Answered step by step

Verified Expert Solution

Question

1 Approved Answer

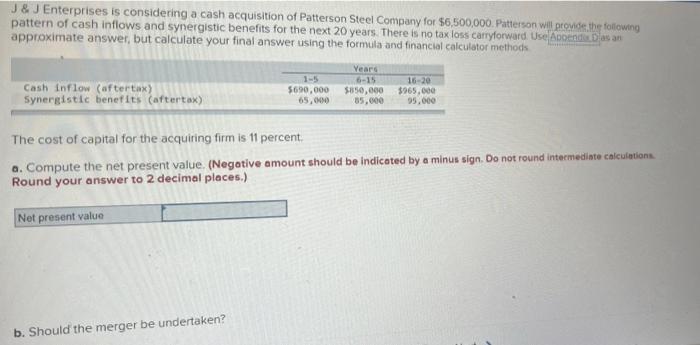

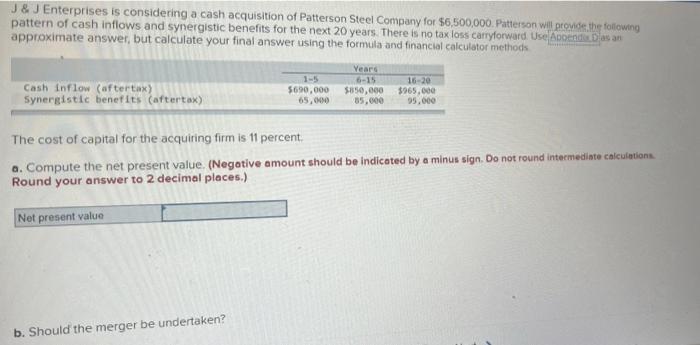

cash acquisition J & J Enterprises is considering a cash acquisition of Patterson Steel Company for $6,500,000. Patterson will provide the fotowing pattern of cash

cash acquisition

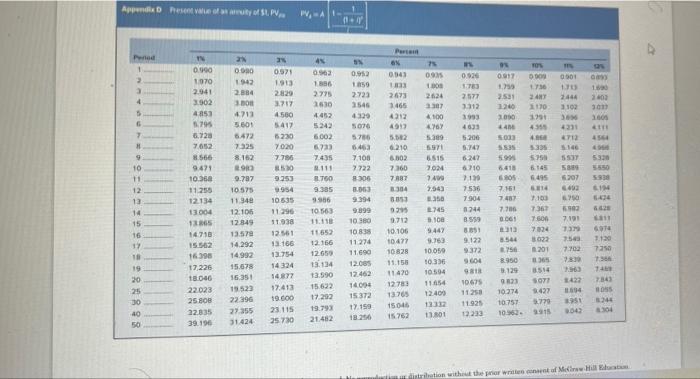

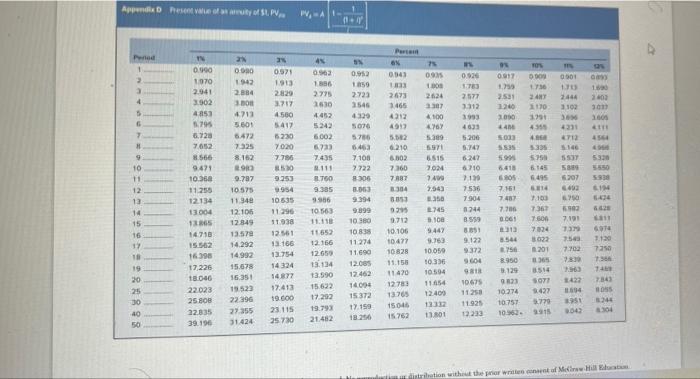

J & J Enterprises is considering a cash acquisition of Patterson Steel Company for $6,500,000. Patterson will provide the fotowing pattern of cash inflows and synergistic benefits for the next 20 years. There is no tax loss carryforward Use Apoca as an approximate answer, but calculate your final answer using the formula and financial calculator methods Years 6-15 16-20 Cash inflow (aftertax) 5690,000 $850,000 $965,000 Synergistic benefits (aftertax) 65,000 35,000 05.000 The cost of capital for the acquiring firm is 11 percent a. Compute the net present value. (Negative amount should be indicated by a minus sign. Do not round intermediate calculations Round your answer to 2 decimal places.) Net present value b. Should the merger be undertaken? App Desentato SLPV PA od Per 6% 0543 1 0.971 0001 TE 2 3 4 1913 2829 2N 0.00 1942 2.884 30 4711 5601 SCH 45 0.963 1886 2.775 2630 4452 5242 5002 0.920 TES 2577 7 09 160 2624 3307 4100 76 2673 1465 3717 9 0917 1. 2.531 1240 2010 246 1 2003 2444 3102 CIEC 0.000 736 247 1110 1991 4.5 4 0.952 1850 2723 2545 4329 5076 5786 6.463 7108 7.722 8306 5 412 3605 & 4231 4500 5417 5230 7020 7.786 7 # CEU 557 SES COS SESS 1555 7.325 8.162 140 4913 5.02 6.210 6.502 7360 7887 SIS LESS 5330 9 10 11 OSU 7435 1.111 2.750 9.335 393 4633 5.200 5.749 6:24 6.710 7130 7536 7.904 3244 8559 59 6.411 6805 58 6207 9253 12 1956 5338 SIM VICE 7161 TOP 0.90 1070 2.041 3302 4853 1.795 6.728 7052 8.566 9.471 10.30 11.255 12134 13004 13865 14718 15562 16398 17 226 1806 22.023 25 BON 22.035 39.196 5758 6145 6.495 14 1103 7367 7.606 7824 9956 EL 6750 COM 28 10 163 11.118 748 7706 061 313 14 15 16 19 7.190 IS CCO 9.787 10575 11.340 12.106 12.849 13.578 14.292 14.992 15.678 16.351 15523 22396 2355 31.424 DIE 1024 740 7.963 35 1745 3.100 9.447 9.750 10.01 10:36 10594 11654 12400 12112 10 535 11296 11.30 12561 13166 13.754 14 124 14372 17.413 19.000 23.115 25730 9.394 9890 10.30 10835 11274 11.690 12.00 12.462 140 15372 201 7350 303 92 9712 10.106 1047 1028 11.158 11470 1278 13.765 1504 15762 12.166 12.650 13.134 13 990 15.622 17.202 19.793 21.452 O 19 20 25 9.122 9372 5604 SER 10675 1125 11.925 12233 7:50 7.70 7.30 7.56) 1422 3.750 2.950 129 9023 10.274 10757 102 SOT Ta 784) 1095 344 LOS 5779 USE CPE POC 1156 40 50 IOWE stration with the growth of Me

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started