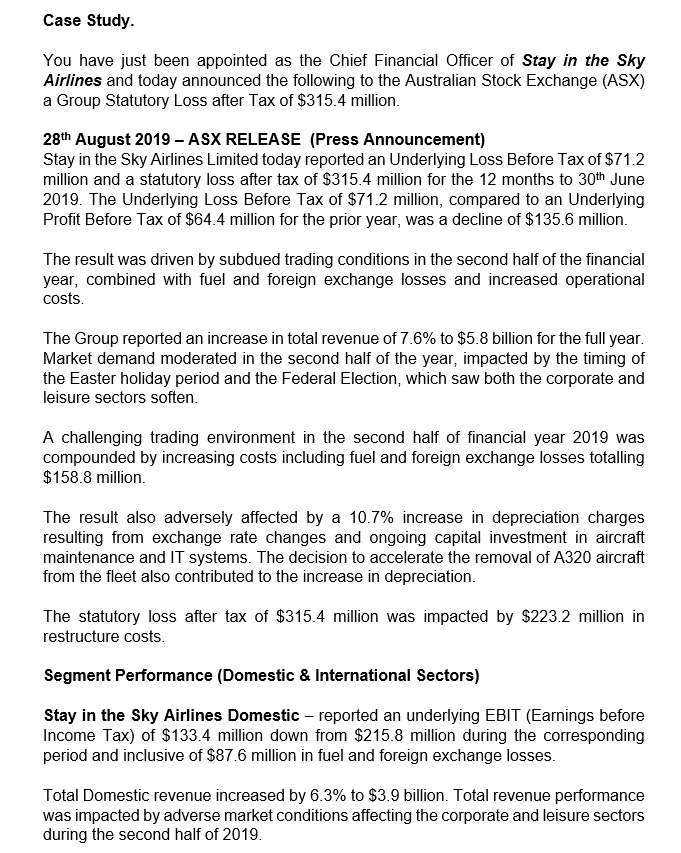

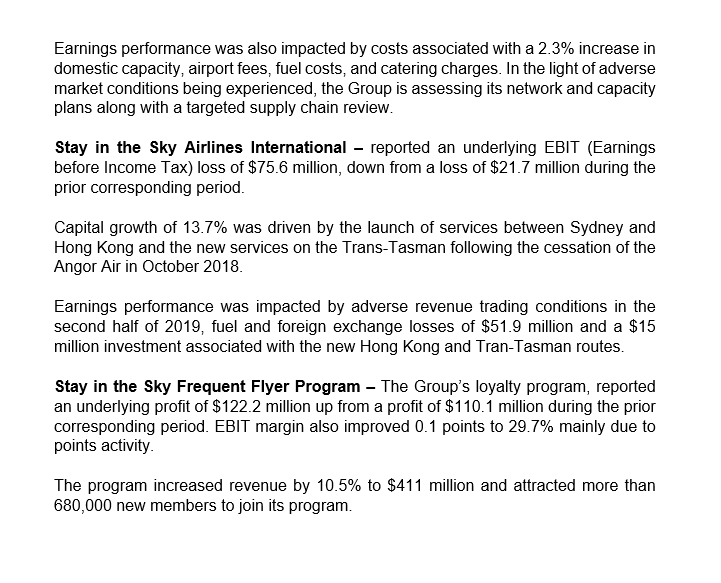

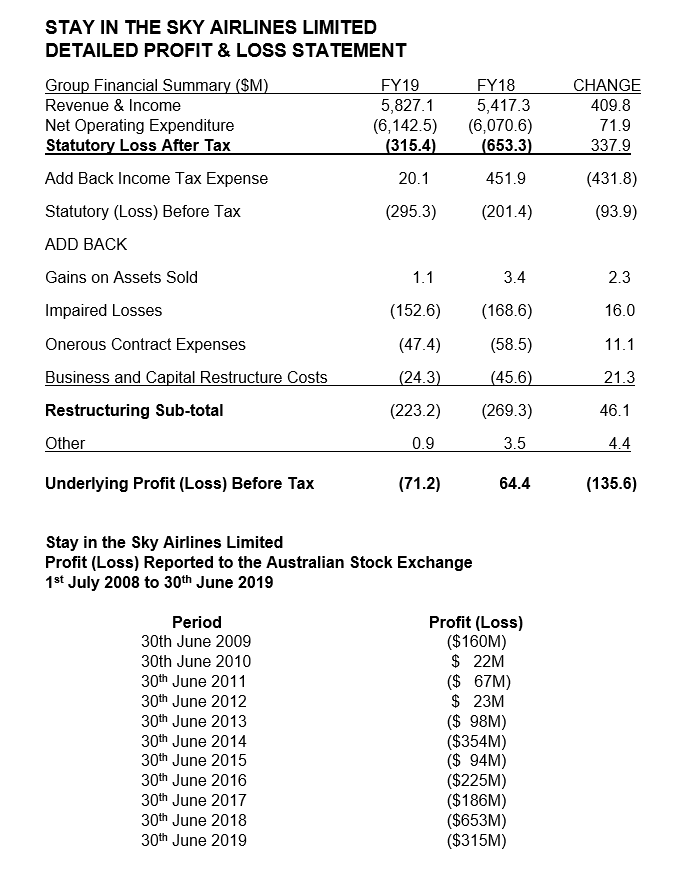

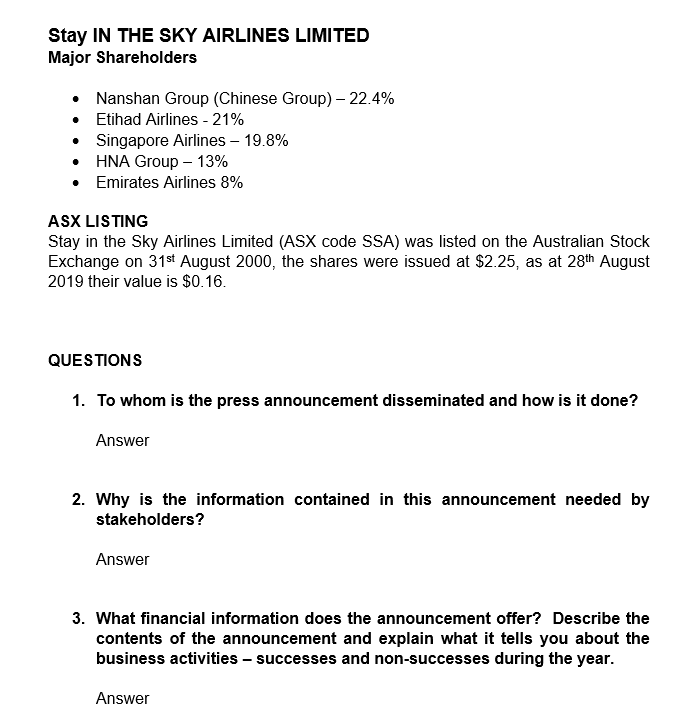

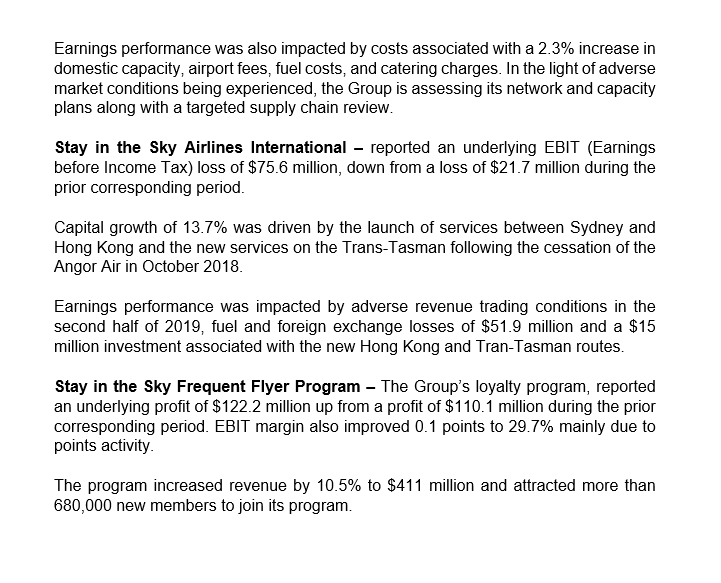

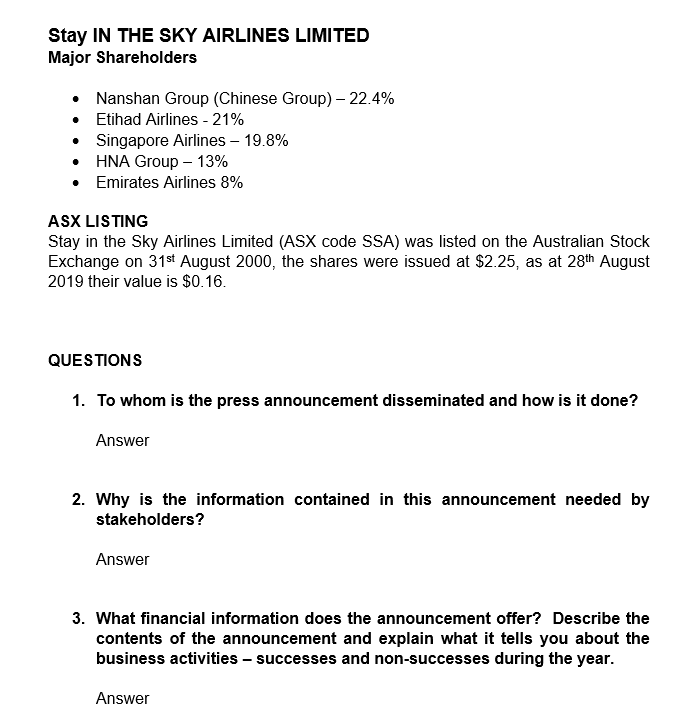

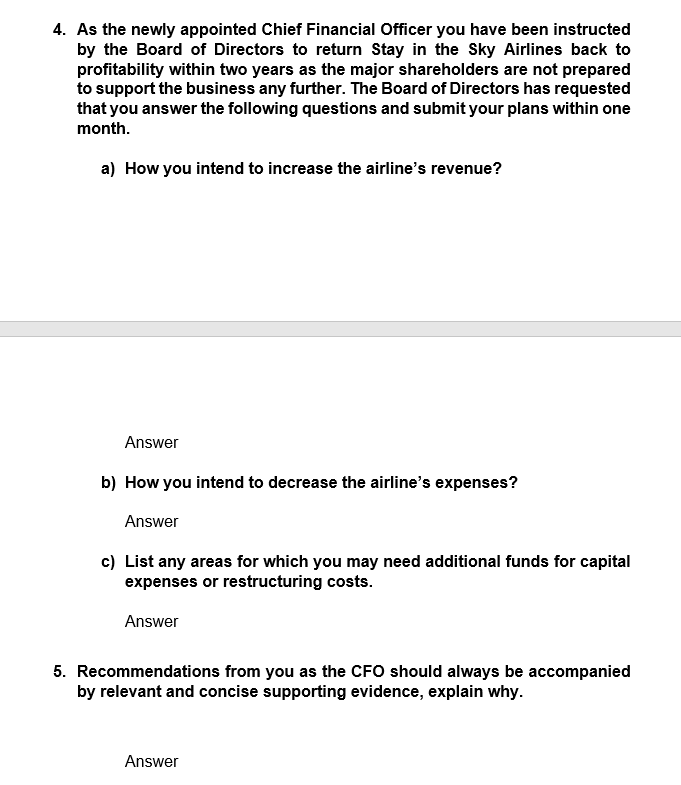

Case Study. You have just been appointed as the Chief Financial Officer of Stay in the Sky Airlines and today announced the following to the Australian Stock Exchange (ASX) a Group Statutory Loss after Tax of $315.4 million. 28th August 2019 - ASX RELEASE (Press Announcement) Stay in the Sky Airlines Limited today reported an Underlying Loss Before Tax of $71.2 million and a statutory loss after tax of $315.4 million for the 12 months to 30th June 2019. The Underlying Loss Before Tax of $71.2 million, compared to an Underlying Profit Before Tax of $64.4 million for the prior year, was a decline of $135.6 million. The result was driven by subdued trading conditions in the second half of the financial year, combined with fuel and foreign exchange losses and increased operational costs. The Group reported an increase in total revenue of 7.6% to $5.8 billion for the full year. Market demand moderated in the second half of the year, impacted by the timing of the Easter holiday period and the Federal Election, which saw both the corporate and leisure sectors soften. A challenging trading environment in the second half of financial year 2019 was compounded by increasing costs including fuel and foreign exchange losses totalling $158.8 million. The result also adversely affected by a 10.7% increase in depreciation charges resulting from exchange rate changes and ongoing capital investment in aircraft maintenance and IT systems. The decision to accelerate the removal of A320 aircraft from the fleet also contributed to the increase in depreciation. The statutory loss after tax of $315.4 million was impacted by $223.2 million in restructure costs. Segment Performance (Domestic & International Sectors) Stay in the Sky Airlines Domestic