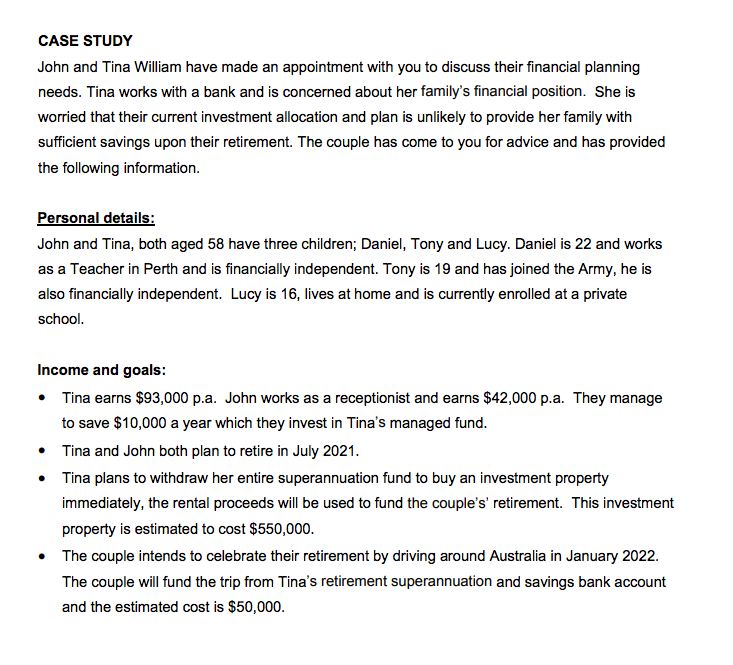

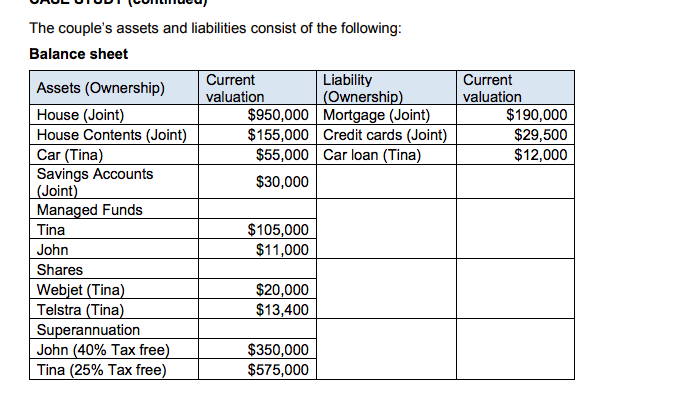

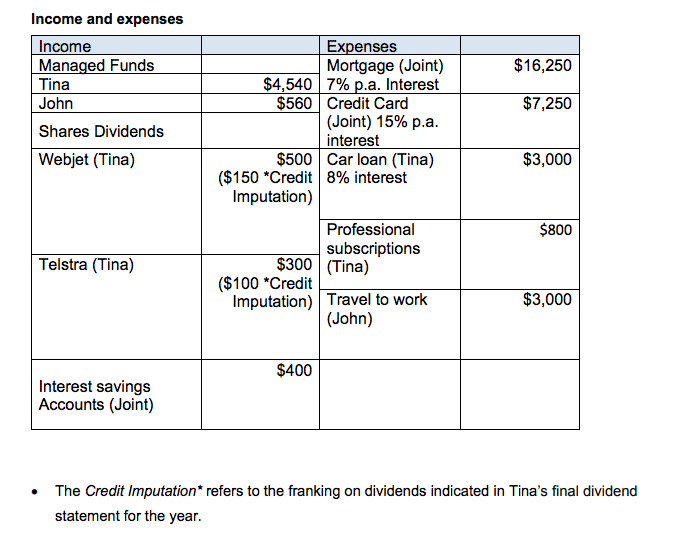

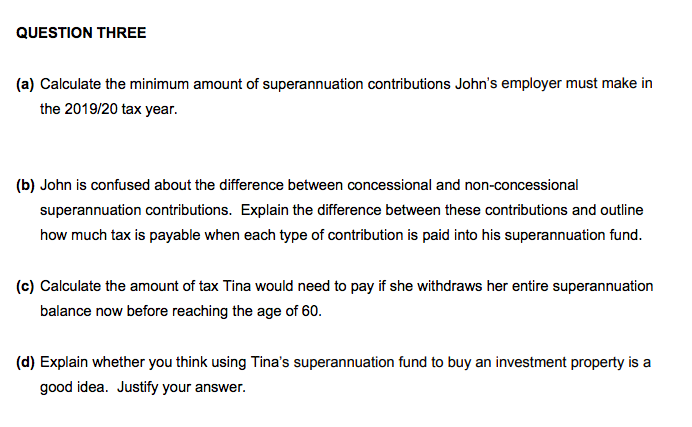

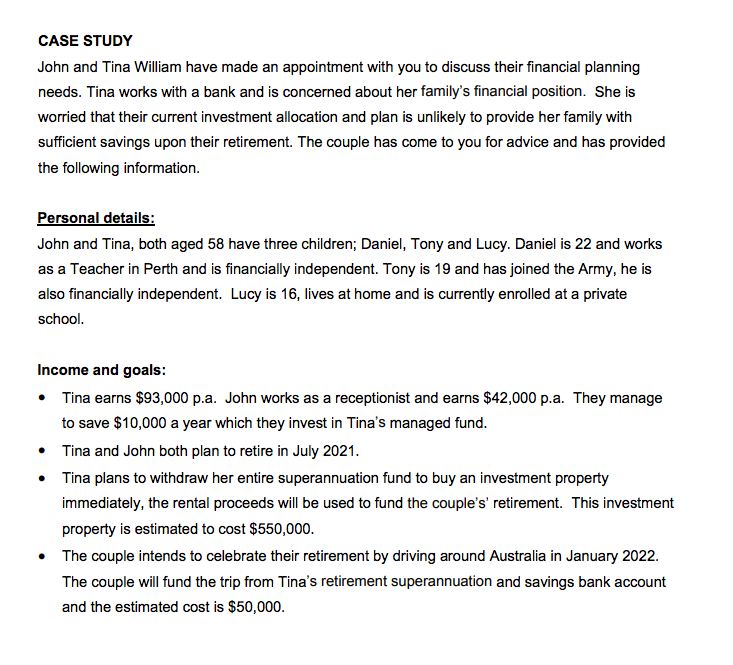

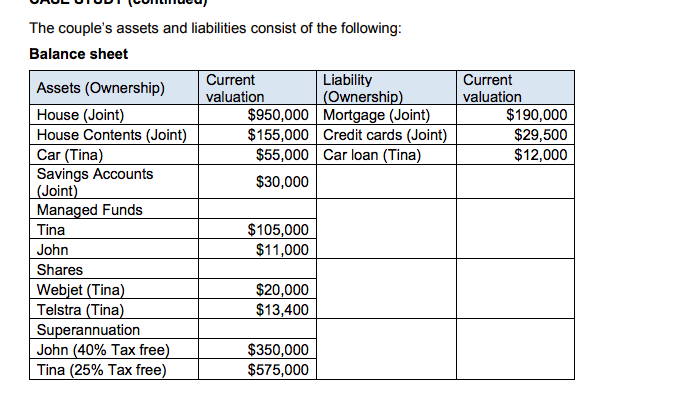

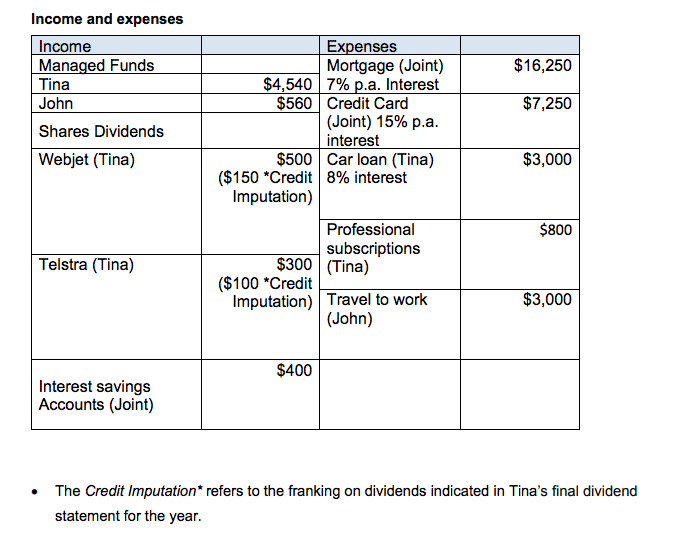

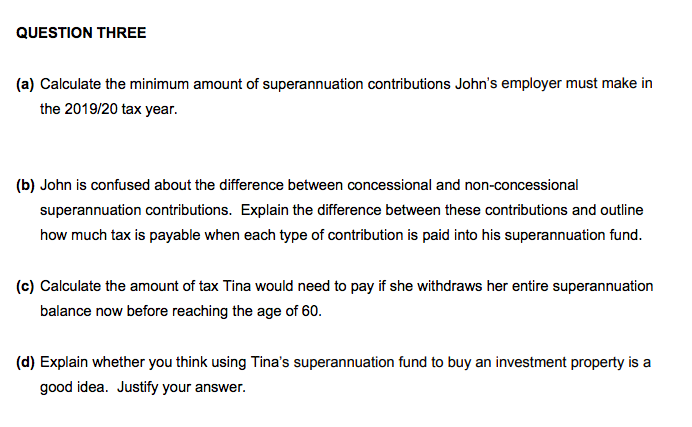

CASE STUDY John and Tina William have made an appointment with you to discuss their financial planning needs. Tina works with a bank and is concerned about her family's financial position. She is worried that their current investment allocation and plan is unlikely to provide her family with sufficient savings upon their retirement. The couple has come to you for advice and has provided the following information Personal details: John and Tina, both aged 58 have three children; Daniel, Tony and Lucy. Daniel is 22 and works as a Teacher in Perth and is financially independent. Tony is 19 and has joined the Army, he is also financially independent. Lucy is 16, lives at home and is currently enrolled at a private school. . Income and goals: Tina earns $93,000 p.a. John works as a receptionist and earns $42,000 p.a. They manage to save $10,000 a year which they invest in Tina's managed fund. Tina and John both plan to retire in July 2021. Tina plans to withdraw her entire superannuation fund to buy an investment property immediately, the rental proceeds will be used to fund the couple's' retirement. This investment property is estimated to cost $550,000. The couple intends to celebrate their retirement by driving around Australia in January 2022. The couple will fund the trip from Tina's retirement superannuation and savings bank account and the estimated cost is $50,000. Current valuation $190,000 $29,500 $12,000 The couple's assets and liabilities consist of the following: Balance sheet Current Liability Assets (Ownership) valuation (Ownership) House (Joint) $950,000 Mortgage (Joint) House Contents (Joint) $155,000 Credit cards (Joint) Car (Tina) $55,000 Car loan (Tina) Savings Accounts $30,000 (Joint) Managed Funds Tina $105,000 John $11,000 Shares Webjet (Tina) $20,000 Telstra (Tina) $13,400 Superannuation