Case study

Question: What is Mary Spencer's current financial situation?

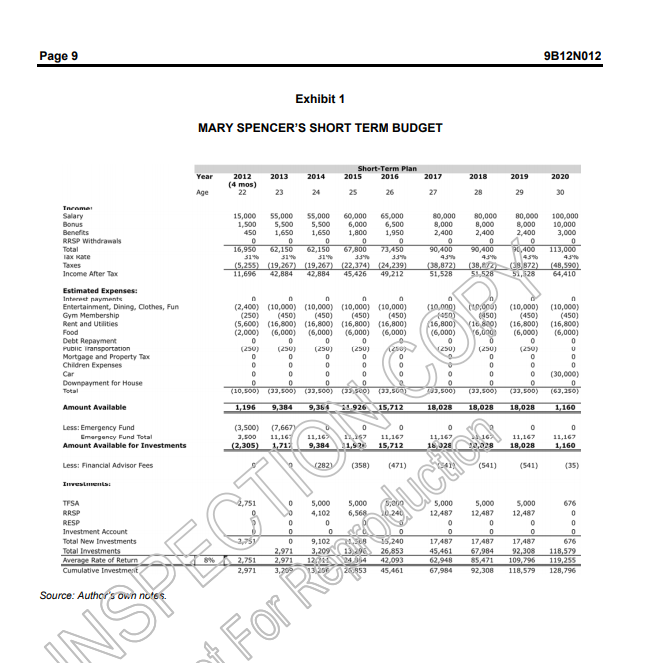

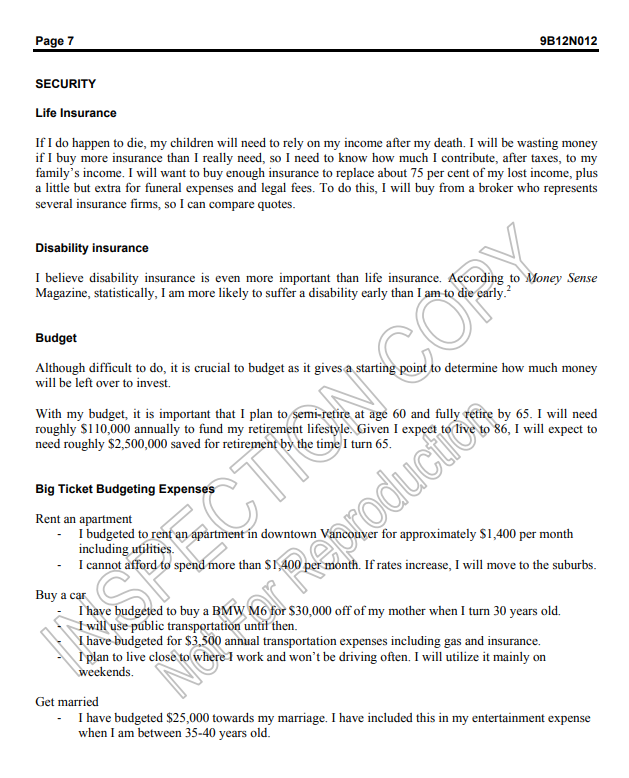

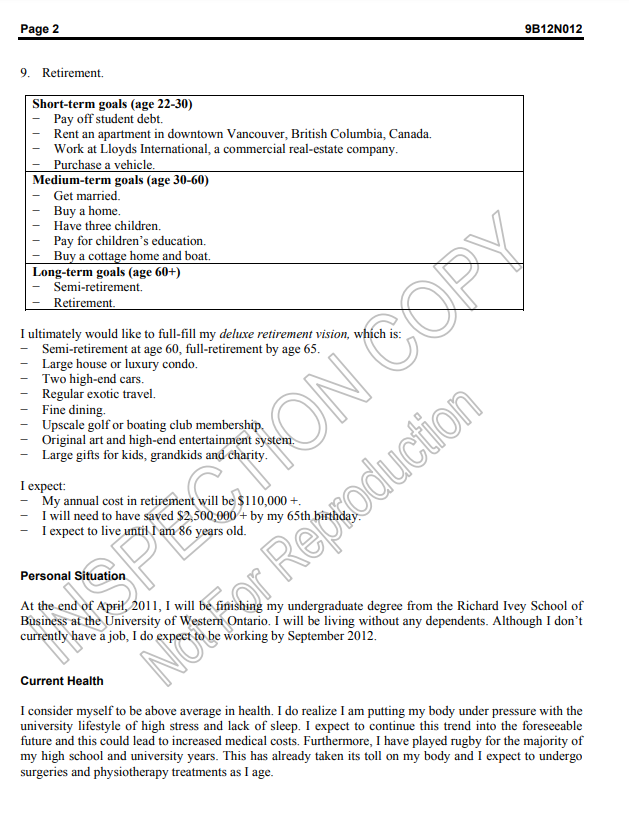

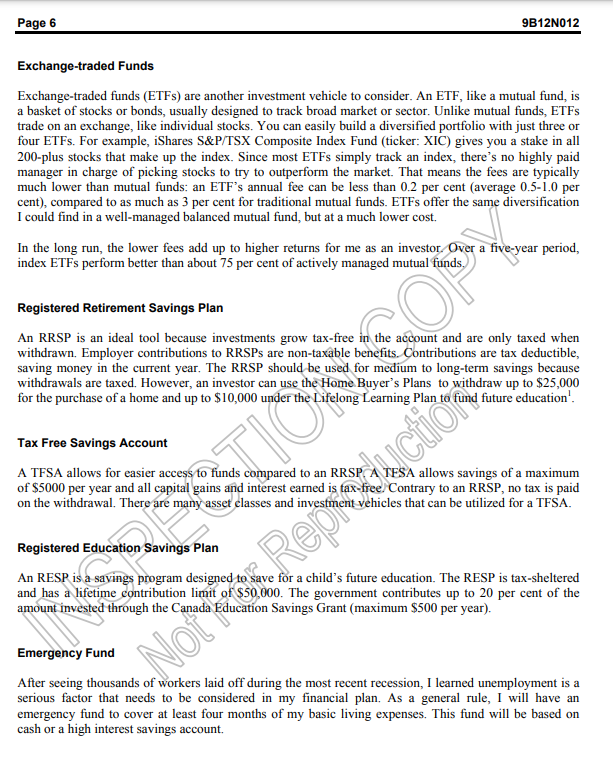

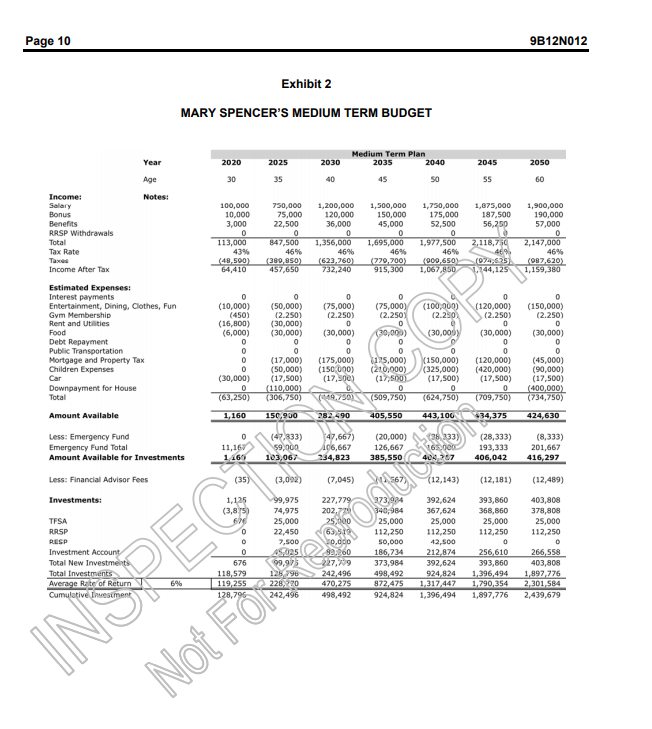

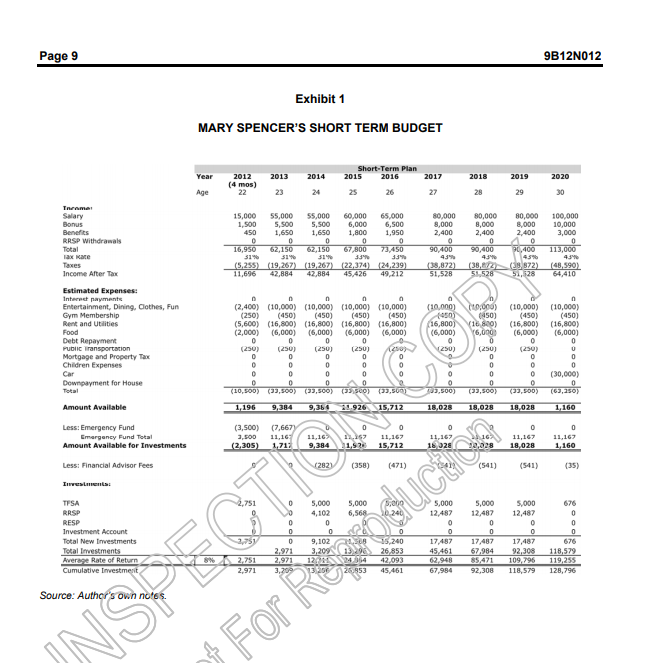

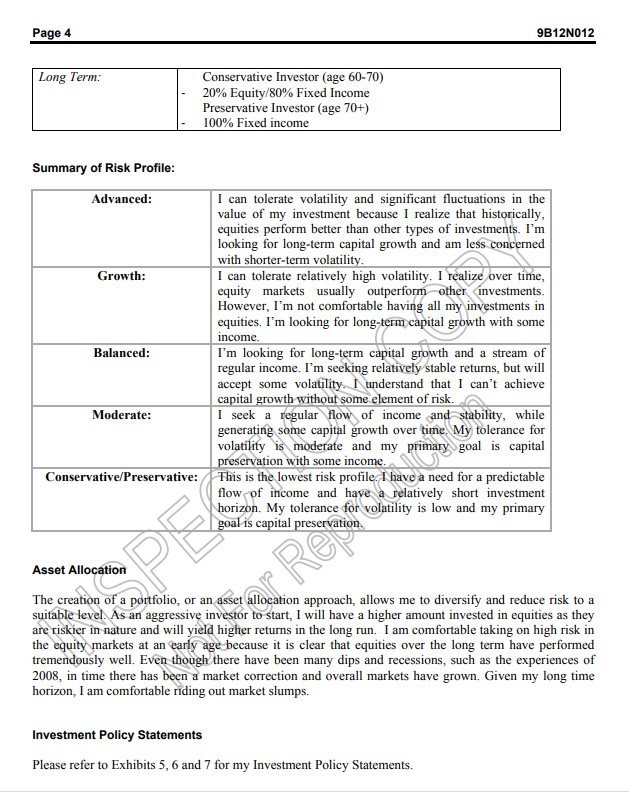

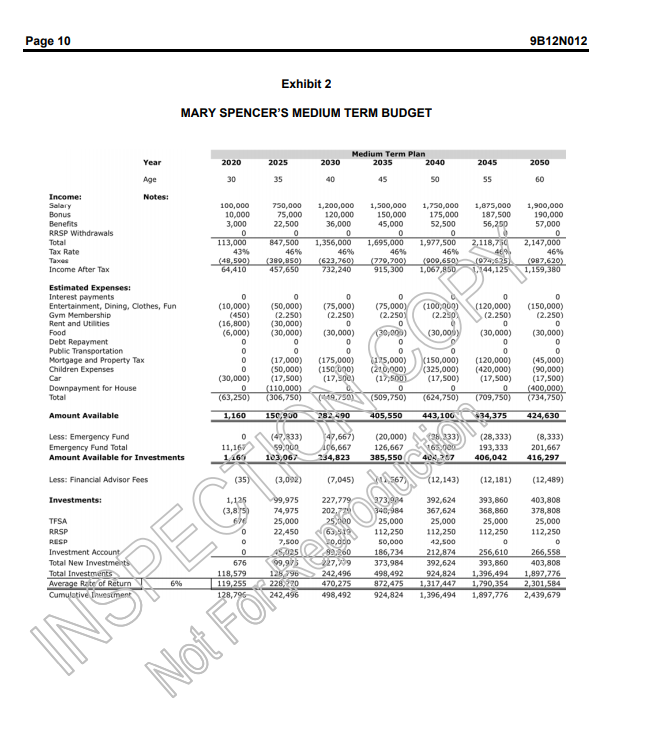

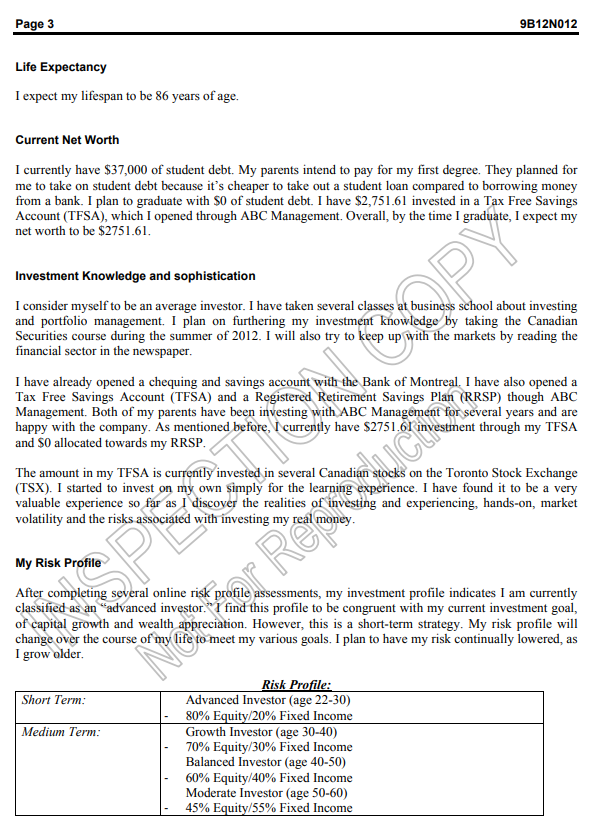

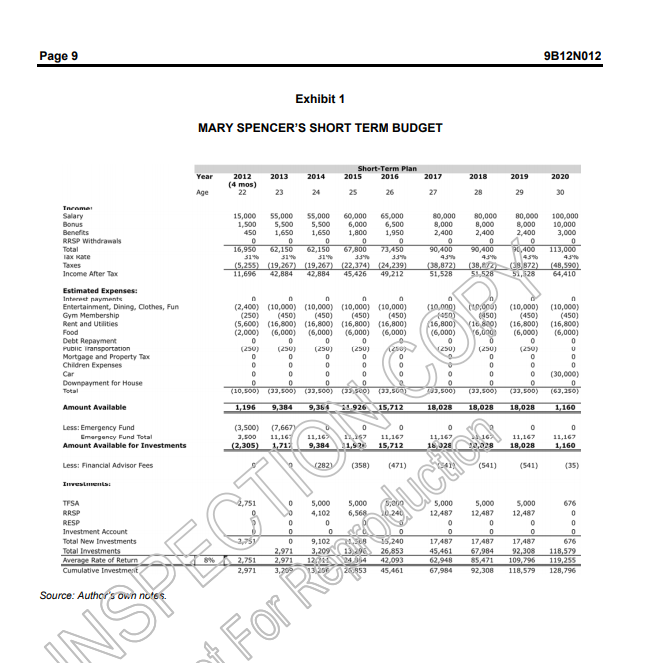

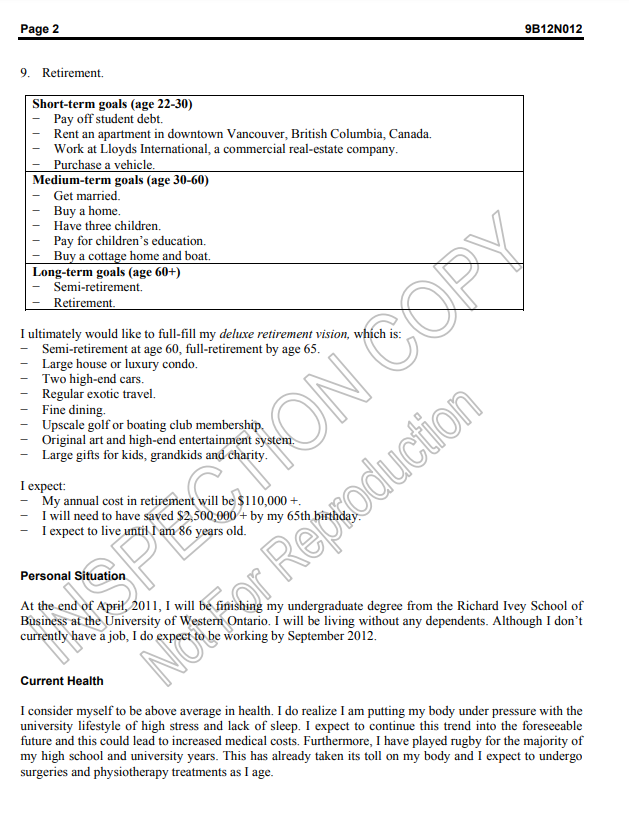

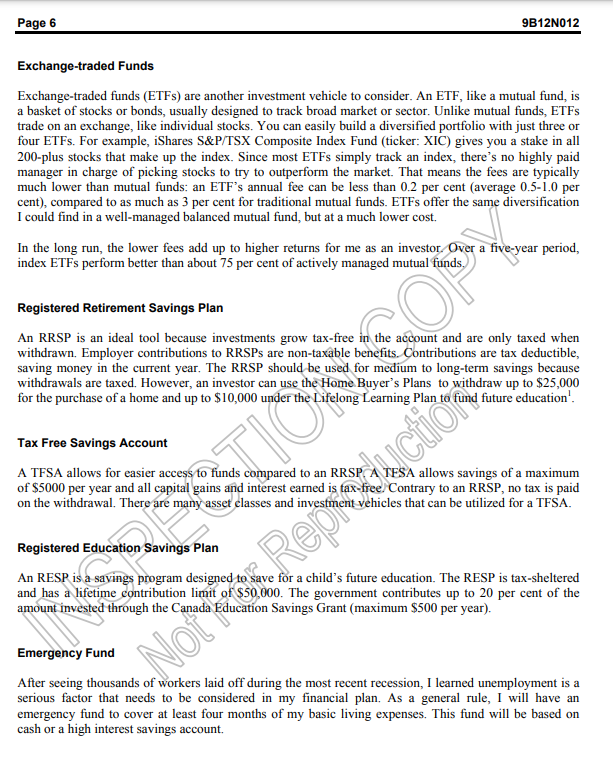

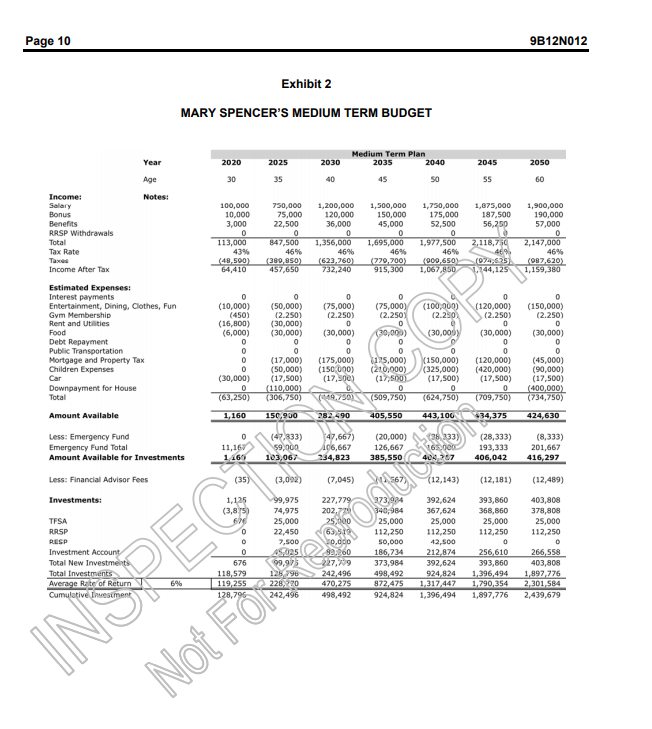

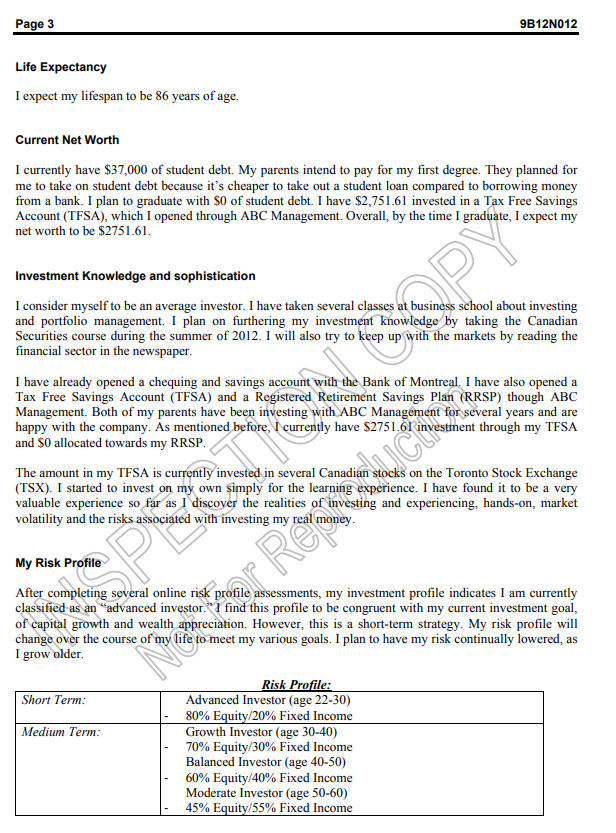