reported an underlying EBIT (Earnings before Income Tax) of $133.4 million down from $215.8 million during the corresponding period and inclusive of $87.6 million in fuel and foreign exchange losses. Total Domestic revenue increased by 6.3% to $3.9 billion. Total revenue performance was impacted by adverse market conditions affecting the corporate and leisure sectors during the second half of 2019. Earnings performance was also impacted by costs associated with a 2.3% increase in domestic capacity, airport fees, fuel costs, and catering charges. In the light of adverse market conditions being experienced, the Group is assessing its network and capacity plans along with a targeted supply chain review. Stay in the Sky Airlines International reported an underlying EBIT (Earnings before Income Tax) loss of $75.6 million, down from a loss of $21.7 million during the prior corresponding period. Capital growth of 13.7% was driven by the launch of services between Sydney and Hong Kong and the new services on the Trans-Tasman following the cessation of the Angor Air in October 2018. Earnings performance was impacted by adverse revenue trading conditions in the second half of 2019, fuel and foreign exchange losses of $51.9 million and a $15 million investment associated with the new Hong Kong and Tran-Tasman routes. Stay in the Sky Frequent Flyer Program - The Group's loyalty program, reported an underlying profit of $122.2 million up from a profit of $110.1 million during the prior corresponding period. EBIT margin also improved 0.1 points to 29.7% mainly due to points activity. The program increased revenue by 10.5% to $411 million and attracted more than 680,000 new members to join its program. FY18 5,417.3 (6,070.6) (653.3) CHANGE 409.8 71.9 337.9 451.9 (431.8) STAY IN THE SKY AIRLINES LIMITED DETAILED PROFIT & LOSS STATEMENT Group Financial Summary (SM) FY19 Revenue & Income 5,8271 Net Operating Expenditure (6,142.5) Statutory Loss After Tax (315.4) Add Back Income Tax Expense 20.1 Statutory (Loss) Before Tax (295.3) ADD