Answered step by step

Verified Expert Solution

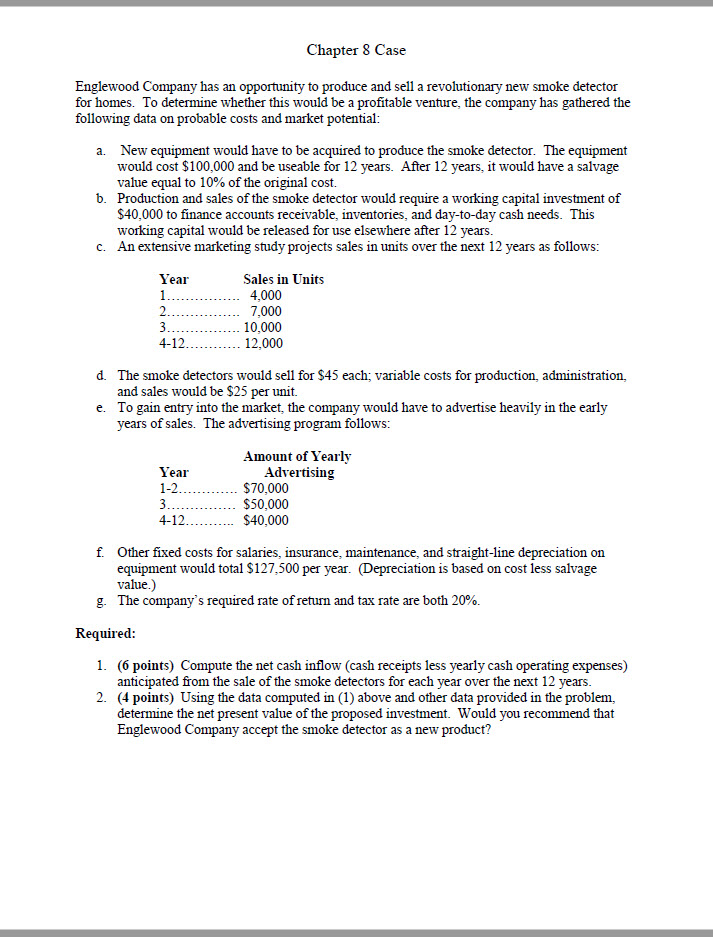

Question

1 Approved Answer

Cases have no word - count requirement. Simply answer the questions for each case. Your work must be shown within your solution in order to

Cases have no wordcount requirement. Simply answer the questions for each case. Your work must be shown within your solution in order to receive credit for calculationsfinal numeric answers alone are insufficient. Each student is allowed only submissionmake sure your case is complete before submission.

Solutions must be wordprocessed to receive credit. I prefer Excel or Word documents, but pdf files are acceptable. Do not worry if your Excel or Word document gets distorted in the Blackboard "preview" of your submission. The Blackboard word processor is not very powerful. As long as you attach your actual file, I can open it and review your work as you intended it to be submitted.

When using intermediate decimal calculations which require rounding, please use this rule for maximum accuracy of your final answer: decimals should be rounded to as many decimal places as there are digits in your underlying data. For example, if your data is in the ten millions you should round to eight decimal places. If your data is in the ten thousands you should round to decimal places.

To help make sure you get off to a good start on the Chapter Case, here is a hint:

The case may be approached in two ways:

Treat Req. and Req. independently. For Req. Calculate the yearly cash flows including tax effects from only the sales of smoke detectors. For Req. Determine the present values of your results from Req. and combine those present values with the present values of the remaining cash flow items in the case to determine NPV

Treat Req. and Req. together as a part of a "big picture" approach. To do this, construct a spreadsheet similar to Exhibit on page which incorporates all the cash flow items mentioned in the case. This is the approach I would recommend.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started