Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are currently working as a graduate accountant and are provided with the following information from a client. The client, Susan, has the following

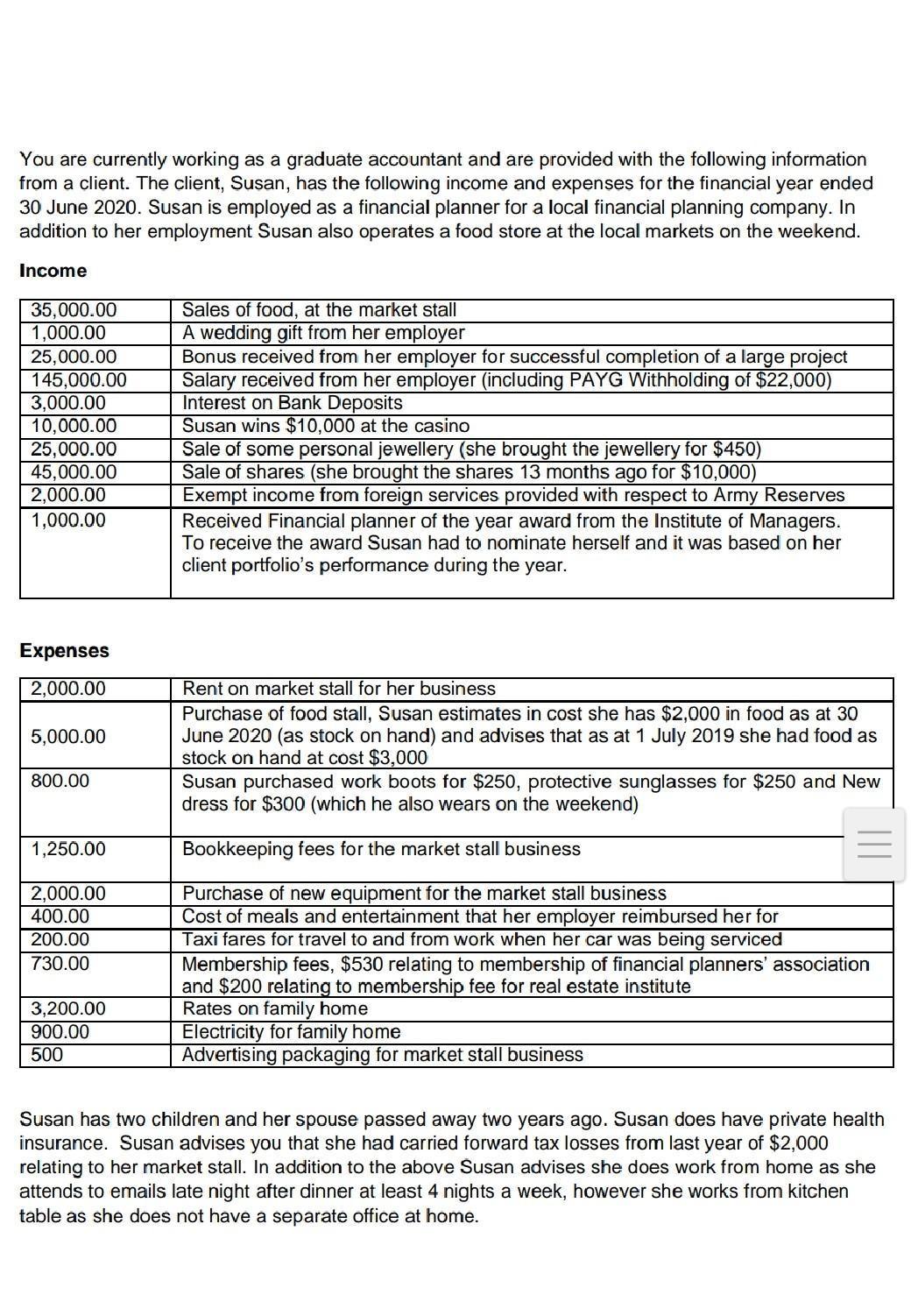

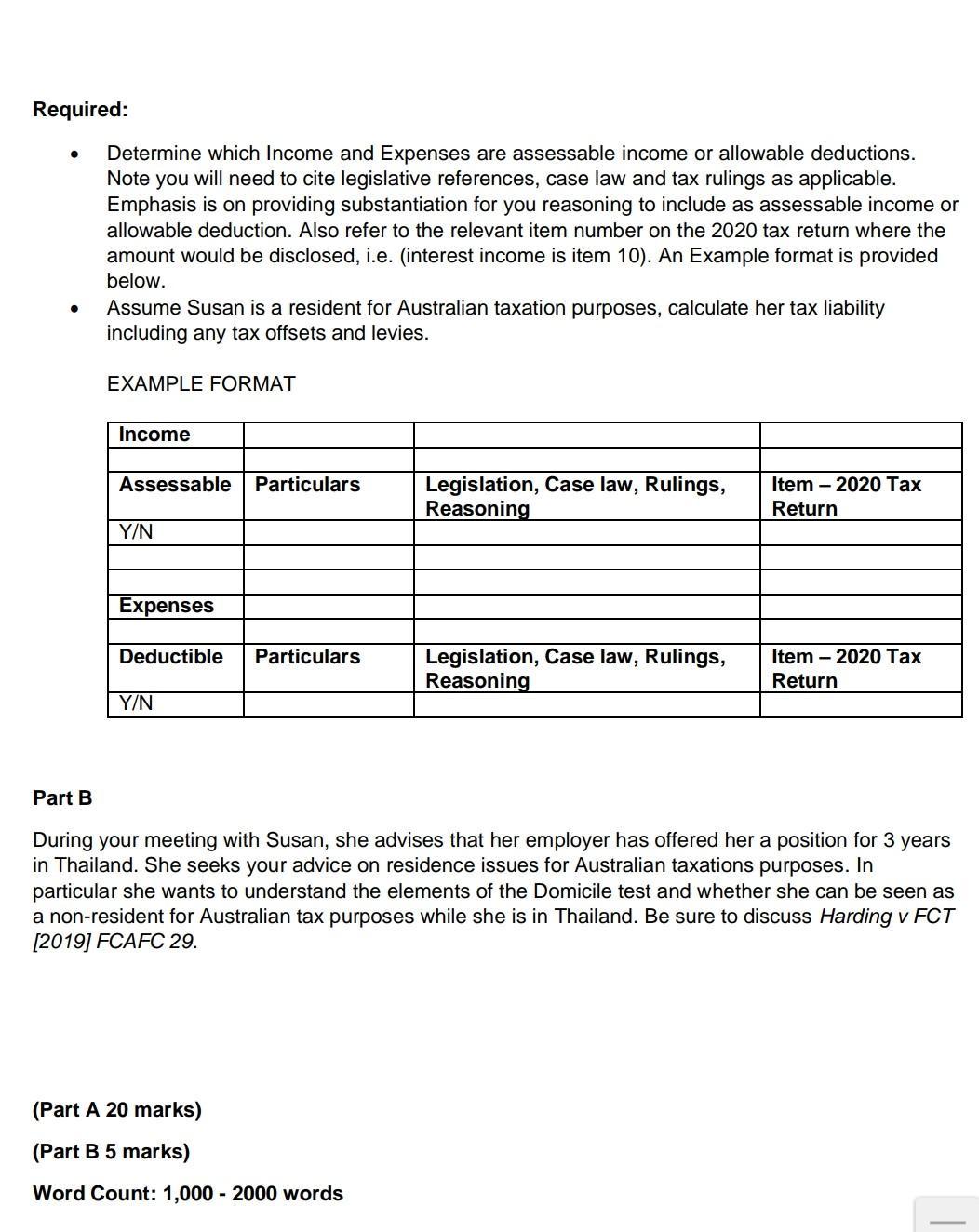

You are currently working as a graduate accountant and are provided with the following information from a client. The client, Susan, has the following income and expenses for the financial year ended 30 June 2020. Susan is employed as a financial planner for a local financial planning company. In addition to her employment Susan also operates a food store at the local markets on the weekend. Income Sales of food, at the market stall A wedding gift from her employer Bonus received from her employer for successful completion of a large project Salary received from her employer (including PAYG Withholding of $22,000) Interest on Bank Deposits Susan wins $10,000 at the casino Sale of some personal jewellery (she brought the jewellery for $450) Sale of shares (she brought the shares 13 months ago for $10,000) Exempt income from foreign services provided with respect to Army Reserves 35,000.00 1,000.00 25,000.00 145,000.00 3,000.00 10,000.00 25,000.00 45,000.00 2,000.00 1,000.00 Received Financial planner of the year award from the Institute of Managers. To receive the award Susan had to nominate herself and it was based on her client portfolio's performance during the year. Expenses 2,000.00 Rent on market stall for her business Purchase of food stall, Susan estimates in cost she has $2,000 in food as at 30 June 2020 (as stock on hand) and advises that as at 1 July 2019 she had food as stock on hand at cost $3,000 Susan purchased work boots for $250, protective sunglasses for $250 and New dress for $300 (which he also wears on the weekend) 5,000.00 800.00 1,250.00 Bookkeeping fees for the market stall business 2,000.00 400.00 Purchase of new equipment for the market stall business Cost of meals and entertainment that her employer reimbursed her for Taxi fares for travel to and from work when her car was being serviced 200.00 730.00 3,200.00 900.00 500 Membership fees, $530 relating to membership of