BACK Gains on Assets Sold 1.1 Impaired Losses (152.6) Onerous Contract Expenses (47.4) Business and Capital Restructure Costs (24.3) Restructuring Sub-total (223.2) (201.4) (93.9) 3.4 2.3 (1686) 16.0 (58.5) 11.1 (45.6) 21.3 (269.3) 46.1 Other 0.9 3.5 4.4 Underlying Profit (Loss) Before Tax (71.2) 64.4 (135.6) Stay in the Sky Airlines Limited Profit (Loss) Reported to the Australian Stock Exchange 1st July 2008 to 30th June 2019 Period 30th June 2009 30th June 2010 30th June 2011 30th June 2012 30th June 2013 30th June 2014 30th June 2015 30th June 2016 30th June 2017 30th June 2018 30th June 2019 Profit (Loss) ($160M) $ 22M ($ 67M) $ 23M ($ 98M) ($354M) ($ 94M) ($225M) ($186M) ($653M) ($315M) Stay IN THE SKY AIRLINES LIMITED Major Shareholders Nanshan Group (Chinese Group) - 22.4% Etihad Airlines - 21% Singapore Airlines 19.8% HNA Group 13% Emirates Airlines 8% ASX LISTING Stay in the Sky Airlines Limited (ASX code SSA) was listed on the Australian Stock Exchange on 31st August 2000, the shares were issued at $2.25, as at 28th August 2019 their value is $0.16. QUESTIONS 1. To whom is the press announcement disseminated and how is it done? Answer 2. Why is the information contained in this announcement needed by stakeholders? Answer 3. What financial information does the announcement offer? Describe the contents of the announcement and explain what it tells you about the business activities - successes and non-successes during the year. - Answer 4. As the newly appointed Chief Financial Officer you have been instructed by the Board of Directors to return stay in the Sky Airlines back to profitability within two years as the major shareholders are not prepared to support the business any further. The Board of Directors has requested that you answer the following questions and submit your plans within one month. a) How you intend to increase the airline's revenue? Answer b) How you intend to decrease the airline's expenses? Answer c) List any areas for which you may need additional funds for capital expenses or restructuring