Answered step by step

Verified Expert Solution

Question

1 Approved Answer

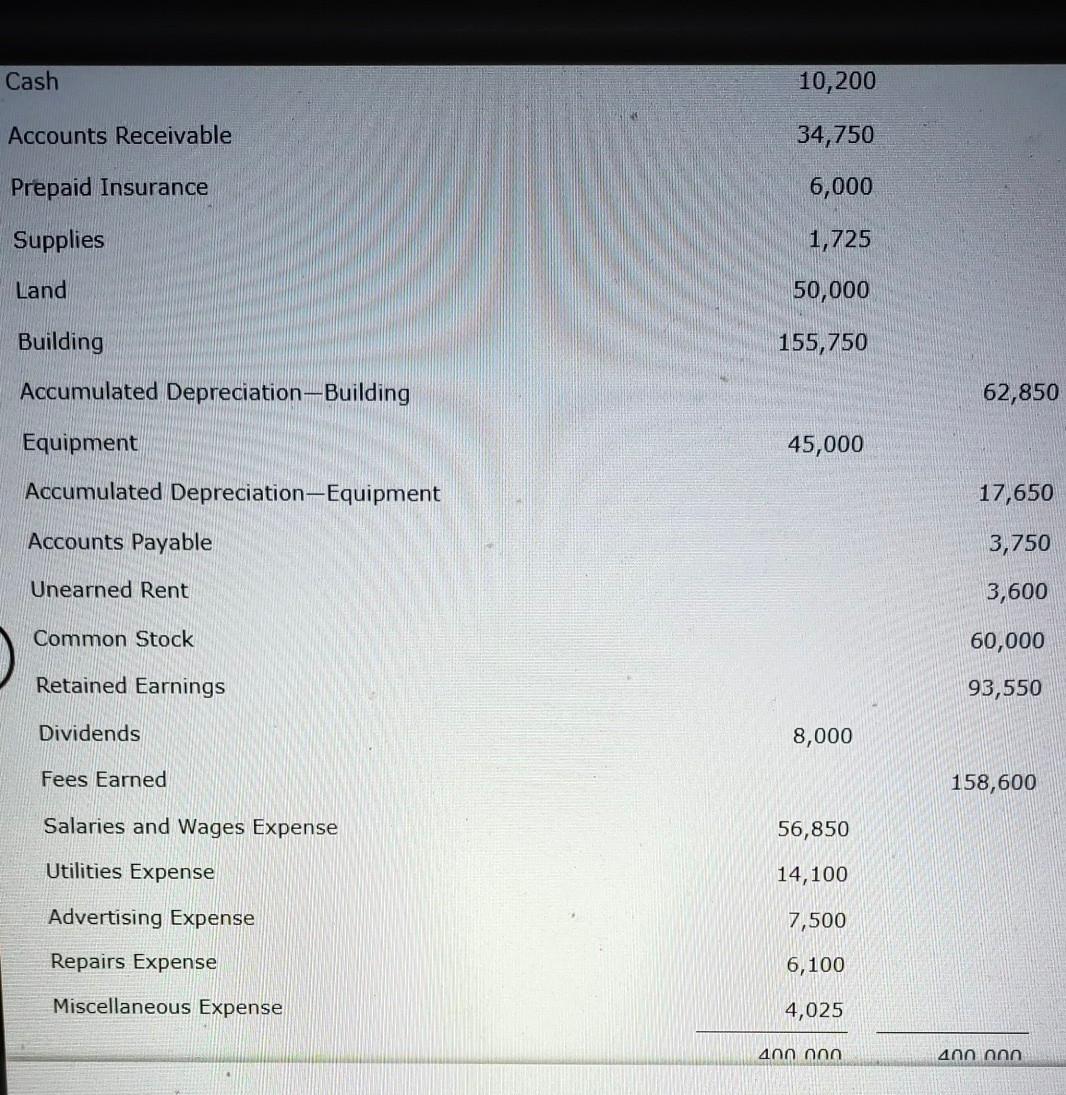

Cash 10,200 Accounts Receivable 34,750 Prepaid Insurance 6,000 Supplies 1,725 Land 50,000 Building 155,750 Accumulated Depreciation-Building 62,850 45,000 Equipment Accumulated Depreciation Equipment 17,650 Accounts Payable

