Answered step by step

Verified Expert Solution

Question

1 Approved Answer

case study form Q3 to Q6 please case forensic4 Q ISSUES IN ACCOUNTING EDUCATION Vol. 29. No. 1 2014 pp. 271-25 American Accounting Asciation DOI:

case study

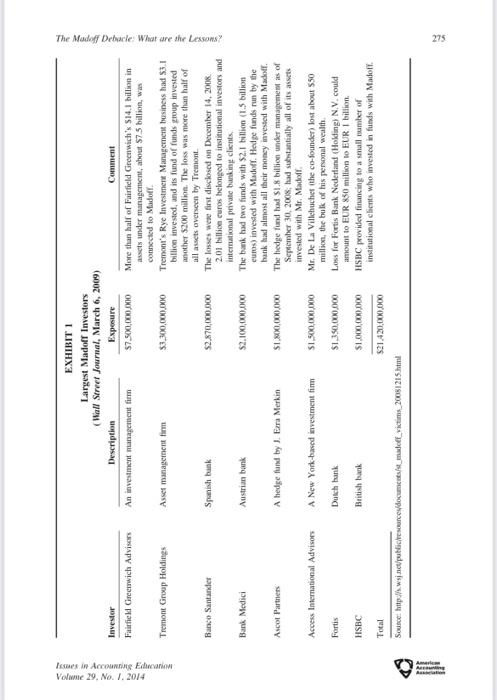

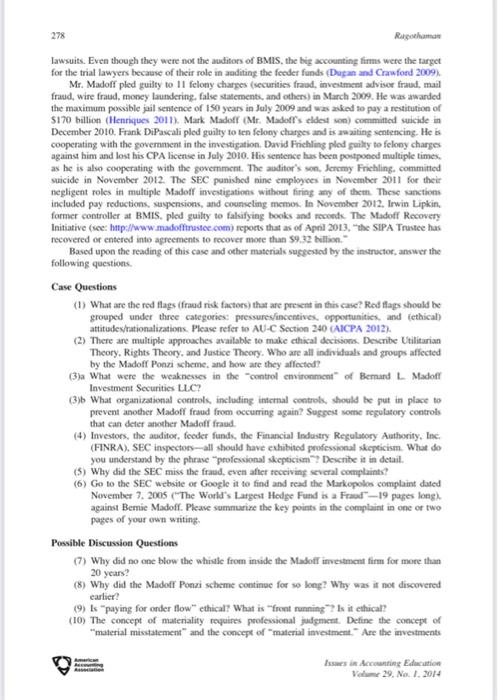

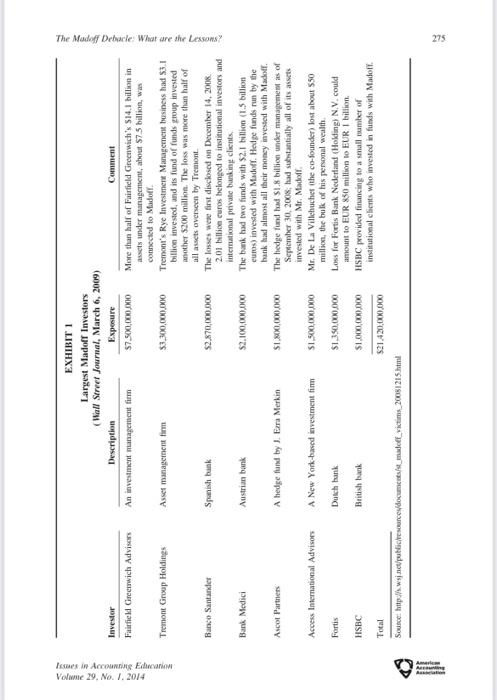

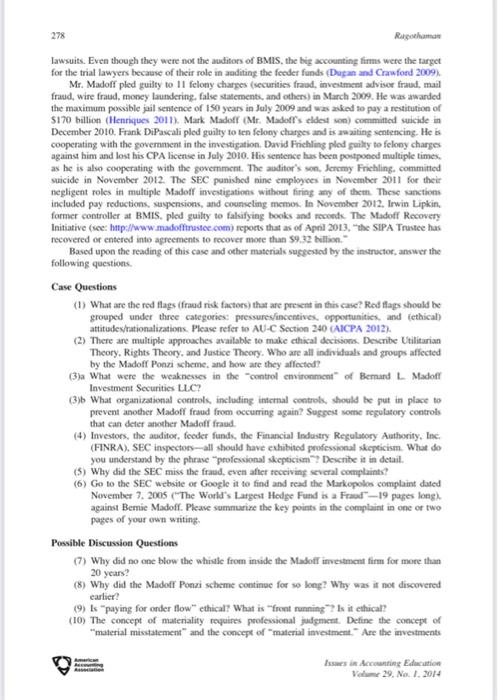

case forensic4 Q ISSUES IN ACCOUNTING EDUCATION Vol. 29. No. 1 2014 pp. 271-25 American Accounting Asciation DOI: 10.230/ace-50597 The Madoff Debacle: What are the Lessons? Srinivasan C. Ragothaman ABSTRACT: This paper describes the implementation of a Ponzi scheme case study in auditing classes at the undergraduate and the Master's level. This instructional case is based on the much-publicized Madoff Ponzi scheme. The case exposes students to several auditing-related concepts, including: (1) fraud auditing: (2) ethical reasoning and utilitarian principles (3) affinity fraud and Pon schemes: (4) intemal control evaluation (5) governance issues; (b) the Securities and Exchange Commission (SEC) investigations: (7) Investment strategies and terminologies, and (8) regulation. The case provides students with an opportunity to assume the role of an extemal auditor and participate in some active learning exercises. About 170 accounting majors participated in this case project during a three-year period at a Midwestem university. Students who worked in groups were genuinely engaged in the Teaming process, and they came up with several red flags associated with the Madoff fraud and suggested many new internal controls. This case provides a hands-on leaming experience to students that could be relevant for them in their future career in public accounting Shudent opinion surveys conducted about the learning Outcomes of this project indicate strong student engagement active learning, and satisfaction Keywords: Ponzi scheme fraud risk factors affinity fraud control environment utilitarian ethics: professional skepticism T CASE INTRODUCTION he Federal Bureau of Investigation (FBI) amested Bemand L Madoff (hereafter, Mr. Madoff) on a rainy moming in December 2008, based on tips from his two sons. They confiscated dozens of checks, totaling S173 million, that were made out by him to his close friends. key employees, and family members. Mr. Madoff was charged with multiple felonies. including securities fraud investment advisor fraud muul faod, and wine fraud. The US. District Court Judge in New York City released him as a $10 million bond save orders to put electronic bracelets on him, and confined him to his Manhattan apartment. It was a disappointment for the prosecutors, who wanted him jailed. However, the prosecutoes got their wishes when the judge also ordered Mr. Madoff and his immediate family members to not sell or transfer any personal assets. Srinivasan Ringotkoman is a Professor at the University of South Dakota Comments at the Effective Stream the American Accounting Acto Anual Meeting held in Denver August 2011 Angeline La Nan Gempa, lead Nielsen, the stand cate editepreciated. This manuscript has beedial comments offered by the eymous Reviewers. The disclaimerupplies Editor's note: Accepted by William Published Online A 2013 272 Ragotan.com The FBI confiscated the passports of Mr. Madoff and his wife, Rath. A federal judge froze the assets of Bernard L. Madoff Investment Securities LLC (BMIS) and a receiver was appointed to handle the case (Henriques 2011). Overview of Bernard Madoff Investment Securities LLC After his high school graduation in 1956, Mr. Madoff attended The University of Alabama for a year, where he was a member of a Jewish fratemity. He transferred to Hofstra University in 1957 and graduated with a degree in political science from Hofstra in 1960. Mr. Madoff and his wife held several small jobs in the early years, including installing sprinklers, babysitting, and performing lifeguard duties in Manhattan (Hennques 2011). He started his investment business in 1968 with a capital of $5.000, which he and his wife had saved during the previous six years. Mr. Madoff's business grew slowly in the initial years. When he got a chance to become a market maker on the National Association of Securities Dealers Automated Quotations (NASDAQ in 1984, he