Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case Study: Complete all tasks according to organisational policies and procedures provided in Appendix 1 (at the end of this document). Accounting industry standards

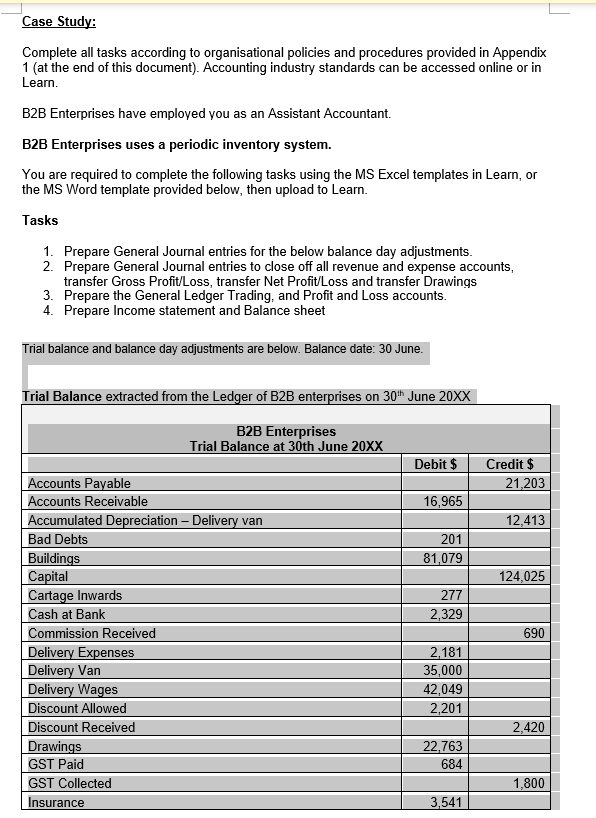

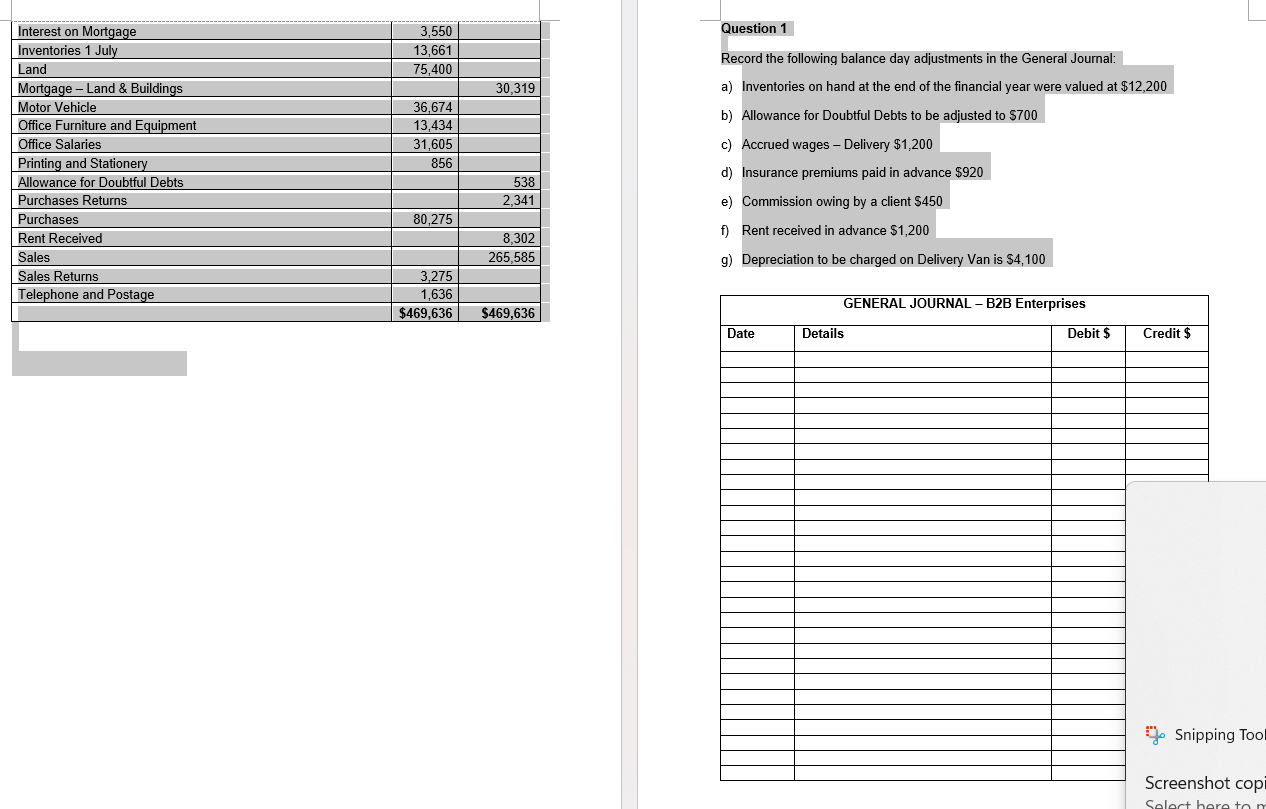

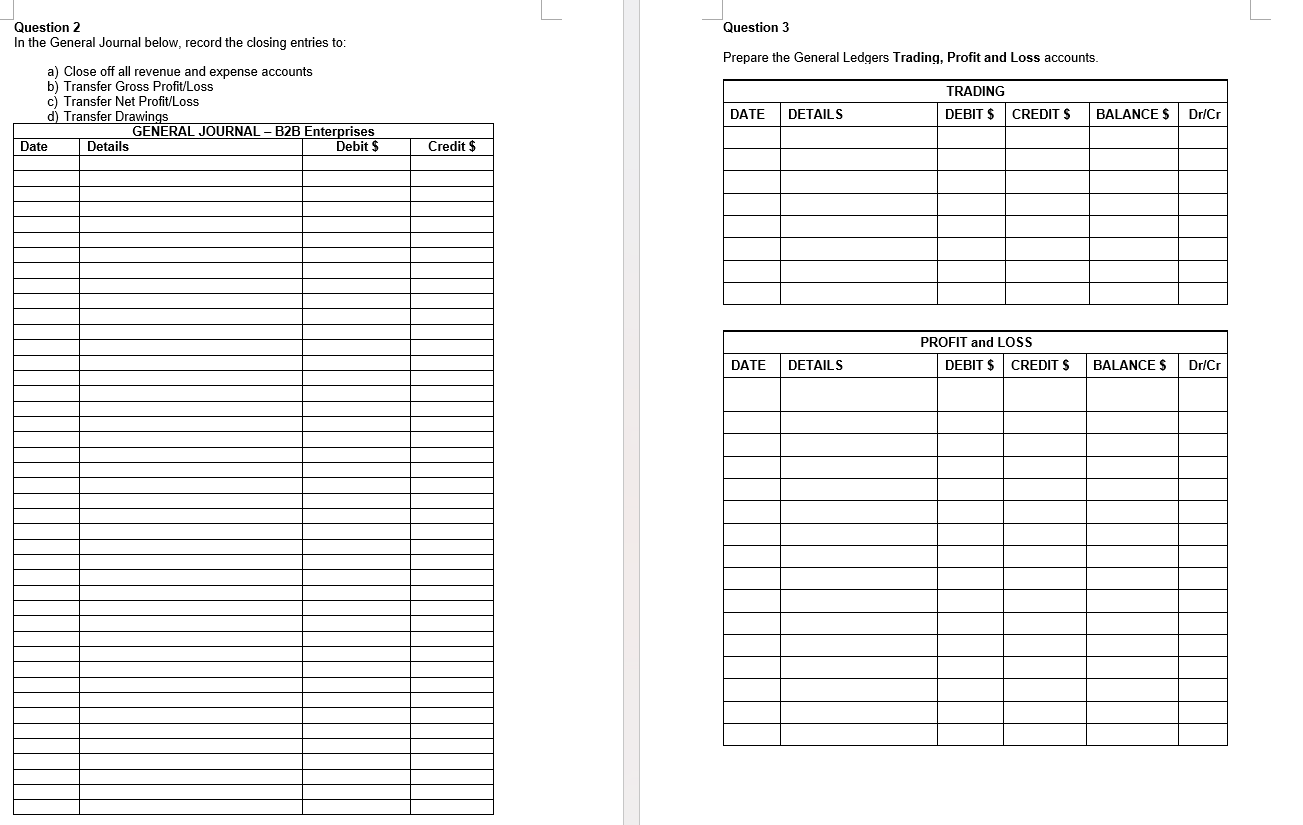

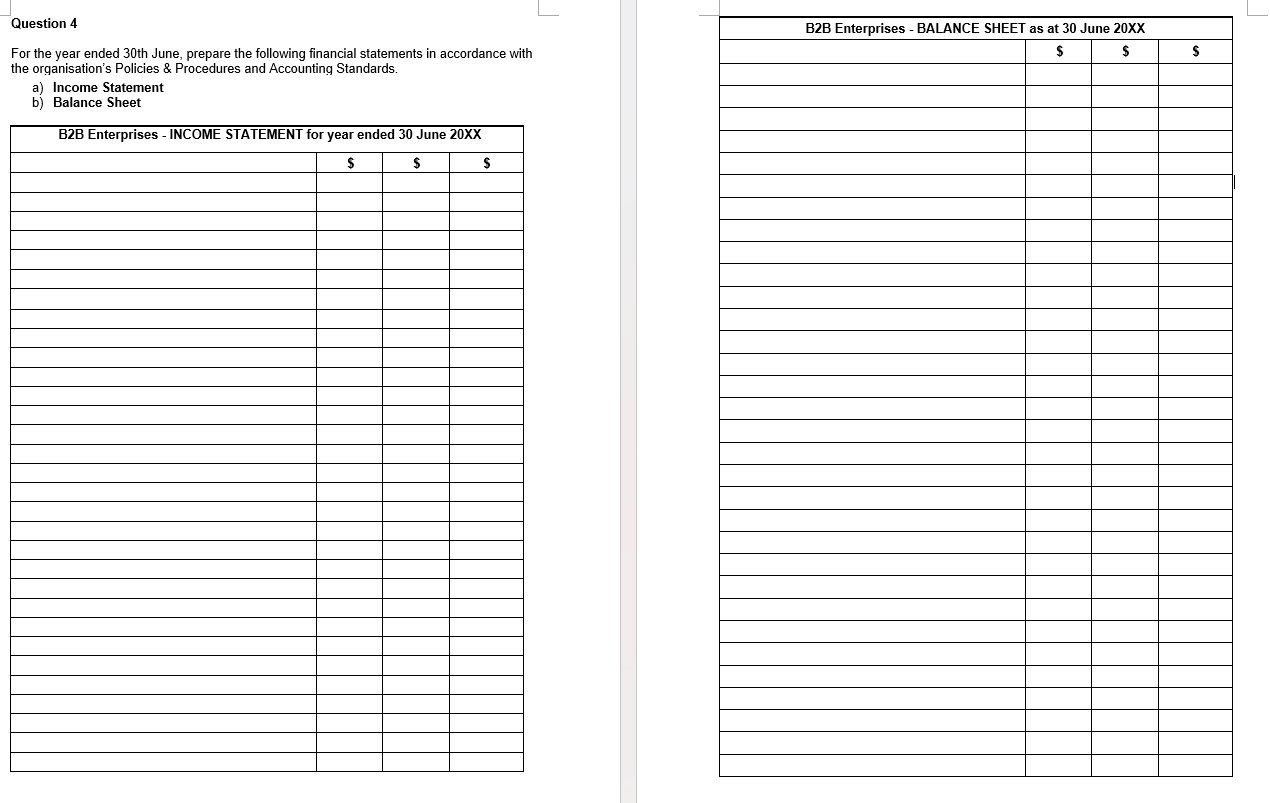

Case Study: Complete all tasks according to organisational policies and procedures provided in Appendix 1 (at the end of this document). Accounting industry standards can be accessed online or in Learn. B2B Enterprises have employed you as an Assistant Accountant. B2B Enterprises uses a periodic inventory system. You are required to complete the following tasks using the MS Excel templates in Learn, or the MS Word template provided below, then upload to Learn. Tasks 1. Prepare General Journal entries for the below balance day adjustments. 