Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case Study - Ria Fernandez Ria Fernandez is single (32) with no children and has just started her job as a registered nurse at

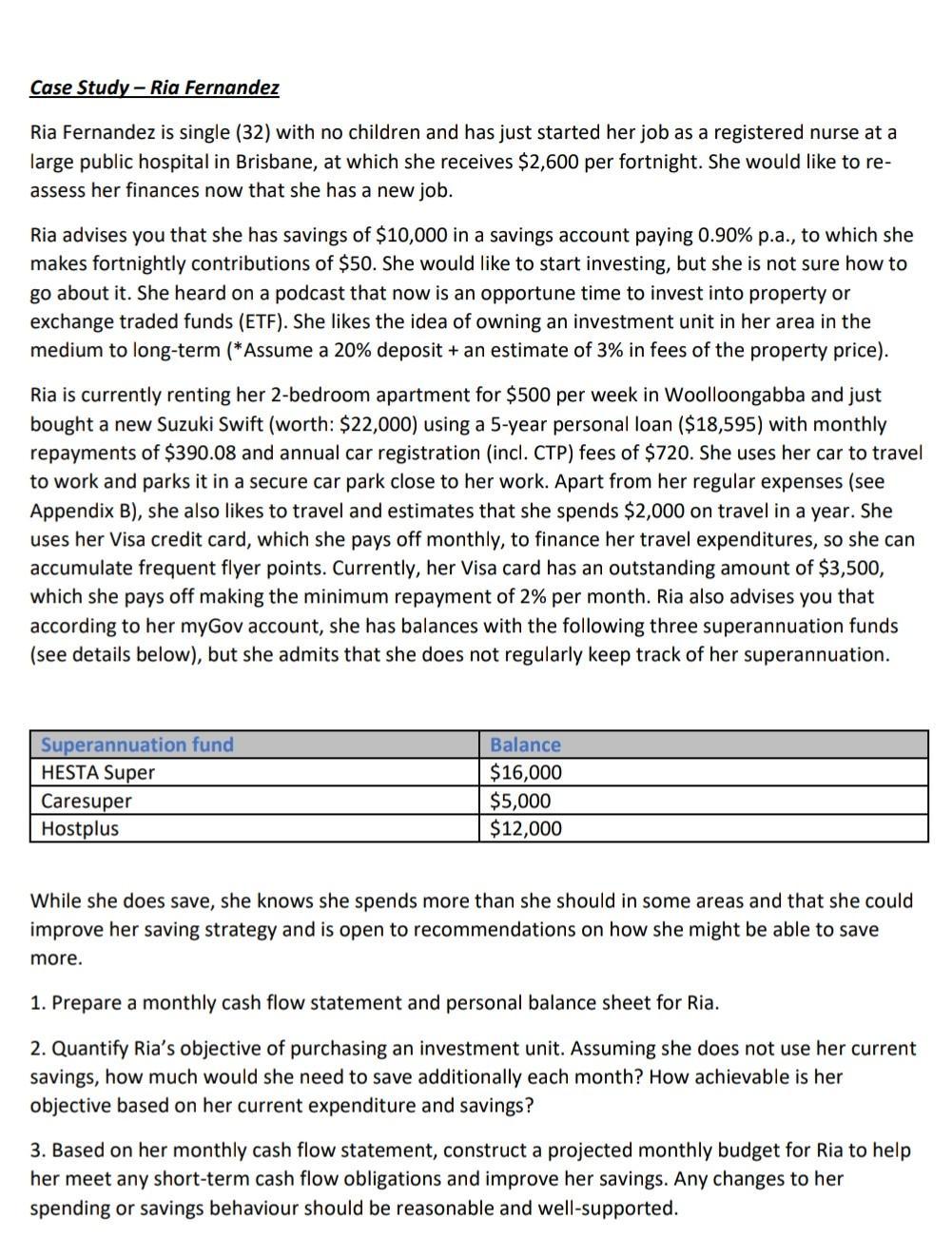

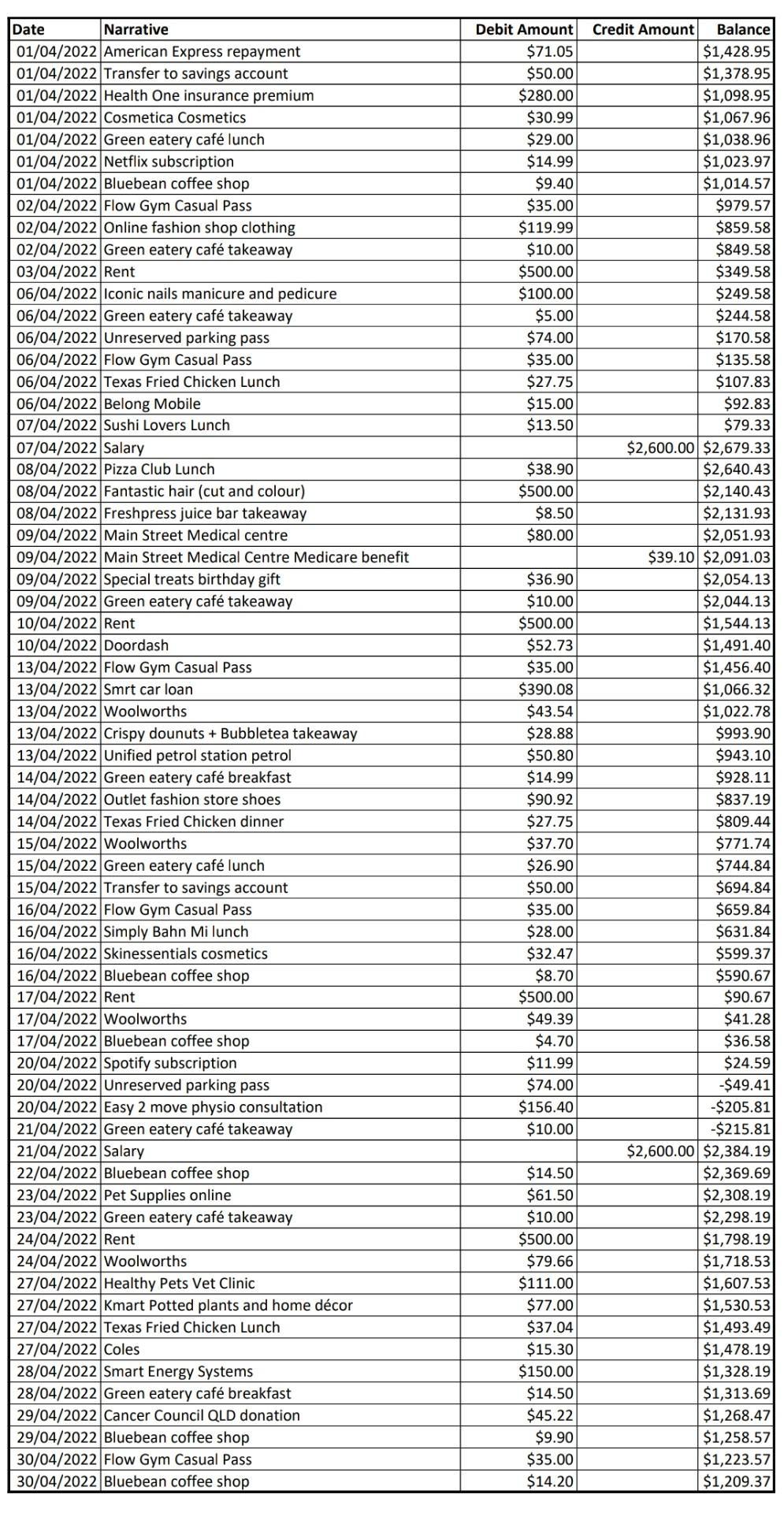

Case Study - Ria Fernandez Ria Fernandez is single (32) with no children and has just started her job as a registered nurse at a large public hospital in Brisbane, at which she receives $2,600 per fortnight. She would like to re- assess her finances now that she has a new job. Ria advises you that she has savings of $10,000 in a savings account paying 0.90% p.a., to which she makes fortnightly contributions of $50. She would like to start investing, but she is not sure how to go about it. She heard on a podcast that now is an opportune time to invest into property or exchange traded funds (ETF). She likes the idea of owning an investment unit in her area in the medium to long-term (*Assume a 20% deposit + an estimate of 3% in fees of the property price). Ria is currently renting her 2-bedroom apartment for $500 per week in Woolloongabba and just bought a new Suzuki Swift (worth: $22,000) using a 5-year personal loan ($18,595) with monthly repayments of $390.08 and annual car registration (incl. CTP) fees of $720. She uses her car to travel to work and parks it in a secure car park close to her work. Apart from her regular expenses (see Appendix B), she also likes to travel and estimates that she spends $2,000 on travel in a year. She uses her Visa credit card, which she pays off monthly, to finance her travel expenditures, so she can accumulate frequent flyer points. Currently, her Visa card has an outstanding amount of $3,500, which she pays off making the minimum repayment of 2% per month. Ria also advises you that according to her myGov account, she has balances with the following three superannuation funds (see details below), but she admits that she does not regularly keep track of her superannuation. Superannuation fund HESTA Super Caresuper Hostplus Balance $16,000 $5,000 $12,000 While she does save, she knows she spends more than she should in some