grabbed the opportunity. His eldest son, Mark, had just finished his M.B.A at Columbia University and was eager to enter the family business. While Mr. Madoff looked after his investment management and advisory business, he put Mark in charge of the market maker end of the business. BMIS directly executed orders from retail brokers. About the same time. Mr. Madoff invested in computer equipment and software to automate the order system (Henriques 2011). Peter Madoff, his brother, spearheaded the computerization project and successfully developed a fast, automated system to handle customer orders. This automated trading system pioneered by BMIS brought fame to the investment firm and added to the mystique of the name: Bernard L. Madoff. By 2008, BMIS was the sixth fargest market maker on the NASDAQ BMIS paid a small commission to retail brokers for order flow. Mr. Madoff compared this to stocking manufacturers paying for the racks that display their products in supermarkets. Some academics have argued that this practice of paying for order flow is not ethical, as it causes the broker to violate his or her fiduciary responsibility to obtain the best execution price for the customer. The New York Stock Exchange (NYSE) did not like this Madoff business practice and dubbed these payments bribes" or "kickbacks." The NYSE argued with the regulator that paying for onder flow is illegal and that the practice should be banned. However, the regulators eventually sided with Mr. Madoff and the practice was declared legal (Henriques 2011). BMIS was govemed by a small closely knit board of directors. Mr. Madoff was the founding Chairman of BMIS and retained that position until his arrest in 2008. Brother Peter Madoff was the Managing Director and the Chief Compliance Officer. Peter's daughter, Shana Madoff, served as the compliance attorney for the investment firm (Henriques 2011). In addition, Mr. Madoff's two sons (Mark and Andrew) served as the lead officers in the market maker" division of the firm. The chief financial officer, Frank DiPascali, was a long-term associate of Mr. Madoff. In short, the management of BMIS was dominated by family members and friends. Mr. Madoff was elected as the chair of the National Association of Securities Dealers (NASD) in 1990 and held that prominent post for three years. As chair of the NASD, Mr. Madoff vigorously championed the cause of transparency. He was a founding member of the International Clearing Corporation in London. He portrayed himself as a person of unimpeachable integrity. His now defunct) website used to say "In an era of faceless organizations owned by other equally faceless organizations, Bemard L. Madoff Investment Securities LLC harks back to an earlier era in the financial world: The owner's name is on the door. Clients know that Bernie Madoff has a personal interest in maintaining the unblemished record of value, fair-dealing, and high ethical standards that has always been the firm's hallmark." His fame grew far and wide. By 1993, feeder funds had started investing heavily with Madoff. They were impressed with his steady retums. Some feeder funds did not tell their investors that they were investing with Mr. Madott. The managers of some of these Am Acting Action Issues in Accounting Education Volume 29. No. 1. 2014 The Madoff Debacle: What are the Lessons 273 feeder funds rationalized that they were investing only a small portion (10 10 15 percent of their portfolio with Madoff. Other feeder fund managers invested substantial portions of their portfolio with Madoff. For example, Fairficld Greenwich Advisors invested $7.5 billion with BMIS, which was 53 percent of assets under its management. These feeder funds were paid a finder's fee for bringing investments to BMIS. Feeder funds also received substantial commissions from their investors. Mr. Merkin, who managed three Madoff feeder fund, was alleged to have collected $470 million in fees and commissions for bringing in $2.4 billion to BMIS (Chew 2009). Several hedge fund managers also invested with BMIS. When it was all over. Mr. Madoff had cheated his investors to the tune of approximately $20 billion through his Ponci scheme (see: http://www.madoffrustee.com). Mr. Madoff was on the Board of New York City Center, an innovative cultural institution