Question

CASE STUDY -----##Please do not copy paste answer from another same question , because NOT correct ans.###---- Fares West and Adam East meet at the

CASE STUDY

-----##Please do not copy paste answer from another same question , because NOT correct ans.###----

Fares West and Adam East meet at the HHD environmental convention in Istanbul Turkey. Both men work for construction companies. Mr. West works for the Florida construction company FCC in the United states. FCC has embarked on constructing an underwater tunnel between Florida and Cuba. Mr. East works for unfa Qatar limited AQL which is currently in the process of building an underwater tunnel. Both projects started in January 2014 due to environmental concerns the projects are expected to take nine years until completion. The two men are the convention to discuss how their respective companies have addressed environmental concerns on their projects.

The following is a conversation that took place between the two men:

Mr.East: Nice to meet you Mr. West I enjoyed your presentation about how your company has this with environmental concerns off cause of Florida. It's interesting that our company has also embarked on a similar project to build a tunnel.

Mr.West: nice to meet you too Mr. East at Florida construction company we pride ourself on putting their valuable first even if it costs us more money and time.

Mr.East: I read your biography information and realized that you were an accountant before taking the role of a project manager. That's interesting as they have accounting breaking ground too.

Mr. West: actually I had the chance to read a summary of your project costs and revenue and you will be surprised to know that they are the same as ours.

Mr. East: Thats interesting that's incredible however I must tell you that we don't use percentage of completion method.

Mr. West: we also don't use the percentage of completion method as well.

Mr. East: our chief accountant has informed me that at the end of the 2016 three years since the start of the project we are making excellent progress as we follow international financial reporting standards the method we use produces higher profit than that which would be produced by the method used by your company.

Mr. West: as you know we use the GAAP method and I think that accounting method that we use for construction contracts has increased our total assets of course in comparison with your method

1. Discuss some of the challenges that face accountants worldwide when conducting international transactions.

2.Assuming that the US GAAP is adopted, describe the methods of recognizing revenue when there is significant uncertainty in cash collectability for installment sales (whenever it is possible, support your answer with empirical illustrations)

3.Answer the following questions with respect to FCC and AQL companies:

a) Do you agree with Mr. Easts position that at the end of 2016, his company makes a higher profit from the project when compared to the profit that FCC makes from its project? Provide evidence to support your decision.

b) Do you agree with Mr. Wests position that at the end of 2016, his company increased its total assets from the project when compared to the method used by AQL (please focus only on Construction in progress, Billings on construction contracts and Accounts receivable)? Provide evidence to support your decision

c) Assume that the percentage of completion method was available to AQL at the start of the project in 2014. Assume the company compares its current method with the percentage of completion method. Based on the results at the end of 2016 and 2021, which of the two methods provides: - Lowest expenses. - Highest net income - Highest total assets (please focus only on Construction in progress, Billings on construction contracts and Accounts receivable).

Note: When using the percentage of completion method, make sure you round to the fourth decimal place. For example, if you get the following result 0.7512869, your answer should be 0.7513 or 75.13%.

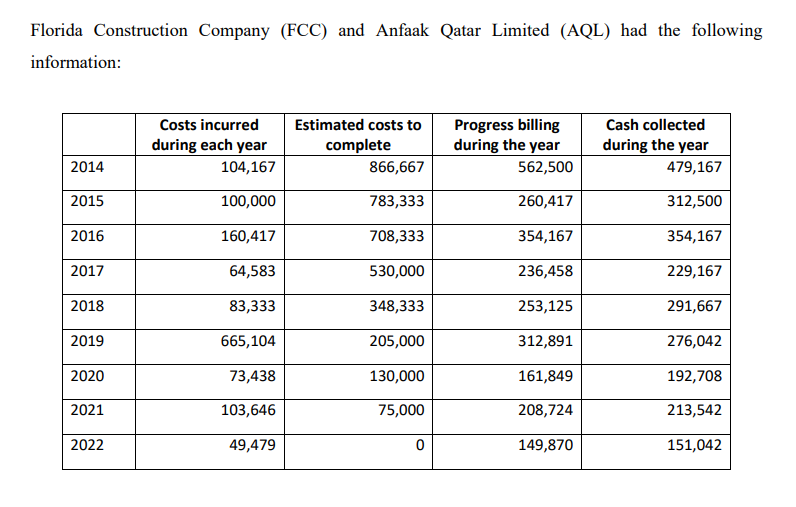

Florida Construction Company (FCC) and Anfaak Qatar Limited (AQL) had the following information: Costs incurred during each year 104,167 Estimated costs to complete 866,667 Progress billing during the year 562,500 Cash collected during the year 479,167 2014 2015 100,000 783,333 260,417 312,500 2016 160,417 708,333 354,167 354,167 2017 64,583 530,000 236,458 229,167 2018 83,333 348,333 253,125 291,667 2019 665,104 205,000 312,891 276,042 2020 73,438 130,000 161,849 192,708 2021 103,646 75,000 208,724 213,542 2022 49,479 0 149,870 151,042 Florida Construction Company (FCC) and Anfaak Qatar Limited (AQL) had the following information: Costs incurred during each year 104,167 Estimated costs to complete 866,667 Progress billing during the year 562,500 Cash collected during the year 479,167 2014 2015 100,000 783,333 260,417 312,500 2016 160,417 708,333 354,167 354,167 2017 64,583 530,000 236,458 229,167 2018 83,333 348,333 253,125 291,667 2019 665,104 205,000 312,891 276,042 2020 73,438 130,000 161,849 192,708 2021 103,646 75,000 208,724 213,542 2022 49,479 0 149,870 151,042Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started