areas and that she could improve her saving strategy and is open to recommendations on how she might be able to save more. 1. Prepare a monthly cash flow statement and personal balance sheet for Ria. 2. Quantify Ria's objective of purchasing an investment unit. Assuming she does not use her current savings, how much would she need to save additionally each month? How achievable is her objective based on her current expenditure and savings? 3. Based on her monthly cash flow statement, construct a projected monthly budget for Ria to help her meet any short-term cash flow obligations and improve her savings. Any changes to her spending or savings behaviour should be reasonable and well-supported. Date Narrative 01/04/2022 American Express repayment 01/04/2022 Transfer to savings account 01/04/2022 Health One insurance premium 01/04/2022 Cosmetica Cosmetics 01/04/2022 Green eatery caf lunch 01/04/2022 Netflix subscription 01/04/2022 Bluebean coffee shop 02/04/2022 Flow Gym Casual Pass 02/04/2022 Online fashion shop clothing 02/04/2022 Green eatery caf takeaway 03/04/2022 Rent 06/04/2022 Iconic nails manicure and pedicure 06/04/2022 Green eatery caf takeaway 06/04/2022 Unreserved parking pass 06/04/2022 Flow Gym Casual Pass 06/04/2022 Texas Fried Chicken Lunch 06/04/2022 Belong Mobile 07/04/2022 Sushi Lovers Lunch 07/04/2022 Salary 08/04/2022 Pizza Club Lunch 08/04/2022 Fantastic hair (cut and colour) 08/04/2022 Freshpress juice bar takeaway 09/04/2022 Main Street Medical centre 09/04/2022 Main Street Medical Centre Medicare benefit 09/04/2022 Special treats birthday gift 09/04/2022 Green eatery caf takeaway 10/04/2022 Rent 10/04/2022 Doordash 13/04/2022 Flow Gym Casual Pass 13/04/2022 Smrt car an 13/04/2022 Woolworths 13/04/2022 Crispy dounuts + Bubbletea takeaway 13/04/2022 Unified petrol station petrol 14/04/2022 Green eatery caf breakfast 14/04/2022 Outlet fashion store shoes 14/04/2022 Texas Fried Chicken dinner 15/04/2022 Woolworths 15/04/2022 Green eatery caf lunch 15/04/2022 Transfer to savings account 16/04/2022 Flow Gym Casual Pass 16/04/2022 Simply Bahn Mi lunch 16/04/2022 Skinessentials cosmetics 16/04/2022 