2. Prepare General Journal entries to close off all revenue and expense accounts, transfer Gross Profit/Loss, transfer Net Profit/Loss and transfer Drawings 3. Prepare the General Ledger Trading, and Profit and Loss accounts. 4. Prepare Income statement and Balance sheet Trial balance and balance day adjustments are below. Balance date: 30 June. Trial Balance extracted from the Ledger of B2B enterprises on 30th June 20XX B2B Enterprises Trial Balance at 30th June 20XX Debit $ Credit $ Accounts Payable Accounts Receivable Accumulated Depreciation - Delivery van 21,203 16,965 12,413 Bad Debts Buildings Capital Cartage Inwards Cash at Bank Commission Received Delivery Expenses Delivery Van 201 81,079 124,025 277 2,329 690 2,181 35,000 Delivery Wages 42,049 Discount Allowed 2,201 Discount Received 2,420 Drawings 22,763 GST Paid 684 GST Collected 1,800 Insurance 3,541 Interest on Mortgage 3,550 Inventories 1 July 13,661 Land 75,400 Mortgage - Land & Buildings 30,319 Motor Vehicle 36,674 Office Furniture and Equipment 13,434 Office Salaries 31,605 Printing and Stationery 856 Allowance for Doubtful Debts 538 Purchases Returns 2,341 Question 1 Record the following balance day adjustments in the General Journal: a) Inventories on hand at the end of the financial year were valued at $12,200 b) Allowance for Doubtful Debts to be adjusted to $700 c) Accrued wages - Delivery $1,200 d) Insurance premiums paid in advance $920 e) Commission owing by a client $450 Purchases 80,275 f) Rent received in advance $1,200 Rent Received Sales 8,302 265,585 Sales Returns 3,275 Telephone and Postage 1,636 g) Depreciation to be charged on Delivery Van is $4,100 GENERAL JOURNAL - B2B Enterprises $469,636 $469,636 Date Details Debit $ Credit $ Snipping Tool Screenshot copi Select here to m Question 3 Prepare the General Ledgers Trading, Profit and Loss accounts. DATE DETAILS Debit $ Credit $ Question 2 In the General Journal below, record the closing entries to: a) Close off all revenue and expense accounts b) Transfer Gross Profit/Loss c) Transfer Net Profit/Loss d) Transfer Drawings GENERAL JOURNAL - B2B Enterprises Date Details TRADING DEBIT $ CREDIT $ BALANCE $ Dr/Cr PROFIT and LOSS DATE DETAILS DEBIT $ CREDIT $ BALANCE $ Dr/Cr Question 4 For the year ended 30th June, prepare the following financial statements in accordance with the organisation's Policies & Procedures and Accounting Standards. a) Income Statement b) Balance Sheet B2B Enterprises - INCOME STATEMENT for year ended 30 June 20XX $ $ $ B2B Enterprises - BALANCE SHEET as at 30 June 20XX $ $ $

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Task 1 General Journal Entries for Balance Day Adjustments GENERAL JOURNAL B2B Enterprises Date Details Debit Credit 300620XX Inventory 12200 To record closing inventory 300620XX Allowance for Doubtfu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started