Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case study. Please help! Over the last three years, the owner of Silk Screen Inc., Scott White, has seen his business increase signifi- cantly. Scott

Case study. Please help!

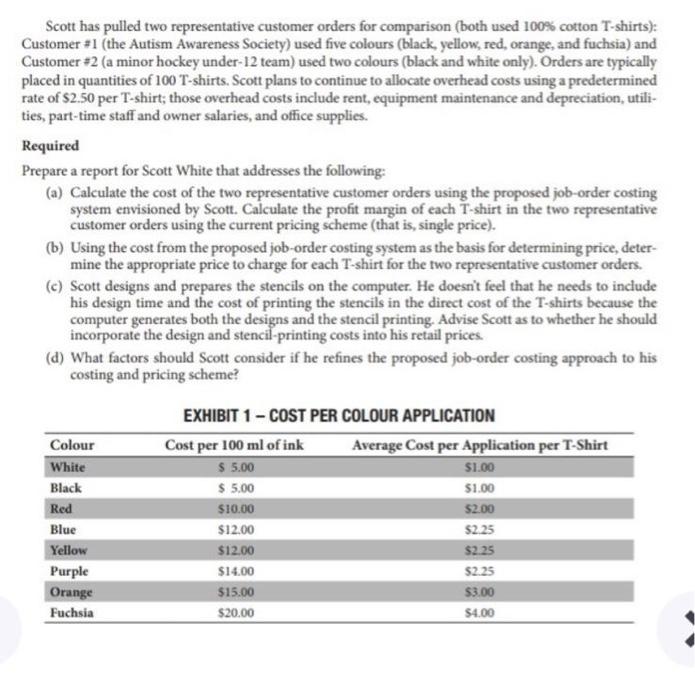

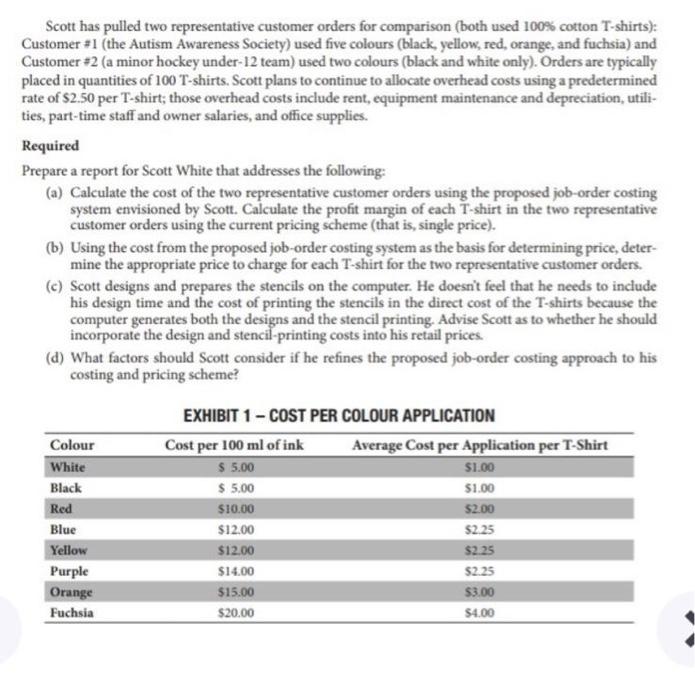

Over the last three years, the owner of Silk Screen Inc., Scott White, has seen his business increase signifi- cantly. Scott decided to start a silk-screening business in the city of the university from which he graduated three years ago. Scott recognized that there was a market for silk-screened products, especially T-shirts. The various varsity teams, university clubs, minor hockey teams, soccer camps, festivals, and so on all require T-shirts with various designs and new T-shirts each year. All of these organizations previously had to order silk-screened products from a provider 100 km out of the city and had to build in enough lead time for ordering, which was often difficult because of the complexities in anticipating demand. Scott developed his business model by charging a flat rate per T-shirt. The T-shirts are of good quality and Scott, who has design experience, can help the teams and organizations in designing their T-shirts. As the business grew, customers' design expectations also grew, becoming more elaborate and incorporating more colours. Scott is pleased with the growth of the business but is concerned about the profit margin, which appears to be shrinking. He would like to achieve an average profit margin of 25% on cost. Scott shared with his accountant his suspicions that the elaborate designs, which require more time and ink in the silk-screening process, are hurting the bottom line. For example, the investment society of the local university has a simple design for its T-shirts, just a black dollar sign. The local dance group, however, requires T-shirts with an elaborate design--multiple dancers, costumes and shoe types-using six colours. The only difference in the sales price of the T-shirts is the type of shirt that the customer requests. Cur- rently, 50/50 (50% cotton, 50% polyester) T-shirts, 100% cotton T-shirts, and 100% cotton golf shirts each cost wholesale $10, $15, and $25, respectively. Scott sells these T-shirts to customers for $20, $25, and $40, respectively, regardless of the design and the number of colours of ink. Elaborate designs and numerous ink colours require more set-up time, more ink, and more colours Silk-screen printing is a technique in which a stencil is used to apply an image to an object, such as a T-shirt. The stencil forms open areas through which ink is transferred. The ink is transferred onto the object by moving a blade or squeegee across the stencil and pushing the ink through the stencil onto the object. Only one colour can be applied at any one time and each colour requires its own stencil. More elaborate designs require more complex stencils and colours. Because only one colour can be applied at any one