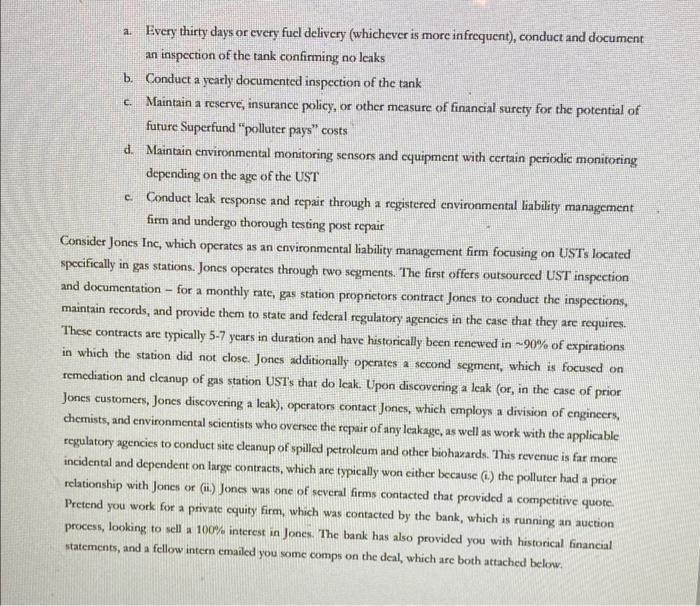

Case Study: Fuel station environmental liability management. Though environmental issues have recently come to the forefront of investing, comprehensive codes and regulation governing the environmental impacts of business havc, oftentimes, been in place for decades. One of the places this is most apparent is in the case of gas stations, and their so-called USTs, or underground storage tanks. Typically, gas stations maintain a very large (thousands of gallons) sub-surface storage tank, directly underneath the pumps, which is continually re-filled by periodic tanker truck deliveries. After Superfund was passed in 1980, the U.S. EPA began placing a strong emphasis on so-called petroleum brownfields, which were sites that, historically, had seen large amounts of petroleum seep into the ground- and nearby freshwater. There are currently roughly 450,000 known petroleum brownfields which the EPA keeps tabs on, and a significant number of these are former gas stations, whose poorly kempt underground tanks had proved to be a significant conduit for leaking oil and its derivatives into the surrounding groundwater. This sparked a new regulatory regime, as it is currently, with a federalist patchwork of the EPA and many state regulators insisting on strong controls over properties which have a UST instilled. The current regulatory framework requires that owners of properties with a UST, among other things, must remain in compliance with the following: a. Every thirty days or every fuel delivery (whichever is more infrequent), conduct and document an inspection of the tank confirming no leaks b. Conduct a yearly documented inspection of the tank c. Maintain a reserve, insurance policy, or other measure of financial surety for the potential of future Superfund "polluter pays" costs d. Maintain environmental monitoring sensors and cquipment with certain periodic monitoring depending on the age of the UST c. Conduct leak response and repair through a registered environmental liability management firm and undergo thorough testing post repair Consider Jones Inc, which operates as an environmental liability management firm focusing on USTs located specifically in gas stations. Jones operates through two segments. The first offers outsourced UST inspection and documentation - for a monthly rate, gas station proprietors contract Jones to conduct the inspections, maintain records, and provide them to state and federal regulatory agencies in the case that they are requires. These contracts are typically 5-7 years in duration and have historically been renewed in -90% of expirations in which the station did not close. Jones additionally operates a second segment, which is focused on remediation and cleanup of gas station UST's that do leak. Upon discovering a leak (or, in the case of prior Jones customers, Jones discovering a leak), operators contact Jones, which employs a division of engineers, chemists, and environmental scientists who oversee the repair of any leakage, as well as work with the applicable regulatory agencies to conduct site cleanup of spille petroleum and other biohazards. This revenuc is far more incidental and dependent on large contracts, which are typically won cither because the polluter had a prior relationship with Jones of (11.) Jones was one of several firms contacted that provided a competitive quote. Pretend you work for a private equity firm, which was contacted by the bank, which is running an auction process, looking to sell x 100% interest in Jones. The bank has also provided you with historical financial statements, and a fellow intern emailed you some comps on the deal, which are both attached below. FY16 FYIS F20 FY21 FY22 YTD LTM Jones in financials Revenue Inspection Revenue 11.952 12344 13,602 Cleanup Revenue Total Revenue 11.440 477 8700 20,140 12,200 sa 13.785 26,073 12.25 24,277 2.519 20,863 3,594 513 1,320 6914 1959 22.561 Cost of Cleanup Replacement