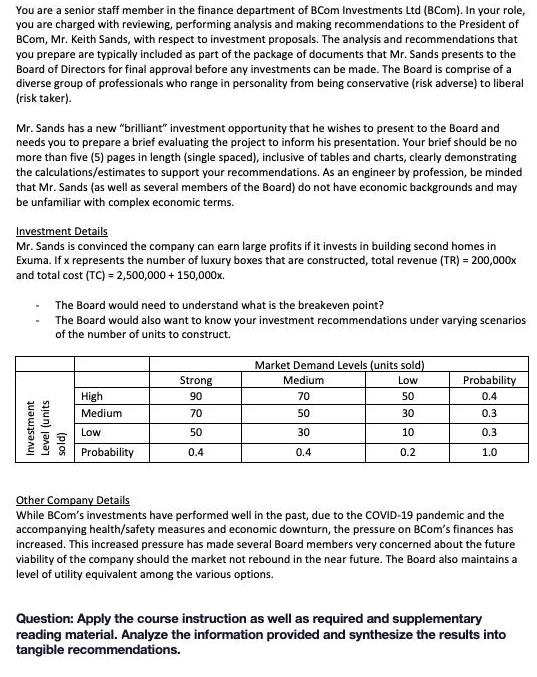

You are a senior staff member in the finance department of BCom Investments Ltd (BCom). In your role, you are charged with reviewing, performing analysis and making recommendations to the President of BCom, Mr. Keith Sands, with respect to investment proposals. The analysis and recommendations that you prepare are typically included as part of the package of documents that Mr. Sands presents to the Board of Directors for final approval before any investments can be made. The Board is comprise of a diverse group of professionals who range in personality from being conservative (risk adverse) to liberal (risk taker). Mr. Sands has a new "brilliant" investment opportunity that he wishes to present to the Board and needs you to prepare a brief evaluating the project to inform his presentation. Your brief should be no more than five (5) pages in length (single spaced), inclusive of tables and charts, clearly demonstrating the calculations/estimates to support your recommendations. As an engineer by profession, be minded that Mr. Sands (as well as several members of the Board) do not have economic backgrounds and may be unfamiliar with complex economic terms. Investment Details Mr. Sands is convinced the company can earn large profits if it invests in building second homes in Exuma. If x represents the number of luxury boxes that are constructed, total revenue (TR) = 200,000x and total cost (TC) = 2,500,000 + 150,000x. The Board would need to understand what is the breakeven point? The Board would also want to know your investment recommendations under varying scenarios of the number of units to construct. Market Demand Levels (units sold) Strong Medium Low Probability High 90 70 50 0.4 Medium 70 50 30 0.3 Low 50 30 10 0.3 Probability 0.4 0.4 0.2 1.0 Other Company Details While BCom's investments have performed well in the past, due to the COVID-19 pandemic and the accompanying health/safety measures and economic downturn, the pressure on BCom's finances has increased. This increased pressure has made several Board members very concerned about the future viability of the company should the market not rebound in the near future. The Board also maintains a level of utility equivalent among the various options. Question: Apply the course instruction as well as required and supplementary reading material. Analyze the information provided and synthesize the results into tangible recommendations. Investment Level (units (pjos

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Total revenue TR 200000x Total Costs TC Total Fixed Cost Total Variable Cost 2500000 150000x To fi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started