Page 9 9B12N012 Exhibit 1 MARY SPENCER'S SHORT TERM BUDGET Short-Term Plan Year 2012 2013 2014 2015 2016 2017 2018 2019 2020 (4 mos) Age 22 M 15,000 55,000 $5,000 60/000 65,000 107000 60,000 80,COO 5.500 100/000 5.50 6.000 6.500 Benefits 8,000 8,000 10.00 450 1,650 1,800 1,950 2,400 2,400 RASP Withdrawals 2,400 3,000 Total 16,950 62.150 62.150 10 400 20.400 113,000 31%% Taxes (5.253 (19,267) [19,207) (22.374) Income After Tax (24.239] 18.872 11,696 42,884 (48,590) 42,884 45,426 40.217 51,528 51 528 51,128 64,410 Estimated Expenses: Interest payments n Entertainment, Dining, Clothes, Fun 2,4003 (10,000) (10,000) (10,000] (10,000] 10.000j (10.000) Gym Membership (10,000 (250) (450) (450 [450) (450) Bent and Utilities 4450 (450) (450) (450] (5,600) (16,800) (16,800) (16,800] (16,800] Food 16,800) (16 830) (16 800) (2,000) (16,800) (6,000) (6,000) (6.000) (6,000) (6,000) 16.000% Debt Repayment (6,000) (6.000) Public Transportation 12500 1250 Mortgage and Property Tax 250) (250 Children Expenses 0 Car Downpayment for House (30,90 0) Total (10,500) (33,500) 703.5001 (30,5009 (63,350) Amount Available 1,196 9,384 9.361 18028 18,028 18,028 1. 160 Less: Emergency Fund (3,500) (7,667 Emergency Fund Total 3,500 11,167 11,147 Amount Available for Investments 11,167 11,167 11,167 (2.305) 1,717 9.384 15.712 18 028 1,160 Less: Financial Advisor Fees 12821 (358) (471) Investments: Fuction TPSA 5,000 5,000 $,000 5,000 5,000 RASP 476 5,568 13.487 RESP 12,487 12,487 Investment