Parts Gross Profit 3.915 16,233 5,617 19,456 2.002 17,23s 4,285 16577 1650 254 4,874 17.687 SGGA Inspection SGGA, Cleanup Compensation, inspection Compensation, Cleanup Segment EBITDA Inspection Segment EBITDA. Cleanup Firm EBITDA 1.500 1,250 5152 1,022 4.75 1,700 5.500 1523 1.263 5,530 2,895 5,236 1,011 L247 1.545 1,275 0378 2.500 5,020 1420 (456 1,569 1.28 6,005 1.579 S771 390 325 1,617 697 1579 639 2.216 1574 1.291 6.123 1,831 907 912 5,819 137 Supplementat information Capital Expenditures Deprecation. Cleanup 2115 2750 2104 2736 1789 2723 2057 2709 543 674 2186 2706 Jones Inc. Comps (LTM 50001) Inspection Revenue Cleanup Revenue Inspection EBITDA Cleanup EBITDA Deal Multiple American Petroleum Waste 33,500 4,020 21 EPA Associates LLC 8,500 3,400 6.1 Tidewater Environmental 21,000 11,000 6,300 880 44 Koning Partners 131,000 76,500 65,500 11,475 6.5 Please feel free to do additional online research about any of the points you are unsure of. As a good starting point, most states and the EPA have sites describing their regulatory regime. You may also be able to find other real-world companies that do this, or other reputable sources. 1.) What are some attractive aspects about Jones, both about the company and the industry it operates in? 2.) What are some unattractive aspects about Jones, both about the company and the industry it operates in? 3.) You have a call with the bankers who are selling Jones tomorrow. Suggest some questions that you would ask to dig deeper into Jones to determine if it is an attractive investment opportunity, 4) The first round of bidding in investment bank "auction processes" is the submission of IOIs, or indications of interest, in which you submit, among other things, the price you propose to pay. Pretend the selling bank lets you bid on both Jones as a whole, and just on the inspection division stand alone (s.e. a so-called carveour deal in which you would just buy the inspection operations). How much would you be willing to pay for each? Explain Case Study: Fuel station environmental liability management. Though environmental issues have recently come to the forefront of investing, comprehensive codes and regulation governing the environmental impacts of business havc, oftentimes, been in place for decades. One of the places this is most apparent is in the case of gas stations, and their so-called USTs, or underground storage tanks. Typically, gas stations maintain a very large (thousands of gallons) sub-surface storage tank, directly underneath the pumps, which is continually re-filled by periodic tanker truck deliveries. After Superfund was passed in 1980, the U.S. EPA began placing a strong emphasis on so-called petroleum brownfields, which were sites that, historically, had seen large amounts of petroleum seep into the ground- and nearby freshwater. There are currently roughly 450,000 known petroleum brownfields which the EPA keeps tabs on, and a significant number of these are former gas stations, whose poorly kempt underground tanks had proved to be a significant conduit for leaking oil and its derivatives into the surrounding groundwater. This sparked a new regulatory regime, as it is currently, with a federalist patchwork of the EPA and many state regulators insisting on strong controls over properties which have a UST instilled. The current regulatory framework requires that owners of properties with a UST, among other things, must remain in compliance with the following: a. Every thirty days or every fuel delivery (whichever is more infrequent), conduct and document an inspection of the tank confirming no leaks b. Conduct a yearly documented inspection of the tank c. Maintain a reserve, insurance policy, or other measure of financial surety for the potential of future Superfund "polluter pays" costs d. Maintain environmental monitoring sensors and cquipment with certain periodic monitoring depending on the age of the UST c. Conduct leak response and repair through a