John (40% Tax free) $350,000 Tina (25% Tax free) $575,000 $16,250 Income and expenses Income Managed Funds Tina John Shares Dividends Webjet (Tina) $7,250 $3,000 Expenses Mortgage (Joint) $4,540 7% p.a. Interest $560 Credit Card (Joint) 15% p.a. interest $500 car loan (Tina) ($150 *Credit 8% interest Imputation) Professional subscriptions $300 (Tina) ($100 *Credit Imputation) Travel to work (John) $800 Telstra (Tina) $3,000 $400 Interest savings Accounts (Joint) The Credit Imputation* refers to the franking on dividends indicated in Tina's final dividend statement for the year. QUESTION THREE (a) Calculate the minimum amount of superannuation contributions John's employer must make in the 2019/20 tax year. (b) John is confused about the difference between concessional and non-concessional superannuation contributions. Explain the difference between these contributions and outline how much tax is payable when each type of contribution is paid into his superannuation fund. (c) Calculate the amount of tax Tina would need to pay if she withdraws her entire superannuation balance now before reaching the age of 60. (d) Explain whether you think using Tina's superannuation fund to buy an investment property is a good idea. Justify your answer. CASE STUDY John and Tina William have made an appointment with you to discuss their financial planning needs. Tina works with a bank and is concerned about her family's financial position. She is worried that their current investment allocation and plan is unlikely to provide her family with sufficient savings upon their retirement. The couple has come to you for advice and has provided the following information Personal details: John and Tina, both aged 58 have three children; Daniel, Tony and Lucy. Daniel is 22 and works as a Teacher in Perth and is financially independent. Tony is 19 and has joined the Army, he is also financially independent. Lucy is 16, lives at home and is currently enrolled at a private school. . Income and goals: Tina earns $93,000 p.a. John works as a receptionist and earns $42,000 p.a. They manage to save $10,000 a year which they invest in Tina's managed fund. Tina and John