Answered step by step

Verified Expert Solution

Question

1 Approved Answer

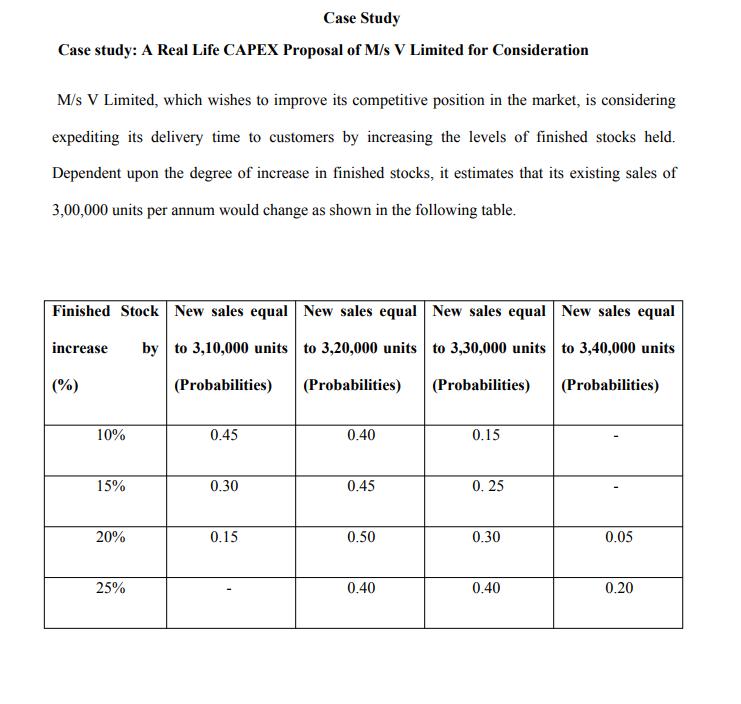

Case Study Case study: A Real Life CAPEX Proposal of M/s V Limited for Consideration M/s V Limited, which wishes to improve its competitive