Bluebean coffee shop 17/04/2022 Rent 17/04/2022 Woolworths 17/04/2022 Bluebean coffee shop 20/04/2022 Spotify subscription 20/04/2022 Unreserved parking pass 20/04/2022 Easy 2 move physio consultation 21/04/2022 Green eatery caf takeaway 21/04/2022 Salary 22/04/2022 Bluebean coffee shop 23/04/2022 Pet Supplies online 23/04/2022 Green eatery caf takeaway 24/04/2022 Rent 24/04/2022 Woolworths 27/04/2022 Healthy Pets Vet Clinic 27/04/2022 Kmart Potted plants and home dcor 27/04/2022 Texas Fried Chicken Lunch 27/04/2022 Coles 28/04/2022 Smart Energy Systems 28/04/2022 Green eatery caf breakfast 29/04/2022 Cancer Council QLD donation 29/04/2022 Bluebean coffee shop 30/04/2022 Flow Gym Casual Pass 30/04/2022 Bluebean coffee shop Debit Amount Credit Amount $71.05 $50.00 $280.00 $30.99 $29.00 $14.99 $9.40 $35.00 $119.99 $10.00 $500.00 $100.00 $5.00 $74.00 $35.00 $27.75 $15.00 $13.50 $38.90 $500.00 $8.50 $80.00 $36.90 $10.00 $500.00 $52.73 $35.00 $390.08 $43.54 $28.88 $50.80 $14.99 $90.92 $27.75 $37.70 $26.90 $50.00 $35.00 $28.00 $32.47 $8.70 $500.00 $49.39 $4.70 $11.99 $74.00 $156.40 $10.00 $14.50 $61.50 $10.00 $500.00 $79.66 $111.00 $77.00 $37.04 $15.30 $150.00 $14.50 $45.22 $9.90 $35.00 $14.20 Balance $1,428.95 $1,378.95 $1,098.95 $1,067.96 $1,038.96 $1,023.97 $1,014.57 $979.57 $859.58 $849.58 $349.58 $249.58 $244.58 $170.58 $135.58 $107.83 $92.83 $79.33 $2,600.00 $2,679.33 $2,640.43 $2,140.43 $2,131.93 $2,051.93 $39.10 $2,091.03 $2,054.13 $2,044.13 $1,544.13 $1,491.40 $1,456.40 $1,066.32 $1,022.78 $993.90 $943.10 $928.11 $837.19 $809.44 $771.74 $744.84 $694.84 $659.84 $631.84 $599.37 $590.67 $90.67 $41.28 $36.58 $24.59 -$49.41 -$205.81 -$215.81 $2,600.00 $2,384.19 $2,369.69 $2,308.19 $2,298.19 $1,798.19 $1,718.53 $1,607.53 $1,530.53 $1,493.49 $1,478.19 $1,328.19 $1,313.69 $1,268.47 $1,258.57 $1,223.57 $1,209.37

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Case Study Ria Fernandez Financial Assessment Ria Fernandez recently started a new job and is now earning a salary of 2600 per month She has the following monthly expenses Rent 500 Car repayments 390 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started