Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case Study: Lost Accounting Fact Implications Background: XYZ Corporation, a leading manufacturing company, recently discovered a lost accounting fact pertaining to its inventory valuation. Due

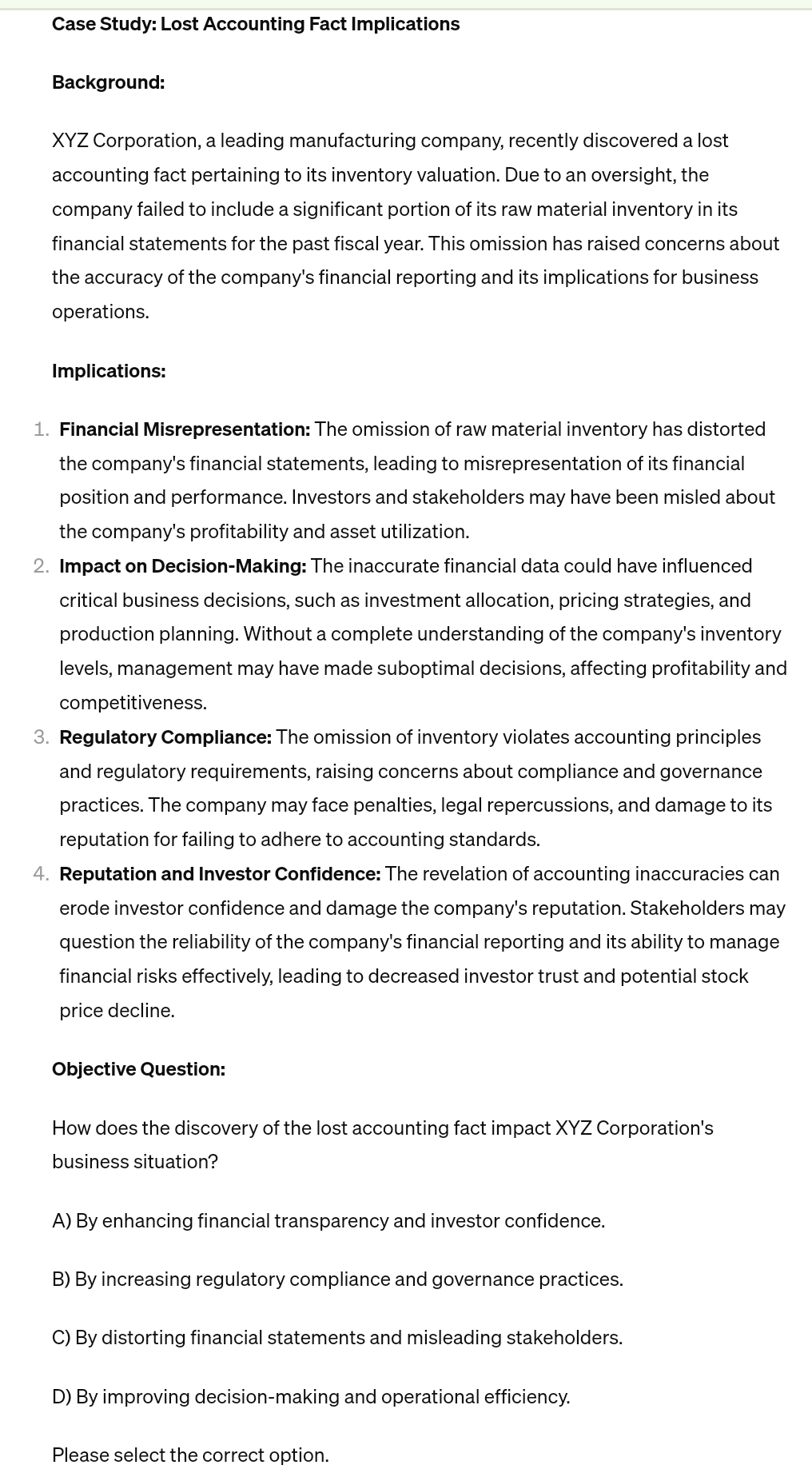

Case Study: Lost Accounting Fact Implications

Background:

XYZ Corporation, a leading manufacturing company, recently discovered a lost accounting fact pertaining to its inventory valuation. Due to an oversight, the company failed to include a significant portion of its raw material inventory in its financial statements for the past fiscal year. This omission has raised concerns about the accuracy of the company's financial reporting and its implications for business operations.

Implications:

Financial Misrepresentation: The omission of raw material inventory has distorted the company's financial statements, leading to misrepresentation of its financial position and performance. Investors and stakeholders may have been misled about the company's profitability and asset utilization.

Impact on DecisionMaking: The inaccurate financial data could have influenced critical business decisions, such as investment allocation, pricing strategies, and production planning. Without a complete understanding of the company's inventory levels, management may have made suboptimal decisions, affecting profitability and competitiveness.

Regulatory Compliance: The omission of inventory violates accounting principles and regulatory requirements, raising concerns about compliance and governance practices. The company may face penalties, legal repercussions, and damage to its reputation for failing to adhere to accounting standards.

Reputation and Investor Confidence: The revelation of accounting inaccuracies can erode investor confidence and damage the company's reputation. Stakeholders may question the reliability of the company's financial reporting and its ability to manage financial risks effectively, leading to decreased investor trust and potential stock price decline.

Objective Question:

How does the discovery of the lost accounting fact impact XYZ Corporation's business situation?

A By enhancing financial transparency and investor confidence.

B By increasing regulatory compliance and governance practices.

C By distorting financial statements and misleading stakeholders.

D By improving decisionmaking and operational efficiency.

Please select the correct option.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started