both plan to retire in July 2021. Tina plans to withdraw her entire superannuation fund to buy an investment property immediately, the rental proceeds will be used to fund the couple's' retirement. This investment property is estimated to cost $550,000. The couple intends to celebrate their retirement by driving around Australia in January 2022. The couple will fund the trip from Tina's retirement superannuation and savings bank account and the estimated cost is $50,000. Current valuation $190,000 $29,500 $12,000 The couple's assets and liabilities consist of the following: Balance sheet Current Liability Assets (Ownership) valuation (Ownership) House (Joint) $950,000 Mortgage (Joint) House Contents (Joint) $155,000 Credit cards (Joint) Car (Tina) $55,000 Car loan (Tina) Savings Accounts $30,000 (Joint) Managed Funds Tina $105,000 John $11,000 Shares Webjet (Tina) $20,000 Telstra (Tina) $13,400 Superannuation John (40% Tax free) $350,000 Tina (25% Tax free) $575,000 $16,250 Income and expenses Income Managed Funds Tina John Shares Dividends Webjet (Tina) $7,250 $3,000 Expenses Mortgage (Joint) $4,540 7% p.a. Interest $560 Credit Card (Joint) 15% p.a. interest $500 car loan (Tina) ($150 *Credit 8% interest Imputation) Professional subscriptions $300 (Tina) ($100 *Credit Imputation) Travel to work (John) $800 Telstra (Tina) $3,000 $400 Interest savings Accounts (Joint) The Credit Imputation* refers to the franking on dividends indicated in Tina's final dividend statement for the year. QUESTION THREE (a) Calculate the minimum amount of superannuation contributions John's employer must make in the 2019/20 tax year. (b) John is confused about the difference between concessional and non-concessional superannuation contributions. Explain the difference between these contributions and outline how much tax is payable when each type of contribution is paid into his superannuation fund. (c) Calculate the amount of tax Tina would need to pay if she withdraws her entire superannuation balance now before reaching the age of 60. (d) Explain whether you think using Tina's superannuation fund to buy an investment property is a good idea. Justify your