supported by the Madoff couple for decades (Henriques 2011). He served as the Chairman of the Board of Directors of the Sy Syms School of Business at Yeshiva University and as the Treasurer of its Board of Trustees. He moved in the upper echelons of society with aplomb and quickly established himself as a prominent philanthropist. His family foundation handed out sizable donations to various noble causes: cancer, theater, lymphoma research, education, hospitals, and other non-profit institutions. It appears that charlatans are often schizophrenic. Mr. Madoff owned opulent mansions in New York, Palm Beach, the French Riviera, and London (Kravitz 2009). His massive Montauk, New York, beach house alone is valued at $8.75 million. His Palm Beach and London homes were in the name of his wife exclusively, and other mansions were co-owned by the couple. He and his wife also co-owned an S8 million dollar luxury apartment in Manhattan (Kravitz 2009). Mr. Madoff owned a luxury boat nicknamed "Bull stationed in Miami, as well as a yacht on the Mediterranean. He had acquired fancy cars, expensive watches, exclusive country club memberships, Savile Row suits, and other luxury items. He owned a Brazilian-built Embraer Regional Jet with a price tag of S29 million (Kravitz 2009). Mr. Madoff had a lavish lifestyle befitting a king. While under house arrest, he tried to mail jewelry and watches worth a million dollars to his family before he was stopped by the authorities, a Madoff Clientele Mr. Madoff initially targeted rich people in his own community. People were kept waiting if they wanted to invest with Madoff. Not everyone was allowed to invest. It was an honor and a privilege to invest with BMIS. Mr. Madoff was an insider and a pillar of the community and, hence. people trusted him too quickly. He soon started promising a steady return of 10 to 12 percent each year for his clients. These returns were guaranteed both in up and down markets. Mr. Madoff promised positive and steady returns-always. A 10 percent return appeared modest when house prices were going up 20 percent or more every year. The Internet and real estate bubbles made a 10 to 12 percent return look reasonable and feasible. Mr. Madoff advertised that he was using a so called "fool-proof investment strategy--the split-strike conversion scheme or collar trade (Henriques 2011). Under this scheme, Mr. Madoff claimed he purchased 35 to 50 Standard & Poor's (S&P) 100 stocks, sold a call option (upside exposure) on the S&P 100 index, and bought a put option (downside protection on the S&P 100 index (Henriques 2011). Several analysts who tried to replicate this strategy came to the conclusion that it would not generate steady returns of 10 to 12 percent over several years. It did not pass the "Sniff" test. To secure a net retum of 12 percent. Madoff had to cam at least 16 percent so that he could pay a 4 percent fee to feeder fund managers who brought in the investors (Markopolos 2005). Smart investors should have been skeptical about these high levels of promised tetums, perhaps their trust in Madoff blinded them. Mr. Madoff's clientele spread far and wide over the years. Many of his clients shared Madoff's religious affiliation--they were Jewish. His client list included prominent people in the entertainment, business, and cable news industry. Celebrity Madoff investors included Steven Am Issues in Accounting Education Volume 29. No. 1. 2014 274 Ragatham Spielberg, Kevin Bacon, Kyra Sedgwick, Jeffrey Katzenberg. Mort Zuckerman, Larry King, Elie Wiesel, and others (Henriques 2011). Several other investors were well-to-do retirees who were living in Florida, Arizona, Nevada, and Southern California. Many of them, unfortunately, did not appear to properly diversify their investment. They trusted Madoff with their retirement funds. The eight largest investors with Madoff had invested a whopping $2142 billion. Exhibit provides the details. Desiring steady returns, several charitable foundation also invested their funds with Mr. Madoff, the famed New York philanthropist. Many Jewish charitable organizations were severely burnt by their trust in Madoff (Szep 2008). A few of them invested 100 percent of their corpus with BMIS. For example, the Chais Family Foundation invested all of its money with Madoff. les