Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case Study: Understanding Tax Laws and Regulations In today's global economy, tax laws and regulations play a pivotal role in shaping business operations, investment decisions,

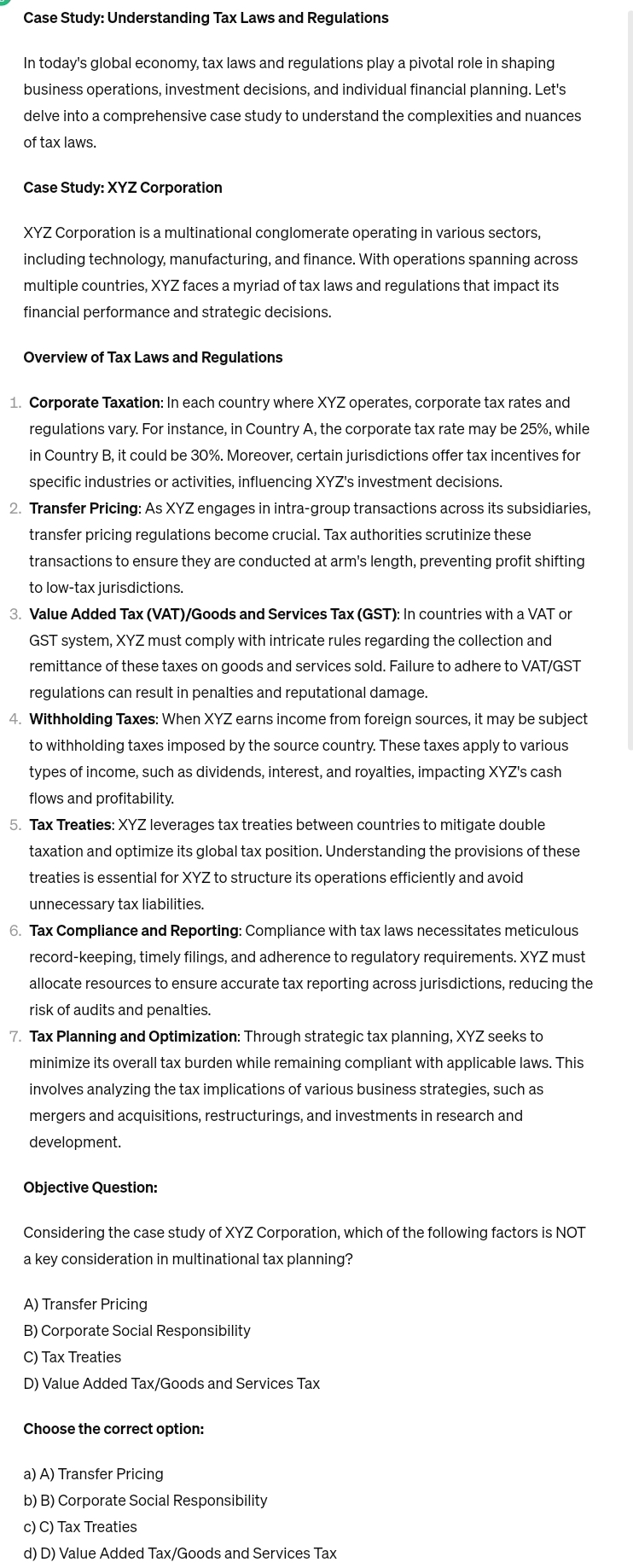

Case Study: Understanding Tax Laws and Regulations

In today's global economy, tax laws and regulations play a pivotal role in shaping business operations, investment decisions, and individual financial planning. Let's delve into a comprehensive case study to understand the complexities and nuances of tax laws.

Case Study: XYZ Corporation

Corporation is a multinational conglomerate operating in various sectors including technology, manufacturing, and finance. With operations spanning across multiple countries, XYZ faces a myriad of tax laws and regulations that impact its financial performance and strategic decisions.

Overview of Tax Laws and Regulations

Corporate Taxation: In each country where XYZ operates, corporate tax rates and regulations vary. For instance, in Country A the corporate tax rate may be while in Country B it could be Moreover, certain jurisdictions offer tax incentives for specific industries or activities, influencing XYZs investment decisions.

Transfer Pricing: As XYZ engages in intragroup transactions across its subsidiaries, transfer pricing regulations become crucial. Tax authorities scrutinize these transactions to ensure they are conducted at arm's length, preventing profit shifting to lowtax jurisdictions.

Value Added Tax VATGoods and Services Tax GST: In countries with a VAT or GST system, XYZ must comply with intricate rules regarding the collection and remittance of these taxes on goods and services sold. Failure to adhere to VATGST regulations can result in penalties and reputational damage.

Withholding Taxes: When XYZ earns income from foreign sources, it may be subject to withholding taxes imposed by the source country. These taxes apply to various types of income, such as dividends, interest, and royalties, impacting XYZs cash flows and profitability.

Tax Treaties: XYZ leverages tax treaties between countries to mitigate double taxation and optimize its global tax position. Understanding the provisions of these treaties is essential for XYZ to structure its operations efficiently and avoid unnecessary tax liabilities.

Tax Compliance and Reporting: Compliance with tax laws necessitates meticulous recordkeeping, timely filings, and adherence to regulatory requirements. XYZ must allocate resources to ensure accurate tax reporting across jurisdictions, reducing the risk of audits and penalties.

Tax Planning and Optimization: Through strategic tax planning, XYZ seeks to minimize its overall tax burden while remaining compliant with applicable laws. This involves analyzing the tax implications of various business strategies, such as mergers and acquisitions, restructurings, and investments in research and development.

Objective Question:

Considering the case study of XYZ Corporation, which of the following factors is NOT a key consideration in multinational tax planning?

A Transfer Pricing

B Corporate Social Responsibility

C Tax Treaties

D Value Added TaxGoods and Services Tax

Choose the correct option:

a A Transfer Pricing

b B Corporate Social Responsibility

c C Tax Treaties

d D Value Added TaxGoods and Services Tax

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started