costs. Answer 5. Recommendations from you as the CFO should always be accompanied by relevant and concise supporting evidence, explain why. Answer Case Study. You have just been appointed as the Chief Financial Officer of Stay in the Sky Airlines and today announced the following to the Australian Stock Exchange (ASX) a Group Statutory Loss after Tax of $315.4 million. 28th August 2019 - ASX RELEASE (Press Announcement) Stay in the Sky Airlines Limited today reported an Underlying Loss Before Tax of $71.2 million and a statutory loss after tax of $315.4 million for the 12 months to 30th June 2019. The Underlying Loss Before Tax of $71.2 million, compared to an Underlying Profit Before Tax of $64.4 million for the prior year, was a decline of $135.6 million. The result was driven by subdued trading conditions in the second half of the financial year, combined with fuel and foreign exchange losses and increased operational costs. The Group reported an increase in total revenue of 7.6% to $5.8 billion for the full year. Market demand moderated in the second half of the year, impacted by the timing of the Easter holiday period and the Federal Election, which saw both the corporate and leisure sectors soften. A challenging trading environment in the second half of financial year 2019 was compounded by increasing costs including fuel and foreign exchange losses totalling $158.8 million. The result also adversely affected by a 10.7% increase in depreciation charges resulting from exchange rate changes and ongoing capital investment in aircraft maintenance and IT systems. The decision to accelerate the removal of A320 aircraft from the fleet also contributed to the increase in depreciation. The statutory loss after tax of $315.4 million was impacted by $223.2 million in restructure costs. Segment Performance (Domestic & International Sectors) Stay in the Sky Airlines Domestic reported an underlying EBIT (Earnings before Income Tax) of $133.4 million down from $215.8 million during the corresponding period and inclusive