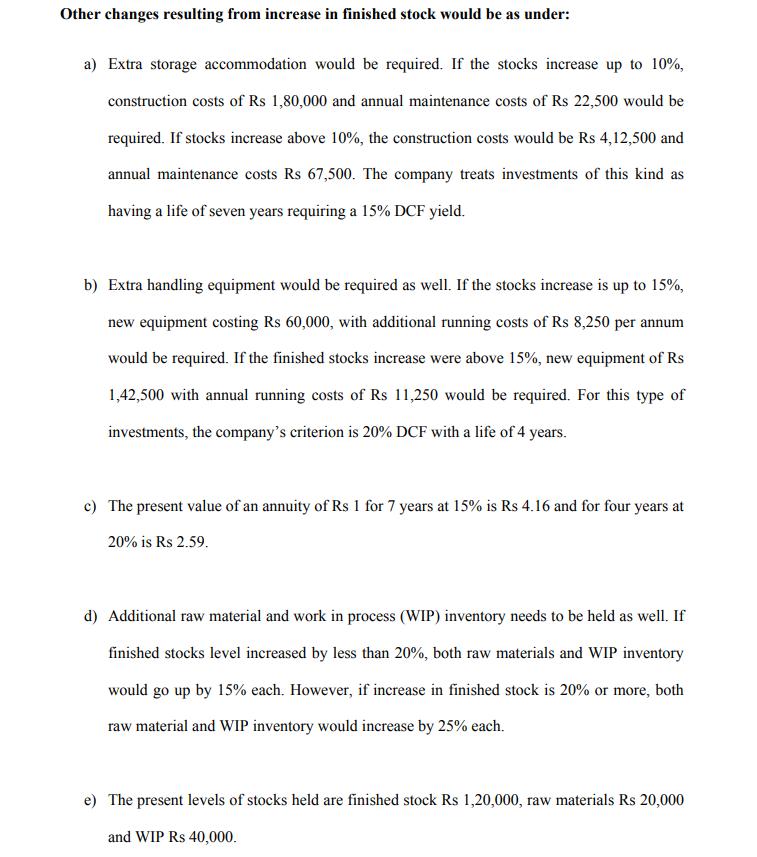

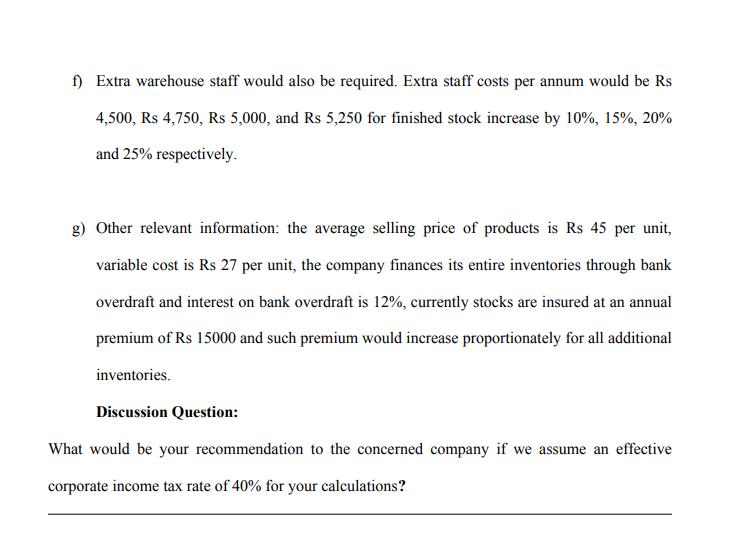

Case Study Case study: A Real Life CAPEX Proposal of M/s V Limited for Consideration M/s V Limited, which wishes to improve its competitive position in the market, is considering expediting its delivery time to customers by increasing the levels of finished stocks held. Dependent upon the degree of increase in finished stocks, it estimates that its existing sales of 3,00,000 units per annum would change as shown in the following table. Finished Stock New sales equal New sales equal New sales equal New sales equal increase by to 3,10,000 units to 3,20,000 units to 3,30,000 units to 3,40,000 units (%) (Probabilities) (Probabilities) (Probabilities) (Probabilities) 10% 0.45 0.40 0.15 15% 0.30 0.45 0. 25 20% 0.15 0.50 0.30 0.05 25% 0.40 0.40 0.20 Other changes resulting from increase in finished stock would be as under: a) Extra storage accommodation would be required. If the stocks increase up to 10%, construction costs of Rs 1,80,000 and annual maintenance costs of Rs 22,500 would be required. If stocks increase above 10%, the construction costs would be Rs 4,12,500 and annual maintenance costs Rs 67,500. The company treats investments of this kind as having a life of seven years requiring a 15% DCF yield. b) Extra handling equipment would be required as well. If the stocks increase is up to 15%, new equipment costing Rs 60,000, with additional running costs of Rs 8,250 per annum would be required. If the finished stocks increase were above 15%, new equipment of Rs 1,42,500 with annual running costs of Rs 11,250 would be required. For this type of investments, the company's criterion is 20% DCF with a life of 4 years. c) The present value of an annuity of Rs 1 for 7 years at 15% is Rs 4.16 and for four years at 20% is Rs 2.59. d) Additional raw material and work in process (WIP) inventory needs to be held as well. If finished stocks level increased by less than 20%, both raw materials and WIP inventory would go up by 15% each. However, if increase in finished stock is 20% or more, both raw material and WIP inventory would increase by 25% each. e) The present levels of stocks held are finished stock Rs 1,20,000, raw materials Rs 20,000 and WIP Rs 40,000. f) Extra warehouse staff would also be required. Extra staff costs per annum would be Rs 4,500, Rs 4,750, Rs 5,000, and Rs 5,250 for finished stock increase by 10%, 15%, 20% and 25% respectively. g) Other relevant information: the average selling price of products is Rs 45 per unit, variable cost is Rs 27 per unit, the company finances its entire inventories through bank overdraft and interest on bank overdraft is 12%, currently stocks are insured at an annual premium of Rs 15000 and such premium would increase proportionately for all additional inventories. Discussion Question: What would be your recommendation to the concerned company if we assume an effective corporate income tax rate of 40% for your calculations?

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started