annual distribution to various causes was approximately $12.5 million. This foundation had to fire all of its employees and shut down. The Robert L. Lappin Foundation invested all S8 million of its corpus with Madoff. and it was also forced to close down. The Carl and Ruth Shapiro Family Foundation, a Boston-based organization, estimated its loss exposure at $145 million, which represents between 40 percent and 45 percent of its total assets (Szep 2008) Yeshiva University invested S110 million in Madoff investments, which was roughly 10 percent of its entire endowment. Mort Zuckerman, who owns the New York Daily News, reported that his charitable Trust could lose $30 million, its entire endowment. due to Madoff shenanigans. The Elie Wiesel Foundation for Humanity and the Wunderkinder Foundation run by Stephen Spielberg both had substantial amounts of their corpus invested with BMIS. New Jersey Senator Frank Lautenberg entrusted a substantial portion of his family's charitable funds to Madoff and was exposed to heavy losses. Charities typically distribute 5 percent of their investment annually to various recipients. Clients came from affinity groups and, lence, it was easier for them to trust Mr. Madoff. Charities are typically satisfied with an annual income of 5 percent and seldom seek the refund of their corpus. Thus, Mr. Madoff could pay them 5 percent per year even if he made no real investments and could perpetuate the Ponzi scheme for 20 long years! Shenanigans at Bernard L. Madoff Investment Securities Professionals who sold Madoff investments included lawyers, accountants, bunkers, brokers and even doctors. Many of these veterans thought Madoff had a system to make money. Salespeople for Madoff investments in Europe were well trained and spoke multiple European languages. They were wealthy and well connected. A large proportion of Madoff's business came from well-to-do European investors. Mr. Madoff only had two dozen people working for him in the U.S. hedge fund business and another 28 working for him in his London office (Henriques 2011). A key employee in accounting assisted Mr. Madoff by creating an elaborate phony paper trail and by mailing falsified account statements to customers on a regular basis. His employees, including the sales professionals, were well compensated. They were paid much above the industry norms. Key employees were paid substantial bonuses, as well. Perhaps such exceedingly generous payments should have raised some eyebrows. Peter Madoff served as the Chief Compliance Officer and Senior Managing Director at BMIS from 1969 to 2008. Peter was in charge of developing compliance policies and procedures and overseeing their implementation. He created a comprehensive compliance manual and annual compliance reports overseen by competent investment professionals. However, it was all an illusion created with the fake filings and fictitious documentation. In June 2012, the Securities and Exchange Commission (SEC) filed a criminal complaint against Peter Madoff in the US. District Court for the Southern District of New York alleging: that in addition to creating false compliance materials, Peter Madoff created false broker- dealer and investment advisor registration applications filed by BMIS. He also failed to implement and review required policies and procedures, and falsified the firm's books and A A Issues in Accounting Education Volume 29. Na 1.2014 Volume 29. No. /. 2014 Issues in Accounting Edwin The Madoff Debacle: What are the Lessons EXHIBIT 1 Largest Madoff Investors (Wall Street Journal, March 6, 2009) Investor Description Exposure Comment Fairfield Greenwich Advisors An investment management firm $7.500,000,000 More than half of Fairfield Greenwich's $14.1 billion in assets under management, about $75 billion, was connected to Madofl. Tremont Group Holdings Asset management firm $3.300,000,000 Tremont's Rye Investment Management business had $3.1 billion invested, and its fund of funds group invested another $200 million. The loss was more than half of all assets overseen by Tremont Banco Santander Spanish bank $2,870,000,000 The losses were first disclosed on December 14, 2008 2.01 billion euros belonged to institutional investors and international private banking clients Bank Medici Austrian bank S2.100,000,000 