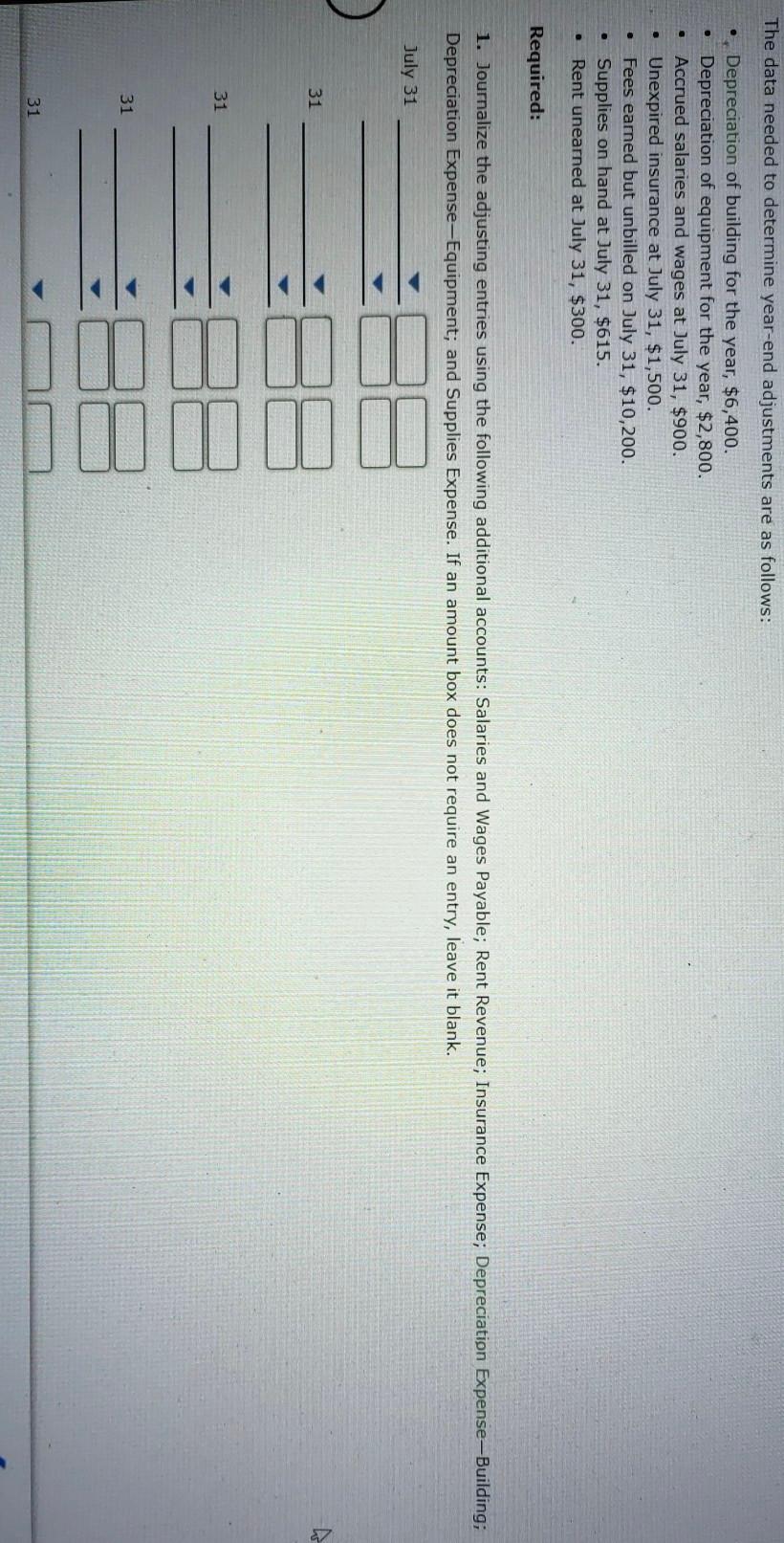

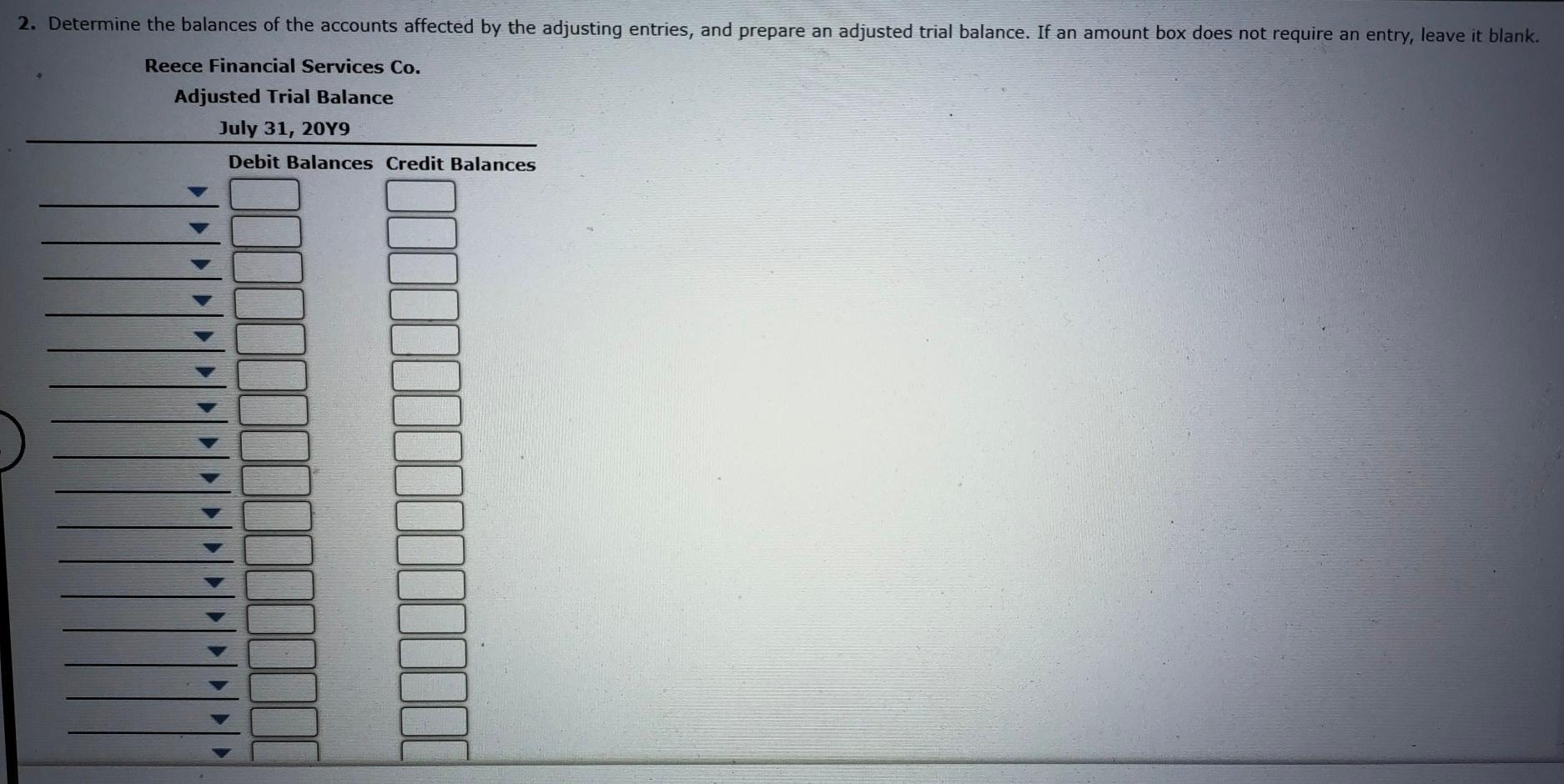

Cash 10,200 Accounts Receivable 34,750 Prepaid Insurance 6,000 Supplies 1,725 Land 50,000 Building 155,750 Accumulated Depreciation-Building 62,850 45,000 Equipment Accumulated Depreciation Equipment 17,650 Accounts Payable 3,750 Unearned Rent 3,600 Common Stock 60,000 Retained Earnings 93,550 Dividends 8,000 Fees Earned 158,600 Salaries and Wages Expense 56,850 Utilities Expense 14,100 Advertising Expense 7,500 Repairs Expense 6,100 Miscellaneous Expense 4,025 annnnn 4nnnnn The data needed to determine year-end adjustments are as follows: Depreciation of building for the year, $6,400. Depreciation of equipment for the year, $2,800. Accrued salaries and wages at July 31, $900. Unexpired insurance at July 31, $1,500. Fees earned but unbilled on July 31, $10,200. Supplies on hand at July 31, $615. Rent unearned at July 31, $300. Required: 1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable; Rent Revenue; Insurance Expense; Depreciation Expense-Building; Depreciation Expense-Equipment; and Supplies Expense. If an amount box does not require an entry, leave it blank. July 31 I 31 31 31 31 2. Determine the balances of the accounts affected by the adjusting entries, and prepare an adjusted trial balance. If an amount box does not require an entry, leave it blank. Reece Financial Services Co. Adjusted Trial Balance July 31, 2019 Debit Balances Credit Balances

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started