Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Casey Consulting opened for business on January 1, 2018 and engaged in the following business transactions in January: Jan. 20 Issued 5000 shares of

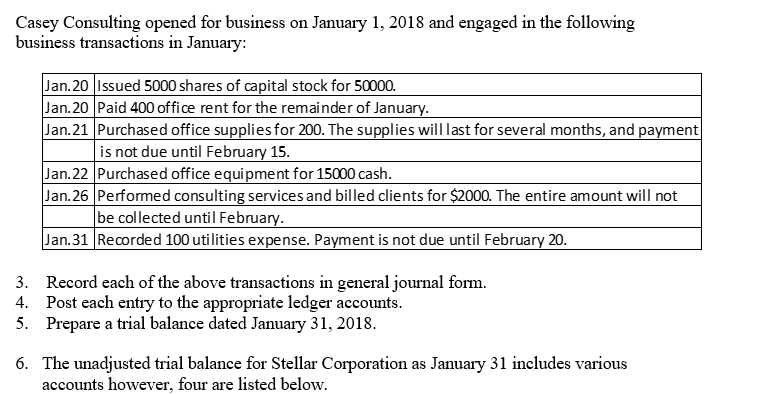

Casey Consulting opened for business on January 1, 2018 and engaged in the following business transactions in January: Jan. 20 Issued 5000 shares of capital stock for 50000. Jan.20 Paid 400 office rent for the remainder of January. Jan.21 Purchased office supplies for 200. The supplies will last for several months, and payment is not due until February 15. Jan.22 Purchased office equipment for 15000 cash. Jan. 26 Performed consulting services and billed clients for $2000. The entire amount will not be collected until February. Jan. 31 Recorded 100 utilities expense. Payment is not due until February 20. 3. Record each of the above transactions in general journal form. 4. Post each entry to the appropriate ledger accounts. 5. Prepare a trial balance dated January 31, 2018. 6. The unadjusted trial balance for Stellar Corporation as January 31 includes various accounts however, four are listed below.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started