time, designs with multiple colours require an application for each colour and a stencil for each colour. Conse- quently, the costs for silk screening relate to the time to develop the design, the cost of each colour of ink, and the time to apply each colour. Scott's accountant suggested that they review the cost of different designs and colours of representative T-shirt orders that he has manufactured in the recent month. Although Scott's current pricing approach is to charge a single price for every design, he is now interested in looking at costing, pricing, and profit analysis using a new approach that accumulates costs by order; that is, a job-order costing system. The job-order costing system that Scott envisions allocates costs to orders based on the type of T-shirt, the number of colours of ink used in the design, and the cost of the ink colours used. The number of colours depends on the complexity of the design and each colour of ink is priced separately. (See Exhibit 1 for a listing of common colours of ink and their costs.) Scott has pulled two representative customer orders for comparison (both used 100% cotton T-shirts): Customer #1 (the Autism Awareness Society) used five colours (black, yellow, red, orange, and fuchsia) and Customer #2 (a minor hockey under-12 team) used two colours (black and white only). Orders are typically placed in quantities of 100 T-shirts. Scott plans to continue to allocate overhead costs using a predetermined rate of $2.50 per T-shirt; those overhead costs include rent, equipment maintenance and depreciation, utili- ties, part-time staff and owner salaries, and office supplies. Required Prepare a report for Scott White that addresses the following: (a) Calculate the cost of the two representative customer orders using the proposed job-order costing system envisioned by Scott. Calculate the profit margin of each T-shirt in the two representative customer orders using the current pricing scheme (that is, single price). (b) Using the cost from the proposed job-order costing system as the basis for determining price, deter- mine the appropriate price to charge for each T-shirt for the two representative customer orders. (C) Scott designs and prepares the stencils on the computer. He doesn't feel that he needs to include his design time and the cost of printing the stencils in the direct cost of the T-shirts because the computer generates both the designs and the stencil printing. Advise Scott as to whether he should incorporate the design and stencil-printing costs into his retail prices. (d) What factors should Scott consider if he refines the proposed job-order costing approach to his costing and pricing scheme? Colour White Black Red EXHIBIT 1 - COST PER COLOUR APPLICATION Cost per 100 ml of ink Average Cost per Application per T-Shirt $ 5.00 $1.00 $ 5.00 51.00 $10.00 52.00 $12.00 $2.25 $12.00 $2.25 $14.00 $2.25 $15.00 $3.00 $20.00 $4.00 Blue Yellow Purple Orange Fuchsia

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started