Account Total New Investments 9,102 14300 15,240 7,487 17 487 Total Investments 45,461 67.984 92,398 Average Rate of Return 418,579 2.751 ,971 42,093 12,940 $1.471 109,795 119.259 Cumulative Investment 45,461 67.984 92.308 118,579 128,796 Source: Author's own notes. For RePage 5 9B12N012 INVESTMENT GUIDELINE Debt Before I start investing, I want to be completely debt free. I will begin debt free thanks to my parents, however, if I do accumulate debt I will want to pay off my highest interest rate debt first before investing. Lingering debt will only accumulate and become a burden later in life if it is not addressed early. Invest Early Every dollar I save now is worth more than saving it in any other decade due to compounding interest. To achieve my goals, it is imperative I start savings and investing now, for the future, in order to take advantage of compounding interest. Inflation I expect inflation will be above 3.0 per cent within the next four to six years. If anything, I will strive to have my savings and investments beat inflation, so the value of my savings is not eaten away. Risk When I am young I can afford to take on more risk since I have time to ride out the inevitable storms. It may be a good idea for me to allocate a high percentage to the equities market. This can include buying blue-chip stocks, exchange-traded funds (ETFs) or equity mutual funds. I may want to look at bonds or other less volatile investments, but this should only be a small part of my long-term portfolio since inflation will eat away at the small returns I may achieve. INVESTMENT VEHICLES Repro Mutual Fund A mutual fund is an investment vehicle I am willing to consider. It is an investment made up of a pool of funds collected from many investors for the purpose of investing in securities such as stocks, bonds, money market instruments and similar assets. Professional money managers operate them. A mutual fund's portfolio is structured and maintained to match the investment objectives stated in its prospectus. Mutual funds usually change a fee of 2.5 per cent of the funds worth. Commissioned Advisors Advisors who work on commission almost never recommends index funds: they earn higher commissions from more expensive products, and many mutual fund dealers are not licensed to sell ETFs.Page 4 9B12N012 Long Term: Conservative Investor (age 60-70) 20% Equity/80% Fixed Income Preservative Investor (age 70+) 100% Fixed income Summary of Risk Profile: Advanced: I can tolerate volatility and significant fluctuations in the value of my investment because I realize that historically, equities perform better than other types of investments. I'm looking for long-term capital growth and am less concerned with shorter-term volatility. Growth: I can tolerate relatively high volatility. I realize over time, equity markets usually outperform other