Question

Case Study The Harsh & Julie PATEL Story BACKGROUND. Harsh and Julie called you one day and booked an appointment to review their retirement plan

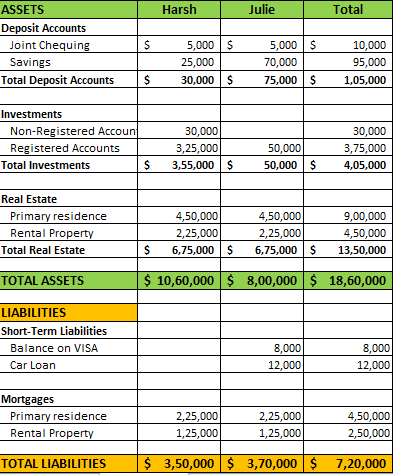

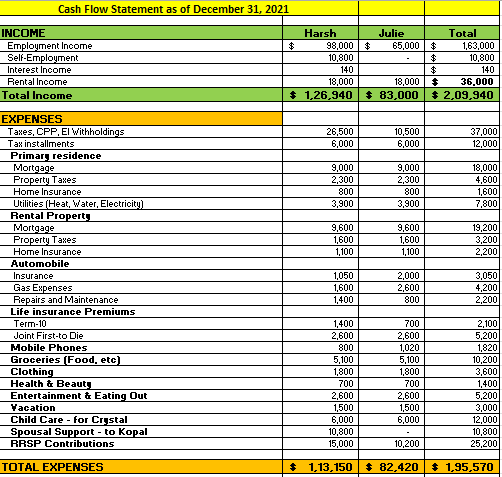

Case Study The Harsh & Julie PATEL Story BACKGROUND. Harsh and Julie called you one day and booked an appointment to review their retirement plan and investment portfolio. They heard about you through one of their friends who is one of your better clients. During the initial meeting, they explained that they are already working with a CFP professional just like you - from Royal Bank of Canada and they wanted a second opinion about their financial situation. You are now meeting them for the second time. Julie tells you that she is the one that keeps track of the family finances and she pays all the household bills. She has prepared a Net Worth statement and a Cash Flow statement for you to get a better understanding about their current financial position. They are happy and surprised that you have provided them with a letter of engagement outlining your financial planning process and responsibilities for both parties. They explain that such a letter was not provided by their existing advisor. PERSONAL INFORMATION Harsh, 54 years old and Julie, 36 years old live in Brampton, Ontario. They are married and they have been together for the past seven years. They are both in excellent health. This is Harshs second marriage and Julies first. Harsh is making regular spousal support payments to his ex-wife Kopal under an agreement they signed in September 2010. Harsh and Kopal did not have any children together. Harsh and Julie have a daughter, Crystal who is now 3 years old. They pay $ 1,000 a month to send her to a daycare center. They heard that the government of Ontario is bringing $ 10-a-day day- care and they are very excited about that. They are wondering if you know if they can take advantage of this right now. EMPLOYMENT INFORMATION Harsh is a full-time business professor at the local community college earning $ 98,000. He says he is enjoying his research work there but the day-to-day teaching is starting to get to him. He would like to retire in about 6 years. He thinks that in addition to the pension funds provided by the College, he has enough money set aside to provide him with the sort of lifestyle in retirement he wants. Besides his regular employment, Harsh has published several books on the history of education. He receives royalties from his publisher and is often asked to contribute articles to national newspapers. This brings in an extra $ 900 a month. When he retires FINA704 The Financial Planning Capstone Course Fall 2022 from teaching, he hopes to spend more time doing this type of work ... between writing and appearing an expert on TV and radio, he should be able to earn $ 55,000 a year. Julie works for the local TV station (City TV) as a commissioned employee selling advertisements to local businesses. Instead of working at the offices of City TV, she meets with clients at their offices or at her own home. She uses her own car to travel to appointments and he converted one of the rooms in their house into an office. Julies income varies from year to year. On average, she earns around $ 45,000 as a base salary and another $ 20,000 in commissions. She is very happy with her job saying that City TV offers her a benefits package including prescription drugs, paramedical services up to $ 1,500 per year, subsidized meals at the cafeteria, access to a fitness center for free, and lots of free training courses. REAL ESTATE Harsh & Julie live in a house they purchase about seven years ago for $ 450,000. It is a big house with 10 rooms. He says that after doing renovations and upgrades of about $ 100,000, he believes the current value of the home is around $ 900,000. They are currently making mortgage payments of $ 1,500 a month, $ 1,000 of which is interest. Last year, a house close by was up for sale at a very low price, just $ 320,000. They decided to purchase the home as an investment and they started renting it to students attending the local college. They are making monthly mortgage payments of $ 1,600 ($ 900 is interest), while they are bringing in about $ 3,000 in rental income every month. They figure the property is currently worth about $ $ 450,000. TAXATION ISSUES Harsh is unhappy that he is paying so much taxes to the government every year. He explains it is not just the income taxes, he is paying property taxes and also sales taxes (HST) on many of the things he buys. He is wondering I you have any ideas on how to reduce their annual tax bill. Also, he has heard if the term marginal tax rate and he does not understand what it means. CURRENT INVESTMENTS The College has a defined contribution pension plan which is managed by the ALPHA insurance Company. Harsh has a total of $ 325,000 in his RRSP with the following holdings. $ 130,000 in Alpha Canadian Balanced mutual fund, MER 2.3 % $ 85,000 in Alpha Canadian Small Cap mutual fund, MER 2.5 % FINA704 The Financial Planning Capstone Course Fall 2022 $ 110,000 in Alpha Canadian Dividend mutual fund. MER 2.1 % Harsh also owns two stocks (market value $ 24,000) in his non-registered account: 1000 shares of Manulife Financial currently trading @ 15 a share 500 shares of Tech Communications currently trading @ 18 a share. He says that he purchased the