financial planners' association and $200 relating to membership fee for real estate institute Rates on family home Electricity for family home Advertising packaging for market stall business Susan has two children and her spouse passed away two years ago. Susan does have private health insurance. Susan advises you that she had carried forward tax losses from last year of $2,000 relating to her market stall. In addition to the above Susan advises she does work from home as she attends to emails late night after dinner at least 4 nights a week, however she works from kitchen table as she does not have a separate office at home. Required: Determine which Income and Expenses are assessable income or allowable deductions. Note you will need to cite legislative references, case law and tax rulings as applicable. Emphasis is on providing substantiation for you reasoning to include as assessable income or allowable deduction. Also refer to the relevant item number on the 2020 tax return where the amount would be disclosed, i.e. (interest income is item 10). An Example format is provided below. Assume Susan is a resident for Australian taxation purposes, calculate her tax liability including any tax offsets and levies. EXAMPLE FORMAT Income Assessable Particulars Legislation, Case law, Rulings, Reasoning Item - 2020 Tax Return Y/N Expenses Deductible Particulars Legislation, Case law, Rulings, Reasoning Item 2020 Tax Return Y/N Part B During your meeting with Susan, she advises that her employer has offered her a position for 3 in Thailand. She seeks your advice on residence issues for Australian taxations purposes. In years particular she wants to understand the elements of the Domicile test and whether she can be seen as a non-resident for Australian tax purposes while she is in Thailand. Be sure to discuss Harding v FCT [2019] FCAFC 29. (Part A 20 marks) (Part B 5 marks) Word Count: 1,000 - 2000 words

Step by Step Solution

★★★★★

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER PART A PARTB Answer Issue The issue of the taxation law is whether Susan will be an Australian resident for tax purposes Rule There are four ru...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started