Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CASE STUDY: Business management. COMPARING THE ACCOUNTS OF THE COLA GIANTS How can stakeholders in PepsiCo and Coca-Cola, the world's two best-known soft drink businesses,

CASE STUDY: Business management.

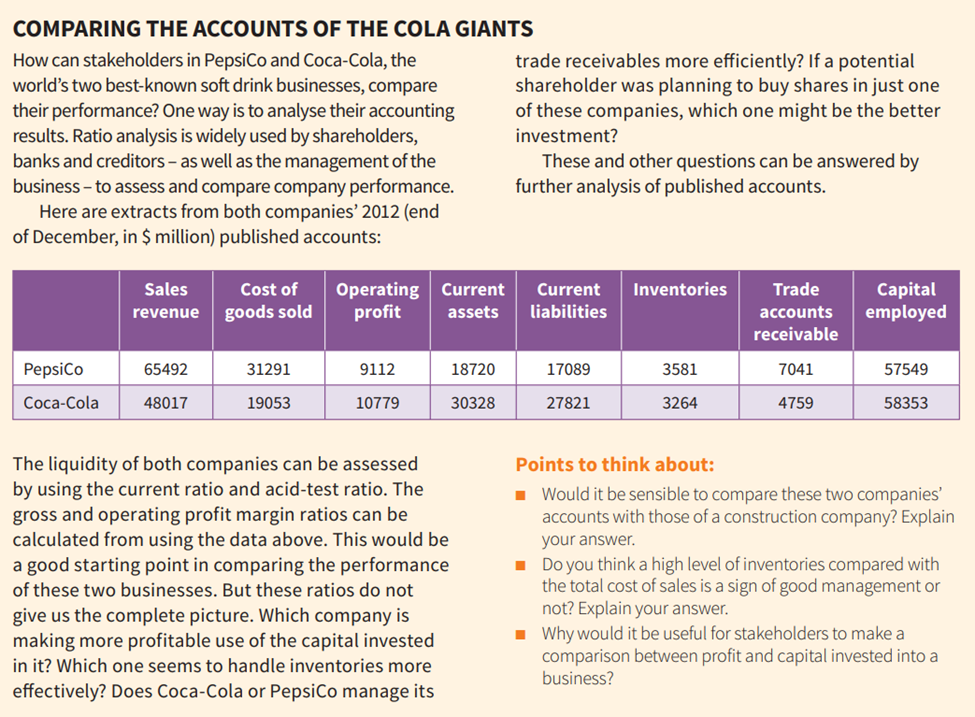

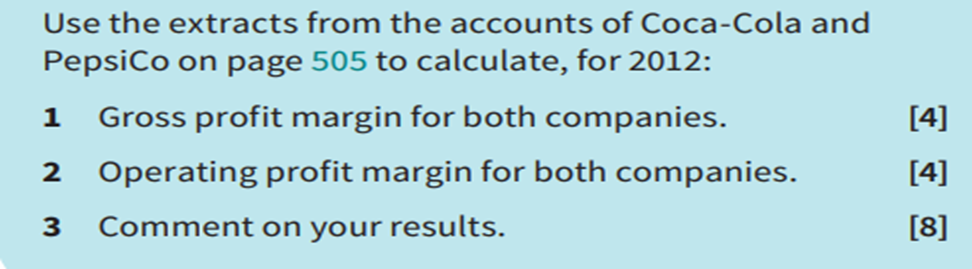

COMPARING THE ACCOUNTS OF THE COLA GIANTS How can stakeholders in PepsiCo and Coca-Cola, the world's two best-known soft drink businesses, compare their performance? One way is to analyse their accounting results. Ratio analysis is widely used by shareholders, banks and creditors - as well as the management of the business - to assess and compare company performance. Here are extracts from both companies' 2012 (end of December, in \$ million) published accounts: The liquidity of both companies can be assessed by using the current ratio and acid-test ratio. The gross and operating profit margin ratios can be calculated from using the data above. This would be a good starting point in comparing the performance of these two businesses. But these ratios do not give us the complete picture. Which company is making more profitable use of the capital invested in it? Which one seems to handle inventories more effectively? Does Coca-Cola or PepsiCo manage its trade receivables more efficiently? If a potential shareholder was planning to buy shares in just one of these companies, which one might be the better investment? These and other questions can be answered by further analysis of published accounts. Points to think about: - Would it be sensible to compare these two companies' accounts with those of a construction company? Explain your answer. - Do you think a high level of inventories compared with the total cost of sales is a sign of good management or not? Explain your answer. - Why would it be useful for stakeholders to make a comparison between profit and capital invested into a business? Use the extracts from the accounts of Coca-Cola and PepsiCo on page 505 to calculate, for 2012: 1 Gross profit margin for both companies. [4] 2 Operating profit margin for both companies. [4] 3 Comment on your results. [8]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started