of $87.6 million in fuel and foreign exchange losses. Total Domestic revenue increased by 6.3% to $3.9 billion. Total revenue performance was impacted by adverse market conditions affecting the corporate and leisure sectors during the second half of 2019. Earnings performance was also impacted by costs associated with a 2.3% increase in domestic capacity, airport fees, fuel costs, and catering charges. In the light of adverse market conditions being experienced, the Group is assessing its network and capacity plans along with a targeted supply chain review. Stay in the Sky Airlines International reported an underlying EBIT (Earnings before Income Tax) loss of $75.6 million, down from a loss of $21.7 million during the prior corresponding period. Capital growth of 13.7% was driven by the launch of services between Sydney and Hong Kong and the new services on the Trans-Tasman following the cessation of the Angor Air in October 2018. Earnings performance was impacted by adverse revenue trading conditions in the second half of 2019, fuel and foreign exchange losses of $51.9 million and a $15 million investment associated with the new Hong Kong and Tran-Tasman routes. Stay in the Sky Frequent Flyer Program - The Group's loyalty program, reported an underlying profit of $122.2 million up from a profit of $110.1 million during the prior corresponding period. EBIT margin also improved 0.1 points to 29.7% mainly due to points activity. The program increased revenue by 10.5% to $411 million and attracted more than 680,000 new members to join its program. FY18 5,417.3 (6,070.6) (653.3) CHANGE 409.8 71.9 337.9 451.9 (431.8) STAY IN THE SKY AIRLINES LIMITED DETAILED PROFIT & LOSS STATEMENT Group Financial Summary (SM) FY19 Revenue & Income 5,8271 Net Operating Expenditure (6,142.5) Statutory Loss After Tax (315.4) Add Back Income Tax Expense 20.1 Statutory (Loss) Before Tax (295.3) ADD BACK Gains on Assets Sold 1.1 Impaired Losses (152.6) Onerous Contract Expenses (47.4) Business and Capital Restructure Costs (24.3) Restructuring