Manulife shares @ $ 10 a share three years ago and the Tech shares @ $ 9 last year. These purchases were made at the advice of his good friend Deval who spends a great deal of time researching the markets. He has heard from some colleagues that ETFs is the way to go now and he wants to hear your opinion on these type of investments. He also has $ 6,000 in a 1-Year GIC earning 1.5 %, maturing in 3 months from now. Finally, he has $ 25,000 in a Savings account earmarked for emergencies earning an interest rate of 0.2 %. Harsh has contributed $ 5,000 to a spousal RRSP for Julie for the past 4 years. Julie has accumulated another $ 30,000 over the years and they are currently invested in an RRSP with the ALPHA Investment Company as follows: $ 25,000 in ALPHA Canadian Conservative fund, MER 2.3 % $ 10,000 in ALPHA US Large Cap Equity fund, MER 2.6 % $ 15,000 in ALPHA Canadian Bond fund, MER 1.8 % Julie tells you that her grandmother Camille left her around Euro 50,000 which is equivalent to about CAD $ 70,000 (at an exchange rate of 1.40 EUR/CAD). The money is currently in a deposit account at the BNP Paribas bank in Paris earning around 1 %. She is asking for advice on what to do with that money. She is thinking to leave the money in France and use during their vacations there. Julie notes that she is considering about investing the money with an advisor in Paris since she does not have to pay any taxes on the investment income. She is asking for your advice if this is good idea. INSURANCE INFORMATION Harsh has term life insurance at two times his salary from the College and Julie has term life insurance through her employer for $ 50,000. They bought Term 10 insurance from a local insurance agent six years ago with a face value of $ 250,000. They also took a T-100 joint first-to-die insurance when Crystal was born for $ 400,000. They are wondering if this is enough insurance for them. Harsh explained that if something were to happen to him, he would like Julie to have an additional regular FINA704 The Financial Planning Capstone Course Fall 2022 income of at least $ 55,000 until she reaches the age of 65. Also, they heard that whole life insurance is the way to go and they want to know the advantages and disadvantages of this type of insurance as well as premium costs. You explained to them that you are a licenced insurance agent in the Province of Ontario and can advise them on all insurance matters. EDUCATION PLANNING Harsh and Julie would like to set aside some money for Crystals education. They are also planning to have another child very soon. They heard that one way to go is purchase a whole life insurance policy. They would like your advice on the best way to save for Crystals education. They heard about RESPs but they are unsure about the details and what happens if their daughter does not make it to College or University. Tuition fees in Ontario are increasing at a faster rate than the CPI (inflation) and they are currently around $ 12,000 per year. They would like your advice on how to save enough to send Crystal for at least 4 years of post-secondary education. INVESTMENTS - RISK TOLERANCE Harsh and Julie consider themselves as conservative to moderate risk takers. They are willing to take some risk for higher returns but they do not want to lose any money from their capital. They are willing to take more risk inside their RRSPs because they have a longer time horizon. Harsh feels that the markets have done very well in 2020 and 2021. But he is very disappointed with the returns this year. He explained that the TSX is down about 14 % for the year and the S&P 500 is down about 25 %. He is even considering liquidating his investments to cash and go back into the market after the correction. Also he has been reading about crypto investments lately and he is asking for your opinion on these investments. His nephew Girish is pushing him to invest in Bitcoin or Ethereum saying that investments in cryptocurrencies will double in 2022. Girish told him that he made 80 % on his money in 2021. Julie is younger than Harsh and she is willing to take a bit more risk than her husband but she is not prepared to risk all of her capital. She explains that she can tolerate a market decline of about 20 % in any given year. GOALS & OBJECTIVES - RETIREMENT Harsh explains that he is looking forward to semi-retirement not full retirement. He is planning to stay active and work part-time until he is 70 years old. His primary concern is that Julie and Crystal are provided for no matter what. This is one of the reasons he FINA704 The Financial Planning Capstone Course Fall 2022 purchased the rental property to provide a steady source of income regardless of market volatility. Julie is not thinking about retirement yet. She is concerned about the increasing cost of groceries and gas prices. Her priority is to make sure that Crystal will have the financial support to stay in school for as long as she wants. WILLS AND POWER OF ATTORNEYS Harsh and Julie setup wills with a lawyer when Crystal was born. They are not sure if they need power of attorneys yet. Some of their friends do not even have wills in place. They named each other as beneficiaries and Julies brother John was named as the executor in the will. They did not have a chance to tell John yet that he is the executor but they plan to tell him as soon as possible.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started