The bank had two funds with $2.7 billion (1.5 billion euros) invested with Madofl. Hedge funds run by the hank had almost all their money invested with Madoll. Ascot Partners A hedge fund by J. Fara Merkin SI00,000,000 The hedge fund du 8 billion under management as of September 30, 2008, had substantially all of its assets invested with Mr. Madell Access International Advisors A New York-based investment fim 51.500,000,000 Mr. De la Villehuchet the co-founder) lost about 550 million, the bulk of his personal wealth Fortis Dutch bank $1,350,000,000 Loss for Fortis Bank Nederland (HoldingN.V. could amount to EUR 850 million to EUR 1 billion. HSBC British bank $1,000,000,000 HSBC provided financing to a small number of institutional clients who invested in funds with Madoff. Total $21.420.000.000 Source: http://.wsj.net/publicescurces/documents/e_madell victims 20081215.html A 275 276 Rapehome records. Peter Madoff was richly tewanded for his misconduct, pocketing tens of millions of dollars through salary and bonuses, fake trades, sham loans, and direct, undocumented transfers of investor funds to himself from the bank account that EMIS used to perpetrate the Ponzi scheme. (SEC 2012) Peter Madoff was sentenced to ten years in jail for his role in the Madoff fraud in December 2012 The chief financial officer, Frank DiPascali, was in charge of maintaining the accounting records and financial management at BMIS. A 33-year veteran at BMIS, Frank was the chief lieutenant of Mr. Madoff. Frank was also the director of options trading at the firm. Every three months, BMIS would mail quarterly statements to the firm's investors. Many of these statements showed investments in blue chip companies. These statements always showed a positive return of 3 to 4 percent every quarter. In earlier years, if investors requested a liquidation of their investments, a check for the balance was promptly mailed to them. Since most of the investors were individually very wealthy, the refund requests were sporadic. In addition, some investors were chantable organizations and were not seeking the return of their original investment. Mr. Madoff, his brother and Frank DiPascali formed a tight knit group that engineered this massive fraud and kept it secret for a long time, to the detriment of thousands of gullible investors BMIS claimed to be a private fund and did not register with the SEC. Hence, it was not filing financial information with the SEC on a regular basis for many years, BMIS, however, was audited by Frichling & Horowitz, a small CPA firm in New York City. This accounting firm operated out of a 13 feet by 18 feet office in uptown New York (Ahkowitz 2008). The CPA fim consisted of three people, including a secretary Jerome Horowitz, the senior accountant at the firm, retired in 1991 and moved to Florida. The only active accountant at the firm, David G. Frichling, was a past president of the Rockland County chapter of the New York State Society of Certified Public Accountants and sat on the chapter's executive board. David Frichling. a 49-year-old accountant apparently worked sporadically, according to a nearby worker in the office building (Abkowitz 2008). He was often seen driving a luxury Lexus Mr. Frichling essentially attested for 17 years that BMIS had a clean audit record. He collected a $250.000 audit fee for just signing the audit report and performed no audit procedures. Frichling & Horowitz did not submit itself for peer review during the last 17 years (Abkowitz 2008). The firm had been consistently telling the New York State CPA Society that they had not done any audits during those 17 years and therefore, were not subjected to any peer review. Mr. Frichling was also not registered with the Public Company Accounting Oversight Board (PCAOB). The Madoff Trustee, Irving Picard, sued JPMorgan Chase in December 2010. Picard alleged that the Madoff banker had known that Frichling had neither registered with the PCAOB nor subjected himself to the American Institute of Certified Public Accountants CAICPA) peer review as carly as 2006. The Office of the Comptroller of the Currency (OCC) is also unhappy with JPMorgan Chase and is faulting the bank for not conducting due diligence and for failing to report suspicious activity at BMIS. Fairfield Greenwich Group