Sub-total (223.2) (201.4) (93.9) 3.4 2.3 (1686) 16.0 (58.5) 11.1 (45.6) 21.3 (269.3) 46.1 Other 0.9 3.5 4.4 Underlying Profit (Loss) Before Tax (71.2) 64.4 (135.6) Stay in the Sky Airlines Limited Profit (Loss) Reported to the Australian Stock Exchange 1st July 2008 to 30th June 2019 Period 30th June 2009 30th June 2010 30th June 2011 30th June 2012 30th June 2013 30th June 2014 30th June 2015 30th June 2016 30th June 2017 30th June 2018 30th June 2019 Profit (Loss) ($160M) $ 22M ($ 67M) $ 23M ($ 98M) ($354M) ($ 94M) ($225M) ($186M) ($653M) ($315M) Stay IN THE SKY AIRLINES LIMITED Major Shareholders Nanshan Group (Chinese Group) - 22.4% Etihad Airlines - 21% Singapore Airlines 19.8% HNA Group 13% Emirates Airlines 8% ASX LISTING Stay in the Sky Airlines Limited (ASX code SSA) was listed on the Australian Stock Exchange on 31st August 2000, the shares were issued at $2.25, as at 28th August 2019 their value is $0.16. QUESTIONS 1. To whom is the press announcement disseminated and how is it done? Answer 2. Why is the information contained in this announcement needed by stakeholders? Answer 3. What financial information does the announcement offer? Describe the contents of the announcement and explain what it tells you about the business activities - successes and non-successes during the year. - Answer 4. As the newly appointed Chief Financial Officer you have been instructed by the Board of Directors to return stay in the Sky Airlines back to profitability within two years as the major shareholders are not prepared to support the business any further. The Board of Directors has requested that you answer the following questions and submit your plans within one month. a) How you intend to increase the airline's revenue? Answer b) How you intend to decrease the airline's expenses? Answer c) List any areas for which you may need additional funds for capital expenses or restructuring costs. Answer 5. Recommendations from you as the CFO should always be accompanied by relevant and concise supporting evidence, explain why