registered environmental liability management firm and undergo thorough testing post repair Consider Jones Inc, which operates as an environmental liability management firm focusing on USTs located specifically in gas stations. Jones operates through two segments. The first offers outsourced UST inspection and documentation - for a monthly rate, gas station proprietors contract Jones to conduct the inspections, maintain records, and provide them to state and federal regulatory agencies in the case that they are requires. These contracts are typically 5-7 years in duration and have historically been renewed in -90% of expirations in which the station did not close. Jones additionally operates a second segment, which is focused on remediation and cleanup of gas station UST's that do leak. Upon discovering a leak (or, in the case of prior Jones customers, Jones discovering a leak), operators contact Jones, which employs a division of engineers, chemists, and environmental scientists who oversee the repair of any leakage, as well as work with the applicable regulatory agencies to conduct site cleanup of spille petroleum and other biohazards. This revenuc is far more incidental and dependent on large contracts, which are typically won cither because the polluter had a prior relationship with Jones of (11.) Jones was one of several firms contacted that provided a competitive quote. Pretend you work for a private equity firm, which was contacted by the bank, which is running an auction process, looking to sell x 100% interest in Jones. The bank has also provided you with historical financial statements, and a fellow intern emailed you some comps on the deal, which are both attached below. FY16 FYIS F20 FY21 FY22 YTD LTM Jones in financials Revenue Inspection Revenue 11.952 12344 13,602 Cleanup Revenue Total Revenue 11.440 477 8700 20,140 12,200 sa 13.785 26,073 12.25 24,277 2.519 20,863 3,594 513 1,320 6914 1959 22.561 Cost of Cleanup Replacement Parts Gross Profit 3.915 16,233 5,617 19,456 2.002 17,23s 4,285 16577 1650 254 4,874 17.687 SGGA Inspection SGGA, Cleanup Compensation, inspection Compensation, Cleanup Segment EBITDA Inspection Segment EBITDA. Cleanup Firm EBITDA 1.500 1,250 5152 1,022 4.75 1,700 5.500 1523 1.263 5,530 2,895 5,236 1,011 L247 1.545 1,275 0378 2.500 5,020 1420 (456 1,569 1.28 6,005 1.579 S771 390 325 1,617 697 1579 639 2.216 1574 1.291 6.123 1,831 907 912 5,819 137 Supplementat information Capital Expenditures Deprecation. Cleanup 2115 2750 2104 2736 1789 2723 2057 2709 543 674 2186 2706 Jones Inc. Comps (LTM 50001) Inspection Revenue Cleanup Revenue Inspection EBITDA Cleanup EBITDA Deal Multiple American Petroleum Waste 33,500 4,020 21 EPA Associates LLC 8,500 3,400 6.1 Tidewater Environmental 21,000 11,000 6,300 880 44 Koning Partners 131,000 76,500 65,500 11,475 6.5 Please feel free to do additional online research about any of the points you are unsure of. As a good starting point, most states and the EPA have sites describing their regulatory regime. You may also be able to find other real-world companies that do this, or other reputable sources. 1.) What are some attractive aspects about Jones, both about the company and the industry it operates in? 2.) What are some unattractive aspects about Jones, both about the company and the industry it operates in? 3.) You have a call with the bankers who are selling Jones tomorrow. Suggest some questions that you would ask to dig deeper into Jones to determine if it is an attractive investment opportunity, 4) The first round of bidding in investment bank "auction processes" is the submission of IOIs, or indications of interest, in which you submit, among other things, the price you propose to pay. Pretend the selling bank lets you bid on both Jones as a whole, and just on the inspection division stand alone (s.e. a so-called carveour deal in which you would just buy the inspection operations). How much would you be willing to pay for each? Explain