invested a staggering $7.5 billion with BMIS (see Exhibit 1). In 2008, the Fairfield Fund announced on its website that it was managing S14 billion in assets More than 95 percent of this S14 billion came from Europe, Asia and the Middle East. Hence, a little more than 50 percent of the funds were invested with one individual (Mr. Madoff) by Fairfield managers. As a feeder fund, it was Fairfield's fiduciary duty to do due diligence about BMIS before investing. It appears that Fairfield failed to perform this duty and did not exhubit cough professional skepticism. Of course, Fairfield was receiving substantial fees from its own clients and from BMIS (Henriques 2011). Issues in Arce Education Volume 29.1.2014 The Madoff Debacle: What are the lowes? 277 Red Flags The SEC received multiple complaints against Mr. Madoff over the years (Scannell 2009). Whenever the SEC made inquiries about the trading practices at BMIS, Mr. Madoff used his charm and manipulative ways to explain away his dealings to the SEC inspection teams. While some of these complaints were anonymous, several were credible and had professional names associated with them. The earliest complaint was in 1992 and was directed at an associate of Mr. Madoff, Mr. Avellino (Berenison 2009). Avellino and Bienes initially had set up an accounting tim in Manhattan in 1977 and soon shifted their focus to raising funds for Mr. Madoff. By 1992, they had raised $441 million from 3.200 clients and had entrusted these funds to Madoff (Berenson 2009 What caught the attention of SEC investigators was the promise made by Avellino and Bienes that they would pay 13.5 to 20 percent annual returns to their clients. This generous promise prompted the SEC to wonder whether Avellino and Bienes were running a Ponzi scheme. When Avellino was questioned by SEC investigators, he told them that the money has been entrusted to Mr. Madoff (Berenson 2009). At that time, Madoff's firm was an influential brokerage house on Wall Street Once Avellino assured the SEC investigators that he would return the money to investors and paid a small fine to the SEC, the federal investigators concluded the investigation. Avellino and Madoff had been connected for a long time: Mr. Avellino had worked for Mr. Madoff's father-in-law since 1958 as an accountant. The SEC failed to ask the right question in 1992Is Mr. Madoff (not Avellino) running a Ponzi scheme? Harry Markopolos filed complaints against Mr. Madod multiple times and put his professional name on the line. He complained to the Boston office of the SEC, suggesting that Madoff was either front running or deceiving his investors by running a Ponzi scheme in 2000. As an example, front running would occur if a stockbroker leams that a large retirement fund has a limit order in to purchase a certain stock, and the broker uses this private information to buy the same stock just before the retirement fund's large order is executed. The SEC has banned front running. In an article published in Barron's, Arvedlund (2001) wondered how Madoff was getting such steady returns She was also critical of the secrecy associated with the Madoff methods to generate the returns. A long memo was sent by Markopolos in 2005 to the SEC detailing why he considered BMIS a fraud. Markopolos (2005) listed 29 red flags in support of his allegation that Madoff had been committing a serious fraud. A few of his red flags are discussed below. He pointed out that BMIS reported only seven small monthly losses in 174 months (145 years). This defies logic. This is equivalent to a major league baseball player hitting a 0.960. There were not enough index put option contracts in total in the market to hedge the way Madoff said he was hedging. Several investors believed that Mr. Madoff subsidized down months. Other investors believed that Mr. Madolf could time the market perfectly because of his insider status. This is incredulous. There was a lot of secrecy associated with BMIS operations, and only family members knew the Madoff investment strategy. The feeder fund (Fairfield Sentry) took extraordinary pains to hide the fact that the real money manager was Mr. Madoff . Sometimes the best advice financial advisors can offer their clients is to be conservative and diversify their investments. Many of the financial advisors failed to offer this advice. The Aftermath Within a few weeks of his house arrest. Mr. Madoff's customers had confessed that their foss exposure totaled several billion dollars. A CNN (2008) business story reported that several prominent Madoff investors, including Royal Bank of Scotland, BNP Paribas, Banco Santander, HSBC, and others, announced billions in expected losses. A few weeks later, the court-appointed receiver reported that he had recovered a sum of S1.1 billion from several Madoff bank accounts (see: http://www.madofftrustee.com). Some of the big accounting firms were staring at potential America Act Isares in Accounting Education Volume 29. No. 1. 2014 278 Rugochamar lawsuits. Even though they were not the auditors of BMIS, the big accounting firms were the target for the trial lawyers because of their role in anditing the feeder funds (Dugan and Crawford 2009) Mr. Madoff pled guilty to 11 felony charges (securities fraud, investment advisor fraud, mail fraud, wire fraud, money laundering, false statements, and others) in March 2009. He was awarded the maximum possible jail sentence of 150 years in July 2009 and was asked to pay a restitution of 5170 billion (Henriques 2011). Mark Madoff (Mr. Madoff's eldest son) committed suicide in December 2010. Frank Dipascali pled guilty to ten felony charges and is waiting sentencing. He is cooperating with the government in the investigation. David Frichling pled guilty to felony charges against him and lost his CPA license in July 2010. His sentence has been postponed multiple times as he is also cooperating with the government. The auditor's son, Jeremy Friehling committed suicide in November 2012. The SEC punished nine employees in November 2011 for their negligent roles in multiple Madoff investigations without firing any of them. These sanctions included pay reductions, suspensions, and counseling memas. In November 2012. Irwin Lipkin. former controller at BMIS. pled guilty to falsifying books and reconds. The Madoff Recovery Initiative (see: http://www.madofftrustee.com) reports that as of April 2013. "the SIPA Trustee has recovered or entered into agreements to recover more than 9 32 billion." Based upon the reading of this case and other materials suggested by the instructor, answer the following questions Case Questions (1) What are the red flags (fraud risk factors that are present in this case? Red flags should be grouped under three categories: pressures/incentives, opportunities, and ethical) attitudes/rationalizations. Please refer to AU-C Section 240 CAICPA 2012). (2) There are multiple approaches available to make ethical decisions. Describe Utilitarian Theory. Rights Theory and Justice Theory. Who are all individuals and groups affected by the Madoff Ponzi scheme, and how are they affected? (3) What were the weaknesses in the control environment of Bemand L Madoff Investment Securities LLC? (3)b What organizational controls, including internal controls, should be put in place to prevent another Madoff fraud from occurring again? Sugpest some regulatory controls that can deter another Madoff fraud (4) Investors, the auditor, feeder funds, the Financial Industry Regulatory Authority, Inc. (FINRA). SEC inspectors--all should have exhibited professional skepticism. What do you understand by the phrase "professional skepticism Describe it in detail. (5) Why did the SEC miss the fraud, even after receiving several complaints! (6) Go to the SEC website or Google it to find and read the Markopolos complaint dated November 7, 2005 ("The World's Largest Hodge Fund is a Frad"-19 pages long). against Bemie Madoff. Please summarize the key points in the complaint in one or two pages of your own writing Possible Discussion Questions (7) Why did no one blow the whistle from inside the Madoff investment firm for more than 20 years? (8) Why did the Madoff Ponzi scheme continue for so long? Why was it not discovered earlier? (9) is "paying for order flow" ethical? What is "front running? kit ethical? (10) The concept of materiality requires professional judgment. Define the concept of material misstatement and the concept of "material investment. Are the investments Issues in Accounting Education Vol 29. No. I.2014 form Q3 to Q6 please

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started